Yielders review with Irfan Khan

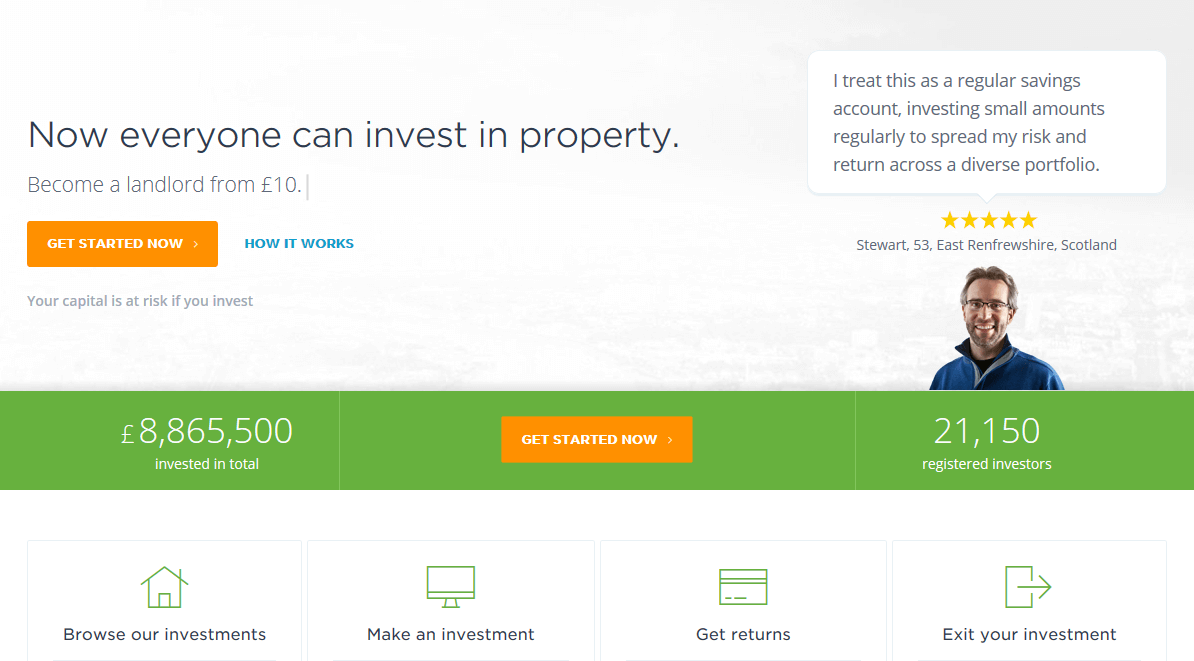

In this interview, Irfan Khan CEO & Founder of Yielders, explains how Yielders can help investors step in the buy to let (BTL) investments without the hassle associated with BTLs. Yielders is a co-investment platforms which syndicates groups of investors to invest in rental properties, the yield from these properties is then divided among between the members of the property syndicate investment.

Can you briefly introduce yourself and your role/position in Yielders?

Irfan is a certified accountant; his career started in Financial services. In the last decade, he has worked for leading Global Banking institutions, organising and coordination organisation wide changes. As an early adopter of fintech, he understood how the market could benefit from a well-managed crowdfunding solution which is fully sharia-compliant. A system which can benefit both the investors with competitive returns and the sustainability of the solution providers. The Yielders difference is that properties are pre-funded, which makes the whole process faster for the investor, bringing in returns much quicker.

His combination of skills in fintech, technology, BPR and operating model design resulted in www.yielders.co.uk. The platform was built from day one, with efficiency at it’s core to minimise cost and maximise returns.

Yeilders will provide access to the retail investor to real estate deals which where previously only available to only those with a unique set of skills and insights.

What investment opportunities is Yielders offering?

Yielders is a crowdfunding investment platform that puts UK property investment within everyone’s reach. From £100, customers can become a Yielder investor. We only offer pre-funded investments to the retail crowd, so that the assets are already generating pre-defined rental incomes. This means investors have the potential to start earning returns within 30 days. Each property investment will have a typical lifespan of 2 – 5 years, and the Yielders UK team manages the whole investment process to maximise yields.

Moreover, labelled a landmark for Islamic Finance, Yielders is the first UK company to gain a Sharia Compliance Certification. We ensure that Sharia compliance principles are fundamental to the operation of the business in order to also serve the UK Islamic market, which is one of the largest, most vibrant and dynamic outside the Middle East.

