Property Moose Review

Property Moose property rental investments:

- Property Moose finds suitable property investments and lists them on their site.

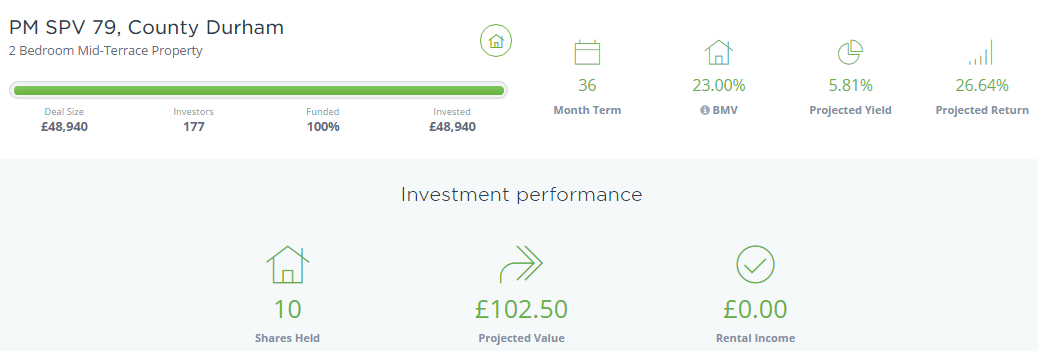

- Registered investors can buy a number of shares in the investments. This is done by buying shares of the SPV (Special purpose vehicle) that owned the investment.

- Investors earn dividends/rental from each of their shares.

- Property Moose manages the property, the fees for this are deducted directly from the rents.

- Ownership of shares in the SPV gives you the right to a slice of the dividends earned from the rent.

There are four main types of investments offered on Property Moose (PM)

- Buy-to-Let Investments (BTL)

- Buy-to-Sell Investments

- Private Equity Investments

- Loan Investments

The main focus of this article is Buy To Let investments (BTL)

SWOT Analysis of Property Moose

Strengths and Opportunities

User Friendliness:

- Easy to Register

- Easy to fund account or buy investments, by credit card or bank account transfer.

- Investing is straight forward. An investor can buy the number of shares, from those available. Each share is worth £10.

- Five Star Customer Service.

Investment Access

- BTL investments are notorious time drainers because of all the paperwork management, and handling of tenants. PM saves you all a lot of time (and grief).

- Great for the small investor, s it gives direct access to an asset whose minimum entry level is very high. Minimum investment sis £10

- Small investors could have difficulty getting a mortgage, through PM this is no longer a problem.

- In principle, No landlording experience or knowledge required, however, such experience would come in handy when analysing the individual propositions

Diversification

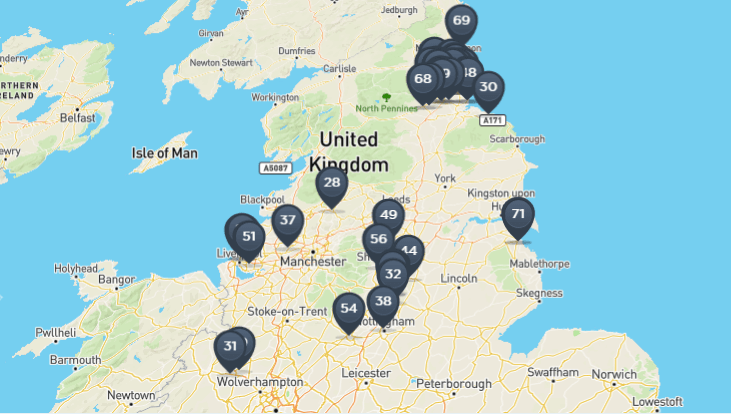

- PM gives investors the opportunity to diversify assets in the UK and across the UK.

- For the international investor, PM provides diversification into another currency and into the UK

- property market.

- Easy to manage BTL investments have not been easily accessible before the advent of p2p fintech or in this case proptech.

- Investments within PM can be spread over a number of properties

Ring Fencing / Protection

- Each property is managed through an SPV (Special purpose vehicle), this ringfencing provides property investors with a level of protection in case of a PM default.

- Investor’s money deposited at property moose sits in a special ring-fenced account managed by a solicitor. In case of a PM default the money is protected.

Transparency

- Strong KYC (Know your customer) / AML (Anti Money Laundering) procedures. Users report having to send several documents to open their account. This is a very strong trait as investors does not want their money to be mixed with money of unknown origins.

- All figures quoted on PM are net figures not gross figures, this makes it easier for investors to analyse their potential returns.

Money and Deal Flow

- Once money is committed to an investment a 3% interest rate is paid even though the property is not yet earning any returns.

