Are you interested in learning about Investing in mutual funds, but don’t know where to start? Look no further! “A Beginner’s Guide to Investing in Mutual Funds” is here to help you navigate the world of mutual fund investments.

In this guide, you will discover the basics of investing in mutual funds and gain a solid understanding of how they work. We will cover topics such as different types of mutual funds, the benefits and risks involved, and how to choose the right funds for your investment goals. Whether you are a complete novice or have some knowledge of investing, this guide will provide you with valuable insights and tips to get started on your mutual fund investment journey. Get ready to unlock the potential of mutual funds and take control of your financial future!

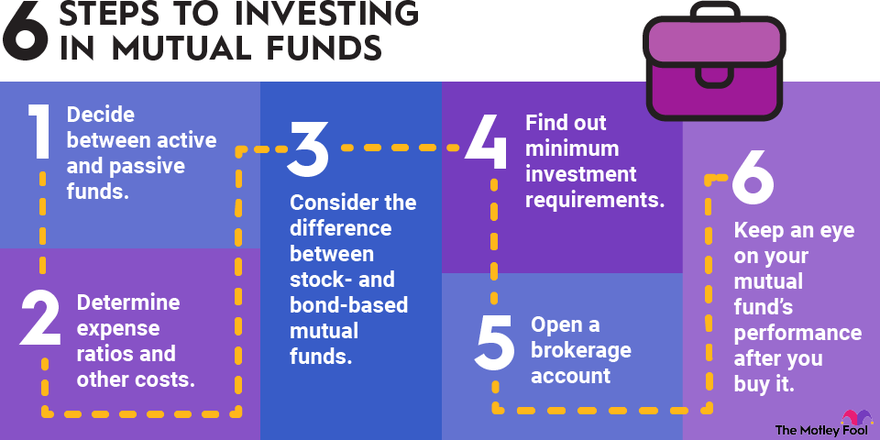

This image is property of m.foolcdn.com.

A Beginner’s Guide to Investing in Mutual Funds

Investing in mutual funds can be a great way to grow your wealth and achieve your financial goals. However, with so many mutual funds available in the market today, it can be overwhelming to choose the right one for you. In this article, we will guide you through the process of selecting the right mutual fund by identifying your investment goals, understanding your risk tolerance, and considering your investment time horizon.

Identifying Investment Goals

The first step in choosing the right mutual fund is to identify your investment goals. What do you want to achieve with your investment? Are you saving for retirement, a down payment on a house, or your child’s education? By clearly defining your goals, you can choose a mutual fund that aligns with your specific objectives.

For example, if you are saving for retirement and have a long-term investment horizon, you may want to consider a mutual fund that focuses on growth and capital appreciation. On the other hand, if you are saving for a short-term goal, such as a down payment on a house, you may prefer a mutual fund that offers stability and preservation of capital.

Understanding Risk Tolerance

Another crucial factor to consider when choosing a mutual fund is your risk tolerance. Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. Some investors are comfortable with taking on high levels of risk in exchange for potentially higher returns, while others prefer more conservative investments with lower risks.

To determine your risk tolerance, consider factors such as your age, financial situation, and investment experience. Generally, younger investors with a longer time horizon can afford to take on more risk, while older investors nearing retirement may prefer lower-risk investments to protect their savings.

Considering Investment Time Horizon

Your investment time horizon is the length of time you expect to hold your investments. It is a vital consideration when selecting a mutual fund as it impacts the type of assets you should invest in. Generally, the longer your investment time horizon, the higher your tolerance for short-term volatility, and the more aggressive investment strategy you can adopt.

For example, if you have a long investment time horizon, such as 10 to 20 years, you can consider investing in equity funds that offer higher potential returns over the long term. Conversely, if you have a short investment time horizon, such as one to three years, you may prefer fixed income funds that provide more stability and regular income.

