Bridge Crowd is UK based p2p lender, they provide loans peer to peer real estate backed loans. The Managing Director Louis Alexander Managing Director at Bridge Crowd explains more.

What is the investment proposal of BridgeCrowd?

As a company we offer bridging loans, typically ranging from a minimum of 3 months...

Bondora is an Estonian p2p lending platform; it facilitates lending between peers. On Bondora, Investors can set their portfolio manager risk level to Conservative, Balanced or Progressive. Using this setting investors, do not need to manually select each loan to invest in. There is a third way of automated...

Review of Capitalia.lv with Juris Grišins

A loan originator on the Mintos

Can you briefly present yourself and the company?

Are are the largest non-bank lender to small and medium enterprises in Latvia, Lithuania and Estonia. To date, Capitalia has financed working capital and investment needs of more than 1000 companies investing over...

{

"@context": "http://schema.org/",

"@type": "Review",

"itemReviewed": {

"@type": "website",

"name": "growthstreet.com"

},

"author": {

"@type": "Person",

"name": "Jim Reynolds"

},

"reviewRating": {

"@type": "Rating",

...

Peer-to-Peer lending is the novel application of technology to one of the most ancient of professions: lending.

The premise of lending is simple: people with excess capital lend money to borrowers who need capital. In return, the borrower promises to repay the debt obligation plus interest at a future date....

Landbay a peer to peer lending platform has launched an Innovative Finance ISA (IFISA).

What is an Innovative Finance ISA?

The “IFISA” allows individuals to use some (or all) of their annual ISA investment allowance to lend funds through the growing Peer-to-Peer lending market, while receiving tax-free interest and capital gains.

More...

Landbay offers mortgages to BTL (buy to let) landlords. When investing with Landbay, Investors participate in crowdfunding of these mortgages. The minimum investment is £100 and then in increments of £10 thereon.

Landbay mortgages are backed up by real property, which gives the investor a level of reassurance that the...

Interview with Xavier Laoureux, director at Mozzeno, a peer to peer lending platform based in Belgium.

Can you introduce yourself and Mozzeno?

Mozzeno is a Belgian fintech founded in December 2015. We have just launched the first digital platform to enable private individuals to participate indirectly in the funding of loans...

Dmitry Balakhnin is the Chief Brand Officer of Rrobo.cash, a recently established (Feb 2017) P2P lending company. The website is user-friendly and has an integrated auto investor for 100% hands off investing. In this interview, he explains more about the investment product they are offering.

What is Robo.Cash about, which Markets...

NSR Invest - A LendingClub and Prosper Investment Manager

Interview with Summer Tucker Investor Relations Director at NSR Invest

Peer to peer lending is a new asset class, which in the last few years has opened up to the retail and institutional investors on a massive scale. This asset class creates...

MiCrowd.es is a for-profit social lending p2p platform, the CEO, Alejandro de León shared his journey with InvestItIn.com.

What is the story behind MiCrowd.es?

In 2009 I started giving scholarships in Nicaragua, I was fascinated by the place and the genuine nature of the people. When I was living there, I had...

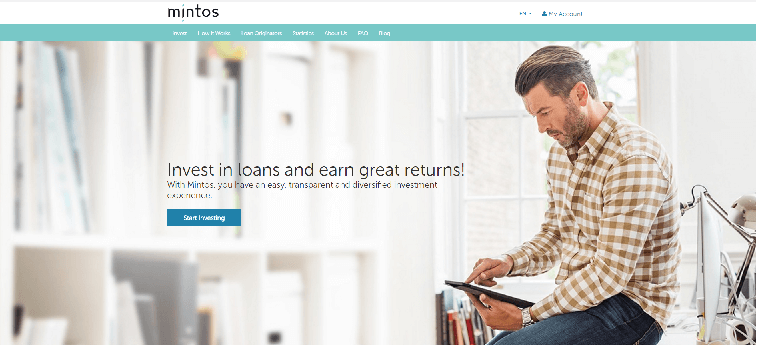

Investing in Polish car loans can be done on

Mintos the peer to peer lending platform.

Mintos, 13th February 2017.

Non-bank car loan provider Mogo is expanding its presence on the Mintos marketplace!

Mogo will now offer car loans issued in Poland on the platform. The loan originator will offer investment opportunities in...

How to invest in the Latvian Agriculture Credit Market

AgroCredit Latvia is operating since 2011 as non-bank lender and offers loans to the farmers, mainly crop-growers. The main financing product offered is seasonal financing for current assets, which is repaid in the end of each farming season - after the...

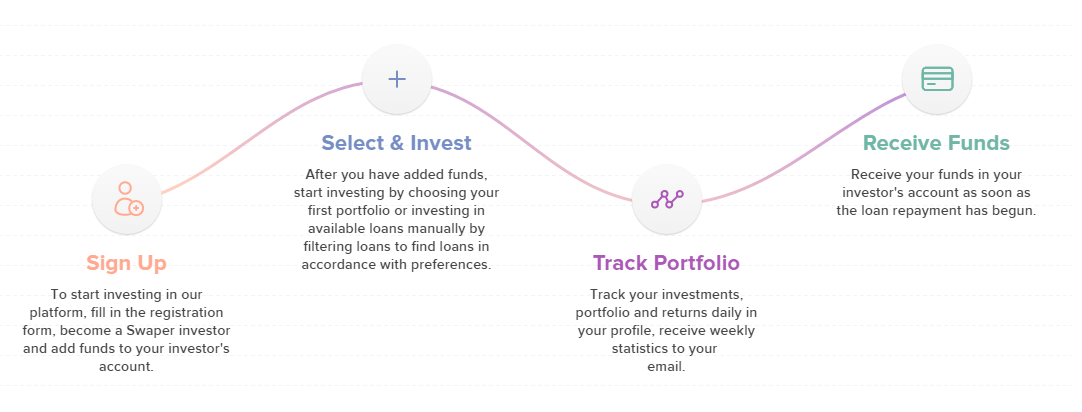

Swaper.com is a new player in the p2p space; it offers payday loans at 12% interest.

