Investing in Belize RealEstate

Review of Mahogany Bay Village with Dave Zook

Intro, thoughts on diversification by Jim Reynolds.

Diversification is key in investing. The stock market is the biggest driver of capitalism. Each stock being traded represents products and services. Investors vote with their money on which products and services are the most efficient. This system of stock trading , first appeared in 1531 in Belgium and today it dominates most of the investment space.

Sophisticated and high net worth investors have a challenge; How to diversify in assets outside the stock market? While shares have many pros they do have some cons, and these cannot be mitigated by buying more shares.

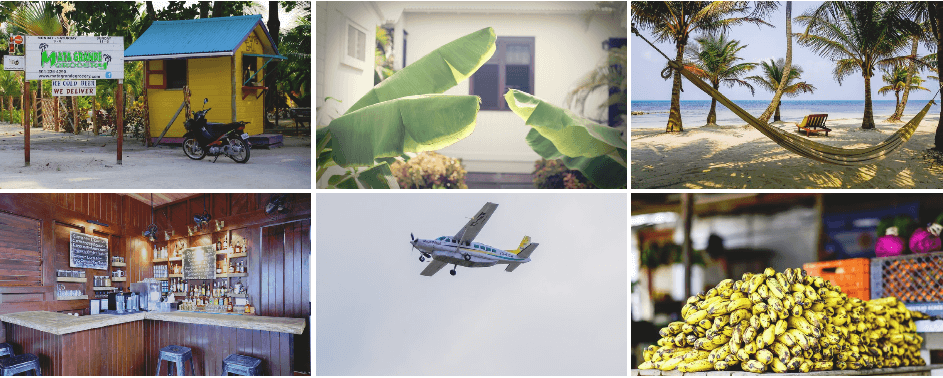

Diversification within the stock market is easy, but diversification outside is complex. Select investments which require careful due diligence are available. For example, the Mohagony Bay Village resorts are providing access to real estate investments in Belize.

Interview with Dave Zook

Can you briefly introduce yourself and the team working on this project?

I am Dave Zook. All my adult life I have been an Entrepreneur and Investor and after building several successful businesses I started having Tax problems in that I was giving almost half my money that I was earning back to the Government. After doing a lot of reading and educating I realized that Real Estate (specifically Multi Family) when used strategically could be a real tax shelter. So coming out of the Great Recession of 2008 we started to acquire Multi Family assets, small at first but then ramping up and we have acquired over 2300 apartment units mostly in the Memphis area since then.

I had a great relationship with the guys that introduced me to the Memphis area and we ended up doing some business together which was very successful so when they invited me to come see what they were building in Belize I came down, got involved and have been here ever since.

Can you describe the Mahogany Village from an investment perspective?

It is in my opinion one of the best Investment opportunities in the world with the right mix of Appreciation, Cashflow, Diversification and Lifestyle. I will dive into each one of those. Appreciation:

- Appreciation: we have the opportunity right now to buy a lot with 3 fully built turn key homes for $650k-$800k while at the same time those lots are being appraised by a 3rd party for $1.2M – 2.4M. There is no financing in the market and not a lot of folks have seen this resort.

- Cashflow: We believe this will be a strong cashflow property when we open to the World with Hilton.

- Diversification: We love the idea of holding some of our assets offshore.

- lifestyle: I choose to invest offshore somewhere where not only do the numbers make sense and a lot of other boxes are checked but where it is beautiful and a fun place to come and visit.

How has Belize become more investor friendly in the last ten years?

Well for one it is just starting to be recognized as a vacation destination, one of their hottest selling gifts was a hat with the text “Where is Belize”

It is investment friendly in that it is a British common law country, it has property rights laws very similar to the US. Foreigners can take fee simple title to Real Estate and the official language as well as all Real Estate documents are in English.

What are they key trends which make this project interesting in the long term?

The development team is first class and has been able to do some amazing things here at MBV and the Supply demand issues that are developing for one are huge, we had an increase of 55% in overnight tourist arrivals just in the last 5 years and so when you look at the rooms that should have been built to keep up with demand there should have been 990 new units built when in reality there was only 80 new units built. You have a really business friendly government and the tax system in Belize is very friendly to investors who cater to tourism. The tax on rental income in Belize is only 1.75%

Have any major brands in the industry endorsed or have become involved this project?

Yes, for the first time ever there is now a brand on this Island. Mahogany Bay Village is now a branded Hilton Resort. Hilton has signed on and has the exclusive on about 300 homes on streets 2 and 3.

We also just lately had Coastal Living which is part of the Time Inc family of magazines sign on with us and they now have the Exclusive on street 4 of the resort.

