Are you interested in investing in metals but don’t know where to start? Look no further! This beginner’s guide will walk you through the basics of investing in metals, giving you the knowledge and confidence to make informed decisions.

Investing in metals can be a smart way to diversify your portfolio and potentially generate long-term returns. To begin, it’s crucial to understand the different options available, such as gold, silver, platinum, and palladium. Each metal has its unique characteristics and market dynamics, so it’s essential to familiarize yourself with them before making any investment. Additionally, consider factors like supply and demand, geopolitical situations, and industrial uses that can influence metal prices. Research reputable dealers or platforms that facilitate metal investments, ensuring they have a solid track record, transparent pricing, and secure storage options. By taking these steps and staying educated about market trends, you’ll be well on your way to becoming a successful metals investor.

This image is property of Amazon.com.

Beginner’s Guide: How to Invest in Metals

Investing in metals can be an excellent way to diversify your investment portfolio and protect your wealth. However, choosing the right metal to invest in and understanding the various investment vehicles can be overwhelming for beginners. This comprehensive guide will walk you through the process step by step, helping you make informed decisions and achieve your investment goals.

Consider Your Investment Goals

Before diving into the world of metals investing, it’s essential to consider your investment goals. Are you looking for long-term growth and wealth preservation, or are you seeking short-term gains? Additionally, diversification is a crucial consideration. Diversifying your portfolio across different metals can help mitigate risk and maximize potential rewards.

Research Different Metals

To make well-informed investment decisions, it’s crucial to research different metals and understand their characteristics and market dynamics. Let’s explore some popular options:

Gold

Gold is often seen as a safe-haven investment and a store of value during economic uncertainties. Its scarcity, durability, and historical relevance make it a favorite among investors. When researching gold, pay attention to factors like supply and demand, global economic trends, and industrial use.

Silver

Silver offers a more affordable investment option than gold while still providing potential for returns. Silver is known for its industrial use in various sectors, including electronics and solar panels. Understanding the demand for silver in these industries and monitoring global economic factors can help inform your investment decisions.

Platinum

Platinum is a precious metal with a wide range of industrial applications, particularly in the automotive and jewelry industries. Its limited supply and high demand can make it an attractive investment choice. However, it’s important to stay updated on factors like supply levels, the state of the global economy, and the performance of relevant industries.

Palladium

Palladium is a lesser-known precious metal that has gained traction among investors due to its use in the automotive industry, specifically in catalytic converters. As car production increases, the demand for palladium is expected to rise. Monitoring trends in the automotive sector and assessing supply and demand dynamics can aid in your investment decisions.

Assess Market Trends and Performance

Understanding market trends and performance is essential for successful metals investing. Consider the following factors:

Supply and Demand

Analyzing the supply and demand dynamics of specific metals can provide insights into potential price movements. Factors such as mining output, recycling rates, industrial demand, and geopolitical factors can impact the overall supply and demand balance for a metal.

Global Economic Factors

Closely monitoring global economic trends can help investors anticipate how metal prices may be affected. Factors such as GDP growth, inflation, interest rates, and currency fluctuations can all influence the performance of metals.

Industrial Use

The industrial applications of metals play a significant role in their value and price fluctuations. Keeping an eye on industries that heavily rely on a particular metal can help predict demand and identify potential investment opportunities.

Understanding Different Investment Vehicles

Once you have decided on a metal to invest in, it’s important to understand the different investment vehicles available to you. Here are some common options:

Physical Metals

Physical metals refer to actual bars, coins, or bullion that you own and store yourself. Consider the following options:

Bullion

Bullion refers to highly refined gold, silver, platinum, or palladium bars or ingots. They are typically priced based on the metal’s weight and purity and are a popular choice among investors who want to directly own the metal.

Coins

Coins made from precious metals, such as gold and silver, are another popular physical investment option. They often have collectible value in addition to their intrinsic metal value.

Bars

Similar to bullion, bars are available in various sizes and weights. They are usually produced by accredited refiners and are a straightforward way to invest in physical metals.

Exchange-Traded Funds (ETFs)

ETFs provide an alternative way to invest in metals without physically owning them. Here’s what you need to know:

Investing in ETFs

ETFs are funds traded on stock exchanges that aim to replicate the performance of a specific metal or a group of metals. They provide exposure to metals without the need for physical possession.

Pros and Cons

Investing in ETFs offers several advantages, such as liquidity, ease of trading, and diversification. On the other hand, ETFs may involve management fees and can be subject to market volatility.

Futures Contracts

Futures contracts allow investors to speculate on the future price of metals without owning the physical metal. Consider the following:

How Futures Contracts Work

Futures contracts are agreements to buy or sell a specific amount of a metal at a predetermined price and date in the future. They can be highly leveraged and offer potential opportunities for profit, but they also carry significant risks.

