Forestry investments in Estonia, Latvia or Lithuania.

InvestItIn.com had the pleasure to interview Kai Thygesen, Head of Sales at HD Forest. In this interview, Mr Thygesen crushes the old saying that “Money does not grow on trees”. Indeed it does. Forests are an investment vehicle which serves various objectives for example:

- Multi-generation assets

- Inflation protection

- Geographic diversification

- Asset Diversification

- Access to a Real Asset Class

Interview with Kai Thygesen

HD Forest is the largest private independent forest manager in the three Baltic States with 50,000 hectares under management. HD Forest is present with local management and employees in all three markets and has been active in the Baltic States since 1997. HD Forest offers a broad field of services within forest management and management of forest investments for private as well as for institutional investors. For investors HD Forest help with the establishment, forest purchase, financial reporting, forest management and exit.

Why is forestry a good investment?

In general because you can diversify your existing investment portfolio with something very different. In economic downturns or financial crisis the timber price and land price might fall together with stocks, bonds and real estate – but the trees keep growing no matter what so in the end you have more cubic meters than when you started. Lastly forests are green and sustainable investments.

Forest investments in the Baltics provide returns of 5 – 7 % at the moment after costs and with no financing. That is rather attractive in today´s market with low interest rates on cash and bonds and with an all-time high stock market. Forestry investment is seen as low operational risk in the Baltics. This is due to many small and geographically widespread forest properties, natural resilience, flexibility in timing of harvesting, modern infrastructure and strong forest legislation. On the political note you have EU and NATO memberships as well as all countries being part of the euro currency zone. Lastly forestry is a long-term and green investment suitable for pension savings and generational/succession planning. The prices of forestland in the Baltics is lower compared to the land prices in the neighbouring countries of the Baltic Sea like Finland, Sweden or Denmark. There could be an upside in the land prices.

HD Forest operates in Estonia, Latvia and Lithuania what are the main differences in each market?

The forest legislation differs among the three countries, where Estonia has liberalised the most and Lithuania least. Examples are that in Estonia they lowered the cutting age and also introduced opportunity to cut by diameter. This is not yet possible in Lithuania and Latvia is somewhere in between. After cutting in Estonia and Latvia there has to be new forest after 5 years, which is time enough for natural regeneration in most cases, whereas in Lithuania there has to be forest after 3 years, which means planting is more common here.

There are some general tax differences. Lithuania has a 5% timber felling sales tax as the only country. Lithuania and Latvia has a standard 15% corporate income tax. In Estonia companies do not pay tax on retained or reinvested earnings, the tax obligation is deferred to the moment of distributing profits at a gross rate of 20%.

Taxes may change and there are other smaller differences and it also depends on whether you invest personally or establish a company etc. so you should always seek legal and financial assistance before establishment.

How does the price of purchase costs, land, maintenance costs and local taxes relate to the price of timber in each market?

The biggest influence on price of timer is distance to forest industry like sawmills and distance to ports. But when you buy land including tress the land price is already reflecting these factors. We see quite similar returns from 5 – 7 % per year no matter which country or market you buy in and regardless of the small tax differences.

What are the common selection criteria when choosing a forest?

What are the deal stoppers when choosing a particular forest?

What makes a forest more attractive to buy compared to other forests?

It depends on your strategy. Some investors prefer only to buy either pine, spruce or birch, depending on what they believe will be more worth in the future. Investors who first buy conifers may choose primarily broadleaves for their second purchase. We recommend a forest portfolio with a good mix of tree species and mix of tree ages, and these mixed forests are quite common in the Baltics anyway. Investors who use financing, may choose more mature forests so that they can fell yearly and pay their debts. Investors who primarily believe in the tree growth by forest with middle-aged stands to mature stands, which means a lot of cubic meters per hectare. They are less vulnerable to land price fluctuations and most of their values lies in the trees. Other investors believe in the land price increase potential and thus buy young forests with less cubic meters per hectare in order to maximize the number of hectares for the same amount of money.

