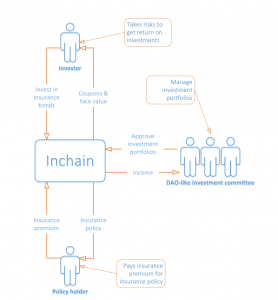

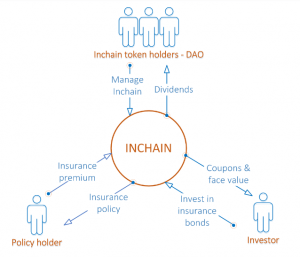

Inchain is a decentralised blockchain platform designed for insuring risks while simultaneously providing opportunities for investing in insurance-based bonds. Based on the Ethereum blockchain, the platform issues and maintains tokenised insurance policies and bonds, transferring risks from policyholders to bond investors.

Inchain is a decentralised blockchain platform designed for insuring risks while simultaneously providing opportunities for investing in insurance-based bonds. Based on the Ethereum blockchain, the platform issues and maintains tokenised insurance policies and bonds, transferring risks from policyholders to bond investors.

Once the trader has obtained the insurance policy as described above, Inchain issues bonds linked to the policy. The bonds have specific coupon rates, face values, ratings and durations.

The bonds become available at the trading section immediately after issuing.

The face value of the bonds are paid:

• To the policyholder if the risks have materialised

• To the investor if the bonds are expired

SWOT Analysis

Strengths

- Untapped market

- Strong team, which come from the crypt world and the insurance world

- Inchain will be using the Etherum platform

Weakness

- There is potential for insurance scams

- There could be theft of the InChain tokens

Opportunities

- Looks better organised then the previous DAO, which failed.

- Inchaintokenholders will manage a DAO that oversees both the sale of insurance policies and the issuance and trade of the insurance-linked bonds.

- Blockchain will be an integral life of our life by 2020. Blockchain insurance will become more important.

Threats

- This is a startup and carries all the risks of startups.

- If inchain forks, who will own the underlying assets?

- More inChain tokens/coins could be issued in the future diluting your holding.

Details

Start: October 26, 2016

End: November 23, 2016

How to invest?

ICO means an initial coin offering. The coins are the shares within the Inchain organisation, owning these will make you part of the success of failure of inchain.

To participate visit : http://ico.inchain.io/

Other sources: