Are you interested in learning about index funds and how to invest in them? Look no further, because “A Beginner’s Guide to Investing in Index Funds” is here to help you navigate this exciting world of investing.

In this guide, we will walk you through the basics of index funds and provide you with practical tips to get started. Whether you’re a complete novice or have some knowledge of investing, this guide is designed to support you every step of the way. With clear explanations and easy-to-follow instructions, you’ll gain a solid understanding of what index funds are, how they work, and how to make wise investment decisions. So, get ready to take charge of your financial future with the help of this beginner’s guide!

A Beginner’s Guide to Investing in Index Funds

This image is property of m.foolcdn.com.

Choosing an Index Fund

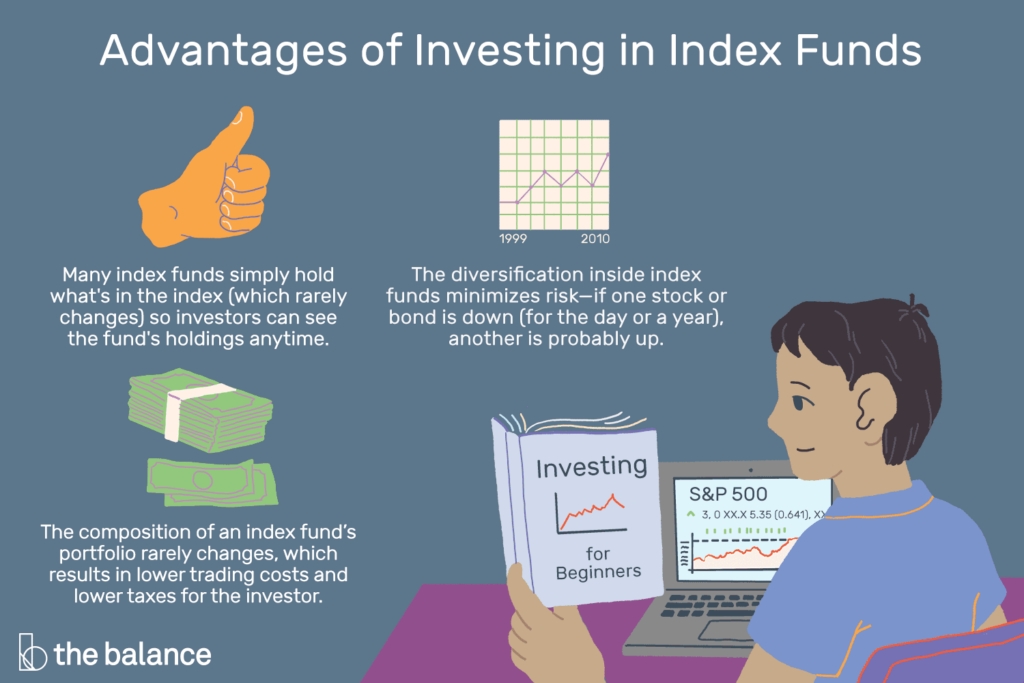

Understanding Index Funds

When it comes to investing, index funds are a popular choice for beginners. But what exactly is an index fund? An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. By investing in an index fund, you are essentially buying a diversified portfolio of stocks or bonds that make up the index it tracks.

