Dmitry Balakhnin is the Chief Brand Officer of Rrobo.cash, a recently established (Feb 2017) P2P lending company. The website is user-friendly and has an integrated auto investor for 100% hands off investing. In this interview, he explains more about the investment product they are offering.

What is Robo.Cash about, which Markets...

{

"@context": "http://schema.org/",

"@type": "Review",

"itemReviewed": {

"@type": "Peer to Peer lender",

"name": "Funding Secure Review"

},

"author": {

"@type": "Person",

"name": "Jim Reynolds"

},

"reviewRating": {

...

Review of Capitalia.lv with Juris Grišins

A loan originator on the Mintos

Can you briefly present yourself and the company?

Are are the largest non-bank lender to small and medium enterprises in Latvia, Lithuania and Estonia. To date, Capitalia has financed working capital and investment needs of more than 1000 companies investing over...

Interview with Xavier Laoureux, director at Mozzeno, a peer to peer lending platform based in Belgium.

Can you introduce yourself and Mozzeno?

Mozzeno is a Belgian fintech founded in December 2015. We have just launched the first digital platform to enable private individuals to participate indirectly in the funding of loans...

Not all p2p lenders are created the same. Each p2p lender has a different profile; investors need to find the right match between a p2p lender and their financial needs. How do investors select the right p2p lenders? This is a question I cannot answer for you, but I...

When investing investors put their capital at risk. This risk changes according to events in the world. In particular, p2p investing is still a relatively new industry and thus is subject to more changes. Regulators, p2p lending platforms, borrowers, investors, loan demand, borrower choice and interest rates are agents...

What is peer to peer lending?

P2P lending is a system of direct loans between a borrower and a lender. These direct loans are managed through a peer to peer lending company which has a platform in the form of a website to administer this process. There are many p2p...

Peer to peer lending is a system in which borrowers and lenders connect directly to lend money to each other. The internet has become a matchmaker between borrowers and investors or lenders who would like to co-invest in such loans with other investors. Co-investing taps into the power of...

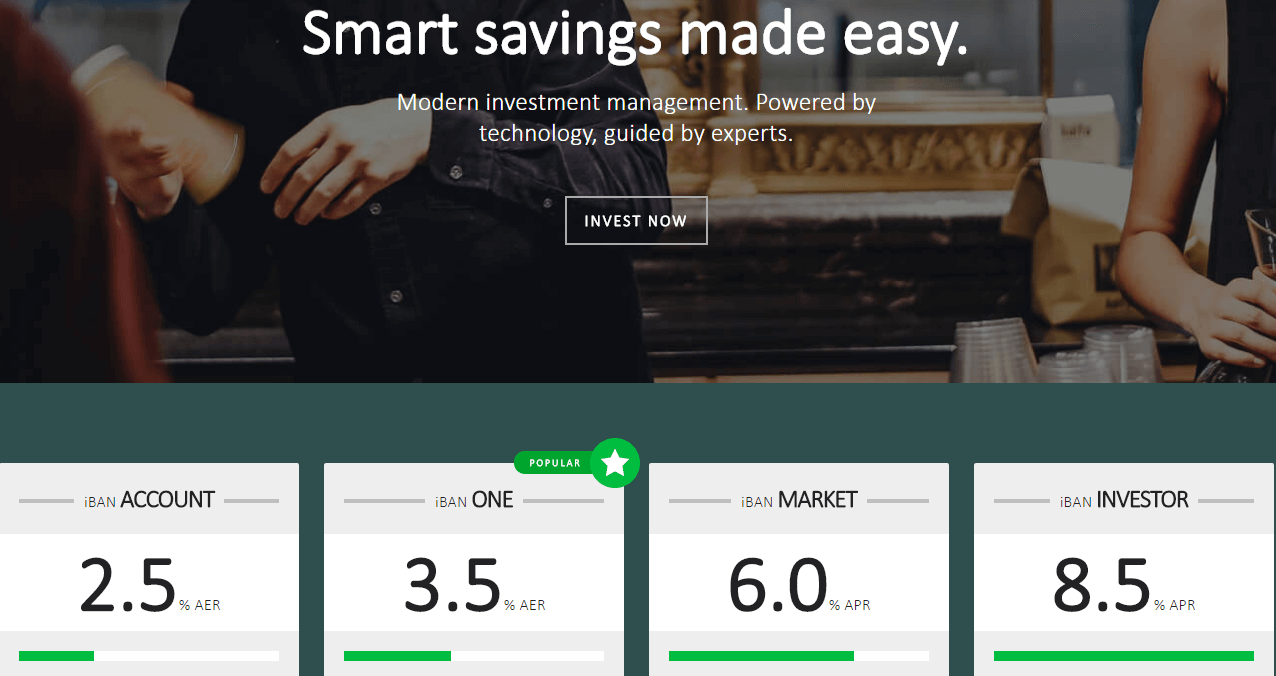

iBAN is a relatively new p2p lending investment platform. They are offering an international investment product which is well fortified against borrower default risks. In interview this Mike Phillips, discusses how investors can make the most of the p2p lending opportunities offered by iBAN.

About iBAN:

Can you briefly introduce yourself...

Interview with Michael Lynn CEO of Relendex, a peer to peer lending platform, offering asset backed loans to investos.

Can you briefly present yourself?

Michael Lynn, founder and CEO. Michael qualified as a Chartered Accountant in 1971. After qualifying he joined Deloitte in London, later moving to their Paris office. He was...

