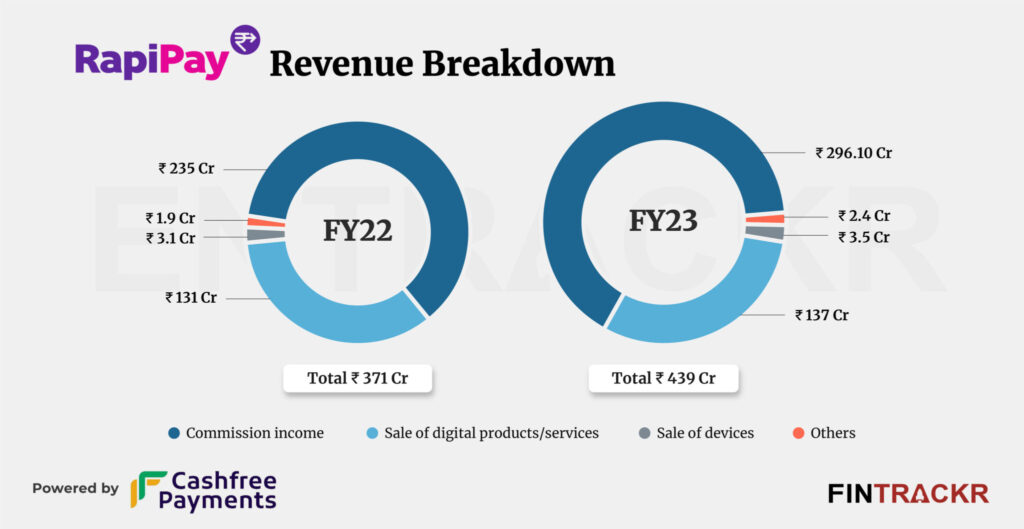

In the fiscal year 2023, RapiPay, a fintech startup, experienced significant revenue growth, nearing Rs 440 crore. However, their losses also surged by 2.3 times during the same period. Despite a deceleration in growth rate compared to the previous year, RapiPay’s revenue from operations increased by 18.3% to reach Rs 439 crore. The Noida-based company offers a range of banking and financial solutions, including payment services, point-of-sale solutions, and loans for micro, small, and medium enterprises. Their income primarily comes from commissions in the digital payment solution space, which saw a 26% surge in FY23. However, expenses followed revenue growth, resulting in a loss of Rs 93.2 crore for the company.

RapiPay’s Revenue in FY23

Revenue Growth in FY22

In FY22, RapiPay experienced significant revenue growth, with a 78% increase compared to the previous fiscal year. This rapid growth showcased the company’s potential and set the stage for further expansion in the coming years.

Revenue in FY23

Building upon its strong performance in FY22, RapiPay achieved impressive revenue figures in FY23. According to the company’s annual financial report filed with the Registrar of Companies, RapiPay’s revenue from operations rose by 18.3% to reach Rs 439 crore in FY23, up from Rs 371 crore in FY22. This steady growth demonstrates RapiPay’s ability to maintain its momentum and adapt to the evolving market landscape.

Annual Financial Report

RapiPay’s annual financial report provides a detailed overview of the company’s financial performance in FY23. It offers valuable insights into key metrics such as revenue, expenses, and profitability. The report serves as a comprehensive snapshot of RapiPay’s financial health and showcases its commitment to transparency and accountability.

$15 Million Funding Round

At the end of FY22, RapiPay successfully raised $15 million in a funding round. This infusion of capital further fueled the company’s growth and expansion efforts. The funding round highlights investor confidence in RapiPay’s business model and signifies a strong endorsement of its long-term potential.

RapiPay’s Banking and Financial Solutions

Wide Suite of Solutions

RapiPay offers a wide range of banking and financial solutions tailored to meet the needs of businesses. As a fintech startup, RapiPay leverages technology to provide innovative and convenient solutions that enhance financial inclusion and drive economic growth. Its suite of solutions includes aided payment services, point-of-sale solutions, and loans designed specifically for micro, small, and medium enterprises (MSMEs).

Services in Digital Payment Solution Space

RapiPay generates revenue by providing services in the digital payment solution space. The company facilitates seamless and secure transactions, enabling businesses and individuals to conduct electronic payments with ease. By leveraging technology and digitization, RapiPay empowers businesses to embrace the digital revolution and unlock new opportunities for growth.

Income from Commission

As part of its business model, RapiPay earns income from commissions. This revenue stream is closely tied to the company’s services in the digital payment solution space. RapiPay’s consistent focus on delivering value to its customers translates into tangible financial gains, as evidenced by its revenue growth in FY23. The company’s ability to generate income through commission highlights its effectiveness in monetizing its suite of banking and financial solutions.

Introduction of Super App NYE

Features of NYE

In a bid to further expand its offerings and enhance its value proposition, RapiPay introduced the super app NYE. This all-in-one platform provides a comprehensive array of financial services, catering to the diverse needs of businesses. NYE offers features such as salary and current accounts, payment solutions, retail and business loans, buy now pay later (BNPL) options, investment opportunities, and insurance coverage. By consolidating multiple services into a single app, RapiPay aims to simplify financial management and empower businesses to achieve their goals.

Integration of Various Services

One of the key strengths of NYE is its seamless integration of various services. Through the super app, users can access a wide range of financial solutions without the need for multiple applications or platforms. This integration streamlines the user experience, making it more convenient and efficient. By eliminating the need to switch between different apps, NYE empowers businesses to optimize their financial operations and maximize their productivity.

