The idea of having an emergency fund is advocated by financial experts who think that having a financial floor is incredibly favorable to cover unexpected situations and emergencies.

Now, is there a chance that you are over-saving for an emergency fund? In fact, there is. If you center too much on saving there’s a possibility you may be overdoing it, which could lead to a misuse of money you could be using to pay off the interests of debts, investing it, or even boosting your retirement savings.

Below, we’ll give four hints to help you understand when your emergency fund is becoming too big, and how you could use the money instead.

1. Your emergency fund is more than enough to make a living

Experts advise that you save an amount equivalent to around three to six months of your daily living expenses. Nonetheless, this is something you may adapt to your personal situation as it is only a guidance.

For instance, if the job you have is specialized and you earn a handsome salary, you may need more significant funds to cover your personal expenses. Let’s say, for example, that you lose your job out of the blue. In this specific scenario, it might take more time for you to find another employment opportunity as your profile is entirely specialized, a fact that would make the loss of income notable.

Similarly, if you are a single person you should consider having a bigger emergency fund, as having just one income source makes it more difficult to maneuver the budget in case of financial emergency.

However, the general rule is to have a financial fund with which you’d be able to pay all of your bills without having to use credit cards or loans, so if you have a much bigger emergency fund, then you could be using that money differently.

If you want to calculate how appropriate your emergency fund is, you can use a monthly budget, listing each and every one of your expenses, multiply this number by 6 or 12 according to the time you’d like to set, and if the result is enough to live during that period of time then you can stop adding money to your fund, and instead think well about how to use that money somewhere else.

2. Your retirement savings are delayed

Even when having too much money in the emergency fund is not considered as a problem, in fact, it could be if you are building this up at the expense of putting money on a retirement saving program.

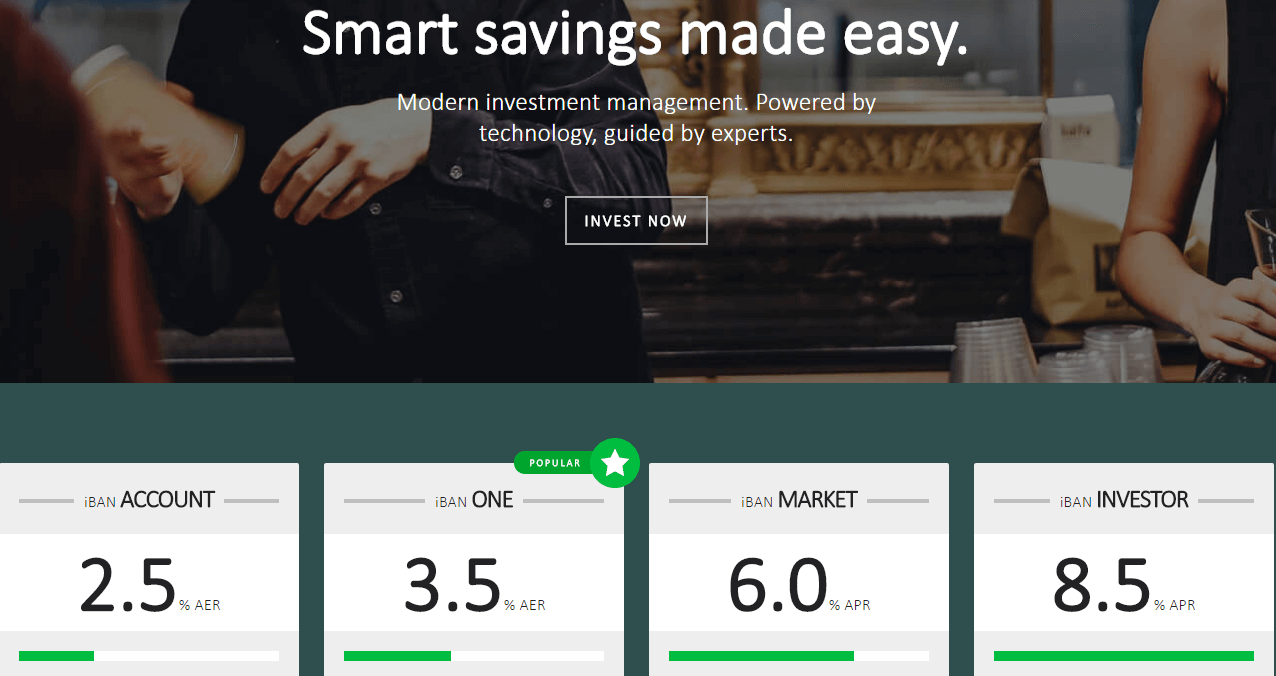

Although funds should be in a safe place, for instance, a saving account, this pays interest at a meager value, even the most reasonable ones pay just 1 dollar or less. The money put in a savings account is actually more likely to behave better if you invest it in an Individual Retirement Account or mutual fund.

Likewise, the extra money you have in your emergency fund can be helpful if used in another way. So if you are delayed on building your retirement funds, an option could be to check up your emergency fund and maybe move some of it into retirement saving programs.

3. Your credit card debts are worrying

It is common to see credit card interest rates above 17%, and this can lead to the struggle of paying the debts. If that’s the case, you perhaps could take a look at your emergency fund, any money remaining there could be used to pay your credit card debts faster.

4. You have more than one income

If you and your partner form a household together with two incomes, your emergency fund does not need to be that big. In case of one losing their job, then the other can serve as the cushion to cover the expenses of the month.

Consequently, if any of these are your case, instead of making your emergency fund bigger, you may consider investing this money into something else, or even working on your retirement fund would be a better idea.