Risks and Rewards

Futures contracts involve high volatility and require careful monitoring. They can provide substantial returns, but the potential for losses is equally significant. Understanding the mechanics of futures trading is crucial for successful investing.

Mining Company Stocks

Investing in mining company stocks allows you to indirectly participate in the performance of metal markets. Here’s what you should know:

Evaluating Mining Company Stocks

When considering mining company stocks, it’s essential to assess factors like the quality of their mining operations, financial stability, management expertise, and exploration activities. Conducting thorough research on prospective mining companies is critical.

Key Factors to Consider

Keep an eye on geopolitical risks, regulatory policies, labor issues, and environmental concerns that may impact mining companies. Additionally, monitor the overall performance of the metal market and industry trends that can influence mining stocks.

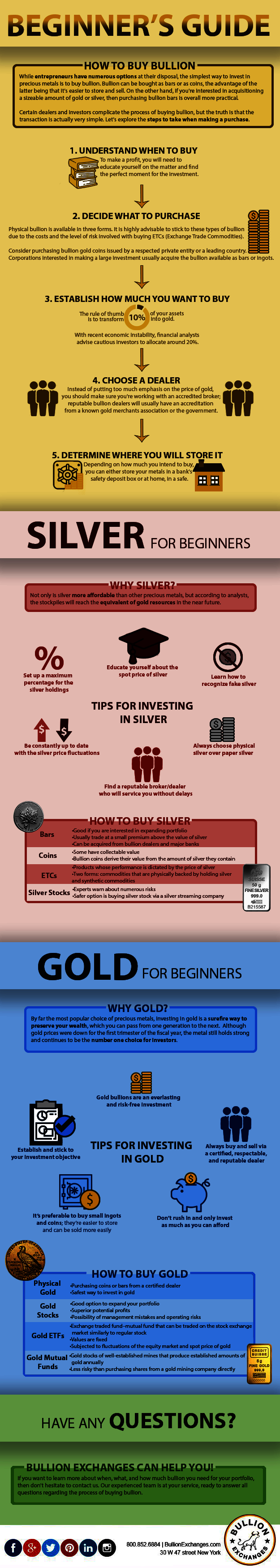

This image is property of cdn.bullionexchanges.com.

Determining Your Investment Strategy

Once you have a solid understanding of the different metals and investment vehicles, it’s crucial to establish an investment strategy that aligns with your goals and risk tolerance. Consider the following aspects:

Setting a Budget

Before investing in metals, determine how much you can afford to allocate to this asset class. Assess your financial situation and establish a budget that suits your needs.

Understanding the Risks

Investing in metals involves inherent risks. Be aware of market volatility, liquidity issues, and the risk of counterparty default. Understanding these risks will help you make informed decisions and manage your investments responsibly.

Establishing a Timeline

Decide whether your investment horizon is short-term or long-term. Factors like your financial goals, risk tolerance, and liquidity needs will influence your investment timeline. Additionally, consider establishing an exit strategy to guide your decision-making process.

Finding a Reputable Dealer or Broker

Once you are ready to invest, finding a reputable dealer or broker is crucial to ensure a smooth and reliable investment experience. Consider the following factors when researching potential dealers or brokers:

Reputation and Track Record

Look for dealers or brokers with a solid reputation and a track record of providing quality service. Check for customer reviews and ratings to assess customer satisfaction levels.

Licensing and Regulation

Ensure that the dealer or broker is licensed and regulated by relevant authorities. This helps ensure compliance with industry standards and provides a level of protection for the investor.

Transparency

Transparency is vital in any financial transaction. Seek out dealers or brokers who provide transparent pricing, clear terms and conditions, and readily available information about the products they offer.

Comparing Pricing and Fees

Pricing and fees can vary among different dealers or brokers. Compare bid-ask spreads, storage and insurance costs, and other fees associated with your investment. Finding a dealer or broker that offers competitive pricing and fee structures is important for maximizing your returns.

Customer Service and Support

A reputable dealer or broker should offer accessible customer service and support. Consider factors like available communication channels, ease of account management, and responsiveness when evaluating their customer service offerings.

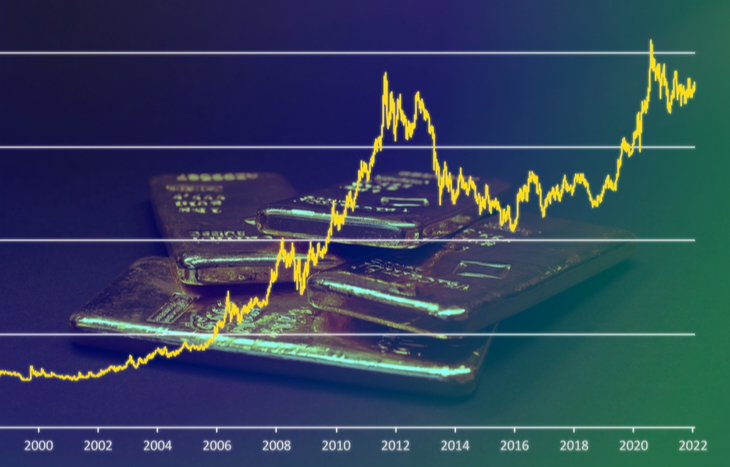

This image is property of investmentu.com.