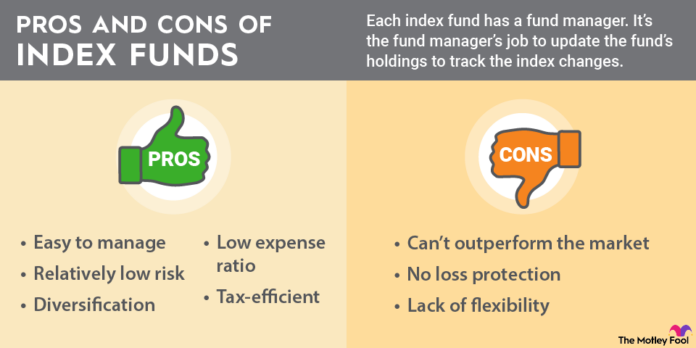

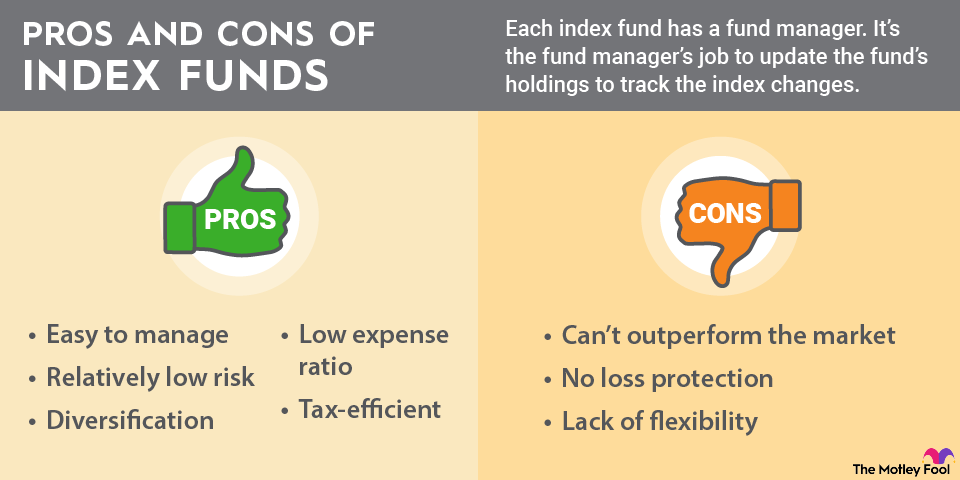

Diversification

One of the key advantages of index funds is their ability to provide diversification. Diversification means spreading your investments across different asset classes, sectors, and regions to reduce the risk of any individual investment impacting your overall portfolio. Index funds offer instant diversification because they hold a large number of securities that make up the index they track. This diversification mitigates the risk associated with investing in individual stocks or bonds.

Expense Ratio

Another important factor to consider when choosing an index fund is the expense ratio. The expense ratio is the annual fee charged by the fund provider to cover the operating expenses of the fund. Since index funds aim to replicate the performance of a specific index, they generally have lower expense ratios compared to actively managed funds. As an investor, it’s essential to evaluate the expense ratio and choose index funds with lower costs to enhance your investment returns over time.

Tracking Error

While index funds aim to track the performance of a specific index, there may be slight discrepancies between the fund’s returns and the index it tracks. This is known as tracking error. It can occur due to factors such as transaction costs, fees, or differences in the timing of acquiring securities. When comparing index funds, it’s important to consider the tracking error and choose funds that closely align with the intended index.

Historical Performance

Examining the historical performance of index funds is an important step in the selection process. While past performance does not guarantee future results, it can provide insights into how the fund has performed relative to its index and other funds in the category. Look for index funds that have consistently delivered solid performance over the long term, as this demonstrates their ability to generate favorable returns for investors.

Determining Investment Goals

Short-term vs Long-term

Your investment goals play a crucial role in deciding the type of index funds that align with your needs. Are you investing for the short-term, such as saving for a down payment on a house, or are you investing for the long-term, such as funding your retirement? Short-term goals typically require more conservative investment strategies, while long-term goals may allow for more aggressive growth-focused investments.

Risk Tolerance

Understanding your risk tolerance is essential when selecting index funds. Risk tolerance refers to your willingness and ability to endure fluctuations in the value of your investments. If you have a high risk tolerance, you may be more comfortable with the potential for higher returns and are willing to tolerate greater fluctuations in your portfolio’s value. On the other hand, if you have a low risk tolerance, you may seek more stable investments with lower potential returns.

Investment Horizon

Your investment horizon is the period of time you expect to hold your investments before needing to access the funds. If you have a long investment horizon, such as several decades until retirement, you may have a higher tolerance for short-term market fluctuations and can consider investing in index funds with a longer-term growth focus. For shorter investment horizons, it may be more prudent to select index funds with a lower level of volatility and shorter-term performance expectations.

Financial Objectives

Clearly defining your financial objectives is crucial in identifying the most suitable index funds for your investment strategy. Are you looking for capital appreciation, income generation, or a combination of both? Different index funds may align better with specific objectives. For example, if you are seeking income generation, bond index funds may be a suitable choice, while broad market index funds may offer better capital appreciation potential.

This image is property of www.thebalancemoney.com.

Exploring Different Index Fund Types

Broad Market Index Funds

Broad market index funds aim to mirror the performance of a broad-based market index, such as the S&P 500. These funds provide exposure to a wide range of companies across various sectors and industries, making them a suitable choice for investors seeking broad diversification and long-term growth potential.

Sector Index Funds

Sector index funds focus on specific industry sectors, such as technology, healthcare, or energy. By investing in sector index funds, you can target specific areas of the market that you believe will outperform, providing an opportunity for potentially higher returns. However, it’s important to note that sector funds can be more volatile and carry higher risks compared to broad market index funds.

International Index Funds

International index funds provide exposure to companies located outside your home country. These funds can be region-specific, such as European or Asian index funds, or more globally diversified. Investing in international index funds can help diversify your portfolio and capture the growth potential of foreign markets. However, it’s important to consider currency fluctuations and geopolitical risks when investing internationally.