Types of Mutual Funds

Once you have established your investment goals, risk tolerance, and investment time horizon, it’s time to explore the different types of mutual funds available in the market. Mutual funds can be broadly categorized into several types, including equity funds, fixed income funds, index funds, sector funds, and hybrid funds.

Equity Funds

Equity funds, also known as stock funds, invest primarily in stocks or equity securities. They offer investors the opportunity to participate in the growth of the stock market. Equity funds can focus on specific regions, industries, or market capitalizations, allowing investors to diversify their portfolio.

These funds are best suited for investors with a long investment time horizon and a high tolerance for risk. They can provide substantial returns over the long term, but they can also be more volatile in the short term.

Fixed Income Funds

Fixed income funds, also called bond funds, invest in fixed-income securities such as corporate bonds, government bonds, and municipal bonds. These funds provide a steady income stream and are generally considered less risky than equity funds.

Fixed income funds are more appropriate for conservative investors or those with a shorter investment time horizon. They can provide stable returns and are less susceptible to market fluctuations.

Index Funds

Index funds aim to replicate the performance of a specific market index, such as the S&P 500. These funds invest in the same securities in the same proportion as the index they track. Since index funds have a passive investment approach, they typically have lower expenses compared to actively managed funds.

Index funds are suitable for investors seeking broad market exposure and low costs. They are a popular choice for those who prefer a hands-off investment approach.

Sector Funds

Sector funds focus on specific industries or sectors of the economy, such as technology, healthcare, or energy. These funds provide investors with the opportunity to invest in sectors they believe will outperform the broader market.

Sector funds can be riskier than diversified funds because they concentrate their investments in a specific sector. Investors interested in sector funds should carefully analyze the prospects of the respective industry and have a higher tolerance for risk.

Hybrid Funds

Hybrid funds, also known as balanced funds, invest in a combination of both stocks and bonds. These funds aim to provide investors with a balanced portfolio that offers potential capital appreciation and income.

Hybrid funds are suitable for investors looking for a diversified investment portfolio within a single fund. They provide a pre-set asset allocation strategy that may be in line with your risk tolerance and investment goals.

This image is property of image.isu.pub.

Diversification in Mutual Funds

Diversification is a fundamental principle of investing and is crucial to reducing risk in your portfolio. It involves spreading your investments across different asset classes to reduce the impact of any single investment’s performance on your overall portfolio. Mutual funds offer an easy and convenient way to achieve diversification.

Importance of Diversification

Diversification is essential because it helps to reduce the risk of losing all your investment in a single company or asset class. By investing in a variety of different securities, such as stocks, bonds, and cash equivalents, you can spread your risk and potentially offset losses in one investment with gains in others.

The benefit of diversification is that it can smooth out the fluctuations in your overall portfolio’s value. Different asset classes often have a negative correlation, meaning that when the value of one class increases, the value of another may decrease. By combining different asset classes in a diversified portfolio, you can reduce the overall volatility and potential downside of your investments.

Different Asset Classes

To achieve diversification, it is important to understand the different asset classes and their characteristics. The main asset classes include equities, fixed income, cash equivalents, and alternative investments.

-

Equities: Equities or stocks represent ownership in a company. They are subject to market fluctuations and offer the potential for capital appreciation.

-

Fixed Income: Fixed income investments, such as bonds, provide a fixed income stream in the form of regular interest payments. They are generally less volatile than stocks and offer stability and income.

-

Cash Equivalents: Cash equivalents include highly liquid and low-risk investments, such as money market funds or treasury bills. They provide stability and can be quickly converted to cash.

-

Alternative Investments: Alternative investments include assets such as real estate, commodities, or hedge funds. They provide diversification beyond traditional asset classes and can offer potential returns not correlated to the stock or bond markets.

Allocation Strategies

Once you understand the various asset classes, you can implement different allocation strategies to achieve diversification. Common allocation strategies include:

-

Asset Allocation: This strategy involves dividing your portfolio’s investments among different asset classes, such as stocks, bonds, and cash equivalents, based on your risk tolerance and investment goals.