Monitoring Your Investments

Once you have invested in metals, actively monitoring your investments is crucial for making informed decisions and managing risk. Consider the following strategies:

Tracking Market Prices

Stay informed about market prices by utilizing online platforms that provide real-time or delayed pricing data. Reliable resources such as financial news websites and specialized market analysis tools can help you stay up to date on market developments.

Reviewing Portfolio Performance

Regularly assessing the performance of your metals portfolio is essential for understanding your returns and making adjustments as needed. Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Staying Informed

Stay updated on industry news and updates that may impact the performance of your investments. Additionally, keep an eye on economic indicators that can provide insights into overall market trends.

Managing Risk and Diversifying

Managing risk and diversifying your portfolio is fundamental to successful metals investing. Consider the following strategies:

Diversify Your Portfolio

Investing in multiple metals can help spread risk and provide exposure to different market dynamics. Allocate your funds across various metals and other investment vehicles to balance your risk-reward profile.

Consider Hedging Strategies

Hedging strategies aim to protect your investments from adverse price movements. Options and futures, dollar-cost averaging, and stop-loss orders are examples of hedging techniques that can help minimize risk.

Set Realistic Expectations

Understand the inherent volatility of the metals market and set realistic expectations. Historical performance can provide insights, but it’s important to exercise patience and focus on long-term growth rather than short-term fluctuations.

This image is property of Amazon.com.

Tax Considerations

Before investing in metals, it’s crucial to understand the tax implications. Consult with a tax advisor to ensure compliance with relevant tax laws and regulations. Consider the following aspects:

Capital Gains Tax

When selling metals or metal-related investments, you may be subject to capital gains tax. Understand the tax rates and reporting requirements associated with capital gains to avoid any surprises.

Reporting Requirements

Keeping accurate records and reporting your investments correctly is vital for tax purposes. Be aware of the reporting requirements specific to metals investing to ensure compliance with tax laws.

Understand Tax-Free Investments

Explore tax-efficient investment options, such as Individual Retirement Accounts (IRAs). Precious metal IRAs offer potential tax advantages and can be an attractive option for long-term retirement planning.

Capital Gains Tax Exemption

In some cases, certain types of transactions or investments may be eligible for capital gains tax exemptions. Understanding these exemptions can help you optimize your tax situation.

Exiting Your Investments

Knowing when and how to exit your investments is an important part of managing your portfolio. Consider the following factors:

Deciding When to Sell

When considering selling your metals or metal-related investments, evaluate factors such as profit-taking opportunities, risk mitigation strategies, and portfolio rebalancing needs.

Determining the Best Selling Method

Decide whether selling physical metals, liquidating ETFs or stocks, or using other selling methods is most suitable for your investment strategy. Consider factors like liquidity, transaction costs, and potential tax implications when making your decision.

Tax Implications

Be aware of the potential capital gains tax associated with selling your metals or metal-related investments. Understand the tax reporting requirements and consult with a tax advisor to navigate the tax implications effectively.

This image is property of www.perthmint.com.

Continuing Education and Research

Staying informed and continuously educating yourself is crucial for long-term success in metals investing. Consider the following strategies:

Stay Updated on Market Developments

Read industry publications and reports, follow reputable financial news websites, and utilize market analysis tools to stay informed about market developments. Keeping up with evolving trends and emerging opportunities is key.

Network with Other Investors

Engage with other investors by joining investment clubs or forums and attending conferences and events. Sharing knowledge and insights with like-minded individuals can enhance your understanding of the market.

Consider Professional Guidance

If you’re unsure about making investment decisions on your own, consider seeking professional guidance. Financial advisors, investment consultants, and precious metal specialists can offer expert advice tailored to your specific needs.

Conclusion

Investing in metals can be a rewarding venture, providing diversification, wealth preservation, and potential for growth. By considering your investment goals, researching different metals, understanding market trends, and selecting the right investment vehicles, you can navigate the world of metals investing with confidence. Remember to establish a clear investment strategy, find a reputable dealer or broker, actively monitor your investments, manage risk through diversification, consider tax implications, and stay informed through ongoing education and research. With these tools and knowledge at your disposal, you’ll be well on your way to becoming a successful metals investor.