Interview with Jan founder of coinlend.org

What does coinlend.org do?

The large cryptocurrency exchanges provide P2P margin funding to fund the leveraged positions of margin traders. Users can lend out their cryptocurrency or fiat holdings and will retrieve interest for their loans. The interest rates are usually very high but also very volatile. This year the average interest rate has been ~29% for Bitcoin and ~26% for the US-Dollar. The problems for the user in using the margin funding are the following:

The interface of Poloniex and Bitfinex is complicated and cluttered. New users are usually daunted by the interface and need a guide to create their first margin loans.

Creating loans for different currencies on different platforms is time-consuming.

As most of the loans have a duration of 2 days and can be repaid by the borrower at any time, the lender has to check his account regularly to renew the loans.

The user has to analyze the lending book to choose a good interest rate for the current market situation.

Coinlend is a service to automate the margin funding process completely and to generate the maximum interest on the crypto and fiat currency holdings for a user.

What are the origins of this project?

Some friends and I started lending cryptocurrencies back in 2013. We did it manually for a long time, but at some point realized, that we have to dedicate a lot of time to lending if we want to generate a good return on investment. So we started to code a simple program to automate the process using the API of the exchanges. In the beginning, it was just a local program so you had to run it on your local machine or on your private server.

Later we created an online version of it to make it accessible for some more friends. It still had no user interface but was functional and efficient. We started to realize there is a huge demand for it. So we created a nice user interface for it and decided to make it accessible for the public beginning of this year.

What are the advantages of using coinlend.org over lending manually?

Lending manually is very time-consuming. Loans have a duration of 2-60 days at Poloniex and 2-30 days at Bitfinex and the borrower can pay back the loan at any time. So most of the loans have a duration less than 2 days. Sometimes loans are even paid back after minutes or seconds.

So to optimize your ROI, you have to be logged in to the exchanges 24/7 and renew your loans as soon as they are paid back. You can use the auto-renew functionality of the exchange, but it renews the loans with the same interest rate as last time. Since the interest rates are very volatile, the auto-renew function will either lend at an interest rate too low and you will miss out on interest or the interest rate is too high and no borrower will take the loan.

Coinlend solves these problems: Once set up, it runs 24/7, calculates the optimal rates and creates new loans every couple of minutes.

What lending strategies does coinlend.org use?

Coinlend does analyze the current lending book, filters out the outliers and calculates the optimal interest rate based on several parameters which are constantly evaluated and updated. The algorithm also evaluates the lending rates of the recent history to prevent low interest rates on short dips.

The loan duration is calculated based on the current interest rate compared to average interest rates. So if the current interest rate is high compared to the average rates, it will lend for longer durations to preserve these interest rates for a longer time.

The user can completely rely on the Coinlend algorithm or he can adjust some parameters like the minimum interest rate or when the loans are created for what duration.

For the advanced users, there are also some advanced features like the “iceberg strategy” which will split funds into many smaller loans over time.

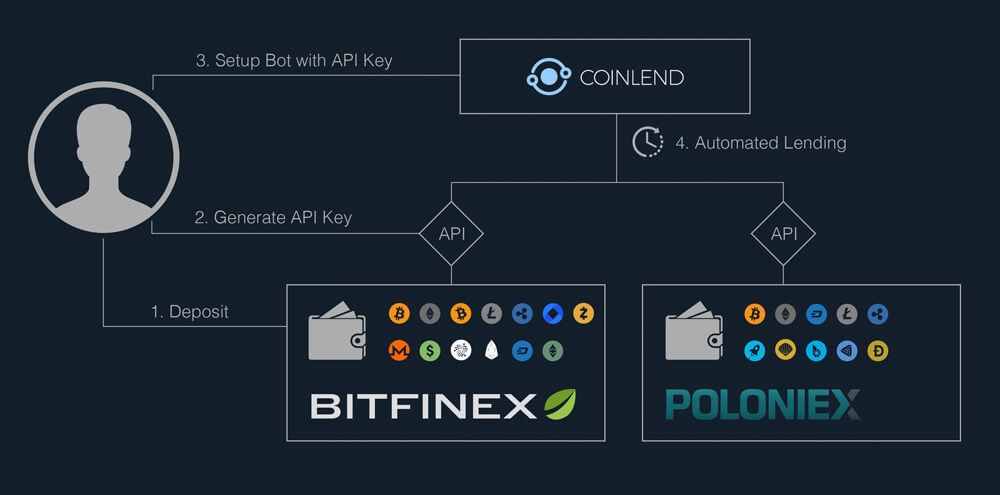

How can a new user start using Coinlend? How long does it take?

Our main focus was to make the setup of the bot as simple as possible. At Coinlend the user only needs to fill out two input fields: API key and API secret and save them. That’s it. Coinlend will take over the rest and will start lending the user funds.

How the API Credentials are created at the exchanges is described in every detail in our step by step guides:

- https://www.coinlend.org/#!PoloSetup

- https://www.coinlend.org/#!BitfinexSetup

So a user totally new to the topic should be able to finish the setup in a couple of minutes.

What are the main differences between lending on Poloniex, BitFinex and Quinone?

They are basically all working the same way. Just the user interfaces and interest rates vary a bit. If the user uses Coinlend, he will have a unified interface for all of them.

Do you know of other platforms that offer interest or passive income from coin lending?

Besides Poloniex and Bitfinex, there is Quoine and BitMEX.

What should investors look out for when selecting a cryptocurrency lending robot?

Most important features are the connection intervals to the exchanges and the reliability of the lending executions. Our service is running on the Google Cloud and can spawn new instances on demand and therefore we are confident in having the most robust and fast lending service.

What are the risks of using coinlend.org?

There is no risk at all in using Coinlend. We store the API credentials at Coinlend encrypted and only accessible from the backend. And even if a hacker could get access to the API credentials, he could not do any harm to the users. When creating the API credentials the user has to select the permissions assigned to the credentials. Coinlend does not need withdrawal nor trading permission and the platform will reject credentials which do provide these permissions.

What are the risks related of on an exchange?

I see the following two risks:

- A big hack or a law enforcement takedown of the exchange. Bitfinex was hacked last year and $80 million of user funds were stolen. Bitfinex paid back the stolen funds to their users out of their own pockets.

- A very big and fast price movement of a coin, so that there is not enough liquidity to close leveraged positions in time. This never happened so far.

Are there strategies to reduce this risk?

An approach to minimize the risk is to distribute the funds across multiple platforms. So if one of the platforms disappears for whatever reason, not everything is lost.

What is your price structure? Do you plan to change it in the near future?

Currently, Coinlend is financed by donations. Since the user base is growing rapidly and the donations barely cover the server costs, we are planning to introduce a premium feature. Premium features will get additional features like detailed tax reporting.

Do you plan to add new features?

We are actively developing new features. The features which are requested the most and therefore are on top of our TODO list are:

- Implementation of additional Exchanges (Quoine, BitMex)

- Interest reports which can be used for tax declarations

- More information on the generated interest (show interest generated on specific days and custom periods)

Which are your favourite top three altcoins today?

- Waves -> Decentral exchange with fiat gateways

- BAT -> Privacy, secure and ad-free browser

- Byteball -> Tangle technology, smart contracts and fair distribution (currently 10% monthly “dividends” during distribution phase)

For more information please visit: http://www.coinlend.org

We thank Jan for the interview.