Review and Due DIlligence primer on Saving Stream

What is Saving Stream?

Saving Stream (SS) is a bridge between borrowers and lenders. Borrowers request loans from SS, credit and property specialists review these requests and if approved are listed on SS.

Accepted loans are first listed as pipeline loans. Investors have the opportunity to set how much they would like to invest in each pipeline loan. Allocation of each investor’s investment is allocated according to a quota. If ever, new loans are unfunded they are listed on the available loans section of the site.

See more: What is Peer to Peer lending?

SS Statistics as of Feb 2017

- Provision Fund: £3,423,697

- Security for loans: £171,184,843

- Live Loans: £371,935,433

- Interest Earned: £18,842,578

What investments are available on Saving Stream?

- What is a Property Bridging Loan (PBL) – 12-month property loan, used until long term finance is secured.

- What is a Development Finance Loan (DFL) – Funds used for property development.

Saving Stream Strengths and Opportunities

Company Maturity

- Launched in 2013

- Regulated by the Financial Conduct Authority FCA

Diversification

- Access to different regions of the UK property market.

- Exposure to Sterling (This could be both good and bad as of Feb 2017 this depends on a Hard/Soft Brexit and the French, Italian, German, Dutch Elections. The election could impact the EURO negatively and the Sterling positively.)

- SS is open to international investors. There isn’t a need to be a UK resident or have a UK bank account to invest.

- International investors can make use of TansferWise and Currency fair to reduce exchange rates and transfer fees.

Investing

- There is no minimum investment amount.

- Current average returns are 12% or 1% on a monthly basis. However, this is changing.

- Highly liquid secondary market for current loans. This potentially allows investors to to exit an investment in full or in part before a loan term ends.

- Up to February 2017, SS had some defaults but no bad debts (capital loss) for investors

- Loans are made directly to the borrower, (not to Saving Stream). This gives protection to the investor if SS defaults.

- Investors could adopt a cycle strategy of selling loans close to their expiry date and use the funds to buy loans with a longer remaining term. This takes time and “fast fingers”.

- The borrower pays compounded interest for the whole loan term, which is paid upfront. SS then pay investors the interest monthly at a non-compounded rate and the reminder is kept as a fee. This eliminates the risk of non-oayment of the interest to the investors.

User Friendliness

- SS website is user-friendly. Although at peak times (during the fast fingers race) it slows down.

- Saving Stream is open to admitting mistakes in a recent communique they stated “We have taken on board the fact that communication with investors has been wholly unsatisfactory and lets what is otherwise an excellent and successful lending platform down. We have grown exponentially and that aspect of the business has been neglected to an extent. […] Many say our communications is our major weakness, we hear you and will resolve this from this point onwards. “ Many investors look forward to the communication improvements.