-

Geographic Allocation: This strategy involves diversifying your investments by geographic location. For example, you can invest in stocks and bonds from different countries or regions to gain exposure to different economic and market conditions.

-

Sector Allocation: This strategy involves diversifying your investments across different sectors of the economy. By investing in sectors such as technology, healthcare, and finance, you can broaden your exposure and reduce the impact of any single sector’s performance.

-

Time-Based Allocation: This strategy involves adjusting your asset allocation over time as your investment goals and risk tolerance change. For example, as you approach retirement, you may gradually shift your investments from equities to more conservative fixed income securities to protect your savings.

By implementing a suitable allocation strategy, you can achieve diversification within your mutual fund investments and potentially reduce risk while maximizing returns.

Evaluating Mutual Funds

When choosing a mutual fund, it is essential to evaluate various factors that can impact the fund’s performance and suitability for your investment goals. Here are some key factors to consider:

Past Performance

Although past performance is not indicative of future results, it can provide insights into a mutual fund’s track record and how it has performed relative to its benchmark and peers. Look for consistent long-term performance rather than short-term fluctuations.

Expense Ratio

The expense ratio represents the annual cost of owning a mutual fund, expressed as a percentage of the fund’s assets. It includes management fees, administrative expenses, and operating costs. A lower expense ratio generally leaves more money in your pocket, so it is important to consider the fees associated with the fund.

Management Style

Different mutual funds are managed in different ways. Some funds follow an active management approach, where the portfolio manager actively selects investments and tries to outperform the market. Others follow a passive management approach, where the fund aims to replicate the performance of a specific index.

Consider whether you prefer an actively managed fund that potentially offers higher returns but higher fees, or a passively managed fund that aims to match the performance of a benchmark index while keeping fees low.

Fund Size

The size of a mutual fund can have implications for its performance and ability to execute its investment strategy. Larger funds may face challenges in fully investing their assets, resulting in higher cash positions. Smaller funds, on the other hand, may have higher expenses or may be more focused on a specific niche.

Consider the fund’s size relative to its peers and its ability to achieve its investment objectives effectively.

Asset Allocation

The asset allocation of a mutual fund determines the mix of different asset classes, such as stocks, bonds, and cash equivalents, within its portfolio. Understanding the fund’s asset allocation can help you determine whether it aligns with your investment goals and risk tolerance.

Consider whether the fund’s asset allocation matches your desired level of risk and return. A fund with a higher allocation to stocks may be more suitable for growth-oriented investors, while a fund with a higher allocation to bonds may be more appropriate for conservative investors seeking income.

This image is property of miro.medium.com.

Researching Mutual Funds

Once you have identified the key factors to consider, it’s time to dive deeper into your research to ensure you select the right mutual fund for your investment needs. Here are some steps to help you research mutual funds effectively:

Reviewing Fund Prospectus

The fund prospectus is a legal document that provides detailed information about a mutual fund, including its investment objective, strategy, risks, fees, and historical performance. It is important to read the prospectus carefully to understand the fund’s investment approach, expenses, and potential risks.

Analyzing Fund Returns

To assess a mutual fund’s performance, review its historical returns over different time periods, such as one year, three years, and five years. Look for consistent performance compared to its benchmark and peers. Also, consider whether the fund’s returns align with your investment goals and risk tolerance.

Examining Fund Holdings

Analyze the fund’s holdings to understand its underlying investments. This can help you determine if the fund’s holdings align with your investment objectives and risk tolerance. Pay attention to the sector, geographic, and individual security concentrations within the portfolio.

Assessing Fund Manager

The fund manager plays a crucial role in the fund’s performance. Research the fund manager’s experience, track record, and investment philosophy. Consider whether the manager has consistently delivered strong results and if their investment approach aligns with your investment goals.

