Are you interested in learning how to invest in Certificates of Deposit (CDs)? Look no further! This beginner’s guide will provide you with everything you need to know about investing in CDs.

Firstly, CDs are a type of financial product offered by banks and credit unions. They are known for their low-risk nature, making them a popular choice for individuals looking to invest their money safely. To invest in CDs, you typically need to have a savings or checking account with a bank or credit union. Once you’ve found a financial institution that offers CDs, you can choose a CD term that suits your needs. CD terms can range from a few months to several years, and the longer the term, the higher the interest rate generally is.

Next, you’ll need to deposit your money into the CD. This amount will be locked in for the duration of the term, and you won’t be able to access it until the CD matures. However, in return for keeping your money locked away, you’ll earn interest on your investment. The interest rates for CDs are typically higher than those of regular savings accounts. Once your CD matures, you can choose to reinvest the funds, withdraw the money, or roll it over into a new CD. It’s important to research and compare different financial institutions to find the best CD rates and terms for you.

Investing in Certificates of Deposit can be a great way to safely grow your money. By understanding the basics of CDs and finding the right terms and rates for your financial goals, you’ll be well on your way to successful CD investments. Happy investing!

This image is property of www.investopedia.com.

A Beginner’s Guide: How to Invest in Certificates of Deposit

If you’re looking for a safe and reliable way to invest your money, certificates of deposit (CDs) may be the perfect option for you. CDs offer a fixed interest rate and are typically held for a set period of time, making them a popular choice among conservative investors. In this comprehensive guide, we’ll explore everything you need to know about investing in CDs, including how they work, the different types available, the pros and cons, and tips for successful CD investing.

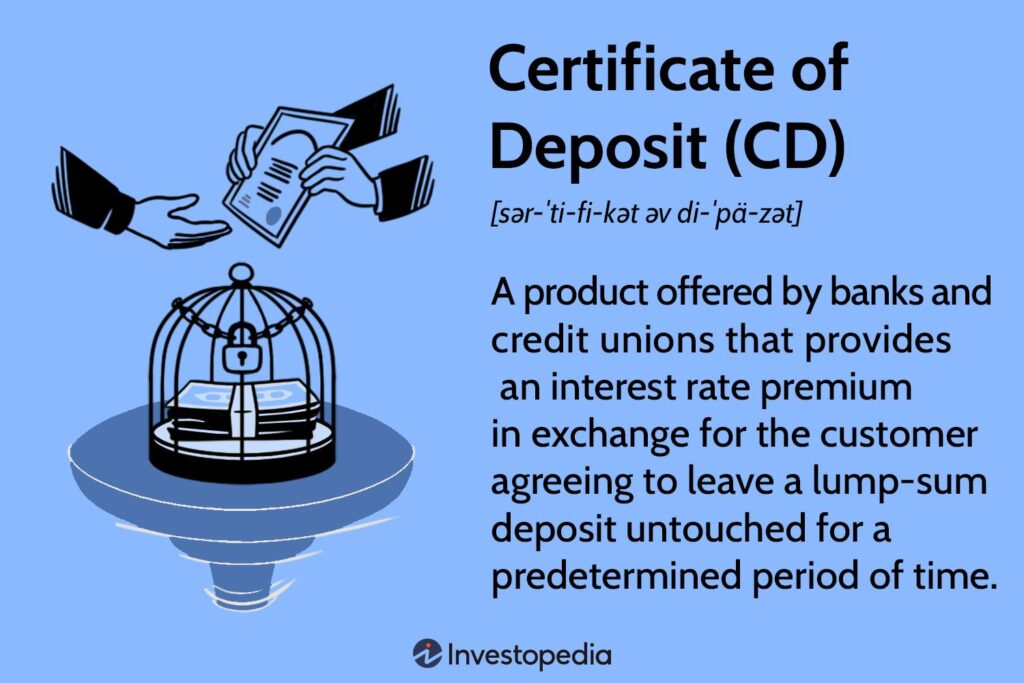

Definition of CD

First, let’s start with the basics. A certificate of deposit, commonly referred to as a CD, is a financial product offered by banks and credit unions. It is a type of time deposit where you agree to keep your money with the financial institution for a specific period, known as the term. In return for locking in your funds, the bank pays you a fixed interest rate for the duration of the CD.

How CDs Work

When you invest in a CD, you agree to deposit a certain amount of money with a financial institution for a set period of time. The minimum deposit requirement for CDs can vary depending on the bank and the type of CD you choose. The longer the term of the CD, the higher the interest rate typically offered. At the end of the term, you can choose to reinvest the money, withdraw it, or cash out the CD entirely.