IFN Extra Finance S.A. was established in 2009 and is registered in the General Register of the National Bank of Romania under number PJR-RG-41-110259 / 2009, with 100% Romanian capital.

Currently, IFN Extra Finance. provides loans to individuals (personal loans with a mortgage) and legal entities (factoring, discounting). The team...

How to invest in the Latvian Agriculture Credit Market

AgroCredit Latvia is operating since 2011 as non-bank lender and offers loans to the farmers, mainly crop-growers. The main financing product offered is seasonal financing for current assets, which is repaid in the end of each farming season - after the...

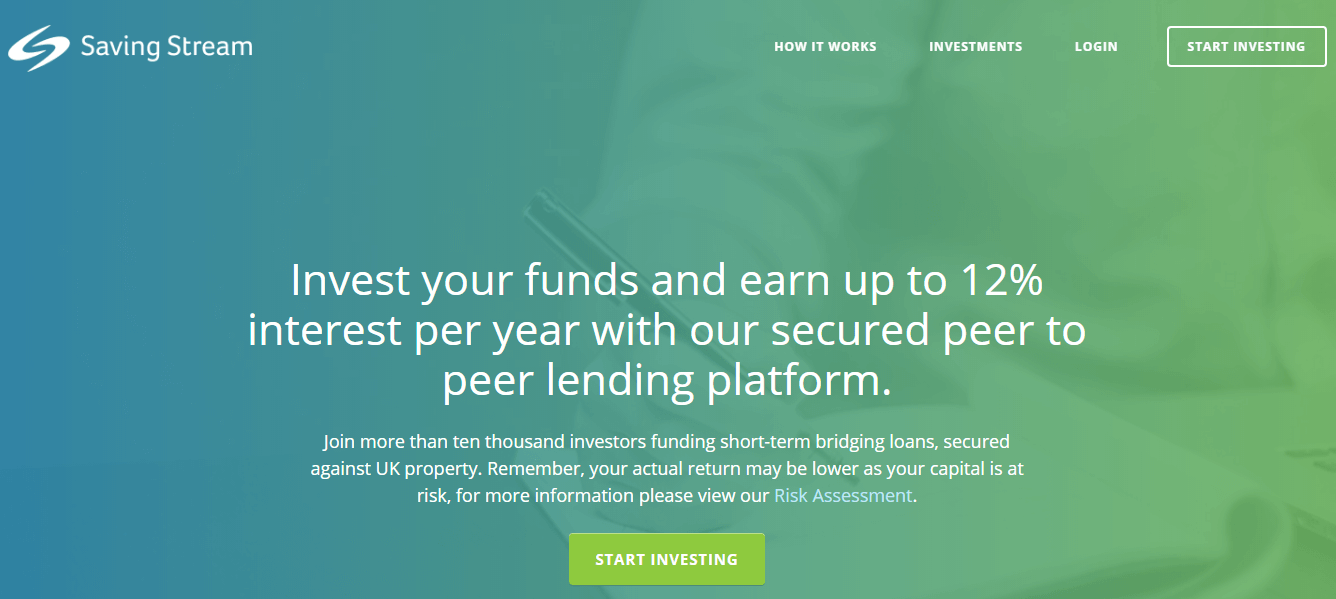

Review and Due DIlligence primer on Saving Stream

What is Saving Stream?

Saving Stream (SS) is a bridge between borrowers and lenders. Borrowers request loans from SS, credit and property specialists review these requests and if approved are listed on SS.

Accepted loans are first listed as pipeline loans. Investors have the...

Landbay a peer to peer lending platform has launched an Innovative Finance ISA (IFISA).

What is an Innovative Finance ISA?

The “IFISA” allows individuals to use some (or all) of their annual ISA investment allowance to lend funds through the growing Peer-to-Peer lending market, while receiving tax-free interest and capital gains.

More...

Investing in Bulgarian p2p loans

with KlearLending

What problem is Klear trying to solve?

If you deposit money in your bank, you get less than 1% return per year. But ask for a credit and your interest rate will be in average above 10%! The gap is big. For sure, there is...

Lithuanian P2P loans: An alternative investment with high ROI

Lenndy a p2p platform with loans from different loan originators

Hello, who are you, what is Lenndy and who is behind Lenndy?

Hi there, Lenndy team is a start-up which launched in September, 2016. Lenndy model was created by different types of professionals who...

Minto p2p loan investing for newbies.

Mintos is a peer to peer platform based in Riga. Mintos is not a bank, but it can legally provide loans to borrowers. Investors can also participate in these loans. This participation is known as crowdfunding, whereby each investor buys a small part of...

Investing in Polish car loans can be done on

Mintos the peer to peer lending platform.

Mintos, 13th February 2017.

Non-bank car loan provider Mogo is expanding its presence on the Mintos marketplace!

Mogo will now offer car loans issued in Poland on the platform. The loan originator will offer investment opportunities in...

MiCrowd.es is a for-profit social lending p2p platform, the CEO, Alejandro de León shared his journey with InvestItIn.com.

What is the story behind MiCrowd.es?

In 2009 I started giving scholarships in Nicaragua, I was fascinated by the place and the genuine nature of the people. When I was living there, I had...

Fellow Finance is a Finnish p2p investment platform, it offers investors the opportunity to invest in different types of p2p loans. Antoni Airikkala has answered the questions from InvestItIn.com

What is the basic investment proposition that FellowFinance is offering to investors?

Fellow Finance offer investors double-digit returns through investments in consumer loans,...