Investment Strategies for Mutual Funds

Once you have selected the right mutual fund, it’s important to consider the most suitable investment strategy based on your financial situation and goals. Here are some commonly used investment strategies:

Systematic Investment Plan (SIP)

A systematic investment plan involves investing a fixed amount of money at regular intervals, such as monthly or quarterly. This strategy helps inculcate discipline and takes advantage of the market’s ups and downs through rupee-cost averaging. It is particularly useful for long-term investment goals.

Lump-Sum Investment

A lump-sum investment involves investing a large amount of money in a mutual fund at once. This strategy is suitable when you have a significant amount of funds available and believe the market is favorable. However, timing the market can be challenging, so consider your risk tolerance and investment goals before making a lump-sum investment.

Market Timing

Market timing involves trying to predict the market’s direction and making investment decisions based on those predictions. This strategy can be risky as it relies on accurately predicting short-term movements in the market. Timing the market is challenging even for experienced investors, so it is generally recommended to follow a long-term investment approach.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money in a mutual fund at regular intervals, regardless of market conditions. By investing the same amount regularly, you buy more units when prices are low and fewer units when prices are high. Over time, this strategy can reduce the impact of market fluctuations on your investment.

Choose an investment strategy that aligns with your risk tolerance, investment goals, and financial situation. Regularly review your strategy and make adjustments as needed to stay on track.

This image is property of Amazon.com.

Purchasing Mutual Funds

Once you have researched and selected a mutual fund, you need to determine how to purchase it. There are several ways to buy mutual funds, including through brokers and financial advisors, direct purchase from fund companies, and online platforms.

Brokers and Financial Advisors

If you prefer professional guidance, you can purchase mutual funds through brokers or financial advisors. These professionals can help you select suitable funds based on your investment objectives and provide personalized advice.

Keep in mind that brokers and financial advisors may charge fees or receive commissions for their services. Make sure to understand their fee structure and any potential conflicts of interest before making a purchase.

Direct Purchase from Fund Companies

Many mutual fund companies allow you to purchase their funds directly. This can be a cost-effective option as it eliminates the need for a middleman.

To make a direct purchase, you can visit the fund company’s website, complete the necessary paperwork, and provide the required investment amount. The fund company will then set up an account for you and provide access to their funds.

Online Platforms

Online platforms have made it easier than ever to buy mutual funds. These platforms allow you to research and compare funds, open an account, and make purchases online.

Online platforms often offer a wide range of mutual funds from different fund companies, providing you with a broader selection to choose from. They may also offer tools and resources to help you make informed decisions.

Before using an online platform, ensure that it is reputable and trustworthy. Research its customer reviews, security measures, and fee structure to make an informed choice.

Monitoring and Rebalancing

Investing in mutual funds is not a one-time event. Once you have purchased mutual funds, it is important to regularly monitor and review your portfolio to ensure it remains aligned with your investment goals and risk tolerance.

Regular Review of Portfolio

Review your portfolio periodically, at least annually, to evaluate its performance and make any necessary adjustments. Assess whether your investments are performing as expected and whether any changes in your financial situation or risk tolerance require modifications to your portfolio.

Adjusting Asset Allocation

Asset allocation refers to the mix of different asset classes within your portfolio. Over time, the performance of different asset classes may cause your portfolio’s asset allocation to shift away from your intended strategy.

Rebalance your portfolio by buying or selling mutual funds to bring your asset allocation back to its desired levels. This allows you to maintain the desired risk/reward profile and ensures that your portfolio remains aligned with your investment objectives.

Tax Implications

Monitor the tax implications of your mutual fund investments. Mutual funds are required to distribute capital gains to shareholders, which may result in taxable events for you. Understand how these capital gains distributions can impact your tax liability and consider the potential tax advantages of investing in tax-efficient funds or tax-deferred accounts.

Regularly review your tax situation and consult with a tax professional to optimize your investment strategy and minimize your tax burden.

This image is property of www.smallcase.com.

