IFN Extra Finance S.A. was established in 2009 and is registered in the General Register of the National Bank of Romania under number PJR-RG-41-110259 / 2009, with 100% Romanian capital.

Currently, IFN Extra Finance. provides loans to individuals (personal loans with a mortgage) and legal entities (factoring, discounting). The team that handles all operations for loans consists of young employees with an average age under 35, with modern and flexible perspective, which have a big impact in meeting customer needs.

IFN Extra Finance S.A. has given special care to adapt to the new changes occurred regarding legislation, know-how, human resources, process technology and customer relationships in order to fulfil its mission: to help the customer with speed and flexibility through its competitive financial products.

What are the greatest achievements for IFN Extra Finance S.A. to date, and what was behind this success?

Growing steadily in the last 8 years to the leader of the market in Romania.A leader in the case of privately owned Institution. The success was influenced by a lot of hard work by a great team and a desire to be number one in the market.

How would you describe the current financial situation of IFN Extra Finance?

After 8 years in the local market, we are very stable and looking to grow in the future.

In what countries is IFN Extra Finance currently operational and do you plan to expand further in the future?

At the moment we are operational only in Romania.We are looking at different alternatives for opening at the end of the year in another country.

What credit approval systems do you use to approve credit requests loan?

We have two lines of business; one is online short term loans witch are fully automated, and the other line is mortgage loans witch involves a more classical procedure.

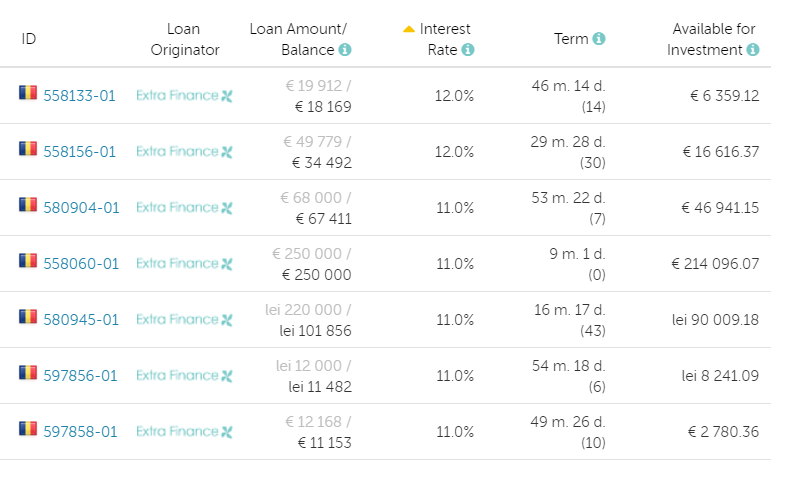

What are the different kinds of loans you offer on Mintos?

What are the amounts, the LTV and the duration?

We offer only consumer loans backed by mortgage on Mintos.Between 5.000 and 100.000 Euro.The LTV is around 40% as an average.And the duration is up to 5 years.

How do the loan repayments you manage compare to industry averages in Romania? Are there any specific trends that explain this?

We are close to 0 with the bad dept, and the average per country in this type of loans is around 7%.The difference is in the way we analyse the request; we very risk adverse in the mortgage area.

What is the current default rate on the loans issued? How do you manage defaults?

20% is going to default, but we resolve 99,9% of them in the recovery process.We manage defaults with a clear and well-established procedure plus a great team.

Do you have a buyback guarantee scheme? What is your opinion about the buyback guarantee schemes in general?

At this point the business line of Mintos is not to have a buyback clause, but in the future it can be done.

My opinion is that a buyback scheme is not the way to go, since that means something similar to a bank deposit to the investor, but it also means that the investor has to analyse the Loan Originator more than the loan he is buying.It is better to educate investors in calculating the risk of what they buy.

InvestItIn.com plug: Investing on the Mintos platform, the simple guide for dummies.

What is your current “skin in the game” percentage in these loans?

We are at 10% skin in the game

How do you compare your loans to others issued on the Mintos platform?

They open a new market for investors since we are the only Romanian company to be present on Mintos.They are highly secured loans and with the almost non-existing bad debt.

What are the advantages of using the Mintos platform?

What is it’s greatest strengths? Where is there more room for improvement?

It improves our finance structure, by tapping in the potential of retail.They are very oriented to business, and it is easy to work with such a team.

Where can investors find more information about IFN EXTRA FINANCE S.A.?