In a significant move for the education sector, Singapore-based fintech startup EduFi has secured $6.1 million in pre-seed funding. This groundbreaking initiative aims to ease the financial burden on students pursuing higher education, especially in markets like Pakistan, where traditional student loan products are scarce.

Innovative Financing Solution:

EduFi, founded by Aleena Nadeem, an MIT alumna with experience at Goldman Sachs and Ventura Capital, is addressing critical issues in Pakistan: high poverty and low literacy rates. Recognizing the challenges of accessing quality education, EduFi has launched an AI-powered ‘Study Now, Pay Later’ (SNPL) lending platform, coupled with a user-friendly mobile app. This move is not just a financial venture but a stride towards educational empowerment in a country where private schooling costs exceed $14 billion annually.

The Funding Round:

The pre-seed round was led by Zayn VC, with contributions from Palm Drive Capital, Deem Ventures, Q Business, and several angel investors. This diverse backing reflects confidence in EduFi’s mission to transform education financing.

Closing the Education Gap:

EduFi is not just a financial tool; it’s a bridge for students who aspire for higher education but are hindered by financial constraints. “There’s a significant drop in college admissions post-high school due to financial barriers,” explains Nadeem. “EduFi aims to close this gap, making higher education more accessible.”

University Partnerships and App Usage:

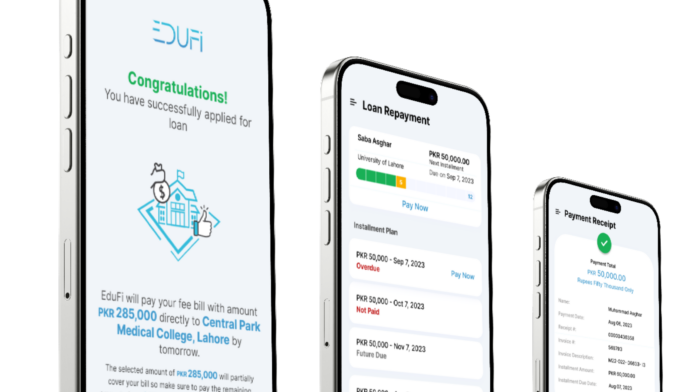

Already partnering with 15 universities, EduFi’s app reaches about 200,000 students across Pakistan, covering fees for various levels of higher education. The app simplifies the loan application process, requiring proof of financial stability and promising prompt disbursement once approved.

Beta Phase Success:

EduFi’s 18-month beta phase involved testing its credit model against traditional bank loans. The result? An efficient system that processes loans within 48 hours, a stark contrast to the usual weeks-long banking procedures. EduFi’s upcoming SECP license will further legitimize its operation, enhancing trust among its users.

Revolutionizing Traditional Banking:

EduFi stands out with its streamlined, digital approach to lending. It challenges the conventional banking system, notorious for high-interest rates and complex application processes. “Our goal is to make education financially attainable,” Nadeem emphasizes, citing EduFi’s role in transforming the lives of aspiring students.

Impact Stories and Future Goals:

EduFi’s impact is tangible, with numerous students already benefiting from its services. Nadeem shares stories of medical and dental students, who otherwise would struggle to afford their education. Looking ahead, EduFi plans to expand its reach, improve its platform, and introduce new fintech products, including student credit cards.

Fostering Financial Inclusion:

EduFi’s mission goes beyond education; it’s about fostering financial inclusion. “In Pakistan, where families often spend over half their income on education, EduFi is a beacon of hope,” states Faisal Aftab of Zayn VC. The startup’s approach not only alleviates financial stress but also enables families to invest confidently in their children’s futures.

Conclusion:

EduFi’s successful funding round marks a pivotal moment in addressing educational inequities. By providing accessible, efficient financial solutions, EduFi is not just funding education; it’s building futures. Its innovative model sets a new standard in the intersection of fintech and education, promising a brighter future for students in Pakistan and beyond.