Are you curious about how to start investing in commodity markets? Look no further! This handy guide called “A Beginner’s Guide to Investing in Commodity Markets” will help you gain a better understanding of the world of commodity investment. Inside, you’ll find valuable information on how to navigate this market effectively and maximize your returns. From understanding the different types of commodities to evaluating their potential risks and rewards, this guide will equip you with the knowledge you need to confidently enter the world of commodity investment. So, get ready to explore the exciting world of investing in commodities and take your first steps towards building a profitable portfolio!

A Beginner’s Guide to Investing in Commodity Markets

This image is property of www.fisdom.com.

Types of Commodities

Commodity markets offer a diverse range of investment opportunities. There are several types of commodities that investors can consider. These include:

Agricultural Commodities

Agricultural commodities cover a wide range of products, including crops like wheat, corn, soybeans, and coffee. Investing in agricultural commodities can provide exposure to the fluctuations of global food prices, which are influenced by factors such as weather conditions, supply and demand dynamics, and government policies.

Energy Commodities

Energy commodities include crude oil, natural gas, and gasoline. These commodities have a significant impact on the global economy and are influenced by geopolitical events, supply disruptions, and changes in energy policies. Investing in energy commodities can be attractive for investors looking to benefit from price movements in the global energy market.

Metals Commodities

Metals commodities consist of precious metals like gold, silver, platinum, and industrial metals like copper and aluminum. These commodities are widely used in various industries and their prices are influenced by factors such as global economic conditions, supply and demand dynamics, and currency fluctuations. Investing in metals commodities can provide investors with a hedge against inflation and diversification from traditional asset classes.

Livestock Commodities

Livestock commodities include cattle, hogs, and poultry. These commodities are affected by factors such as demand for meat products, weather conditions, and government regulations. Investing in livestock commodities can provide exposure to the agricultural sector and diversify an investor’s portfolio.

Soft Commodities

Soft commodities refer to non-agricultural products that are typically grown rather than mined. Examples include cotton, sugar, cocoa, and orange juice. These commodities are influenced by factors such as weather conditions, disease outbreaks, and global demand. Investing in soft commodities can be a unique way for investors to diversify their portfolios and potentially benefit from price fluctuations in these markets.

Benefits of Investing in Commodity Markets

Investing in commodity markets can offer several benefits for investors. Some of the key advantages include:

Diversification of Portfolio

Commodities have a low correlation with stocks and bonds, making them an excellent addition to a diversified investment portfolio. By adding commodities to your portfolio, you can potentially reduce risk and increase returns by spreading your investments across different asset classes.

Inflation Hedge

Commodities have historically acted as an inflation hedge, meaning that their prices tend to rise when inflation is high. By investing in commodities, you can protect the purchasing power of your investments during periods of inflation.

Potential for High Returns

Commodity markets are known for their potential to generate high returns. The prices of commodities can be highly volatile, creating opportunities for investors to profit from price movements. However, it’s important to note that investing in commodities also comes with risks, as we will discuss later in this guide.

Liquid Market

Commodity markets are highly liquid, meaning that you can easily buy and sell com-modities without significant transaction costs. This liquidity provides investors with the ability to enter and exit positions quickly, allowing them to take advantage of market opportunities.

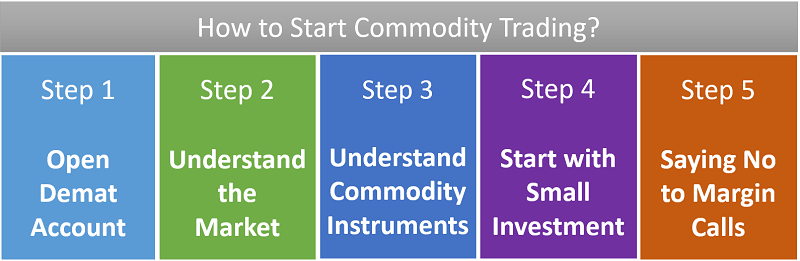

This image is property of top10stockbroker.com.

Risks Associated with Investing in Commodity Markets

While investing in commodity markets can offer attractive benefits, it’s important to be aware of the risks involved. Here are some of the key risks associated with investing in commodity markets:

Price Volatility

Commodity prices can be highly volatile, subject to sudden fluctuations due to various factors such as supply and demand imbalances, geopolitical events, and natural disasters. This volatility can lead to significant price swings that can impact the value of your investments.

Market Manipulation

Commodity markets are susceptible to manipulation, including practices such as price rigging and insider trading. This can lead to distortions in prices and create challenges for investors in accurately valuing their positions.

Lack of Control

Investors in commodity markets have limited control over the factors that influence commodity prices, such as weather conditions, government policies, and global economic trends. These factors can have a significant impact on the profitability of investments in commodity markets.

Perishable or Consumable Nature

Some commodities, particularly agricultural and livestock commodities, have a perishable or consumable nature. This means that they are subject to degradation or consumption over time. Investors need to consider the potential impact of perishability on their investments and manage their positions accordingly.

Factors to Consider Before Investing in Commodity Markets

Before investing in commodity markets, it’s important to assess several factors that can affect the success of your investments. Here are some key considerations to keep in mind:

Risk Tolerance

Investing in commodity markets involves a certain level of risk. It’s essential to evaluate your risk tolerance and determine how much volatility you are comfortable with. Remember that commodity markets can experience significant price fluctuations, and you need to be prepared to ride out these fluctuations if you choose to invest in commodities.

Market Knowledge

Having a good understanding of commodity markets is crucial for success in this asset class. Take the time to educate yourself about the different types of commodities, their price drivers, and the dynamics of commodity markets. This knowledge will help you make informed investment decisions and minimize the risk of making poor investment choices.

