Have you ever wondered how some people seem to have a knack for turning a profit through investing? Well, if you’re ready to dip your toes into the world of investing, we’ve got just the guide for you! Allow us to present “A Beginner’s Guide to Investing in Cars,” a comprehensive road map that will navigate you through the ins and outs of this exciting and potentially lucrative venture.

In this article, you’ll discover everything you need to know about investing in cars, from choosing the right models to understanding market trends and maximizing your returns. We’ll walk you through the step-by-step process, equipping you with the knowledge and confidence to navigate the world of automotive investment like a seasoned pro. Whether you’re a car enthusiast or simply looking for a new avenue to grow your money, this guide is your gateway to unlocking the potential of investing in cars. So, buckle up and get ready for an exhilarating journey as we unravel the secrets to success in this enthralling field.

A Beginner’s Guide to Investing in Cars

This image is property of static.theceomagazine.net.

1. Research and Education

1.1 Understand the Car Market

Before diving into the world of car investments, it is crucial to gain a deep understanding of the car market. Research popular car models, brands, and trends to identify which cars hold their value well over time. Familiarize yourself with factors that influence car prices, such as mileage, condition, age, and demand in the market.

1.2 Learn the Basics of the Automotive Industry

To make informed investment decisions, it is essential to have a basic knowledge of the automotive industry. Understand how manufacturing processes work, the different types of car technology, and the impact of advancements in the industry. This knowledge will help you evaluate the potential of certain car models and anticipate future trends in the market.

1.3 Study the Different Types of Cars for Investment

Cars for investment purposes can be broadly divided into two categories: collectible/classic cars and modern cars. Study the characteristics, history, and market demand for both types. Classic cars have a certain historical value and can appreciate significantly over time, while modern cars may have unique features or desirability that makes them attractive to investors.

1.4 Familiarize Yourself with Car Valuation

Understanding how cars are valued is crucial for making informed investment decisions. Learn about the various factors that affect car valuation, such as brand reputation, condition, scarcity, and historical significance. This knowledge will help you accurately assess the potential profitability of your car investments.

1.5 Stay Updated with Automotive Trends

To succeed in the car investment market, it is important to stay updated with the latest trends. Follow reputable automotive publications, blogs, and forums to keep abreast of industry news, new car releases, and emerging market trends. By staying informed, you can make timely investment decisions and identify potential opportunities for profit.

2. Determine Your Investment Goals

2.1 Identify Your Investment Objectives

Before investing in cars, it is important to define your investment objectives. Are you looking for short-term gains or long-term investments? Do you aim to build a diverse car portfolio or focus on specific niche markets? Clarifying your goals will help you develop a targeted investment strategy and make more informed decisions.

2.2 Set a Budget for Your Car Investments

Establishing a budget is essential to avoid overspending and to ensure your investment remains within your financial capacity. Consider factors like the cost of purchasing the car, maintenance expenses, storage costs, and any potential financing charges. Setting a budget will help guide your investment decisions and prevent financial strain.

2.3 Decide on Your Investment Timeframe

Determine how long you intend to hold your car investments. Some investors prefer short-term flipping, where they buy and sell cars relatively quickly, while others take a long-term approach for potential appreciation. Your investment timeframe will influence the types of cars you consider and the strategies you employ to maximize your returns.

2.4 Define Your Risk Tolerance

Investing in cars, like any investment, carries a degree of risk. Assess your risk tolerance and be realistic about your ability to withstand potential losses. Some cars may be more volatile in terms of price fluctuations, while others offer a more stable investment opportunity. Understanding your risk tolerance will inform your investment decisions and help you manage your portfolio effectively.