Types of CDs

There are several types of CDs available to investors. One common type is the traditional CD, also known as a time deposit CD. These CDs have fixed terms ranging from a few months to several years, and the interest rate remains the same throughout the term.

Another type of CD is the high-yield CD, which generally offers a higher interest rate than traditional CDs. These CDs are often offered by online banks and may have longer terms or other requirements to qualify for the higher rate.

There are also variable-rate CDs, where the interest rate can fluctuate over time. These CDs may be linked to a specific financial index, such as the prime rate, and the interest rate adjusts accordingly.

Pros and Cons of Investing in CDs

Like any investment, CDs have their advantages and disadvantages. One of the major advantages of investing in CDs is the security they offer. Unlike stocks or mutual funds, the principal amount invested in a CD is generally insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank.

Another advantage is the fixed interest rate. With a CD, you know exactly how much interest you will earn over the term of the investment, providing a predictable income stream.

However, CDs also have some drawbacks. One major drawback is the limited liquidity. When you invest in a CD, your money is tied up for a set period of time, and withdrawing funds before the CD matures can result in penalties or loss of interest.

Additionally, CDs may not offer as high of a return compared to other investment options, such as stocks or mutual funds. If you are looking for higher potential returns, CDs may not be the best choice.

Minimum Deposit Requirement

Before investing in a CD, it’s important to consider the minimum deposit requirement. This is the minimum amount of money you need to deposit in order to open a CD account. The minimum deposit requirement can vary depending on the financial institution and the type of CD you choose. Some banks may require a minimum deposit of $500 or $1,000, while others may have no minimum requirement.

It’s essential to evaluate your financial situation and determine how much you can comfortably invest in a CD. Keep in mind that the higher the deposit amount, the potentially higher the interest rate offered.

CD Terms and Maturity

When investing in a CD, you’ll need to choose the term or length of time you want to keep the funds locked in. CD terms can range from as short as a few months to as long as several years. The term you choose will affect the interest rate offered.

Once the CD reaches its maturity date, you have several options. You can choose to renew the CD, which means you keep the funds in for another term with the same or different conditions. Alternatively, you can withdraw the funds or cash out the CD entirely.

Interest Rates

Interest rates are a key consideration when investing in CDs. The interest rate determines how much you’ll earn on your investment over the term of the CD. Generally, CDs with longer terms tend to offer higher interest rates, as you are committing to keeping your funds with the bank for a longer period.

It’s essential to compare the interest rates offered by different financial institutions before making a decision. Online banks often offer higher rates compared to traditional brick-and-mortar banks due to lower overhead costs.

FDIC Insurance

A significant advantage of CDs is that they are typically insured by the FDIC, which provides deposit insurance up to $250,000 per depositor, per insured bank. This means that even if the bank fails, your principal investment is protected.

It’s important to ensure that the financial institution you choose for your CD investment is FDIC-insured. You can check the FDIC’s website or inquire directly with the bank to confirm its insurance status.

Determining Your Investment Goals

Before investing in a CD, it’s crucial to determine your investment goals. What are you hoping to achieve with your investment? Are you looking for a short-term or long-term investment? Are you primarily focused on capital preservation or maximizing returns?

Understanding your investment goals will help you select the right CD that aligns with your objectives. If you have a specific financial goal, such as saving for a down payment on a house in five years, a CD with a corresponding term may be suitable.

Comparing Rates and Terms

When it comes to CDs, not all financial institutions offer the same rates and terms. It’s important to compare the rates and terms offered by different banks before making a decision. Online resources and financial comparison websites can be helpful in finding the best CD rates available.

Consider both the interest rate and the term when comparing CDs. While a higher interest rate may seem attractive, make sure it aligns with your investment goals and the length of time you are willing to commit your funds.

Consider Penalties for Early Withdrawal

CDs have a fixed term, and withdrawing funds before the CD matures can result in penalties or loss of interest. It’s crucial to carefully consider the penalties for early withdrawal before investing in a CD.

Penalties for early withdrawal can vary depending on the financial institution and the type of CD. Some banks may charge a percentage of the interest earned or a set fee. Make sure to read the terms and conditions of the CD agreement to understand the penalties involved.

Assessing the Financial Institution

When investing in a CD, it’s essential to assess the financial institution offering the CD. Consider factors such as the institution’s reputation, stability, and customer service. Look for reviews or ratings of the bank to ensure it is trustworthy and reliable.

Additionally, check if the financial institution is FDIC-insured to ensure the safety of your investment. Researching the financial institution’s track record and reputation can provide peace of mind when investing in a CD.

