iBAN is a relatively new p2p lending investment platform. They are offering an international investment product which is well fortified against borrower default risks. In interview this Mike Phillips, discusses how investors can make the most of the p2p lending opportunities offered by iBAN.

About iBAN:

Can you briefly introduce yourself and your role/position in iBAN

I’m Mike, Investor Relations Manager at iBAN. I joined the company after a stint in management consulting, primarily on process and system re-design projects in several multi-national companies. Now I’m the face of iBAN in the UK – attending events, meeting investors and building up the ‘Lenders’ side of the business.

What is iBAN?

iBAN is a peer-to-peer lending platform between Europe and Latin America – we provide higher returns to lenders in Europe, while providing cheaper and quicker loans to borrowers in Latin America. All our loans are secured against property, and we offer a variety of investment products with different levels of liquidity – from fully liquid to locked for 1 year.

Can you describe iBAN in figures?

After starting a few months ago, we now have around 200 users, roughly 80% of which are lenders, 20% borrowers. We have had a total of around £100,000 in deposits so far, and over £2.7 million in loan requests, of which we analyse and fund the most secure.

In which countries does iBAN operate?

We are currently operating in the UK and Spain on the lenders side, and the Dominican Republic for borrowers. We also have a Colombia roll-out planned for the near future.

What currencies does it support?

We support GBP, USD and Euros – lenders can deposit in any of these currencies no matter where they are located.

Your next milestone is seeking regulatory approvals and permissions, what is the greatest challenge in this step and how are you preparing for it?

Our primary challenge is the timescale to authorisation – P2P lending is quite a complex area of regulation and it takes time to navigate through the various regulatory processes (in our case, we are applying to the FCA in the UK). This won’t be an operational problem for us in the intervening time since we have certain exemptions to operate internationally, but we are making sure we have all the information ready that they may need so that the process can go as smoothly as possible.

Users:

Do iBAN account holders have to pay fees to maintain their account?

There are no fees whatsoever for Lenders – depending on the investment product that they have selected, they receive a certain amount of interest on their deposit directly into their accounts every month.

Do iBAN accounts benefit from depositor protection schemes?

iBAN Accounts do not fall under any government-backed deposit protection schemes (such as the FSCS in the UK). However we do provide security in a number of ways:

- All our loans are backed against property, and we only loan up to 50% of the value of that property – in this way if a borrower defaults the property is sold to cover the recover the loan amount

- We keep 10% of all deposits aside in a Guarantee Fund, which covers 3 of our products (iBAN Account, iBAN One, and iBAN Market). If a borrower from one of these products defaults or misses a payment, we will replace that payment with money from the Fund, so the lender is not affected. Our expected default rate is around 5%, and so with a Guarantee Fund of 10%, we currently have 2x coverage.

- For our clients on the edge of our risk markets we include an insurance that covers the value of the loan if they fail to pay. This includes but is not limited to damage to the loan security and illness or death of the individual.

Can an iBAN account receive money from a bank account?

Yes – an iBAN Account can receive money as a transfer from a bank account or a payment directly from a credit/debit card.

What are the primary differences between an iBAN account and a bank account?