Bond Index Funds

Bond index funds focus on fixed-income securities, such as corporate bonds, government bonds, or municipal bonds. These funds provide investors with a predictable stream of income and are generally considered less risky than equity-based index funds. Bond index funds can be an attractive choice for investors seeking income generation and capital preservation.

Specialty Index Funds

Specialty index funds focus on specific market niches or investment strategies. These funds may track alternative indexes such as those based on environmental, social, and governance (ESG) factors or dividend-focused indexes. Specialty index funds can provide unique investment opportunities beyond traditional market indices, but investors should carefully evaluate the risk and performance characteristics of these funds before investing.

Researching Fund Providers

Reputation and Track Record

When researching index fund providers, consider their reputation and track record. Look for fund providers with a long history of successfully managing index funds, as this demonstrates their expertise and ability to consistently track the performance of the underlying index. Additionally, check if the fund provider has received any industry recognition or awards for their index fund offerings.

Fund Size

The size of a fund can reflect its popularity and investor confidence. Larger index funds often have more significant assets under management (AUM) and may offer greater liquidity. A fund with substantial AUM can attract institutional investors, which may contribute to lower expense ratios and better tracking performance. However, smaller funds can also provide unique investment opportunities by focusing on specific market niches that larger funds may not cover.

Fund Management

Understanding the fund management team is crucial when evaluating index funds. Look for fund providers with experienced and knowledgeable portfolio managers who have a track record of successfully managing index funds. Research the team’s investment philosophy, process, and approach to ensure it aligns with your investment objectives.

Turnover Ratio

The turnover ratio measures the frequency with which a fund buys and sells securities within the portfolio. High turnover can lead to increased transaction costs, which may reduce the fund’s performance. Index funds typically aim to minimize turnover by closely tracking the index they replicate. Lower turnover ratios are generally desirable as they help keep costs low and reduce the potential for adverse tax consequences.

Distribution Method

Consider the distribution method of the index fund when assessing fund providers. Some funds offer dividends or capital gains distributions, while others may reinvest them back into the fund. Depending on your financial objectives, you may prefer funds that provide regular cash distributions or those that reinvest dividends to maximize long-term growth potential.

This image is property of doc.utimf.com.

Understanding Risk and Return

Volatility

Volatility refers to the degree of fluctuation in the value of an investment. In the context of index funds, volatility measures the ups and downs in the fund’s value over time. Higher volatility indicates a greater degree of risk and the potential for larger price swings. While volatility is inherent in the stock market, index funds, particularly those tracking broad market indexes, can help mitigate risk through diversification.

Market Fluctuations

Index funds are not immune to market fluctuations. The prices of securities within the fund’s portfolio will fluctuate as market conditions change. It’s important to be mentally prepared for these fluctuations and avoid making impulsive investment decisions based on short-term market movements. Index funds are designed for long-term investment horizons and benefit from the compounding effect over time.

Past Performance vs Future Results

When reviewing a fund’s historical performance, it’s essential to remember that past performance does not guarantee future results. While analyzing historical returns can provide insights into a fund’s ability to generate favorable results, it’s crucial to assess other factors such as the fund’s investment strategy, management team, and market conditions when making investment decisions.

Investment Risk

All investments come with a certain level of risk. Even index funds, which offer diversification and aim to replicate the performance of an index, are not completely risk-free. Market downturns, economic factors, and other unforeseen events can impact the value of index funds. Understanding and accepting the risks associated with investing is essential for long-term success.

Expected Returns

While index funds generally offer competitive long-term returns, it’s important to maintain realistic expectations. The returns generated by index funds will closely align with the performance of the underlying index, minus the fund’s expenses. Index funds are not designed to outperform the market; instead, they aim to mirror its performance. Investors should set expectations based on historical returns and their individual investment goals.

Creating a Portfolio

Asset Allocation

Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash equivalents. The goal of asset allocation is to manage risk and maximize potential returns by spreading investments across different asset classes with varying levels of risk and return potentials. When building your portfolio, consider your risk tolerance, investment goals, and time horizon to determine the most appropriate asset allocation.

Diversification Strategies

Diversification is a key principle in portfolio construction. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of individual security or market fluctuations on your overall portfolio. Along with investing in index funds, consider diversifying your portfolio with other asset classes such as bonds, real estate, or international stocks to further mitigate risk.

Balancing Risk and Reward

Balancing risk and reward is crucial in portfolio management. Higher-risk investments may offer the potential for greater returns but also come with increased volatility. On the other hand, lower-risk investments may provide stability but offer lower potential returns. Your risk tolerance and investment goals will dictate the appropriate balance between risk and reward in your portfolio.