Researching Financial Institutions

Before opening a CD account, take the time to research different financial institutions. Consider factors such as their reputation, stability, and customer reviews. Look for reputable banks or credit unions that have a long history of providing reliable financial services.

Online resources and financial comparison websites can be helpful in narrowing down your options. Consider both online banks and traditional brick-and-mortar banks to find the best CD options.

Gathering Required Documents

Once you’ve chosen the financial institution for your CD investment, gather the required documents to open the account. Typically, you’ll need to provide identification such as a driver’s license or passport, as well as your Social Security number or taxpayer identification number.

Check with the financial institution to confirm the required documents and any additional steps needed to open a CD account. Some banks may allow you to open an account online, while others may require an in-person visit.

Completing the Application

After gathering the necessary documents, you’ll need to complete the CD application. The application will ask for your personal information, including your name, address, contact information, and Social Security number.

Make sure to double-check all the information entered on the application to avoid any errors or delays. If you have any questions or concerns, reach out to the bank’s customer service for assistance.

Verifying Your Deposit

Before your CD account is officially opened, you’ll need to verify your deposit. This typically involves transferring the funds from your existing bank account to the CD account. Some banks may accept a check or money order as well.

Confirm the deposit process with the financial institution and ensure that the funds are accurately transferred to your CD account. Keep a record of the transaction for future reference.

Tracking Maturity Dates

Once your CD account is open, it’s crucial to track the maturity dates of your CDs. Maturity dates refer to the end of the CD term, at which point you can take action on your investment.

Set reminders or use a financial tracking tool to keep track of your CD maturity dates. This will help you make informed decisions on whether to withdraw, renew, or cash out your CD.

Renewing or Rolling Over Your CD

When a CD matures, you have the option to renew or roll over the CD. This means you keep the funds in for another term, potentially with the same or different conditions. Renewing or rolling over your CD allows you to continue earning interest on your investment without withdrawing the funds.

Consider the current interest rates and your investment goals when deciding whether to renew or roll over your CD. If there are more attractive rates available, it may be beneficial to explore other options.

Withdrawing Funds from a Matured CD

If you decide to withdraw funds from a matured CD, the process will vary depending on the financial institution. Some banks may automatically transfer the funds to an account of your choice, while others may require you to request the withdrawal.

Before the maturity date, check with the bank to understand the process for withdrawing funds from a matured CD. Be prepared to provide any necessary documentation and expect a delay in the funds becoming available.

Reinvesting or Cashing Out

When your CD matures, you also have the option to reinvest or cash out the CD. Reinvesting involves opening a new CD with the funds from the matured CD, potentially with different terms or financial institution. Cashing out means withdrawing the funds entirely.

Before deciding whether to reinvest or cash out, reassess your investment goals, current market conditions, and interest rates. Consult with a financial advisor if needed to determine the best course of action for your financial situation.

Laddering CDs

A strategy for maximizing returns with CDs is known as laddering. Laddering involves opening multiple CDs with different maturity dates. By staggering the maturity dates, you can benefit from the potential higher interest rates offered by longer-term CDs while still having access to funds at regular intervals.

For example, you could open a 1-year CD, a 2-year CD, and a 3-year CD. As each CD matures, you can choose to reinvest or cash out the funds, allowing for flexibility and maximizing returns.

CD Ladders vs. Traditional Savings Accounts

CD ladders can be an attractive alternative to traditional savings accounts. While savings accounts offer easy access to funds, CD ladders provide higher interest rates and the potential for increased returns.

Compared to savings accounts, CD ladders require a higher initial investment, as you’ll be opening multiple CDs with different maturity dates. However, the potential for higher interest rates and the disciplined nature of CD ladders make them a popular choice for conservative investors.

Tapping into Higher-Yield CDs

To maximize your returns with CDs, consider exploring higher-yield options. Online banks often offer higher interest rates compared to traditional brick-and-mortar banks. These higher-yield CDs may have longer terms or other requirements, such as a higher minimum deposit.

Carefully evaluate the terms, conditions, and risks associated with higher-yield CDs before investing. While the potential for higher returns is enticing, ensure that it aligns with your investment goals and risk tolerance.

Exploring CD Promotions and Specials

Financial institutions occasionally offer promotions and specials on CDs to attract new customers. These promotions may include higher interest rates, bonus offers, or other incentives. Keep an eye out for such promotions and take advantage of them when they align with your investment goals.

Be sure to read the fine print and understand any terms or conditions associated with the promotions. Evaluate the long-term benefits and consider whether the promotion aligns with your investment strategy.

Liquidity Risk

One risk associated with investing in CDs is liquidity risk. CDs are not as liquid as other investment options, such as savings accounts or money market funds. Withdrawing funds from a CD before the maturity date can result in penalties or loss of interest.