Saving Stream Weaknesses and Threats

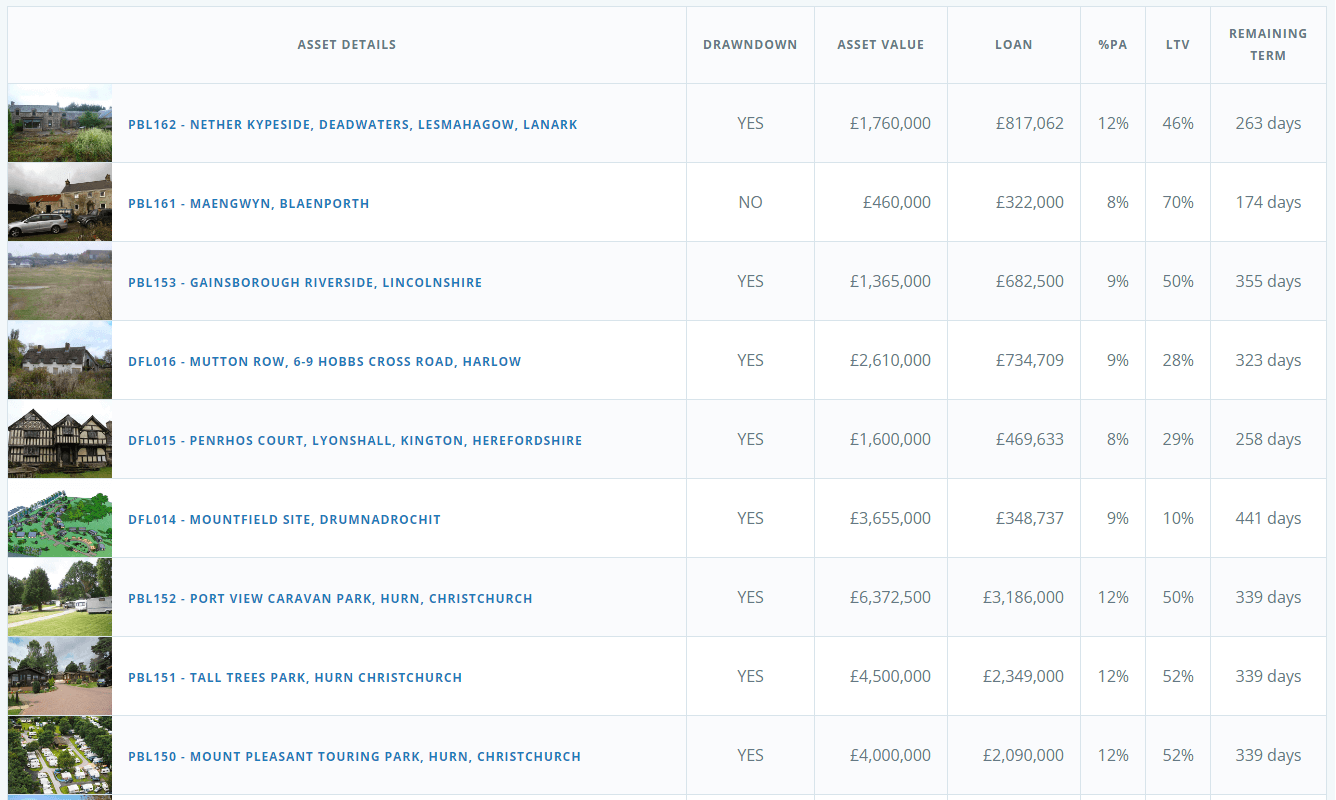

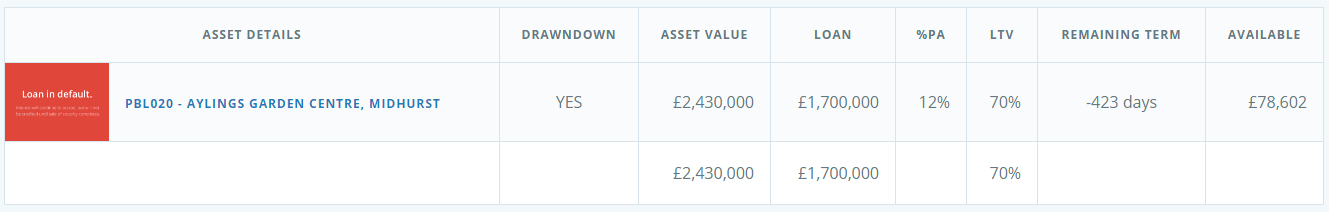

Defaults

- Some loans are being extended. While it is natural for some loans to be extended due to the nature of property business. The uptick should be monitored by the concerned investor. A defaulted loan does not mean that the investors lost their capital or interest.

- Saving Stream has recently changed their defaults policy:“Tolerance Period of 180 days from the loan repayment date For the first 90 days of the Tolerance Period, we will continue to pay interest due to investors out of our own funds 5. After day 90 of the Tolerance Period investors will continue to accrue interest but interest will not be credited until, for example, the sale of the security completes. The final interest credit is dependent upon the amount of repayment that we are ultimately able to secure.” See full statement here: https://savingstream.co.uk/documents/OVERDUE_LOANS_DEFAULT_POLICY.pdf

For the investor, this means that interest will be accrued but not paid. This delayed payment will result in the loss of the potential interest on the unpaid interest. - SS could default, but since borrowers own money directly to the lenders/investors. Investors have a certain level of protection.

- Borrower default, this is mitigated by the respectable loan to value rates which usually are 70% or less. This provides a level of security to the investor. Some protection is also offered by an SS administered Provision Fund.

- Defaults on the larger loans in the SS portfolio could have an adverse impact if they default, as they could deplete the provision fund and investors in other loans could be exposed.