Choosing the Right Mix

Selecting the right mix of index funds for your portfolio is a critical decision. Consider your investment goals, risk tolerance, and time horizon when determining the allocation of your investments across different index funds. A well-diversified mix of broad market index funds, sector funds, and international funds can help you capture the growth potential of various market segments while managing risk.

Rebalancing

Rebalancing is the process of adjusting your portfolio’s asset allocation back to its original target weights. Over time, the performance of different asset classes or index funds may cause your portfolio to deviate from your desired allocation. Regularly reviewing and rebalancing your portfolio ensures that you maintain your desired risk level and investment strategy. Rebalancing can be done annually, semi-annually, or when significant market shifts occur.

This image is property of www.thestockdork.com.

Investing in Index Funds: Step-by-Step

Opening an Investment Account

To invest in index funds, you’ll need to open an investment account. This can be done through a brokerage firm, a mutual fund company, or an online investment platform. Compare the different providers based on factors such as account fees, minimum investment requirements, and the availability of the index funds you are interested in.

Selecting the Desired Index Fund

Once you have opened an investment account, you can start researching and selecting the index funds that align with your investment goals. Consider factors such as the fund’s expense ratio, tracking error, historical performance, and the index it aims to replicate. Review the fund’s prospectus or fact sheet for detailed information about the fund’s holdings, strategy, and objectives.

Investment Amount

Decide on the amount you are willing to invest in index funds. Some index funds have minimum investment requirements, so ensure that the amount you plan to invest meets these criteria. It’s important to strike a balance between investing a significant amount to benefit from potential returns and ensuring you have sufficient funds for your other financial obligations.

Placing Trades

Once you have selected the index fund you want to invest in, you can place a trade through your investment account. This can typically be done online or through a broker. Enter the desired investment amount and review the trade details. Ensure that all the information is accurate before finalizing the trade. The index fund shares will be purchased at the prevailing market price at the time of the trade.

Monitoring and Making Adjustments

After investing in index funds, it’s important to regularly monitor your portfolio’s performance. Keep track of the fund’s returns, overall market conditions, and any relevant news or events that may impact the performance of the index fund. Depending on changes in your investment goals or market conditions, you may need to make adjustments to your portfolio by selling or adding index fund shares.

Tax Considerations

Tax Efficiency of Index Funds

Index funds are known for their tax efficiency compared to actively managed funds. Due to their passive investment approach and low turnover, index funds generate fewer taxable events, such as capital gains distributions. These funds can help investors minimize their tax liabilities and maximize after-tax returns. However, it’s important to consult with a tax professional to understand the specific tax implications based on your individual circumstances.

Dividends and Capital Gains

Index funds generate income through dividends and capital gains distributed by the underlying securities held within the fund. Dividends paid by the stocks or bonds held in the fund are passed through to investors in the form of dividends. Capital gains are generated when the fund sells securities that have appreciated in value. Dividends and capital gains distributions may be subject to income tax or capital gains tax, depending on the holding period and tax laws.

Tax-Advantaged Accounts

Investing in index funds through tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k) plans, can provide additional tax benefits. Contributions made to these accounts may be tax-deductible or made on a pre-tax basis, reducing your current taxable income. Earnings within tax-advantaged accounts grow tax-free until withdrawals are made, potentially allowing you to defer taxes on investment gains.

Tax-Loss Harvesting

Tax-loss harvesting involves strategically selling investments that have experienced a loss to offset capital gains and potentially reduce your tax liability. While index funds generally aim to minimize tax consequences, there may be opportunities for tax-loss harvesting if specific index funds within your portfolio have declined in value. This strategy should be implemented carefully and in consultation with a tax professional to ensure compliance with tax regulations.

Consulting a Tax Professional

Tax considerations can play a significant role in investment decisions. It’s advisable to consult with a tax professional or financial advisor who can provide guidance based on your specific tax situation. They can help you navigate the tax implications of investing in index funds, identify potential tax-saving strategies, and ensure compliance with tax regulations.

This image is property of i.insider.com.

Monitoring and Evaluating

Tracking Fund Performance

Regularly tracking the performance of your index funds is essential for evaluating their overall effectiveness in helping you achieve your investment goals. Monitor the fund’s total return, which includes both price appreciation and dividends, and compare it to the underlying index it aims to replicate. Evaluate the fund’s performance relative to other funds in the same category to determine if it is generating competitive returns.

