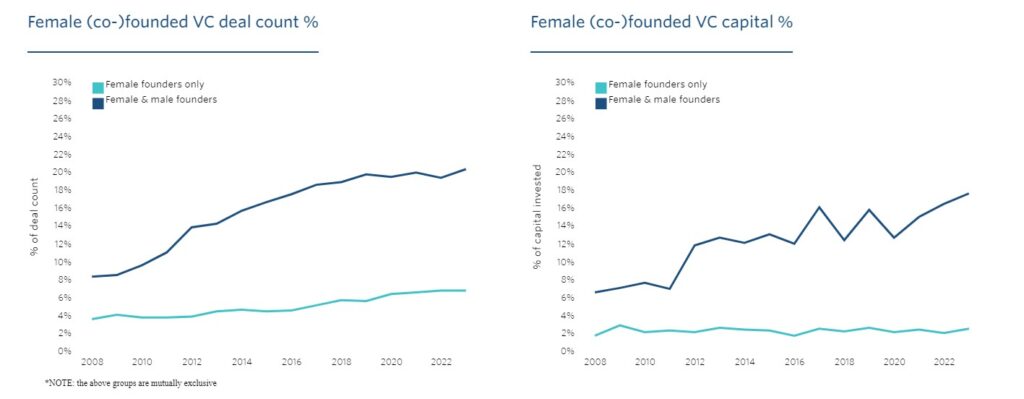

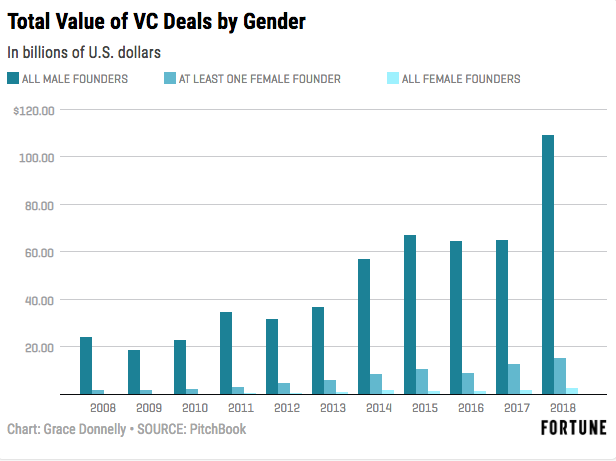

Did you know that startups founded by women in the US received less than 2% of all venture capital investment last year? It’s true! And the situation is only slightly better in the UK, where women-founded startups received 6% of venture capital investment. But don’t worry, there is hope. Organizations and initiatives have emerged to address this funding gap and direct resources towards women entrepreneurs. Dedicated funds, support tools, and networks have been established to support women in the startup space. There are even crowdfunding platforms focused on female entrepreneurs, such as iFundWomen. By increasing awareness of unconscious bias and improving business plans and pitches, women founders can improve their chances of receiving funding. But it’s not just about individual efforts. Structural change, such as building new social networks and increasing mentorship opportunities, can help level the playing field. And the benefits go beyond just women entrepreneurs – equal funding could bring €290 billion to the UK economy and increasing diversity in portfolio companies will benefit investors. So let’s work together to create a more inclusive and thriving startup ecosystem.

Current state of venture capital investment in startups founded by women in the US

