EthLend is a platform which allows owners of ERC20 tokens to borrow Ethereum against their ERC 20 tokens.

Interview with Stani Kulechov founder of EthLend.

What problem is ETH Lend trying to solve?

ETHLend creates an effective way for the borrowers to access funding globally and lenders to fund loan requests around the world. ETHLend uses decentralisation and cryptocurrency to create a global lending market. The effect is that a borrower in the UK is not limited to local lenders and banks in the UK. Instead, the borrower can access funding from Asia, South-America and other parts of the world.

Since there is more liquidity available locally, this should give pressure on interest rates. For lenders, global lending market would mean more investment opportunities. Additionally, decentralised lending provides faster lending compared to the use of the banking system. Transactions are sent within seconds or minutes compared to days in the traditional banking system. By the use of cryptocurrency, ETHLend is able to provide access to finance for the unbanked as well.

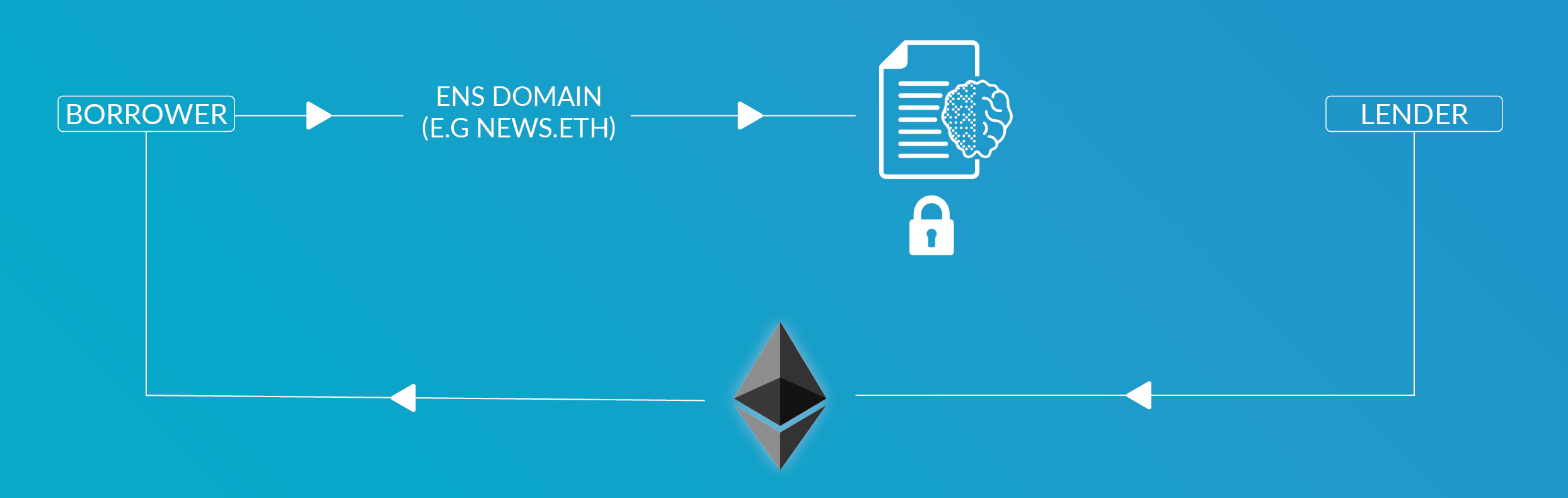

Technically ETHLend provides efficiency for decentralised lending. Previously decentralised lending was not mature since once a transaction is sent to an untrusted address, there was no guarantee that the borrower would repay the loan. ETHLend came up with the solution to secure the loans by using ERC-20 compatible tokens which may represent almost any value such as gold (see e.g. DigixDAO). Alternatively, the borrower can pledge Ethereum Name Service (ENS) domains for securing a loan. By using a collateral, the lender can regain loss in case of default.

Case-example: John invests in commodities and has participated in the DigixDAO ICO and now has 10 ETH worth of tokens. Now, John needs liquidity but does not want to sell his tokens. John places a loan request for 8 ETH with 0.4 ETH premium (5%) and pledges 10 ETH worth of tokens as a collateral for the loan. This loan would be attractive to the lenders since it gives 120% collateral for the lender in case there is volatility. Now if John decides not to repay the loan back on time, the lender can claim the tokens and sell these on exchange.

Secure by design. All the data of the loan transactions are stored on Ethereum blockchain. Therefore, making it resistant for tampering. The collateral is held by the smart contract, which means that not even ETHLend can move the collateral once the collateral is sent to the smart contract.

ETHLend soon introduces unsecured lending by the use of reputation gained on ETHLend from secured lending.

Why do ERC20 token holders want to borrow using their funds as collateral? Who will be the primary borrower on ETHLend?

The idea of Ethereum-based tokens is that any value can be represented by these tokens, such as commodities, real property, shares, cars, intellectual property and even pets. Tendencies for tokenization is increasing and we can see DigixDAO as a good example of using ERC-20 tokens for representing gold ownership. Such representation can be traded or pledged. However, most of the popular ERC-20 tokens today are the result of Initial Coin Offerings. Since these tokens do have a market price, they can be used as a pledge.

Modelling the real world. In the real world, there are use-cases where people pledge property such as real property, commodities or shares. The reason why ERC-20 holders want to pledge is the same reason why in the real world people pledge. Pledging property gives access to finance without selling your property. A person in the real world might not want to sell Tesla shares even if they are liquid and the person could later buy them back from the stock market. Therefore, the person can enjoy simultaneously the market price increase and fulfil the temporary need of liquidity.

