In “Crypto Funding in August: A Closer Look,” it is revealed that the state of crypto funding is not as optimistic as it may appear at first glance. While August seemed to bring some relief with an increase in venture capitalists’ investments, the numbers are not as promising as they seem. This is because the increase in funding is primarily driven by two significant rounds raised by Haqqex and BitGo. Without these rounds, there would have actually been a decline in investment compared to July. Furthermore, when compared to the same time last year, there has been a substantial 53% decline in funding. This trend of decreased enthusiasm from venture capital investors has been ongoing since Q1 of 2022. Despite the seemingly positive numbers in August, the overall outlook for the future remains uncertain in the crypto funding space.

Crypto Funding in August: A Closer Look

Introduction

Welcome to a comprehensive analysis of crypto funding in the month of August. In this article, we will delve into the funding situation for crypto and blockchain startups, examine the figures from August, and discuss the impact of significant funding rounds by Haqqex and BitGo. We will also compare the funding levels to previous years, analyze the long-term trend, and explore the challenges that startups face in this space. Finally, we will take a look at the future outlook for crypto funding and conclude with a summary of the key findings.

Overview of the Funding Situation

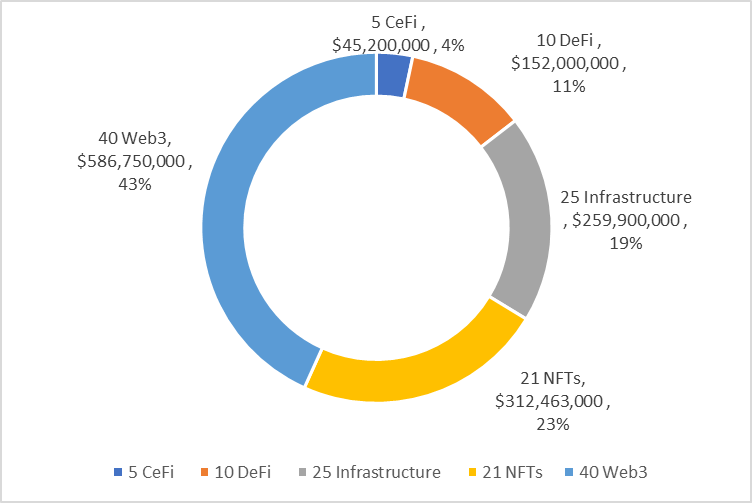

Crypto and blockchain startups have been experiencing a slowdown in funding for quite some time now. This can be attributed to various factors, including a stronger focus on due diligence by investors and concerns over the macroeconomic environment and regulations in the U.S. Despite these challenges, August appeared to be a promising month for startups, with venture capitalists investing a total of $819 million across 91 companies. However, it is important to take a closer look at these numbers to understand the true funding situation.

August Figures

While the total funding amount in August may seem impressive, it is crucial to consider the impact of two significant funding rounds by Haqqex and BitGo. Haqqex, a “Shariah-compliant” digital asset exchange, raised a massive $400 million round, while crypto custodian BitGo secured a $100 million round. Without these two rounds, the overall investment in the crypto space would have actually seen a decline compared to July. This highlights the importance of analyzing the funding numbers in depth to get an accurate picture of the situation.

Impact of Haqqex and BitGo Rounds

The funding rounds by Haqqex and BitGo significantly skewed the funding figures for August. While these rounds brought some relief to startups, they also mask the underlying challenges faced by the industry. It is essential to evaluate the funding environment without relying solely on these outlier rounds in order to gain a comprehensive understanding of the funding landscape.

