In unfortunate news, Braid, a promising startup founded in January 2019 by Amanda Peyton and Todd Berman (who left in 2020), based in San Francisco, aimed to make shared wallets more mainstream among consumers but has announced its closure. The company had ambitious goals of offering friends and family an FDIC-insured, multi-user account designed to make it easy for users to pool, manage, and spend money together. With the ability to create a cash pool towards a collective goal, such as saving for a trip to Europe, Braid provided a branded debit card that allowed users to spend their funds on airfare, lodging, and more.

Braid had a strong backing from investors, raising a total of $10 million in funding over multiple rounds from Index Ventures, Accel, and others. However, despite the initial promise and investment, the startup ultimately faced insurmountable challenges that led to its closure. In a blog post, founder Amanda Peyton shared her experiences in building the company and acknowledged that it was not going to be a viable business venture. Taking full responsibility for Braid’s demise, Peyton emphasized the importance of sharing her story as a way to learn from failure and inspire others in the startup community.

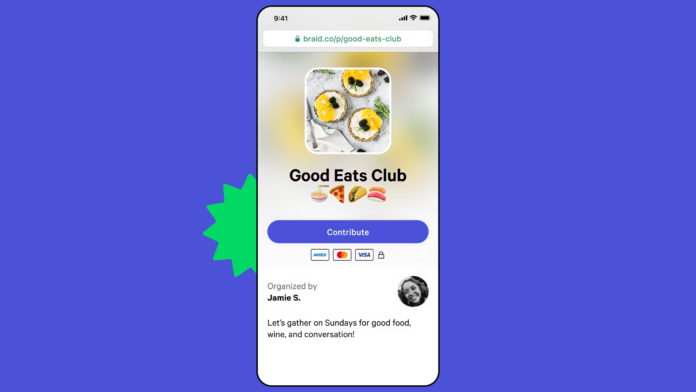

Braid aimed to revolutionize the way consumers think about shared wallets, recognizing the potential of allowing groups of people to pool their funds, manage them effectively, and spend them collectively. By offering a multi-user account, Braid provided a platform that made it easier for friends and family to save for common goals and access their funds seamlessly.

However, Braid faced significant setbacks, particularly with its sponsor bank, from July 2022 to January 2023. The company’s inability to process payments efficiently and securely during this period had severe implications for its viability as a business venture.

Reflecting on the challenges faced by Braid, founder Amanda Peyton identified crucial lessons. One takeaway was the realization that relying on third-party software did not necessarily accelerate the development process. Braid discovered that each additional partner introduced the potential for technical difficulties and complications.

Recognizing these risks, Braid realized the importance of building as much as possible in-house to maintain greater control over their technology and its performance. Moreover, building in-house was essential for the startup’s unit economics and maintaining a sustainable financial model.

Despite the closure of Braid, founder Amanda Peyton remains resilient and optimistic about the future. She purchased the intellectual property for Braid in an auction following the shutdown, demonstrating her continued belief in the potential of shared wallets and the fintech industry as a whole.

With her background in notable companies like Google and Etsy, as well as previous startup ventures, Peyton is well-positioned to explore new opportunities in the fintech space. Her experience and knowledge will undoubtedly serve her well as she navigates the ever-evolving landscape of consumer payments and financial technology.

The closure of Braid serves as a valuable learning experience rather than a failure. Founder Amanda Peyton encourages entrepreneurs to embrace the lessons that come with setbacks, recognizing the less glamorous parts of the startup life cycle, such as failures and closures, as they contribute to personal growth and the development of a resilient mindset.

Looking ahead, Peyton’s enthusiasm for the fintech industry remains unwavering, and there is no doubt that her passion and determination will fuel her success in future endeavors.