What is the story behind Swaper.com ?

We are a team of field professionals, who have an extensive experience, working at 4finance, Twino and other leading financial companies. Wandoo Finance Group and also Swaper project were...

EstateGuru is a Euro-based peer to peer lending platform. All the loans listed are backed by property assets and interest rates are above 10%. Triin Jõeleht, investor relationship manager at EstateGuru answered my question in detail. The answers provide insights on how to make the best of this p2p investing...

Swisspeers offers peer to peer loans for SMEs in Switzerland. It was launched in 2016, and to date has issued a total of more than CHF 7’000’000 in loans. Their primary target market is SMEs which require capital to expand, replace equipment and want to expand internationally. In this interview, Alwin Meyer of Swisspeers has answered...

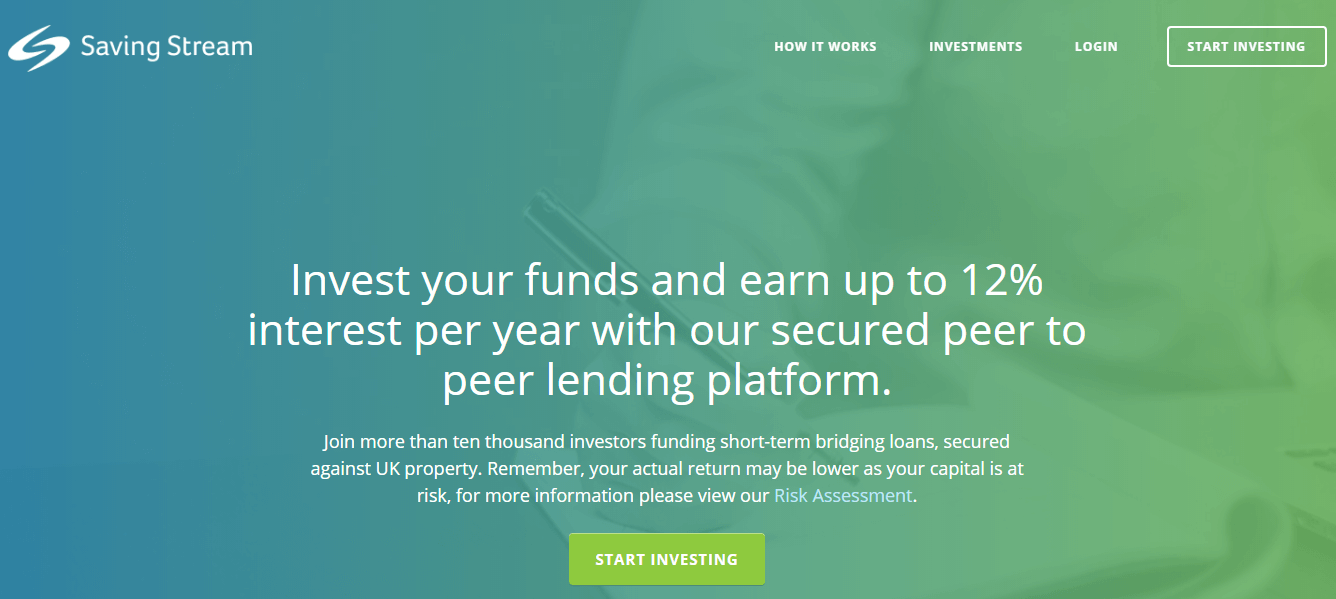

Review and Due DIlligence primer on Saving Stream

What is Saving Stream?

Saving Stream (SS) is a bridge between borrowers and lenders. Borrowers request loans from SS, credit and property specialists review these requests and if approved are listed on SS.

Accepted loans are first listed as pipeline loans. Investors have the...

Interview with Arturas Stukalo, CMO of Lenndy

Can you introduce yourself?

Lenndy is a P2P lending marketplace where investors around the world are able to invest in business loans already issued by multiple loan originators. Lenndy focuses on providing sufficient supply of short-term Eastern European business loans. This advanced P2P business model...

Younited Credit, 1ère plateforme en ligne de crédits aux particuliers en France. Frédéric Chaignon present les opportunités d'investissement avec Younited credit.

Pouvez-vous vous présenter?

Frédéric Chaignon, responsable des relations investisseurs de la plateforme Younited. Après avoir travaillé chez JP Morgan à Paris, j’ai rejoint la plateforme en 2013 afin de développer...

What is peer to peer lending?

P2P lending is a system of direct loans between a borrower and a lender. These direct loans are managed through a peer to peer lending company which has a platform in the form of a website to administer this process. There are many p2p...