There is no such thing as bad forest, only bad price. A deal stopper is when the price for a particular forest is too high and the projected returns thus are too low. Badly managed forests would also be avoided.

What makes a forest more attractive is when the price is good, meaning projected returns are in the high end. If returns look the same then it could be when a particular forest is diversified with a good mix of tree species and tree ages. It could also be the surroundings if it is close to one of the major cities or placed in an area of beautiful nature with hills and lakes as you then possibly could develop housing plots over time and gain a significant value.

How is technology changing the way HD Forest manages and monitors forests?

Does this lead to more efficiency but also higher costs?

As a test we bought a drone in Latvia and it is efficient in the way that it provides a quick overview and we save time walking through the entire forest. This can be used during field visits by clients or to inspect after a storm. However, we mostly use external independent surveyors during a forest purchase and he goes physically in the forest. We do the same with our subcontractors when they are planning felling etc. Drones, satellites and laser measuring are all new opportunities we might introduce. So far the costs have not yet surpassed the efficiency gains.

What do investors commonly overlook when choosing a turn-key forest manager?

We believe investors look for track record and credibility. They want a trusted partner that can provide full services from establishment, purchase of forests, management, financial reporting and exit. HD forest has nearly 20 years’ experience in the Baltics with investors from the US, UK, Ireland, Sweden and Denmark.

The minimum forestry investment your recommend, to achieve the economies of scale is 300,000 Euros. Would it be possible for a group of investors to pool funds and purchase a forest as a group? Do you have a “waiting list”?

Actually most of our investors are in fact investor groups of 2, 3, 4 and up to 17 people who invest together. HD Forest do not organize these groups or make waiting lists. It is up to each investor to decide if he wants to invest alone or find co-investors. We do not have projects as such waiting. When an investor shows interest, we show what is for sale in the market at the moment and facilitate the process between buyer and the local seller.

What are the main risks for forest investments and how does HD forest help mitigate them?

How do these forestry risks differ in each country?

We do not see risks that differ from one country to another. The biggest risk of an investor is declining land and timber prices due to the general economic downturn. This is why we recommend long term investment. During the financial crisis in 2007 timber prices more than halved, but after two years the prices were back 90% and the forest kept growing. Price fluctuations can be encountered by actively timing the operation of timber and property sales. Declining land and timber prices are not assessed as likely – beyond short-term economic swings. The risks of storm fall, fire and disease are low due to natural resilience and by geographically diversifying into many small land plots rather than one big central land plot.

