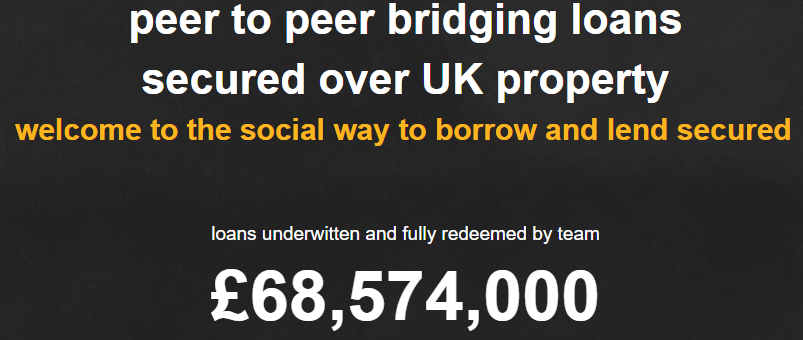

Bridge Crowd is UK based p2p lender, they provide loans peer to peer real estate backed loans. The Managing Director Louis Alexander Managing Director at Bridge Crowd explains more.

What is the investment proposal of BridgeCrowd?

As a company we offer bridging loans, typically ranging from a minimum of 3 months to a maximum of a 12 month loan secured over UK property – residential and buy to lets. Our maximum Loan to Value is 70%. All properties are valued by our panelled surveyors.

What credit rating/credit history data is available on the developers/borrowers and how do you use this in your due diligence?

We use Experian for credit reports, bankruptcy register, insolvency register, court orders, PEP sanctions, internet searches, family courts, death registers.

When did BridgeCrowd Launch?

4 years ago.

What was the greatest challenge so far for TheBridgeCrowd and how did you solve it?

The greatest problem, oh, that is a tricky one. Probably keeping investors abreast of all the ins and outs of the loan process and loan recovery process. They want to know everything, and rightly so.

Under what regulation regime does BridgeCrowd operate?

We are fully authorized and regulated by the FCA.

What happens to the loans under management in the unlikely event of BridgeCrowd defaulting?

Your investments and the loans with the borrowers are ring fenced from the BridgeCrowd trading. Should the BridgeCrowd stop trading or become insolvent, then your loans would then be managed by the solicitors as executors (rather than the BridgeCrowd) on your behalf until all loans are redeemed and the loan book is closed.

This BridgeCrowd Platform has been established on the overriding principle of protection of each investor and that each investor’s investment follows the performance of each loan in which it invests. This means each investor’s money is ‘ring-fenced’. This means on the insolvency of BridgeCrowd, each investor’s money – either in it’s E.Wallet prior to an investment, or the interest and return of capital it is entitled to in respect of the relevant loan from the relevant borrower – is protected and will not form part of BridgeCrowd’s assets and will not be used to repay any of BridgeCrowd’s liabilities. The monies will at all times belong to and be the assets of the Investor. Any relevant appointment insolvency practitioner will segregate all such Investor monies and will manage the outstanding loans to ensure that any returns are paid directly to the relevant investors.

What is the range of loan terms you have had on the platform?

We have had loan terms from 1 month to 24 months.

What are the main risks for investors?

Not earning the full interest if a loan goes into default and it takes over to 2 years to recover the full proceeds. (This has never happened).

Is the interest paid monthly or at the end of the loan period?

All Interest is paid monthly.

What is the average loan to value ratio for the loans?

Our average LTV is 58%.

Are investors lending to BridgeCrowd or directly to the borrowers?

Investors are directly assigned part of the loan they have invested pro rata to their investment. See here for more info: https://www.thebridgecrowd.com/how-it-works#loanstructure

What kinds of loans are available to investors?

Bridging loans secured over UK property up to 70% loan to value which on average pay out 1% interest per month to investors.

What is the difference in practical terms between a social lender and a commercial lender?

We call our lenders Social because it is Peet to Peer they are lending to their peers and other members of society.

Why is the minimum investment 1,000 Sterling?

Our minimum loan is £5k. It may be reduced to £2k soon. This is for admin reasons.

You have not had a default in four years of operation what is the secret to this?

We are very particular to who we lend to and have a thorough screening process. We have  had technical defaults (i.e. the borrower does not pay back on the deadline) but we have not lost any Capital and all interest on every loan has been earned and paid to investors as the rate advertised.

had technical defaults (i.e. the borrower does not pay back on the deadline) but we have not lost any Capital and all interest on every loan has been earned and paid to investors as the rate advertised.

What happens in the unlikely case of a borrower defaulting? Will the interest rate remain the same?

Multiple options – we may offer the borrower an extension, depending in their circumstances and if repayment is likely. If the borrower continually does not repay then we can reposted the property and sell it in order to return our money.

How does BridgeCrowd handle potential fraud by borrowers?

With all applicants, as mentioned before we have an exceptional screening process with thorough security checks including internal anti-money laundering and anti-fraud checks eliminating unsuitable candidates, this is part or tripartite system that works in conjunction with all major banks and credit reference agencies.

Where do you see the BridgeCrowd in five years time?

Loan book of £500m

Do you have any tips for investors that would like to use the secondary market?

Yes, it is good and active.

Why in your opinion have p2p platforms only came to existence in the last few years?

Furslt the trust in P2P. We have been doing P2P for about 15 years. It was just not called P2P. Now, with historically low interest rates, investors are not able to get a decent return in through the more traditional investments thus coming to use p2p platforms to maximise their return.

At this time have you seen any impact from the Brexit referendum result on Britain’s property prices?

Not on our loan book – we lend on Resi and BTL.

Commercial properties were hit.

How can investors sign up? What documentation is needed?

Investors can sign up here: https://www.thebridgecrowd.com/register

What are the fees for investors?

There are no fees for investors.

How can readers learn more about BridgeCrowd?

We thank Louis Alexander for the interview.