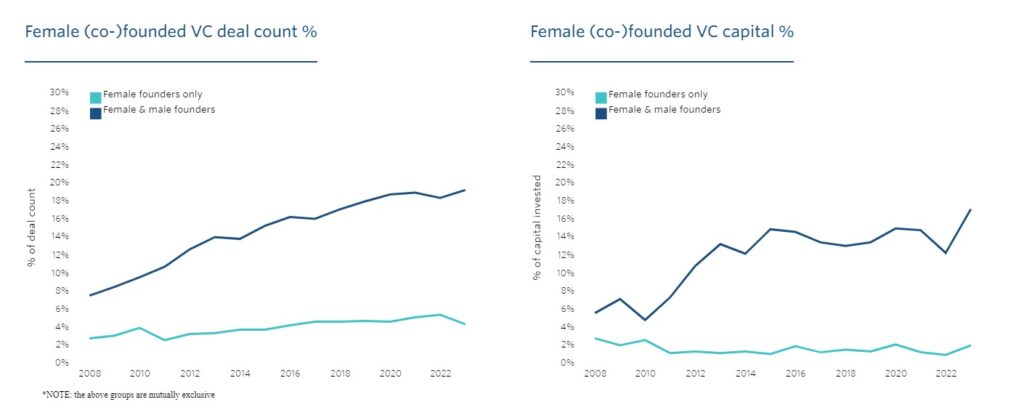

Less than 2% of all venture capital investment went to women-founded startups in the US last year. This is a staggering statistic that highlights the significant funding gap facing women entrepreneurs in the startup space. Despite the incredible potential and innovation that women bring to the table, they are severely underrepresented in terms of funding.

Comparison to venture capital investment in women-founded startups in the UK

When we look at the situation in the UK, the numbers are slightly better, but still far from ideal. Women-founded startups received 6% of venture capital investment in the UK, showing a difference in investor attitudes compared to their US counterparts. However, there is still much work to be done to level the playing field for women entrepreneurs on both sides of the Atlantic.

Efforts to address the funding gap for women entrepreneurs

The funding gap for women entrepreneurs has not gone unnoticed. Organizations and initiatives have emerged to address this issue head-on and direct the necessary resources towards women-founded startups. These efforts are crucial in providing support and opportunities for women entrepreneurs to thrive.

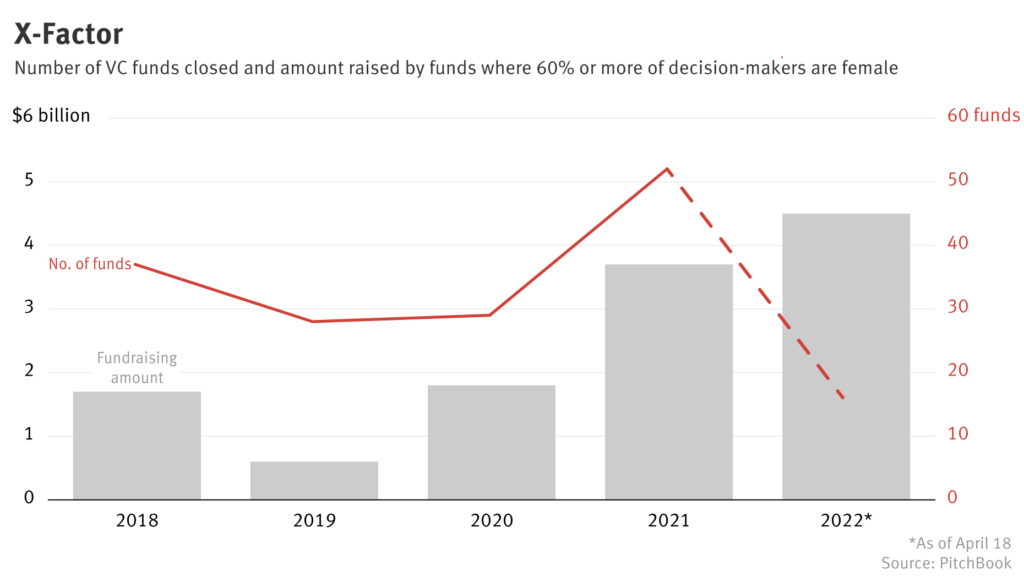

One key development has been the establishment of dedicated funds that specifically focus on investing in women-founded startups. These funds aim to bridge the gap by providing much-needed capital to businesses led by women. The creation of these funds acknowledges the funding gap and demonstrates a commitment to leveling the playing field.

In addition to dedicated funds, several support tools and resources have been made available to women entrepreneurs. These resources provide guidance, mentorship, and access to networks and opportunities that can help women founders navigate the challenges of starting and scaling a business. By providing these tools and resources, the entrepreneurial ecosystem acknowledges the unique experiences and needs of women entrepreneurs and aims to provide them with the necessary support for success.

Another exciting development in recent years has been the creation of crowdfunding platforms specifically for female entrepreneurs. These platforms, such as iFundWomen, provide a space for women founders to showcase their ideas and access funding from a community of supporters who believe in their vision. By leveraging the power of crowdfunding, women entrepreneurs can bypass traditional funding channels and gain the financial support they need to bring their ideas to life.