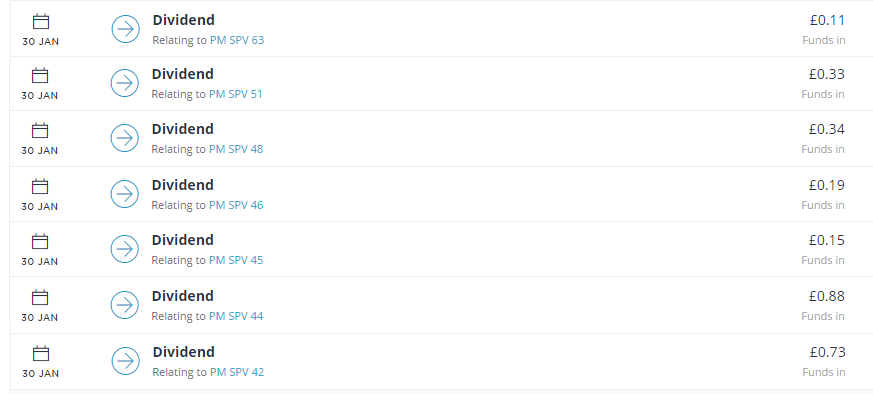

- Dividends are paid monthly.

- On average PM has a BTL investment listed every month.

- Rental Yields range from 3% to 8%

- Some properties come with a rental guarantee, this offers an extra level of protection.

BTL Investment Property Types

- HMO (house in multiple occupations.)

- Mixed use (Commercial / Residential)

- Larger Projects (with multiple residential units)

Credibility

- PM has now been founded in 2013.

- AXM Venture Capital was a seed investor in this firm.

Other

- It seems that BTL investments on PM are Sharia compliant investment

Weaknesses and Threats

Liquidity

- Investors may not be able to liquidate the shares, on the other hand, it is easier to liquidate a house when an investor owns it directly. (At the right price)

- Quick share sales on the secondary market are probably only possible through a realistic discount.

Profits

- There is no guarantee that a property will be rented 100% of the time.

- Estimated rental yields vs real yields differ, especially this is the case for the initial properties. Through experience in both property selection and management, these difference should be reduced.

- Most BTL investments on PM are not leveraged. This has both pros and cons. Leverage increases both profits and risks. Having a mix of both mortgaged and nonmortgaged properties would provide greater diversification for investors.

Managing your investment

- Investing on Property Moose (PM) still require a certain level of time commitment. Although this is still relatively very small compared to active BTL investment.

- Investing significant sums of money across a number of properties on PM takes time, as properties appear on average once a month. For example investing 20k across 20 properties will take you an average of 1.5 years.

Fees and Charges

Nothing is free. The exit fees are great! These align the agenda of property moose to the investor.

| Investment Type | Upfront Fees | Ongoing Fees | Exit Fees |

Buy-to-Let Investments |

5.0% | 10.5% (+VAT) | 15.0% |

Buy-to-Sell Investments |

5.0% | 2.0% p.a. | 15.0% |

Private Equity Investments |

5.0–8.0% | 2.0% p.a. | 15.0% |

Loan Investments |

0.0% | 0.0% | 0.0% |

Liquidity

Investors might agree not to sell a property at the end of the term. In addition, there is no guarantee that SPV shares will be sold on the secondary market. This would result in an investor being stuck with an investment.

The future / Speculation

- An investor needs to wait at least 2 to 3 years to see capital gains if any. Property prices fluctuate less than stocks or cryptocurrencies.

- Future increases in taxes are unpredictable.

- Brexit: British companies are relocating to Europe this means job losses and less demand for real estate. A post-Brexit migration policy post points towards a decline in housing demand in the UK, however probably demand will still exceed supply.

Conclusion

A BTL (Buy to Let) investments require research, knowledge and experience. With Property Moose an investor taps into the experience of experts which are selecting the best BTL investments in the interest of PM and in the interest of investors.

Property moose is a great match for the investors who understands the pros and cons. PM has many strengths in terms of access to this asset type, a hands-off approach to property investing and a monthly yield.

Property Moose – example investment

Other Real estate investment opportunities

Property Co-Investing

Property Partner, See also Property Partner Review

Intro Crowd (not the same business model but similar enough.)

Property ETFs

Vanguard Global ex-U.S. Real Estate ETF (VNQI)

Vanguard REIT ETF (VNQ)

You can see a list of ETFs here : http://etfdb.com/etfdb-category/global-real-estate/

REITs

If you have any more ideas or correction to the above, please add them in the comments section. Let’s help each other in these rather interesting investing times.

Jim Reynolds