What are the three main advantages for investors?

- Prefunded-assets – before the property is even offered to the crowd, our property sourcing team has already acquired the assets

- Zero leveraged – our team of legal experts wrap the assets in an SPV structure

- Fully integrated experience from the comfort of your mobile device – we have streamlined the process of investing in property

What ROI can investors expect?

From £100, you can become a Yielder. Our investors benefit from capital appreciation as well as receive a share of the monthly rental income, and with an average of 5%+ net returns, our yields are among the most competitive available.

Do investors pay any fees?

The fees are as follows:

Initial Fee: 2.5% initial fee, this contributes to the cost of setting up the asset structures and administration costs of on-boarding investors.

Management Fees: 10% management fee of the gross rental income. This is designed to cover the ongoing costs of managing the investment company and its assets (this is already factored into the Net returns we quote)

Profit Share: 15% profit share is tied directly to investor returns! When an asset is sold at a profit at the end of the agreed investment term, Yielders will receive 15% of the capital appreciation.

What is the average term planned for the property investments?

Each property investment will have a typical lifespan of 2-5 years, and the Yielders UK team manages the whole investment process to minimise voids and maximise yields.

Is Yielders open to international investors?

Yes, Yielders offers opportunities for both UK and international investors for the minimum amount of £100.

What are the main risks for investors and how does Yielders mitigate them?

The main risks that come with conventional crowdfunding is the onus on investors to fund and acquire the initial asset, which could hold up the investment process. Subsequent risks come in the form of the need to put tenants into place and set terms to agree to, and the lack of an exit strategy.

Yielders’ business model mitigates these risks via pre-funded assets, which give an added layer of security, and pre-defined rental agreements, which allow us to minimise voids and maximise returns. Moreover, investors are fully aware of their returns prior to investing. All figures provided are net and all costs are completely transparent. The platform also has a secondary market allowing assets to be re-listed giving investors complete control of their funds. In short, Yielders provide a low-risk investment opportunity with competitively higher returns.

Will the properties listed be leveraged?

No – we proudly operate as a zero-leveraged business model

How can investors fund their accounts?

Each investor receives their own e-wallet, they are able to top this up via a debit card or bank transfer.

What are the charges?

2.5% to make the initial investment, 10% charged on the Gross Rental income, this is already factored into the Net numbers we quote. 15% on the profit on disposal.

Can rental income be stored on an online wallet on the site to be re-invested automatically?

Absolutely and many of our investors do this, they re-invest as the minimum investment is £100 (Rather than transferring funds in and out of an account) some choose to build up the funds and then withdraw funds as a source of income.

What systems does Yielders use to rate the value and potential income from the properties?

Yielders has developed a governance model with investment calculators that use industry benchmarks and forecasts to assess the investment proposals. We only list opportunities that pass our vigorous investment due diligence process.

Will Yielders focus on the properties of a specific type or in a specific location?

Yeilders will work with a group of professional deal makers whose market insights will allow them to identify, analyse and access real-estate opportunities before other market participants. The initial market focus will be the South East and London targeting commercial, residential or development opportunities. When the opportunity is there deals from further afield will also be listed on Yeilders. The signature of all assets we will strong net returns (5%pa), with also the potential for capital growth. Local councils across London also use the assets we acquire to provide long-term rental agreements for social housing use.

What was the greatest achievement for Yielders?

We are the first UK FinTech to become Sharia certified.

Can you please describe the current market environment from your perspective? (FinTech)

Two market dynamics currently energising the FinTech industry are digital connectivity and edged-down consumer confidence.

Smartphones and the internet have transformed the way businesses, and consumers interact. The UK has one of the strongest web and mobile phone penetration globally and is a leader in facilitating online access to financial services. Meanwhile, consumer sentiment has plummeted post-crisis and has remained low in the UK.

These collective effects translate into customer dissatisfaction with banks and consumer willingness to try new business models from new providers, especially given London’s high concentration of sophisticated consumer market, open-minded to innovative products. This coupled with the inability by incumbent firms to invest and innovate is providing start-ups with a myriad of opportunities to enter the emerging FinTech industry.

Where do you see Yielders in 3 years?

In three years, we’d like to see Yielders become the UK’s leading Ethical and Sharia investment platform, offering new and exciting investment opportunities in property as well as other assets, and to launch our solutions into new geographical markets.

To find out more information about Yielders visit: http://www.yielders.co.uk

We thank Irfan Khan for the interview