Understanding Fees and Expenses

Before investing in mutual funds, it is important to understand the various fees and expenses associated with owning them. These fees can impact your investment returns, so it’s essential to consider them when evaluating different funds.

Expense Ratios

The expense ratio is the annual cost of owning a mutual fund and is expressed as a percentage of the fund’s assets. It includes management fees, administrative expenses, and operating costs. The expense ratio is deducted proportionally from the fund’s assets and reduces the fund’s returns.

When comparing mutual funds, consider the expense ratios to ensure that you are getting good value for your investment. Lower expense ratios generally leave more money in your account to compound over time.

Front-End Load

Front-end loads, also known as sales loads, are sales charges levied when you purchase mutual funds. These charges, which can range from 1% to 5% or more, are deducted from your investment upfront. Front-end loads are typically paid to the broker or financial advisor who sells the fund.

Consider whether front-end loads are applicable to the mutual fund you are considering, as these charges can reduce the amount of money you initially invest.

Back-End Load

Back-end loads, also known as redemption fees or deferred sales charges, are fees paid when you sell mutual fund shares. These charges are calculated based on the initial investment amount or the net asset value of the shares being sold.

Back-end loads typically decrease over time and may be waived if you hold the fund for a certain period. Consider the potential back-end load fees and their redemption schedules when choosing a mutual fund.

12b-1 Fees

12b-1 fees are annual fees that mutual funds charge shareholders for marketing and distribution expenses. These fees are included in the fund’s expense ratio and can impact your overall investment returns.

Consider the level of 12b-1 fees when comparing mutual funds, as higher fees may erode your investment returns over time.

Redemption Fees

Some mutual funds impose redemption fees when you sell your shares within a specified holding period. These fees are designed to discourage frequent trading and can help protect long-term investors from the costs associated with short-term trading.

Understand the redemption fee policy of the mutual fund you are considering and evaluate its impact on your investment strategy. If you plan to hold your investments for the long term, redemption fees may not be a significant concern.

Tax Considerations in Mutual Funds

When investing in mutual funds, it is important to be aware of the potential tax implications. Understanding the tax considerations can assist you in optimizing your tax position and achieving better after-tax returns.

Capital Gains Distributions

Mutual funds are required to distribute capital gains to shareholders by law. These capital gains distributions are generated when the fund sells securities within its portfolio at a profit. They are subject to capital gains taxes for investors.

Be aware of the timing and impact of capital gains distributions when investing in mutual funds. Consider the potential tax liability and adjust your investment strategy accordingly.

Tax-Efficient Funds

Tax-efficient funds are mutual funds designed to minimize the tax impact on investors. These funds aim to generate low levels of taxable capital gains by employing strategies such as tax-loss harvesting or focusing on tax-free municipal bonds.

Investors in higher tax brackets or taxable accounts may benefit from investing in tax-efficient funds, as they can help reduce the tax burden associated with mutual fund investments.

Tax-Deferred Accounts

Tax-deferred accounts, such as individual retirement accounts (IRAs) or 401(k) plans, provide investors with tax advantages. Contributions to these accounts may be tax-deductible, and the investment growth is tax-deferred until withdrawal.

Consider utilizing tax-deferred accounts to hold your mutual fund investments. These accounts can provide a tax-efficient way to invest and accumulate wealth over the long term.

In conclusion, investing in mutual funds can be a beneficial and accessible way to grow your wealth. By identifying your investment goals, understanding your risk tolerance, and considering your investment time horizon, you can select the right mutual fund for your needs. Diversification, evaluating mutual funds, and researching thoroughly can help you make informed investment decisions. Implementing suitable investment strategies and purchasing through the right channels are also essential. Regularly monitoring and rebalancing your portfolio, understanding fees and expenses, and being aware of the tax considerations can further enhance your mutual fund investing experience. Remember to consult with a financial advisor and tax professional to ensure your investment strategy aligns with your individual circumstances and goals.