Expenses and Cost Analysis

Cost Breakdown

RapiPay’s expenses comprise various components, each contributing to the overall cost structure. A thorough cost breakdown allows the company to understand its expenditure patterns and identify opportunities for optimization. By analyzing its costs, RapiPay can make informed decisions to control expenses and improve its financial performance.

Increase in Employee Benefits

One notable expense for RapiPay is employee benefits. In FY23, the company witnessed a significant increase in employee benefits, which shot up by 2.7X to Rs 114.2 crore. This figure includes Rs 48.1 crore allocated towards employee stock ownership plans (ESOPs), which are non-cash benefits. RapiPay’s investment in employee benefits underscores its commitment to nurturing a talented workforce and driving employee satisfaction.

Legal and Professional Fees

Another significant expense for RapiPay is legal and professional fees. In FY23, the company spent Rs 14.4 crore in this category, which catalyzed its total expenditure. Legal and professional fees are crucial for ensuring compliance with regulations, safeguarding intellectual property, and accessing expert advice. RapiPay’s investment in legal and professional services reflects its focus on maintaining a strong legal and regulatory framework.

Losses and Financial Performance

Increase in Losses

Despite its impressive revenue growth, RapiPay reported a loss of Rs 93.2 crore in FY23, compared to a loss of Rs 40 crore in the previous fiscal year. This increase in losses can be attributed to various factors, including the investment in expanding its suite of solutions, the rise in expenses, and the challenges posed by a rapidly evolving market landscape. It is worth noting that RapiPay’s ability to remain competitive and fuel growth hinges on effectively managing these losses and steering the company towards profitability.

Comparison of ROCE and EBITDA

RapiPay’s return on capital employed (ROCE) and earnings before interest, taxes, depreciation, and amortization (EBITDA) are important metrics to assess its financial performance. In FY23, both ROCE and EBITDA worsened, with figures standing at -74.17% and -17.79% respectively. Analyzing these metrics provides insights into RapiPay’s ability to generate profits and utilize capital efficiently.

Operating Revenue per Unit Expense

Efficiency in utilizing resources is a key driver of financial performance. In FY23, RapiPay spent Rs 1.23 to earn a unit of operating revenue, showcasing the company’s commitment to optimizing its operations. By striving to increase operating revenue per unit expense, RapiPay aims to drive profitability and enhance shareholder value.

Conclusion

In conclusion, RapiPay’s financial performance in FY23 reflects its ability to generate substantial revenue and expand its suite of banking and financial solutions. While the company faced challenges such as rising expenses and increased losses, its commitment to innovation, integration, and efficiency positions it for future success. RapiPay’s introduction of the super app NYE further enhances its value proposition and enables businesses to access a comprehensive range of financial services. Looking ahead, RapiPay’s continuous focus on growth and improvement promises exciting opportunities for the future.

Other News

Crypto Unicorn CoinDCX Employee Layoffs

In other news, crypto unicorn CoinDCX recently announced employee layoffs. This development highlights the challenges faced by companies operating in the cryptocurrency space and the need for prudent resource management.

Opportunities for Musicians through KalaKumbh

KalaKumbh, a platform dedicated to promoting opportunities for musicians, is making waves in the industry. By creating visibility and fostering connections, KalaKumbh empowers musicians to showcase their talent and unlock new avenues for growth and recognition.

Udaan’s New Round of Funding

Udaan, an e-commerce platform connecting businesses with manufacturers and wholesalers, is reportedly in talks to raise a new funding round. This potential investment signifies investor confidence in Udaan’s business model and its ability to capitalize on the growing e-commerce market in India.

FirstCry Stake Acquisition by Ranjan Pai’s Family Office

Ranjan Pai’s family office recently acquired a stake in FirstCry. This strategic move demonstrates the interest of established players in the e-commerce sector and their recognition of the value and potential of companies like FirstCry.

About the Author

Kunal Manchanada is a seasoned financial journalist with a keen focus on reporting on company’s financial growth and strategic development. With an MBA in finance and five years of experience, Kunal brings a wealth of knowledge and insights to his reporting. He can be reached at [email protected] for any inquiries or further information.

Similar Financial Performances

M1xchange’s Growth and Reduced Losses in FY23

Another notable financial performance is M1xchange, an Amazon-backed startup. In FY23, M1xchange saw a significant scale-up with its revenue growing by 2X and its losses shrinking. This financial achievement demonstrates M1xchange’s ability to navigate the challenges of the market and achieve sustainable growth.

Urban Company’s Revenue and Decreased Losses in FY23

Urban Company, a leading home services marketplace, experienced positive financial results in FY23. The company reported a revenue of Rs 637 crore, and its losses decreased by 40%. Urban Company’s ability to drive revenue growth and control losses exemplifies its strong business model and operational efficiency.

Navi’s Q1 FY24 Revenue and Profit Status

Navi, a fintech startup founded by Sachin Bansal, reported its financial performance for Q1 FY24. With a revenue of Rs 439 crore, Navi continued to face challenges in achieving profitability. Nevertheless, its strong revenue figures indicate promising potential for the future.

Country Delight’s Revenue Surge and Increased Losses in FY22

Country Delight, a player in the dairy and fresh produce segment, saw a surge in revenue in FY22. However, this growth was accompanied by increased losses, which surged by 6.6X. Despite facing profitability challenges, Country Delight’s revenue surge highlights its ability to capture market demand and establish a strong foothold in the industry.

About Fintrackr

Fintrackr is a media platform dedicated to providing insights and coverage on startups, entrepreneurs, and technology. The platform focuses on financial growth, strategic development, and other important aspects of the startup ecosystem. With a strong social media presence, Fintrackr aims to keep its audience informed and engaged. For more information, visit the Fintrackr website or contact the team at [email protected]