Interview with Matthew Dibb CEO of Astronaut Capital

Can you introduce yourself?

My name is Matt, the CEO and founder of Astronaut. Astronaut is an asset management platform which strategically gives its subscribers exposure to researched and verified ICOs through just one token.

Astronaut is backed by the team at Picolo Research the leader in independent research and analysis of upcoming token sales and cryptocurrencies.

Token holders enjoy the perks of quarterly performance distributions, automated management of the subscription and exit process, as well as the ability to trade the Astro tokens on global exchanges.

What is the journey that led you here?

Astronaut is a creation based on the needs and wants of our subscribers at Picolo Research. Following a series of interviews and feedback from our 10,000+ subscribers, we were confronted with the inefficiencies that every-day people experience when trying to gain exposure to the right ICOs at the right time.

Who is the team behind Astrounat capital?

Astronaut is a team that has merged with Picolo Research to offer the best analytics and

verified ICO opportunities in the market. The team consists of 10 staff, derived from a background of research, trading and analytics. In addition to myself, there are six members of the investment committee who verify every opportunity that we seek to invest in. Our team consist of professionals from banking and finance and well as blockchain development. You can read about it here: https://astronaut.capital/team.html

Linked In Profiles

Who is the team behind Picolo Research?

Picolo Research started three analysts that simply had a passion for crypto markets. Myself, Scott and Roman began our journey analysing potential opportunities for ourselves and private clients, and eventually got to the point of publishing our research to over 15,000 subscribers every month.

How many ICOs will Astrounat capital be reviewing every week/month?

We will be reviewing up to 15 ICOs a month, however that does not mean that we would place investment in that many. As history would dictate, we will be looking at exposure of between 2-4 per month.

Is the rate at which ICOs are being scheduled sustainable? Can the market keep supplying this much capital indefinitely?

We believe the ICO market will consolidate. This isn’t to say that there will be less money in it, however, we believe that the types of ICOs raising will get better and attract smarter investors as this market matures. There are a lot of shady ICOs out there, our job is to guide investors through this to ensure that they get the best exposure to the best ICOs.

Many ICOs fall below their ICO price, one such ICO which had great promise was Stox. What do these ICOs have in common?

There is a real disconnect between the amount of work a company does during ICO stage (hype) and what they do after they have collected the funds. Its important that these ICOs engage with their community after the ICO more than ever to avoid such disengagement. Further to this, the way in which some of the ICOs in the past have raised (no max cap) created a serious liquidity problem that is hard to get out of.

What are the most interesting ICOs scheduled to launch in the next 2 months?

We believe that Enigma has a great team and great product. Speaking to their team, they have quite a significant amount of progress already as well as a great pipeline for development.

The other is ICON. The South Korean community in blockchain is huge. We believe that ICON could be the next NEO, however, we acknowledge that expansion of their venture outside of the geographic area may be difficult.

What is the difference between Astrounat.capital and similar funds?

Astronaut has a proven and trusted track record in the market through Picolo Research. We have a very specific focus – to identify pre-ICO, ICO and listed opportunities that our analysts deem as either undervalued or present the opportunity for significant growth.

If you look at others operating in the space, they are predominantly focused on Venture Capital and private equity investment which can take years to materialise (if ever). Our horizon is much shorter, focusing on liquidity events that provide token holders with security and income.

How many dividends are needed per quarter to make Astrounat capital viable, what happens if this is not achieved?

Dividends are distributed at a rate of 50% of the performance. Based on previous performance, we anticipate significant growth and have a target of tripling the value of Astronaut AUM within the first 3-5 months. This provides a healthy dividend (based on the funds raised) as well as the appreciation of the ASTRO token value.

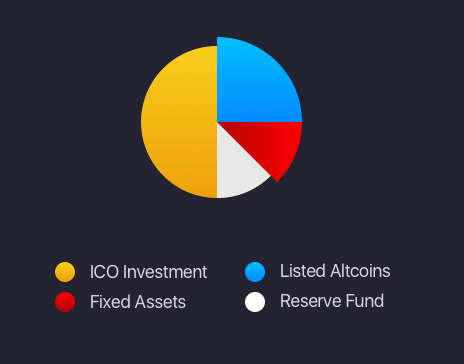

What is the structure of the ICO?

The ICO runs from the 20th of September to the 25th of October. There is a max cap of 30m

tokens. Any unsold will be burnt. The bonus scheme starts at 30% (ending soon) and reduces 10% after every stage.

What are the requirements to participate in the ICO?

There is no minimum commitment. We are not accepting contributions from USA, China or Singapore.

What are the pros and cons for the token holders?

Pros are: access to research backed investment, quarterly dividends, AUM token performance, real-time investor tools

Cons are: Investors from USA, Singapore and China can’t contribute

Was there a pre-ico?

We are currently in a pre-ico just through the Picolo Research subscribers. We anticipate this to finish in the next 48 hours

What is the price of the pre-ico and the price of the ico?

The pre-ico is a 30% discount. The ICO then moves to 20%, 10% and 0% based on contributions.

How many tokens will be issued?

A max of 30m

Is there a cap on the ICO?

Yes, 26,400,000

Would you like to add any further info?

We have a very loyal subscriber base through our reports at Picolo Research. We ask anyone that is considering a contribution to view our research first.

In which jurisdiction is the company incorporated?

Picolo Research is incorporated in Singapore while Astronaut is currently going through the process of settling in Switzerland.

Is this company part of a group of companies?

no

How is the project balancing the interests of the token holders and the shareholders?

There are no shareholders that have contributed money for equity.

In which jurisdiction is the project team based incorporated?

Canada and Singapore

Will the project be audited and will the audit reports be fully published?

Completely. We have a number of investor tools that are focused on transparency and audited accounts. This has always been a top priority for us.

For more information please visit:

We thanks Matthew Dibb for the interview.