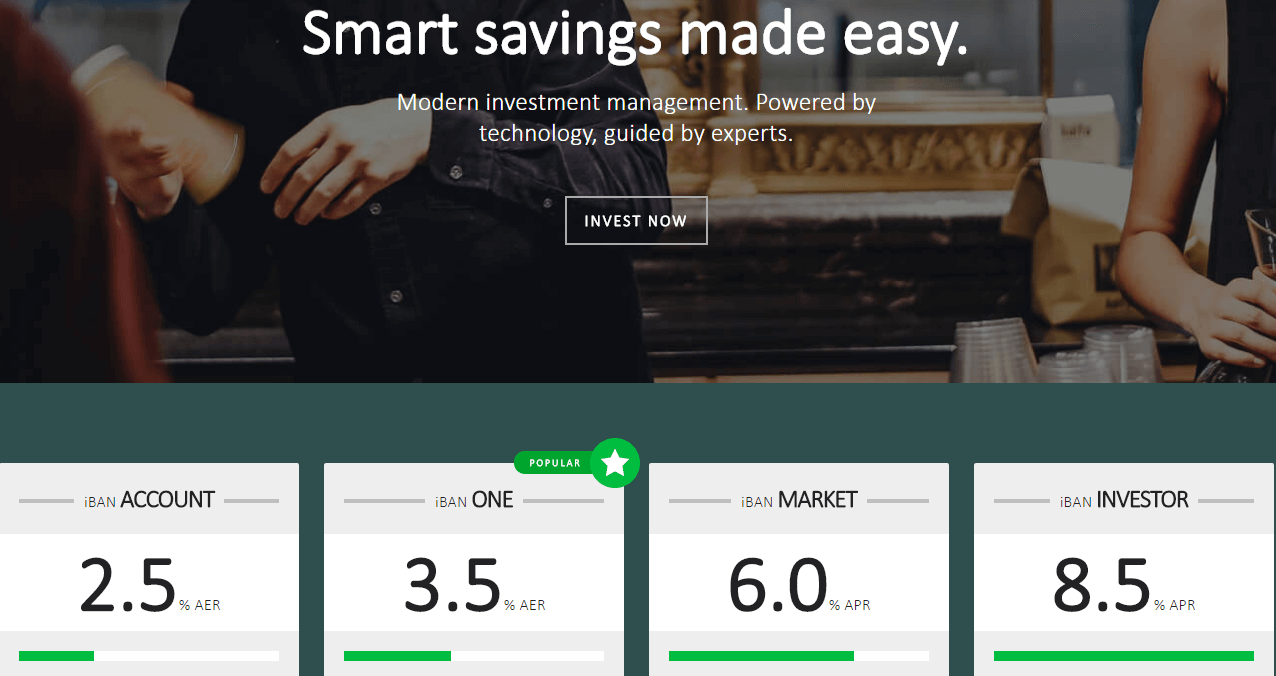

Money held in a bank account is government-backed up to a certain amount. iBAN Accounts are not government-backed, but they are secured against property, meaning that the risk of losing money is less than if the collateral used was vehicles (for example), or if we were offering unsecured personal loans. We offer higher interest rates to compensate for the higher risk to the lender – between 2.5% and 8.5%.

Investing

Can an investor in a loan withdraw his/her funds before the term of the loan ends?

Yes they can, although each of our products has different liquidity. Our iBAN Account (2.5% AER) product is fully liquid, with no limits on number or size of withdrawals, iBAN One (3.5% AER) is locked for a year, and money in iBAN Market (6% APR) and iBAN Investor (8.5% APR) can be removed once another lender deposits the same amount in that product.

Does iBAN offer a guarantee scheme on the loans?

iBAN users benefit from the Guarantee Fund that protects 3 out of 4 of our products, meaning that their money is protected from defaults by iBAN up to £50,000

Can investors use an auto-investor?

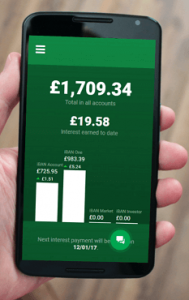

At the moment our model is to offer investment products rather than individual projects, meaning an auto-investor is not needed. We are building a mobile platform called iBAN Wallet which will focus on a marketplace model with lenders being able to filter on loans/projects based on a variety of attributes, for which we will introduce an auto-investor.

What kind of borrower analytics/ metrics do you provide to investors?

We currently only provide the default rate and average loan-to-value (LTV) ratio, but we will begin publishing our full loanbook within the next 6 months, so that lenders can see all loans we have given and view their status.

Loans

What kinds of loans are available to investors on iBAN?

Currently we only offer secured personal loaned, backed against property. This reduces risk and means that we can recover the capital in the event of a default. In the future we may begin loaning against vehicles for lenders using our highest interest rate product, iBAN Investor, given the risk markets that borrowers fall into for this product.

How is liquidity achieved between withdrawals from loans?

We have capital in the business for this reason that is held above the expected rate of withdrawals, and is paid into every month using funds from the loan repayments.

How does iBAN manage defaults?

We always try to help our borrowers get back on track should they miss a payment. If they reach 4 months’ worth of missed repayments, their loan is classed as a default and we begin our recoveries process. We employ a 3rd party recollection agency that will follow legal procedure to re-possess to the property and sell it, with the loan amount returning to iBAN and the lenders, and the remainder going to the borrower.

How does iBAN filter/analyse borrower requests?

Our credit risk analysis team reviews all loan requests – borrowers must supply copies of both identification documents and property titles when they apply. We then check their credit score with the in-country credit bureau and assign them into a risk market. A 3rd party valuer visits the property and provides us a valuation, and we ensure that we would be the only debt against that property. The most secure of these applications then get funded.

Market

What is the likelihood of the household banks being around as we know them in twenty years time?

I think there is zero chance of them being around in their current form. We are already seeing a surge in challenger banks that are re-designing the banking system to focus far more on user experience by utilising the internet and mobile platforms. Models such as P2P lending are taking customers away from the banks by providing simpler and more lucrative services, and this will continue as technology improves. The current household banks will need to adapt (and soon) to survive in 20 years.

There can users find more information about the crowdfunding campaign and iBAN?

Head over to our website at www.ibanonline.com for more information on what we do. We are aslo crowdfunding a seed round of £100,000 on the Seedrs platform, so take a look at our campaign at www.seedrs.com/ibanwallet and join us on our journey!