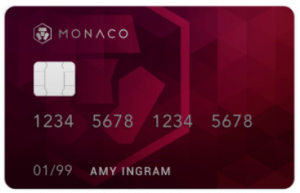

Mona.co are planning to disrupt the credit card industry. Their plan is to be the RyanAir of credit cards. They will offer an innovative product in the form of a debit card for cryptos and a mass market product with much better exchange rates, than the typical retail investor has access to today. Kris Marszalek CEO of Mona.co answers our questions.

Click here to contribute to the Mona.co ICO

What challenge is Mona.co tackling?

We’re eliminating currency exchange fees for our users. With Monaco card & app, users can send, spend & exchange money at perfect interbank rates. Monaco VISA card can be funded with Bitcoin & Ether, making it the most convenient and cost-effective way to spend your cryptocurrency.

In a nutshell, how is Mona.co addressing this challenge?

We’ve built infrastructure that covers both perfect interbank in fiat currencies as well as secure, convenient and cost-efficient access to your cryptocurrency. As a result, users can save $30-40 on every $500 spent with Monaco card.

Where is Mona.co based?

Our holding company is based in Zug, Switzerland. We have operations in Hong Kong (where the app was built) and in Singapore.

Is there a Ltd Company or foundation behind Mona.co?

Swiss GmbH (LLC)

Is the company audited if so by whom?

We’re pre-revenue and have not appointed auditors yet.

What are the key highlights of the Mona.co card?

Use Ether or Bitcoin wherever VISA® cards are accepted. Exchange at perfect interbank exchange rates rather than retail Remittance possible to 120 countries worldwide for free

Transfer funds between Mona.co accounts for free. Customers can create an account from the mobile app.

What can you share about the development team behind Mona.co?

Founding team has 4 members:

- Rafael Melo – CFO – ex-Mastercard, heading our Finance, Compliance, Risk & Treasury functions

- Gary Or – CTO – 9 years full stack engineering experience, heading Technology & Product Development

- Bobby Bao – MD – ex-investment banker with China Renaissance – running our China operations

- Myself – Kris Marszalek – CEO – serial company builder, ran and sold startups, ran an ASX-listed co

Will it be possible to process chargebacks on the card?

Yes, we’re in the process of becoming VISA program manager and will have standard chargeback process you may know from other debit card programs.

When will the actual product be launched?

Aug31st.

Will the code be audited?

The smart contract code has been audited before the ICO by CoinFabrik.

Initially, BTC and ETH will be supported. What is the time line for the addition of new coins such as Dash?

We will have an announcement on that in early June. We’re currently discussing this with the community. Our initial line of thinking is to bring onboard ERC20 tokens that exceed $500m in market cap.

Are only cryptocurrency token holders the target market for Mona.co? If not what are the features that will attract these non-crypto users to this card?

This is a mass market product, which delivers tremendous value for anyone who travels frequently, sends money or shops cross-border in foreign currency.

Mona.co estimates that 5,146,921 users will be using this card within 5 years. Can you share any details about your marketing plans?

We’re going to target cryptocurrency community, expats and frequent travellers in the initial stage.

What are the key benefits of Mona.co compared to other similar products?

Besides carrying a stunning looking card, you end up saving tons of money on every single swipe with Monaco. We’re confident that there’s currently no product in the market which provides better value.

Can you share details about the ICO?

The ICO will start on the 18/05 and end on the 18/06. This is the only MCO token creation event.

The economics of the ICO are as follows

- 30% – ICO investors

- 25% – Founders

- 10% – Expenses such as salaries

- 5% – Advisors

- 30% – Special MCO fund

The Use of the ICO funds:

- 35% – R&D and Product Development

- 20% – Marketing and Customer Acquisition

- 15% – Initial Capex, including costs of e-Money licenses

- 30% – Working Capital

Who is entitled to the proceeds of the MCO fund?

The company creating the MCO tokens – Monaco Technology GmbH (in process of formation, will be completed before the Token Sale ends)

There will be two sets of fees on the card. One is the fee charged to the merchants, in addition, there is a 1% licensing fee charged to the users. The 1% licensing fee, will be shared among the token holders.

1% license fee is charged only on transactions funded with BTC, ETH and other ERC20 tokens. Fiat funded transactions are free.

Is there a defined time limit by which MCO token holders can withdraw their share of fees?

No.

On which exchanges will the token be traded?

We will work with 2-3 reputable exchange to start. Please look out for official announcements 2d/3rd week of June.

Finding out more about Mona.co:

We thank Kris Marszalek for the interview.