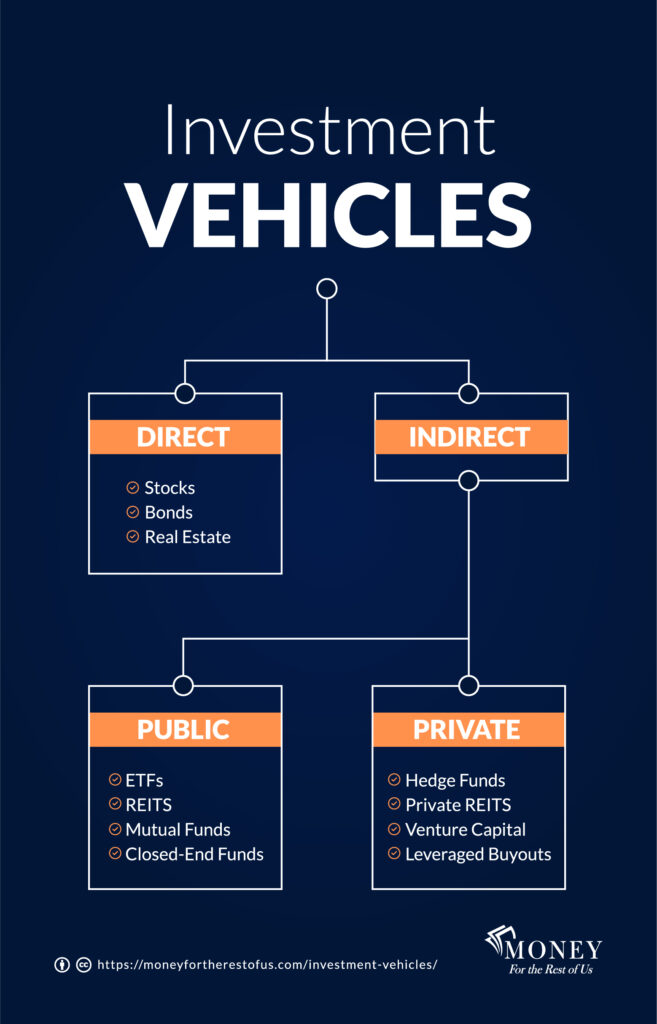

This image is property of moneyfortherestofus.com.

3. Choose Your Investment Strategy

3.1 Decide Between Collectible or Modern Cars

One of the first decisions you need to make is whether to invest in collectible/classic cars or modern cars. Classic cars often have a rich history, limited supply, and inherent value due to their age, rarity, and condition. On the other hand, modern cars may provide opportunities for growth due to technological advancements, innovative features, or rising popularity. Consider your investment goals and risk tolerance when deciding which category aligns with your strategy.

3.2 Select a Niche or Focus Area

To develop a successful investment strategy, it can be beneficial to focus on a specific niche or area within the car market. This could be a particular brand, model, era, or vehicle type. By specializing in a niche, you can become more knowledgeable about that segment, anticipate market trends, and identify undervalued opportunities that others may overlook.

3.3 Consider Investing in Classic Cars

Classic cars have proven to be lucrative investments for many enthusiasts. These timeless vehicles often appreciate in value over time, making them attractive for long-term investment strategies. However, investing in classic cars requires extensive knowledge, careful research, and a substantial financial commitment. Consider consulting experts and attending classic car events to learn more about investing in this unique market.

3.4 Explore Exotic or Luxury Cars

Exotic or luxury cars represent a high-end segment of the car market and can offer profitable investment opportunities. These vehicles often retain their value well, and some models may even experience significant appreciation. However, investing in exotic or luxury cars requires a higher initial investment and ongoing maintenance costs. Conduct thorough research, consider the brand reputation, and assess the demand in the market before making a financial commitment.

3.5 Evaluate the Potential of Future Classics

While investing in classic cars can be highly rewarding, it is also important to consider the potential of future classics. These are cars that are currently in production and have the potential to become highly desirable and valuable in the future. Identifying future classics requires a deep understanding of the automotive industry, emerging trends, and consumer preferences. Stay updated with new car releases and industry developments to spot potential future classics.

4. Budgeting and Financing

4.1 Allocate Your Funds for Car Investments

Once you have established your investment goals and strategy, allocate a specific portion of your funds for car investments. Consider how much you are willing to invest, keeping in mind the purchase price of the cars, ongoing maintenance costs, storage expenses, and potential financing charges. Diversify your investment portfolio by spreading your funds across multiple cars to mitigate risks.