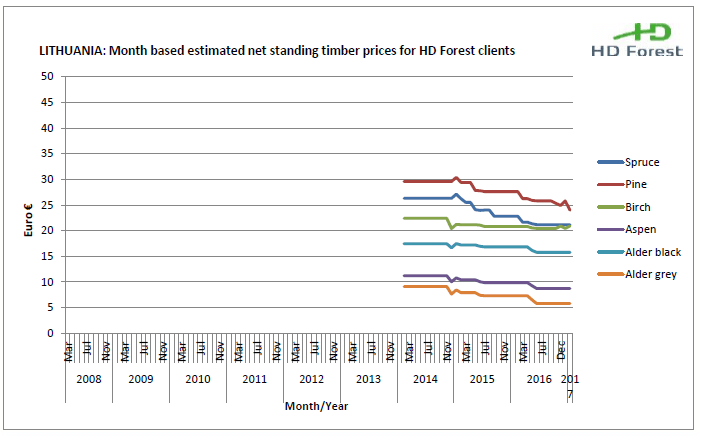

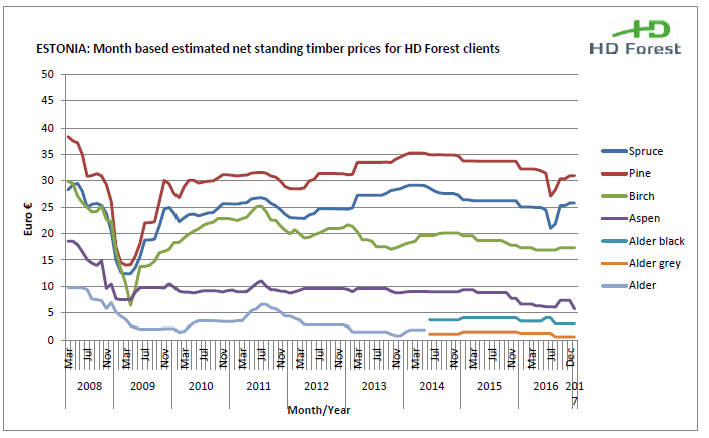

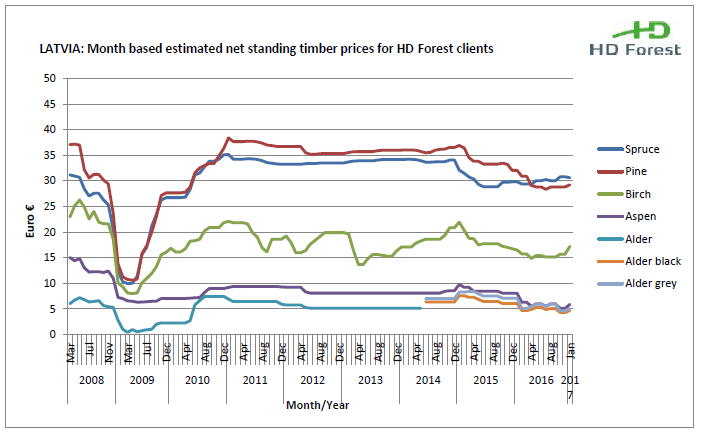

What is the evolution of timber prices in the Baltic States?

Basically they have been pretty flat since the last financial crisis or even down a bit the last couple of years. As we believe the trend line should be around 1% price increase per year, an upward correction could be expected in coming year(s).

What is your view on the investment value of “exotic” timbers such as Paulownia?

Can investors plant these Paulownia in the Baltic forests?

Forestry laws in Estonia, Latvia and Lithuania forbid to use foreign tree species and has strict felling rules according to age and/or diameter. There are tests with poplar in plantations on agricultural land, but HD Forest does none of this.

What are the origins of HD Forest?

HD Forest is a subsidiary of HedeDanmark a/s, which is an international service and trading enterprise in the green area. HedeDanmark a/s is owned by the association Det danske Hedeselskab and its patron is Queen Margrethe II of Denmark. Hedeselskabet started in Latvia 1999 and Lithuania in 2004 with the brand HedeBaltic. Another company called FestForest started in 1997/98 in Estonia and the two companies merged in 2012 with the name HD FestForest. In March 2016 the name was shortened to HD Forest.

I understand that HD Forest is a turnkey solution, what are the elements of this investment that the investor still has to take care of?

Basically the investor has to take an active decision on each forestland purchase. HD Forest will recommend a number of purchase opportunities, but in the end the investor has to take the decision on a specific forest. Some investors buy one large portfolio in one go consisting of many land plots. Other investors prefer to buy piece by piece and collect their own forest portfolio over some years. It is also normal to go at least once to the Baltics to sign necessary papers during the establishment. Lastly we have yearly budget meetings where we recommend the coming activities in the forest and we discuss the forest management plan with the client. This is usually done by phone/skype but can also be yearly physical meetings.

Why do customers choose HD Forest?

Because we have nearly 20 years of Baltic experience and we are independent as we do not own a sawmill or other parts of the value chain. When an investor buys forestland through us he becomes a direct owner and he gets the full potential gain on timber growth, land price increase and timber price increase.

What are your plans for HD Forest in the next three years?

We just increased the resources and focus from the headquarter in Denmark to support the local Baltic staff and increase sales and marketing efforts outside the Baltics. HD Forest plans to significantly increase the number of hectares that we manage already by attracting more foreign investors.

Where can potential customers find more about HD Forest?

We thank Kai Thygesen for the interview.