The landscape of climate tech investment is witnessing a significant shift. No longer are initial public offerings (IPOs) the sole coveted exit strategy for investors. Today, private equity (PE) buyouts are emerging as a compelling alternative, offering a new avenue for financial success in the domain of climate infrastructure startups.

A New Era of Climate Tech Innovation

In the urgent quest to address the climate crisis, an array of startups is creating vital hardware and physical infrastructure. These ventures, ranging from battery manufacturing to carbon removal plants, are pivotal in our transition to a lower-emissions economy. Unlike typical software-focused ventures, these climate tech startups demand substantial capital and present diverse investment opportunities, attracting not only venture capitalists (VCs) but also infrastructure funds and real estate investors.

The Rise of Private Equity in Climate Tech

The journey to an exit for hardware and infrastructure startups is complex and varied. Stefan Maard, a general partner at VC fund Climentum, outlines three primary exit paths: the traditional IPO, corporate trade sales, and a newer trend — the private equity exit. PE firms, known for investing in mid to mature-stage companies, favor less risky, technologically proven, and profitable ventures. They often employ a strategy of acquiring multiple companies in the same industry, merging and streamlining them for a higher valuation.

Green Infrastructure: A Ripe Field for PE Investments

The green infrastructure sector, particularly mature in its technological advancements, presents an ideal landscape for PE-style investments. As Maard notes, the urgent need to green our infrastructure aligns well with PE firms’ investment ethos.

For VCs, the involvement of PE firms often signals a lucrative exit point. Sebastian Heitmann, general partner at Extantia Capital, notes that VCs typically sell their shares once PE investors step in.

Climate Focus: A New Trend in PE Funds

There’s a growing trend of large PE funds with a climate focus. Notable examples include KKR’s $8 billion European fund with a dedicated climate strategy and Copenhagen Infrastructure Partners’ $6.2 billion renewable energy fund. These funds are investing in a wide range of renewable technologies, from wind and solar to energy storage.

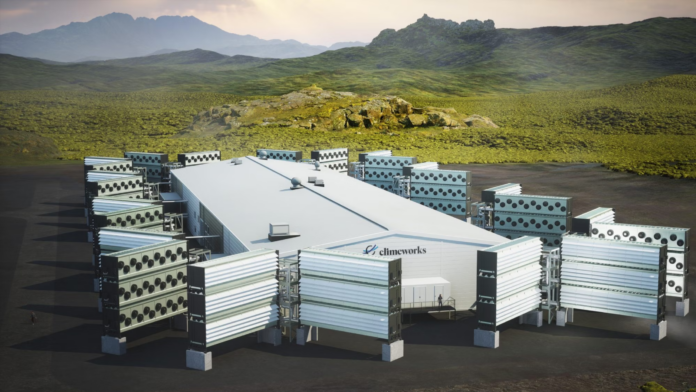

Case Studies: Climeworks and H2 Green Steel

Climeworks, a high-profile carbon dioxide removal startup, and H2 Green Steel, a unicorn in hydrogen-powered steel manufacturing, exemplify this new trend. Both have secured investments from PE firms at critical stages of their development. This backing from PE firms like Altor Equity Partners showcases a growing interest in scalable, proven green technologies.

The Challenge: Bridging the Funding Gap

Despite the enthusiasm for PE investment in climate tech, a funding gap remains, particularly in Europe, at the Series B stage and beyond. This gap poses a risk to startups aiming to reach a size attractive for PE investment. However, there are signs of change, with PE firms increasingly willing to invest earlier in a startup’s lifecycle.

A New Exit Paradigm

The evolving landscape of climate tech investment is shaping a new paradigm of exits. As green technologies mature and the market for sustainable infrastructure grows, PE firms are becoming a more prominent player in the startup ecosystem. This shift offers an alternative exit route for early-stage VCs and presents a promising future for the growth and success of climate tech ventures.