Funding Initial Coin Offerings. Actually, using ERC-20 tokens might become a new way to fund Initial Coin Offerings (ICOs). Blockchain start-ups usually allocate a certain amount of tokens for the company or to so called development fund. These blockchain startups could use ETHLend to raise funds before the ICO. They can simply pledge some amount of the token for a strong collateral ratio (such as 150%) and attractive premium. This way the startup can finance their ICO efforts without the need for pre-ICO sales. Once the ICO is over the company can pay the loan back with the funds raised during the ICO.

Since the environment for decentralised lending is recently explored, we are following the movements of lending. However, ETHLend aims that the DAPP is suitable for peer-to-peer lending and for blockchain start-ups as well.

What are the ICO details?

The ICO will be on 25 September 2017 at 12 GMT.

In what stage, will the software be prior to the ICO?

Actually, we already have a stable version running at http://ethlend.io, which is accessible with MetaMask. It was important to us to develop the application first and write the white paper based on our practical findings. This way we solved a lot of practicalities and had a better  understanding of how decentralised lending should be developed. Currently, secured lending is possible with ERC-20 tokens and ENS domains and we will soon add unsecured lending based on reputation. We differ from the most ICOs since we do have a ready DAPP. It works as a proof that we are the right team to develop a decentralised global lending market.

understanding of how decentralised lending should be developed. Currently, secured lending is possible with ERC-20 tokens and ENS domains and we will soon add unsecured lending based on reputation. We differ from the most ICOs since we do have a ready DAPP. It works as a proof that we are the right team to develop a decentralised global lending market.

Lenders for cryptocurrencies on other platforms seem to value links to profiles on social media and trading websites, do you have plans to implement this in the future?

We might adopt something similar to that as well. We have to mind that we are building ETHLend in 100% decentralised manner which might reduce on what sources we can use. We could, for example, come up with a decentralised solution such as linking to a Steemit account.

Will ETH Lend integrated with systems where loans are needed on demand such as margin trading?

We might provide such soon, we have a lot of community support for obtaining margin trading. If we will develop it, we would work with decentralised exchanges.

Can you share details of the marketing strategy after the ICO?

Our aim is to work with the Ethereum and blockchain communities and local groups. We really do not believe in advertising as such, we are more believers in feedback. I think what we are developing has a lot of potentials but it needs to be developed with the community and users in mind. Once we have a product that the users like to use, then we are on the right track.

Our marketing efforts will aim for attending in local meetups and events for getting feedback for ETHLend. We have a good position for reaching out the world since our team of 18 people is located in different parts of the world. I think this gives us a good edge to understand what is needed for the adoption of decentralised lending in local markets. If we succeed locally in different regions in Europe, Asia, India, Australia, South-America and US, we have a good chance to succeed globally.

Is there a possibility for an external credit rating service for unsecured loans?

Using external credit rating would lead us to the centralised environment. However, I think that ETHLend could benefit from a gateway for external credit rating services. Another decentralised solution would be to create a reputation system or decentralised credit rating.

We are currently working on a reputation system that we will launch anytime soon. One suggestion we received from the community was to adopt prediction market such as Augur or GNOSIS on ETHLend. Prediction market would mean that third parties could predict whether the address will repay the loan by reviewing the address history on block explorer. Using a prediction market is something we are currently researching.

How do the economics of this situation work?

Example:

@ start Price of 10 BAT = 1 ETH

Joe lends 1 ETH to Valerie against 10 BAT collateral

BAT plummets 10 BAT = .1 ETH

What is the incentive of Valerie to pay the loan back?

The only incentive here is reputation, which ETHLend is adopting soon. This means that if any unsecured or secured loan is not repaid, all the reputation of the borrower is burned (permanently deleted). Since reputation is accrued, one might not want to throw it away. However, here the question is more on the risk.

What is the risk that the lenders are willing to take? I, for example, would not fund such a loan. I might find 10 BAT for 0.7 ETH on the same scenario, but I would also take the risk of losing all value. Just as in real life a market crash can remove all value from a stock (e.g. Lehman Brothers). Therefore, the economics here are the same as in real world.

What are the fees and buyback structure?

That is interesting. We came up with a solution that all deployment fees (0.01 ETH fee for deploying a Loan Request and 0.01 ETH fee for funding a loan request) are in ETH. 5% of these fees and additional 1-5% (depending on the previous year’s growth) is used for the buybacks. The solution enables us to deliver a strong token to the market and would not affect the cost of service.

Bonus Questions:

What is the LEND allocation to the founders?

300,000,000 LEND token will be allocated to the development and founders fund. Much of the LEND is held to attract new talent to ETHLend. We are developing a decentralised application that is used on a global scale. Such ambition would require resources that we might not have without the ICO since we do not accept any venture capital (VC). Accepting VC could risk the development of decentralised lending if we would be guided back to the old way that banks work. We really have a unique opportunity to develop something new by the use of blockchain technology. It would be a great loss if our efforts would become something we are used to.

If the founders will receive a salary/bonuses after the ICO, will this amount be disclosed?

Yes. We think that the public and the community is a good way to test what is acceptable. We do not see any negative effects on being paid for labour or rewarded for achievements. In many ways, we are in the position of setting an example on how an ICO or a blockchain startup should operate. We believe that transparency is the only way for decentralised start-ups to succeed.

Where is the company incorporated?

We will disclose it on next week.

Will the company be audited?

Yes, local GAAP or IFRS will be used as an accounting standard and accounts will be audited.

Will the finances and audits of the company be made public?

Yes, it is part of us being transparent.

We thank Stani Kulechov for the interview.

For more information please visit: https://www.ethlend.io