In this article, MIT economists Arnaud Costinot and Iván Werning explore the potential impact of a proposed ‘robot tax’ on automation and jobs. The ongoing debate about robots and their effect on the workforce has sparked discussions about the merits and drawbacks of taxing firms that replace human workers with robots. Proponents argue that such a tax

Debate on the impact of robots on jobs

There has been an ongoing debate about the impact of robots on jobs and the workforce. Some argue that robots will replace bad jobs or make them more efficient, leading to overall job growth. On the other hand, there are concerns about job displacement, with fears that automation could lead to high unemployment rates and economic inequalities. This debate sets the stage for discussions about the potential impact of a ‘robot tax’ on automation and jobs.

Beliefs regarding job displacement

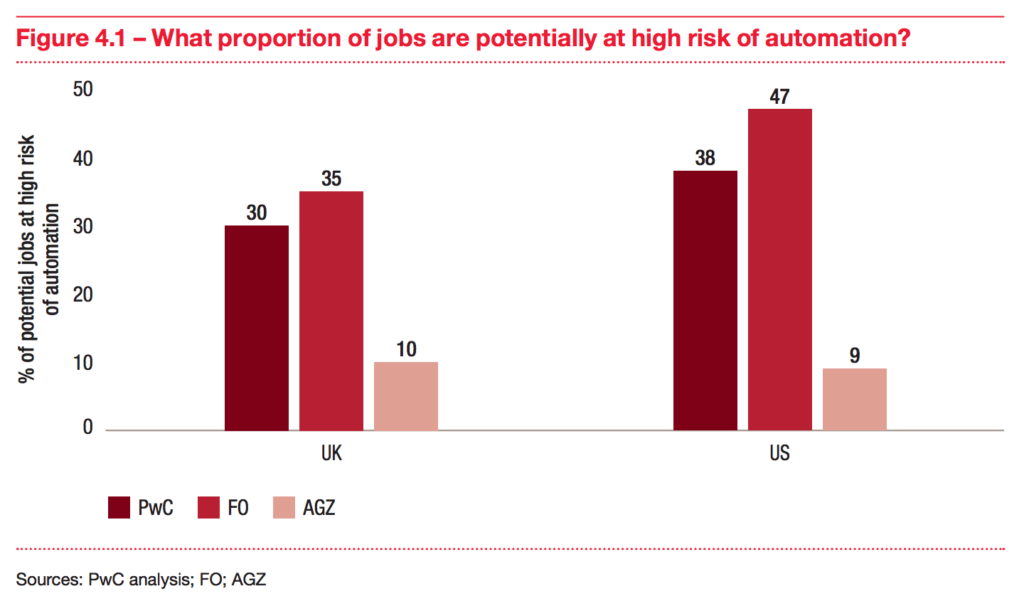

Opinions regarding job displacement caused by automation vary among experts and policymakers. Some believe that the introduction of robots will lead to new job opportunities and an overall increase in employment. They argue that automation allows humans to focus on more complex, creative tasks, while mundane and repetitive tasks are delegated to robots. On the other hand, there are concerns that automation could result in job losses, particularly in industries where tasks can be easily replicated by machines. The fear is that humans will be unable to find alternative employment, leading to economic and social hardships.

The concept of a robot tax

One proposed solution to address the potential negative effects of automation on jobs is the implementation of a ‘robot tax.’ The concept behind a robot tax is simple: firms would be required to pay a tax when they replace a human worker with a robot. By introducing a tax on automation, it aims to disincentivize firms from replacing human employees, effectively slowing down the pace of automation.

Purpose of a robot tax

The primary purpose of a robot tax is twofold. Firstly, it aims to generate revenue for the government, which could be used to fund social safety nets and programs that support workers who may be displaced by automation. Secondly, it serves as a deterrent for firms to automate certain tasks entirely, encouraging the retention of human workers.

Advantages of a robot tax

Supporters of a robot tax argue several advantages. First and foremost, it could help address the potential economic disruption caused by automation. The revenue generated from the tax, if appropriately allocated, could provide support and resources for individuals and communities affected by job displacement. Additionally, a robot tax could encourage companies to invest in worker training and skill development, as it would become more cost-effective to retain and upskill existing employees rather than substitute them with robots. This could foster a more resilient and adaptable workforce, equipped with the skills necessary to thrive in an automated economy.

Disadvantages of a robot tax

However, there are concerns over the potential disadvantages of implementing a robot tax. Some argue that it could stifle innovation and hinder the overall competitiveness of firms. If companies face higher costs when adopting automation, they may be less inclined to invest in research and development to enhance their products and services, potentially slowing down technological progress. Additionally, opponents of a robot tax highlight that it could disproportionately impact small businesses and startups, as they may lack the financial resources to absorb the additional tax burden.

MIT economists’ perspective on robot taxes

MIT economists Arnaud Costinot and Iván Werning have shed light on the impact of a proposed ‘robot tax’ through their research. They suggest that taxes on robots or imported goods should be relatively modest, rather than exorbitant. The economists argue that moderate taxation would strike a balance, allowing the government to generate revenue while still encouraging investment in automation technologies. They suggest that careful consideration of the tax rate is crucial to avoid excessive burden on businesses or disincentivizing automation entirely.

Prominent figures’ views on robot taxation

Several prominent figures have expressed their views on robot taxation. For instance, Bill Gates and Bernie Sanders have both called for some form of taxation to address job displacement caused by automation. While they agree on the need for action, the details of their proposed tax mechanisms may vary. These influential voices contribute to the ongoing public dialogue on the potential impact and necessity of robot taxation.