4.2 Consider Financing Options

If you don’t have sufficient funds to make a full cash purchase, explore financing options. Traditional lenders, specialized automotive lenders, or even lease-to-own arrangements may be available. Evaluate the terms, interest rates, and repayment plans to ensure they align with your financial goals. Remember to include financing costs in your budgeting considerations.

4.3 Factor in Additional Costs

Investing in cars involves more than just the purchase price. Factor in additional costs such as insurance, registration fees, taxes, and ongoing maintenance expenses. These costs can significantly impact the overall profitability of your investment, so it is crucial to include them in your budgeting calculations.

4.4 Create a Contingency Plan

It is wise to have a contingency plan in place to prepare for unexpected situations or market fluctuations. Set aside a reserve fund for unforeseen expenses, fluctuations in the market, or unexpected repairs. A contingency plan will provide peace of mind and ensure you can navigate any challenges that come your way.

This image is property of d7nm3c5ruslmy.cloudfront.net.

5. Inspections and Authenticity

5.1 Conduct Thorough Inspections

Before finalizing any car purchase, conduct thorough inspections to ensure you are making a sound investment. Inspect the exterior, interior, engine, undercarriage, and all mechanical components. Look for signs of damage, wear, or any potential issues that may affect the value of the car. Consider hiring a professional inspector or mechanic to conduct a detailed inspection for you.

5.2 Verify Vehicle History and Authenticity

Ensure the vehicle’s history and authenticity by obtaining a comprehensive report. These reports provide valuable information about previous accidents, ownership records, and maintenance history. Verify the authenticity of classic cars by examining their documentation, including original certificates, service records, and any relevant historical documentation. This step is crucial in avoiding fraudulent or misrepresented cars.

5.3 Seek Professional Assistance if Needed

If you are unsure about the inspection or verification process, seek professional assistance. Automotive experts, mechanics, and experienced dealers can provide valuable insights and help you make informed decisions. Their knowledge and expertise can help you identify potential red flags and ensure you are making a reliable investment.

6. Networking and Building Relationships

6.1 Connect with Car Enthusiast Communities

Networking with fellow car enthusiasts can provide valuable insights, tips, and potential investment opportunities. Join online forums, social media groups, or local car clubs to connect with like-minded individuals who share your passion for cars. Engage in discussions, ask questions, and share your knowledge to build relationships within the car community.

6.2 Attend Automotive Events and Auctions

Attending automotive events, car shows, and auctions can offer great opportunities to expand your network and learn from experts. These events provide a platform to connect with industry professionals, collectors, and dealers. Keep an eye out for events that specialize in collectible or classic cars, as they attract enthusiasts and experts in the field.

6.3 Build Relationships with Experts and Dealers

Establishing relationships with industry experts and seasoned car dealers can be invaluable when investing in cars. Experts can provide guidance, share their knowledge, and offer insights into potential investment opportunities. Developing relationships with reputable dealers can give you access to exclusive deals, opportunities, and reliable sources for sourcing cars.

This image is property of static.moneymade.io.

7. Due Diligence and Negotiation

7.1 Research the Car’s Market Value

Before entering into negotiations, thoroughly research the market value of the car you are interested in purchasing. Analyze recent sales data, consult car valuation guides, and consider appraisals from trusted experts. Having a clear understanding of the car’s market value will empower you during negotiations and ensure you make an informed investment decision.

7.2 Evaluate Seller’s Reputation

When considering a car purchase, evaluate the reputation and credibility of the seller. Research their track record, look for reviews, and consider recommendations from fellow enthusiasts or experts. Dealing with reputable sellers reduces the risk of fraud or misrepresented vehicles and increases the likelihood of a fair and transparent transaction.

7.3 Perform a Vehicle History Check

Obtain a comprehensive vehicle history report to verify the car’s ownership, past accidents, and maintenance records. This step is essential in ensuring the car’s authenticity and understanding any potential issues that may affect its value. Combining the vehicle history report with thorough inspections gives you a complete picture of the car’s condition and history.