Evaluating Fund Managers

While index funds are passively managed, it’s still important to evaluate the fund management team responsible for tracking the chosen index. Look into the experience and expertise of the fund managers, their historical performance in managing index funds, and their ability to mitigate tracking error. Ensure that the index fund provider has a robust investment process and a team that can confidently execute the fund’s strategy.

Keeping up with Market News

Stay informed about market news and developments that may impact the performance of your index funds. Keep an eye on company earnings releases, economic reports, and geopolitical events that could influence the overall market or specific sectors within your portfolio. This information can help you make informed decisions about rebalancing your portfolio or taking advantage of potential investment opportunities.

Evaluating Portfolio Allocation

Periodically evaluate your portfolio allocation to ensure it remains aligned with your investment goals and risk tolerance. As you progress towards your financial objectives or experience changes in your personal circumstances, you may need to adjust the allocation of your investments. Regularly review your asset allocation to maintain the desired risk-reward balance and make any necessary adjustments.

Benchmarking

Benchmarking involves comparing the performance of your index funds against a relevant market index or a benchmark that represents your investment strategy. This comparison can help you assess the effectiveness of your investment decisions and identify areas where your portfolio may be underperforming or outperforming the benchmark. Use benchmarking as a tool to evaluate the success of your index fund investments and make informed decisions about potential adjustments.

Common Pitfalls to Avoid

Chasing Past Performance

One common mistake investors make is chasing past performance. While a fund’s historical returns can provide useful insights, they should not be the sole basis for making investment decisions. Past performance does not guarantee future results, and funds that have performed well in the past may not necessarily continue to outperform in the future. Focus on a fund’s long-term track record, investment strategy, and risk factors rather than solely relying on past performance.

Overreacting to Market News

Reacting impulsively to short-term market movements or sensational news headlines can be detrimental to your investment strategy. Market fluctuations are a normal part of investing, and trying to time the market or making frequent changes to your portfolio based on news can lead to missed opportunities or unnecessary transaction costs. Maintain a long-term perspective and stick to your investment plan, ignoring short-term market noise.

Frequent Trading

Excessive trading within your portfolio can harm your investment returns. Continuous buying and selling of index fund shares can result in increased transaction costs and potential tax implications. Index funds are designed for long-term investing, and frequent trading can disrupt the benefits of compounding and reduce the potential for long-term growth. Be disciplined and avoid unnecessary trading unless it aligns with your long-term investment strategy.

Ignoring Fees and Expenses

While index funds generally have lower expense ratios compared to actively managed funds, it’s still important to consider the impact of fees and expenses on your investment returns. Over time, even small differences in expense ratios can significantly erode your wealth. Compare the costs of different index funds and opt for funds with lower expense ratios, allowing you to keep more of your investment returns.

Lack of Patience

Investing in index funds requires patience and a long-term investment outlook. Avoid getting discouraged by short-term market fluctuations or expecting immediate returns. Stick to your investment plan and remain patient, allowing the power of compounding and the long-term growth potential of index funds to work in your favor. Remember that investing is a marathon, not a sprint.

Seeking Professional Advice

Financial Advisors

If you are unsure about how to proceed with your index fund investments, consider seeking guidance from a certified financial advisor. A financial advisor can provide personalized advice based on your financial goals, risk tolerance, and investment time horizon. They can help you navigate the complex world of investing and ensure that your investments align with your specific needs and objectives.

Robo-Advisors

Robo-advisors are digital platforms that offer automated investment advice based on algorithms and pre-determined investment models. These platforms can create a diversified portfolio of index funds tailored to your investment goals and risk tolerance. Robo-advisors typically have lower fees compared to traditional financial advisors, making them a cost-effective option for beginner investors looking for professional advice.

Online Investment Communities

Engaging with online investment communities can provide educational resources, insights, and support from fellow investors. These communities often consist of individuals with varying levels of investment knowledge and experience who can share their perspectives and strategies. Participating in online investment communities can help you gain a better understanding of index fund investing and learn from the experiences of others.

Investment Education

Investment education is crucial for beginner investors looking to invest in index funds. Take advantage of resources such as books, articles, online courses, and seminars to enhance your knowledge of index funds and investing principles. The more you understand about index funds, the better equipped you will be to make informed investment decisions and navigate the complexities of the financial markets.

Getting Started

Investing in index funds is a great way for beginners to enter the world of investing. By following the steps outlined in this guide, you can learn about index funds, understand your investment goals, explore different types of index funds, and select the right ones for your portfolio. Remember to regularly review your portfolio, consider tax implications, and seek professional advice when needed. With patience and a long-term perspective, index funds can help you achieve your financial goals while minimizing risks.