Current research on robots and employment

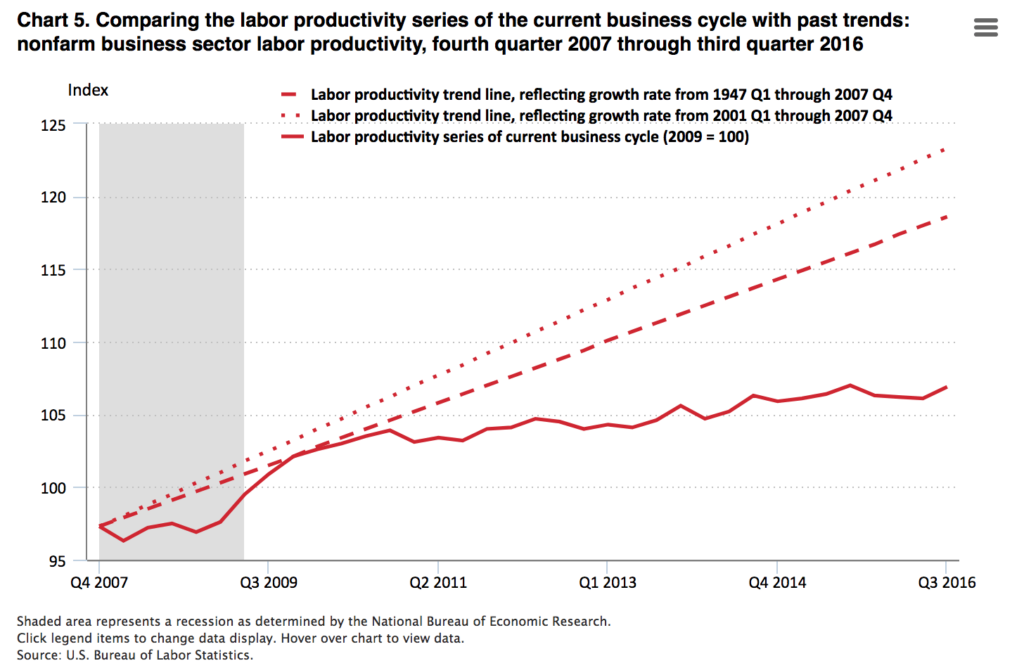

Existing research sheds light on the complex relationship between robots, automation, and employment. Contrary to initial fears, some studies suggest that firms adopting robots actually experience a net increase in employment. This unexpected outcome challenges the assumption that automation directly leads to job losses. However, it is important to note that these studies may not capture the full range of effects across different industries and job types. Therefore, further research is necessary to gain a more comprehensive understanding of the impact of automation on employment.

Legislation on robot taxation in South Korea

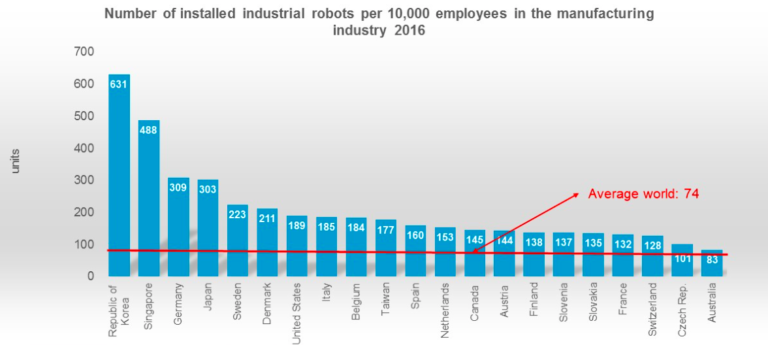

While the implementation of robot taxation remains a topic of discussion in many countries, South Korea has come close to passing legislation related to this matter. The South Korean government has recognized the potential risks and benefits of automation and is actively exploring the idea of a robot tax. Their proposed legislation outlines a tax framework aimed at addressing potential job displacement and generating revenue for social welfare programs. The progress made in South Korea could serve as a valuable case study for other nations considering similar legislation.

Effects of AI and technology on robot taxation

The ongoing advancements in artificial intelligence (AI) and technology have significant implications for the potential impact of robot taxation. As AI becomes more sophisticated, the capabilities of robots and automated systems expand, potentially leading to increased automation in various industries. It is crucial that policymakers continuously assess and update tax frameworks to account for these rapid technological developments. Failure to do so may render existing robot tax legislation ineffective or inadequate in addressing the challenges posed by evolving automation technologies.

Upskilling as a solution to job displacement

Addressing job displacement caused by automation requires comprehensive measures beyond taxation alone. One possible solution is upskilling, which focuses on equipping workers with the skills needed to remain relevant and productive in an automated world. By investing in training programs and education initiatives, individuals can enhance their capabilities and adapt to the changing demands of the job market. While upskilling is seen as a promising solution, its efficacy is mixed, and further research is needed to determine the most effective strategies and approaches.

In conclusion, the potential impact of a ‘robot tax’ on automation and jobs sparks a lively debate among experts, policymakers, and society as a whole. While a robot tax could generate revenue and provide support for those affected by automation, concerns regarding innovation and competitiveness must be carefully considered. Ongoing research, legislation in South Korea, and advancements in AI and technology will shape our understanding of this issue. Ultimately, a comprehensive approach that includes upskilling initiatives and thoughtful tax policies may hold the key to mitigating the potential negative consequences of automation on jobs.