Importance of addressing unconscious bias in venture capital investment

An important factor that contributes to the funding gap faced by women entrepreneurs is unconscious bias. Unconscious bias refers to the automatic and involuntary stereotypes and attitudes that influence our decisions without our conscious awareness. In the context of venture capital investment, unconscious bias can lead to women founders being overlooked or undervalued.

Increasing awareness of unconscious bias is crucial in addressing the funding gap. By understanding the biases that exist within the investment landscape, we can work towards mitigating their impact. Recognizing and challenging these biases allows us to create a more equitable and inclusive ecosystem where women entrepreneurs have equal access to funding opportunities.

Impact of bias on funding decisions

Unconscious bias has a significant impact on funding decisions. Research has shown that investors are more likely to invest in companies led by individuals who resemble them in terms of gender, ethnicity, and background. This bias prevents women entrepreneurs from receiving the same level of funding and support as their male counterparts.

Addressing this bias is not only fair but also beneficial from an economic standpoint. By investing in a diverse range of businesses, investors can tap into a wider pool of talent and ideas, leading to more innovation and ultimately, higher returns. Overcoming unconscious bias is not only the right thing to do, but it also makes good business sense.

Strategies for women founders to improve their chances of receiving funding

While addressing unconscious bias is crucial, women founders can also take specific steps to improve their chances of receiving funding. One key strategy is to polish their business plans. A well-crafted business plan that clearly articulates the value proposition, market opportunity, and growth potential of the venture can make a compelling case to investors.

Furthermore, women founders should focus on crafting effective pitches. A strong pitch that effectively communicates the uniqueness of the business and the potential for growth can capture the attention of investors. Practicing and refining the pitch can help women founders gain confidence and deliver a compelling presentation that resonates with investors.

By investing time and effort into these strategies, women founders can increase their chances of securing much-needed funding for their startups.

Structural changes to level the playing field for women entrepreneurs

In addition to individual strategies, structural changes are needed to level the playing field for women entrepreneurs. Building new social networks that connect women founders with investors, mentors, and fellow entrepreneurs is crucial in creating a supportive ecosystem. These networks provide access to resources, advice, and opportunities that can help women entrepreneurs succeed.

Another important structural change is the increase in mentorship opportunities. Mentorship plays a vital role in the development and growth of entrepreneurs. By connecting women founders with experienced mentors who can provide guidance, support, and valuable connections, we can create a pipeline of successful women entrepreneurs who will inspire and empower the next generation.

The economic potential of equal funding for women-founded startups

A significant economic potential lies in providing equal funding opportunities for women-founded startups. In the UK, it is estimated that equal funding could bring €290 billion to the economy. This staggering figure underscores the immense economic impact that can be achieved by enabling women entrepreneurs to thrive.

By unlocking the full potential of women founders and supporting their ventures, we can foster innovation, create jobs, and drive economic growth. The benefits extend beyond the individual startups and have a ripple effect throughout the entire economy.

Benefits of increasing diversity in portfolio companies for investors

Investors also stand to benefit from increasing diversity in their portfolio companies. By investing in a diverse range of businesses, investors gain access to new perspectives, ideas, and markets. This diversity of thought can lead to groundbreaking innovations and ultimately lead to higher returns.

Furthermore, diverse teams have been shown to outperform homogeneous teams in terms of decision-making, problem-solving, and performance. By investing in women-founded startups, investors can tap into the unique strengths and talents of women entrepreneurs, ultimately enhancing the overall performance of their portfolio.

In conclusion, while the current state of venture capital investment in women-founded startups in the US is disheartening, efforts are being made to address the funding gap. Organizations and initiatives have emerged, dedicated funds have been established, and support tools and resources are available for women entrepreneurs. Additionally, raising awareness of unconscious bias and taking steps to overcome it is crucial in creating a more equitable investment landscape. Women founders can also take proactive steps to improve their chances of receiving funding, such as polishing their business plans and crafting effective pitches. Structural changes, including building new social networks and increasing mentorship opportunities, are necessary to level the playing field. The economic potential of equal funding for women-founded startups is immense and can drive significant growth in the UK economy. Finally, increasing diversity in portfolio companies benefits investors through access to new perspectives, ideas, and higher returns. By addressing the funding gap and promoting diversity and inclusivity, we can unlock the full potential of women entrepreneurs and create a more vibrant and innovative startup ecosystem.