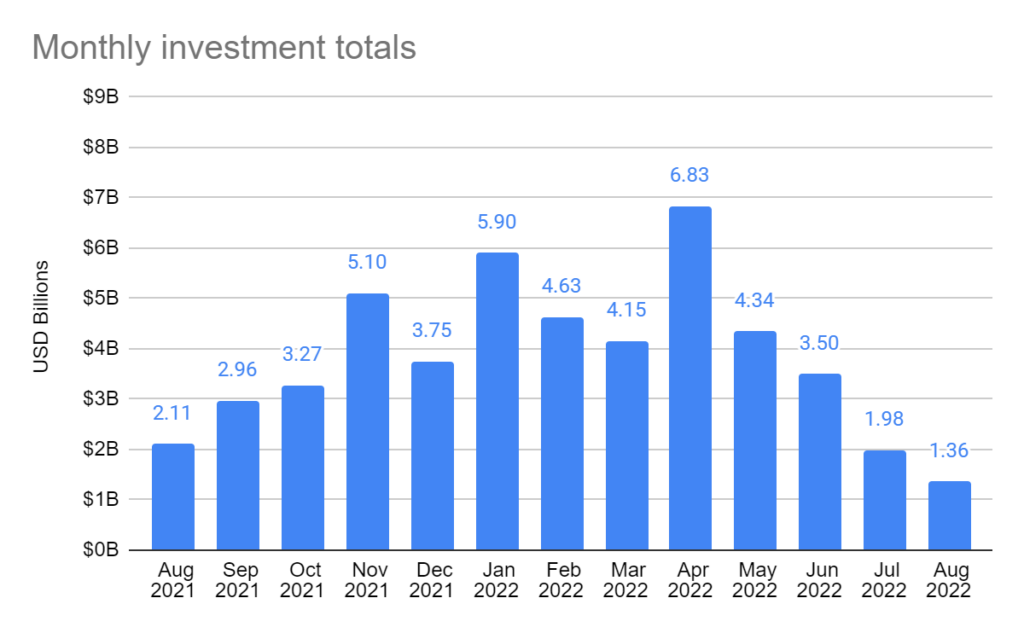

Comparison to Previous Years

When compared to the same time last year, the funding decline becomes apparent. In August 2021, startups raised a total of $1.74 billion, which is a staggering 53% decline from the funding raised in August 2020. This decline is not an isolated trend but rather a continuation of a downward trajectory that has been observed since Q1 2022. The lack of enthusiasm from venture capital investors in the digital asset industry is evident, with five consecutive quarters of decreasing investments.

Long-Term Trend

The long-term trend in the digital asset industry shows a decline in investor sentiment. Although August’s funding numbers might have provided a temporary reprieve, the overall quarterly trends reveal a sustained downturn. It is crucial to closely monitor this trend to understand the broader implications for startups and investors in the space.

Current Quarter Funding

In the current quarter, crypto startups have raised a total of $1.38 billion. To surpass the funding levels of the second quarter, startups would need to secure an additional $960 million in September. However, considering the challenges faced by startups and the declining trend in funding, achieving this goal seems uncertain. Startups must navigate these challenges and potential obstacles to maintain a healthy funding environment.

Challenges for Startups

Fundraising in the crypto space presents unique difficulties for startups. The overall slowdown in funding, coupled with factors affecting investor interest, makes securing investments a challenging task. Additionally, navigating the regulatory landscape poses additional hurdles for startups. It is crucial for startups to adapt to these challenges and find innovative ways to attract investor interest and ensure compliance with regulations.

Future Outlook

Looking ahead, the future outlook for crypto funding remains uncertain. While August’s funding numbers may initially seem positive, a closer analysis reveals the underlying challenges faced by startups in this space. It is important for startups and investors alike to remain vigilant and adapt strategies to overcome these challenges. Continued analysis and monitoring of the funding situation will be crucial to understanding the evolving dynamics of the crypto funding landscape.

Conclusion

In conclusion, the funding situation for crypto and blockchain startups in August was a mix of promise and challenges. While the total funding amount appeared impressive, it was largely influenced by two outlier rounds, and a decline in funding compared to previous years. The long-term trend of decreasing investor sentiment and the challenges faced by startups highlight the need for careful analysis and adaptation in this space. By understanding the funding landscape and navigating the regulatory landscape, startups can position themselves for success in a rapidly evolving industry.