Think of it as one of the largest and fastest growing Hotel Brands in the World and the largest publisher in the US as 2 giant Marketing machines both pointing at Mahogany Bay Village.

How can investor’s “kick the tyres” and see the investment opportunities in Mahogany Bay Village?

They can go to http://therealassetinvestor.com/gre/ and sign on to join us on a 3 day Belize Investor Field trip to really do your due diligence on the market. You spend 3 days with Robert Helms from the Real Estate Guys as he takes you through the market. You really go deep on this tour and you come away with an understanding of what is really driving the market and why it is one of the fastest growing markets in the Caribbean.

Can you describe the location, what is the most interesting natural feature of the island and how does it make this investment in Belize real estate more interesting?

The largest living Barrier Reef is only a few Hundred Yards off the beach and it does several things for us, it provides us with some of the best snorkeling, diving and fishing in the World, in fact it is consistently ranked in the top 3 locations in the world for those activities.

The other thing it does is it provides a natural protective wall that is about ½ mile high and it kills the storm surge which is what causes most of the damage in the event of a hurricane.

Can you describe this real estate investment opportunity in Belize in more detail:

Minimum investment / Maximum Investment

We have Minimum Investment Opportunities of $100K to accredited Investors. In addition, syndication is possible on a few remaining lots. I put together 2-3 lot syndications and the investment is done as a group.

Cash on cash returns on stabilization is above 10%, and it is based on a very conservative nightly rental rate and occupancies north of 80% depending on the season.

Recurring Costs such as insurance, maintenance, etc

- Recurring costs are Taxes which are dirt cheap down here, for example an $800k lot on the canal with 3 homes on it is taxed at less than $1000. Per year.

- Insurance runs at about 1.5% of purchase price annually. And maintenance is roughly $300. Per month

- Tax Payments and Management with regards to the Belize Authorities.

- Tax on rental income is 1.75% in Belize

The biggest and most important thing for me always is Invest in the right team. You can have a World Class property or location but if the team is Incompetent or worse yet doesn’t have integrity it will turn out to be a disaster quickly. So many things can go wrong in development.

But to have a team that can actually get it done on time and on budget is critical and if you have a World class team you attract Organizations like Hilton and Time inc

What are the occupancy rates on similar resorts on the Mohagony bay Island Belize?

It varies a lot between 2-5 star resorts but the occupancy rates have certainly tightened in the last few years and depending on the season well north of 80%.

We have a resort just across the road called Victoria House which averages a 93% occupancy and is getting a nightly rental well above what we projected in our proforma and they will not have anywhere the amenities we have here at MBV.

Who are the main visitors of the Mahogany Village resort and similar resorts on the island?

They are travellers much more so than tourists, what I mean is they are active and they are out doing and seeing things. You will not find them laying on the beach to much.

They are adventurous, and they like to try new things. This is not a discount market $99 per night rental market, so most of the travellers coming here have good incomes and will spend money to go explore.

What are the risks investors need to be aware of and how is Mahogany Village mitigating them?

The risk in my opinion is always greatest in the team or the people you are investing in. If you have the right people driving the ship they will navigate the storms and hurdles that will most certainly come. Just having a great team is key to success in any development project.

Of course there is the risk of Hurricanes which we have a natural protector less than ½ mile off shore.

What are your key targets for this project in the next two years and how are you planning to achieve them?

The key targets are going to be to get the resort opened full scale with Hilton and get to Stabilization quickly.

The buildings are built for Phase 1 which is what we are opening with. Phase 2 will be getting built over the next two years but that is simply execution, the systems are already in place to get those building built quickly and it will be more of the same. We have already built 200 homes and the last 100 will get built in phase 2 quickly.

You have done 1000s of real estate deals, what are your rules of thumb when evaluating a real estate deal?

After I figure out what market I want to invest in it is ALWAYS about the team. I will give you an example of a key player on my team in Memphis. Steve Woodyard is our broker and he is the only broker we use. He and his three-man team are involved in almost half the transaction in the entire city of Memphis, and he brings us great deals.

My partner is a great property manager who only manages our properties, and he does a great job giving us a huge competitive advantage over an out of town investor group using 3rd party management.

When I looked at international Markets I saw a lot of things I liked and didn’t like in other markets but Belize checked a lot of boxes for me and so to be able to work with a great team here has been awesome.

So for me the most important thing is the team. If I have a great Team, great things will happen. If I don’t they won’t.

Where can more information be found on this real estate investment opportunity in Belize?

Visit:

- Mahogany Bay Village

- Contact: info@therealassetinvestor.com