Consider your liquidity needs before investing in a CD. If you anticipate needing access to your funds before the CD matures, it may be better to explore other investment options that provide easier liquidity.

Opportunity Cost

Investing in a CD means tying up your funds for a set period of time. This can result in an opportunity cost, as you may miss out on potential higher returns from other investment options during that time.

Evaluate the potential opportunity cost associated with investing in a CD. Consider your investment goals, risk tolerance, and the current market conditions before committing to a CD investment.

Inflation Risk

Another consideration when investing in CDs is inflation risk. Inflation erodes the purchasing power of money over time. While CDs provide a fixed interest rate, the rate may not keep pace with inflation, resulting in a loss of real value.

Assess the inflation rate and the interest rate offered by the CD before investing. If the inflation rate is significant, explore alternative investment options that have the potential to outpace inflation.

Tax Implications

CD investments have tax implications that you should be aware of. The interest earned on a CD is generally considered taxable income. You may receive a Form 1099-INT from the financial institution, which reports the interest income for tax purposes.

Consult with a tax professional to understand the specific tax implications of your CD investment. They can provide guidance on reporting the income and any deductions or credits available to offset the tax liability.

Traditional Savings Accounts

One alternative to CDs is a traditional savings account. Unlike CDs, savings accounts provide easy access to your funds with no penalties for withdrawal. However, savings accounts typically offer lower interest rates compared to CDs.

Consider a savings account if you prioritize liquidity and need access to your funds at any time. Savings accounts are a good option for emergency funds or short-term savings goals.

Money Market Accounts

Money market accounts are another alternative to CDs. These accounts are similar to savings accounts but typically offer higher interest rates. Money market accounts may have higher minimum balance requirements compared to savings accounts.

Consider a money market account if you want higher interest rates without the commitment of a CD. Money market accounts provide more liquidity compared to CDs but may still have restrictions on the number of withdrawals allowed per month.

Bonds and Bond Funds

For investors seeking potentially higher returns, bonds and bond funds can be considered. Bonds are debt instruments issued by governments, municipalities, or corporations. They typically offer fixed interest payments over a specified period, similar to CDs.

Bond funds, on the other hand, are mutual funds or exchange-traded funds that invest in a diversified portfolio of bonds. Bond funds offer more flexibility in terms of investment amounts and diversification.

Investing in bonds or bond funds introduces additional risks compared to CDs, such as interest rate risk and credit risk. It’s essential to research and understand these risks before investing.

Stocks and Mutual Funds

Investing in stocks or mutual funds offers the potential for higher returns but also comes with more volatility and risk compared to CDs. Stocks represent ownership in a company, while mutual funds invest in a portfolio of stocks, bonds, or other securities.

Consider stocks or mutual funds if you have a longer-term investment horizon and are comfortable with the ups and downs of the stock market. Investing in stocks or mutual funds should align with your risk tolerance and long-term financial goals.

This image is property of miro.medium.com.

Tips for Successful CD Investing

Investing in CDs can be a rewarding experience if approached with a thoughtful strategy. Here are some tips to help you make the most of your CD investments:

Set Clear Investment Goals

Before investing in CDs, set clear investment goals. Determine your time horizon, risk tolerance, and desired returns. Having clear goals will guide your investment decisions and help you choose the right CDs for your portfolio.

Shop Around for the Best Rates

Don’t settle for the first CD you come across. Shop around and compare rates offered by different financial institutions. Online banks often provide higher rates compared to traditional banks, so make sure to explore all your options.

Take Advantage of Promotional Offers

Financial institutions occasionally offer promotional rates and incentives for opening a CD account. Keep an eye out for such offers and take advantage of them if they align with your investment goals. Just be sure to read the fine print and understand any terms or conditions associated with the promotion.

Diversify Your Investments

Consider diversifying your CD investments to manage risk and potentially increase returns. Instead of putting all your funds in a single CD, consider laddering or investing in CDs with different terms. Additionally, explore other investment options, such as stocks or bonds, to diversify your portfolio.

This image is property of Amazon.com.

Conclusion

Certificates of deposit (CDs) are a popular investment option for conservative investors looking for steady returns and capital preservation. CDs offer a fixed interest rate and are held for a set period, providing a predictable income stream. By understanding the basics of CDs, evaluating your investment goals, and exploring different institutions and options, you can make informed decisions and maximize your returns. Keep in mind the risks and considerations associated with CDs and consider alternative investment options as well. With careful planning and research, CD investing can be a valuable addition to your investment strategy.

This image is property of i.investopedia.com.