Time Horizon

Consider your investment time horizon when deciding whether to invest in commodity markets. Commodities are known for their volatility, and short-term investments in commodities can be more challenging due to increased price uncertainty. Long-term investors may have a higher tolerance for price fluctuations and may be better able to weather market downturns.

Financial Goals

Evaluate your financial goals and determine how investing in commodity markets aligns with these goals. Are you seeking capital appreciation, income generation, or risk diversification? Understanding your financial objectives will help you determine the role that commodity investments can play in your overall investment strategy.

This image is property of Amazon.com.

Strategies for Investing in Commodity Markets

There are several strategies that investors can employ when investing in commodity markets. Here are some popular strategies to consider:

Buy and Hold Strategy

The buy and hold strategy involves purchasing commodities with a long-term investment horizon. This strategy is based on the belief that commodities will appreciate in value over time due to factors such as population growth, increasing demand, and limited supply. With this strategy, investors aim to capture long-term capital appreciation and potentially benefit from any income generated by the commodities.

Managed Futures

Managed futures involve investing in a portfolio of futures contracts. These contracts give investors exposure to various commodities and allow them to profit from both upward and downward price movements. Managed futures are typically managed by professional portfolio managers who use sophisticated trading strategies to generate returns for investors.

Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends in commodity markets. Traders who use technical analysis use various indicators and tools to make buy and sell decisions. Technical analysis can be a valuable tool for investors looking to time their trades and capitalize on short-term price movements.

Seasonal Patterns

Commodity prices can exhibit seasonal patterns due to factors such as planting and harvesting cycles, weather conditions, and global demand. By analyzing historical data, investors can identify these seasonality patterns and potentially profit from them. Seasonal trading strategies involve buying commodities when prices are historically low and selling when prices are high.

How to Choose a Commodity Broker

Choosing the right commodity broker is essential for successful investing in commodity markets. Consider the following factors when selecting a commodity broker:

Regulation and Licenses

Ensure that the broker you choose is properly regulated and holds the necessary licenses to operate in the commodity markets. Regulation helps ensure that the broker adheres to industry standards and provides a level of protection for investors.

Fees and Commissions

Compare the fees and commissions charged by different commodity brokers. Different brokers may have different fee structures, and it’s important to understand the costs involved in trading commodities. Consider the impact of fees on your overall investment returns.

Trading Platform

Evaluate the trading platform offered by the commodity broker. The trading platform should be user-friendly, reliable, and provide access to a wide range of commodity markets. It should also offer real-time market data, charting tools, and order execution capabilities.

Research and Educational Resources

Consider the research and educational resources offered by the commodity broker. Does the broker provide market analysis, research reports, and educational materials to help investors make informed decisions? These resources can be valuable for investors, especially those new to commodity markets.

This image is property of i.postimg.cc.

Common Mistakes to Avoid When Investing in Commodity Markets

Investing in commodity markets can be rewarding, but it’s important to avoid common mistakes that can jeopardize your investment success. Here are some mistakes to watch out for:

Lack of Research

Failing to conduct thorough research is a common mistake among novice commodity investors. It’s important to understand the fundamentals and dynamics of the commodities you are investing in. Research can help you make informed decisions and avoid investing based on hearsay or market rumors.

Overleveraging

Overleveraging occurs when investors borrow too much money to invest in commodities. While leverage can amplify potential returns, it also increases the risk of significant losses. It’s important to use leverage judiciously and consider your risk tolerance before taking on excessive debt.

Ignoring Risk Management

Effective risk management is crucial when investing in commodity markets. It’s important to set risk limits, diversify your portfolio, and use stop-loss orders to limit potential losses. Ignoring risk management can expose you to unnecessary risks and potentially lead to substantial financial losses.

Following the Crowd

Investing based on market sentiment or following the crowd can be a recipe for disaster. Market sentiment can be fickle, and investments made based on crowd behavior may not align with your investment goals or risk tolerance. It’s important to make independent investment decisions based on your own analysis and research.

Resources for Learning More About Commodity Markets

If you’re interested in learning more about commodity markets, there are several resources available to expand your knowledge. Here are some options to consider:

Books and eBooks

There are numerous books and eBooks available that provide comprehensive insights into commodity markets. Some recommended titles include “Commodity Investing: Maximizing Returns through Fundamental Analysis” by Adam D. Grossman and “The Little Book of Commodity Investing” by John Stephenson.

Online Courses

Online courses can offer a structured learning experience and cover a wide range of topics related to commodity investing. Platforms like Coursera and Udemy offer courses on commodity trading, commodities market analysis, and risk management.

Webinars and Seminars

Attending webinars and seminars conducted by industry experts can provide valuable insights into commodity markets. Many financial institutions and trading firms offer free webinars and seminars, covering topics such as technical analysis, trading strategies, and market outlooks.

Financial Websites and Blogs

Financial websites and blogs can offer up-to-date information and analysis of commodity markets. Websites like Bloomberg, CNBC, and Investing.com provide news, market data, and expert opinions on commodity markets. Additionally, many financial bloggers specialize in commodities and offer valuable insights and analysis.

In conclusion, investing in commodity markets can provide an excellent opportunity to diversify your portfolio, hedge against inflation, and potentially earn high returns. However, it’s crucial to understand the types of commodities available, the benefits and risks associated with commodity investing, and the strategies and factors to consider before diving into this asset class. By arming yourself with knowledge and following best practices, you can navigate the complexity of commodity markets and make informed investment decisions.

This image is property of blog.elearnmarkets.com.