7.4 Negotiate the Purchase Price

Engage in negotiations with the seller to secure the best possible purchase price. Armed with your research and understanding of the car’s value, present a fair offer based on market conditions and the overall condition of the vehicle. Negotiation skills play a crucial role in securing a favorable deal, so be prepared to negotiate and walk away if the terms are not favorable.

8. Maintenance and Storage Considerations

8.1 Plan for Ongoing Maintenance

Ongoing maintenance is essential for preserving the value and condition of your car investments. Create a maintenance plan that includes regular servicing, inspections, and any necessary repairs. Keep accurate records of all maintenance activities, as these records can enhance the value of the car when it comes time to sell.

8.2 Consider Storage Options

Proper storage is crucial to protect your car investments from environmental elements, theft, or damage. Depending on your available space and budget, consider options such as renting a secure garage, using a car storage facility, or investing in a purpose-built car storage unit. Protecting your cars from the elements and maintaining their condition will help ensure their long-term value.

8.3 Insure Your Investment

Insurance is an imperative step in protecting your car investments. Consult with insurance providers who specialize in classic or high-value cars to find suitable coverage. Ensure that your policy adequately covers potential risks such as accidents, theft, natural disasters, or any damage that may occur during transport or storage. Regularly review and update your insurance to reflect the current value of your assets.

This image is property of www.thetimes.co.uk.

9. Exit Strategies and Resale

9.1 Determine Your Exit Strategy

At some point, you may decide to sell your car investments. Determine the optimal time to exit your investment based on your original investment goals, market conditions, and potential appreciation. Consider factors such as economic trends, collector demand, and the current value of the car when making the decision to sell.

9.2 Understand the Resale Market

Before listing a car for resale, conduct market research to understand the current demand and pricing trends. Analyze recent sales data, consult with experts, and consider working with specialized car dealers or auction houses. Understanding the resale market will help you set a competitive price and increase your chances of a successful sale.

9.3 Timing your Exit

Timing is crucial when selling your car investments. Monitor market trends, collectible car auctions, and industry news to identify the best time to sell. Be mindful of economic fluctuations, changes in interest rates, and any news or events that may affect the desirability and value of your car. By carefully selecting the timing of your exit, you can maximize your returns.

10. Mitigating Risks

10.1 Diversify Your Car Investments

Diversification is key to mitigating risks in any investment portfolio, including car investments. Spread your funds across various car models, brands, or time periods to reduce the potential impact of a single investment’s depreciation or market fluctuations. Diversification helps protect against losses and provides opportunities for profitable returns.

10.2 Consider Condition and Rarity

When investing in cars, pay close attention to the condition and rarity of the vehicles. Cars in excellent condition and those that are rare or limited in production tend to hold their value better and offer greater potential for appreciation. Conduct thorough inspections, research the history of the car, and prioritize investments in vehicles that possess these desirable qualities.

10.3 Be Aware of Market Volatility

The car market, like any investment market, is subject to volatility. Economic conditions, changing consumer preferences, and fluctuations in the automotive industry can impact car prices. Stay informed about market trends, industry developments, and global events that may affect the car market. Being aware of market volatility will help you make informed investment decisions.

10.4 Protect Yourself Against Fraud

Unfortunately, the car investment market is not immune to fraud. Be cautious when dealing with unknown sellers, excessively low-priced cars, or suspicious documentation. Conduct thorough due diligence, verify the authenticity and history of the car, and consider seeking professional advice to avoid falling victim to fraud. Protecting yourself against fraud is crucial for safeguarding your investments.

In conclusion, investing in cars can be an exciting and potentially profitable venture. By conducting thorough research, defining investment goals, and developing a targeted strategy, you can navigate the car investment market with confidence. Remember to stay informed, network with fellow enthusiasts, and make sound investment decisions based on thorough due diligence. With careful planning and execution, investing in cars can open up a world of opportunities and provide long-term satisfaction and financial rewards.