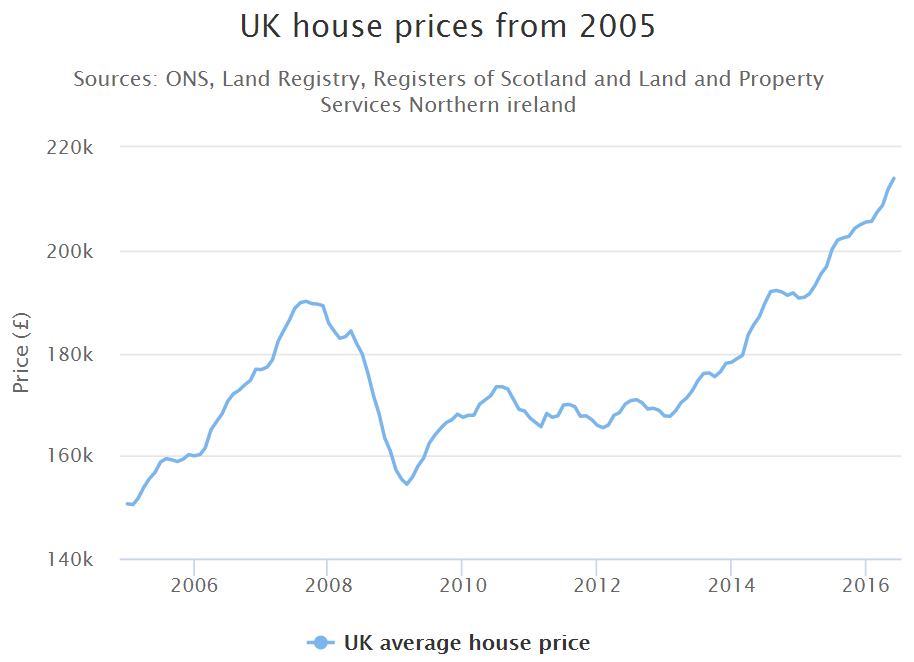

- UK property Market turmoil: Property prices in the UK have been on a steady up trend in the last years. The fundamentals behind this rise are many. Assets which experience sudden valuation spikes are also known to be re-evaluated down. The market will work towards price discovery. This means that the LTV rates move from 70% to 100% and beyond, which would results in the loans not having enough assets to back the capital invested.

See more UK house price predictions for 2017

Interest Rate Evolution

- Demand / Supply dynamics are point towards lower interest rates, in fact SS has already signalled that loans at lower lower interest rates will be listed.

User Friendliness

- The best loans on the secondary market are in high demand. Usually, they appear and are quickly bought. This is the “Fast finger” race.

- At this time it is not possible to sort the loans by the remaining term, amount, interest rate or loan-to-value (LTV) rates.

Investing and Monthly Yield

- As of March 2017, investors can no longer purchase loans, without the necessary balance in the account.

- Loans on sale at the Secondary market do not receive interest.

- Committments for pipe-line loans do not receive interest.

- It is possible for loans to be repaid early, investors relying on SS for monthly income should factor this risk.

- This investment model is sustainable as long as SS maintains a deal flow which can keep up with demand. Such a challenge is not present in other yield-generating investments such as dividend stocks, however yeilds on dividend stocks tend to be much lower.

- Investments are not covered by the Financial Services Compensation Scheme (FSCS).

- There is a difference between the interest rate charged by SS to the borrower and the interest rate offered to the investors. This difference is the profit for SS.

See more: Risks of peer to peer lending

Conclusion

Saving Stream has delivered excellent results to date. The performance has been in-line to what has been promised. It is yet to be seen how resilient this p2p lending model is if the UK property market experiences some re-adjustments. Given the LTV rates which are 70% or lower property prices need to drop by 30% or more to put the capital invested at risk.

Bonus Tip:

On this page: https://openuserjs.org/users/0risk/scripts you can find user made scripts which promise to improve functionality.

| Saving Stream Review | |

| User Friendliness | |

| Risk / Reward Ratio | |

| Leverage | N.A. |

| Reliable Monthly Yield | |

| Company Maturity | |

| Diversification Opportunities | |

| InvestItIn.com Rating 4/5 |

|

Further SS Research

Official info about Saving Stream:

Company’s house:

Founders:

More Saving Stream Reviews:

Alternatives to Saving Stream:

- Funding Secure

- Money Thing

- Property Moose also Check out Property Moose Review

Do you have comments and tips on Saving Stream? Do you have fresh news? Please add it in the comments section.