Are you looking to expand your investment portfolio and explore new avenues to grow your wealth? Look no further! In “The Ultimate Guide to Investing in Debt Funds,” we will delve into the world of debt funds and provide you with valuable insights on how to effectively invest in them.

Debt funds offer a compelling investment opportunity for individuals seeking stability and regular income. In this comprehensive guide, you will discover the different types of debt funds available, such as government bonds, corporate bonds, and money market instruments. We will help you understand the risk-return dynamics associated with each category, enabling you to make informed investment decisions.

Furthermore, we will walk you through the process of investing in debt funds. From selecting the right fund manager to analyzing historical performance and evaluating fund expenses, we will equip you with the necessary tools and knowledge to build a well-diversified debt fund portfolio. Whether you are a novice investor or someone with prior experience, this guide will empower you to navigate the intricacies of debt fund investments and embark on a path to financial success.

Investing in debt funds doesn’t have to be complicated or overwhelming. With “The Ultimate Guide to Investing in Debt Funds,” you will gain the confidence and expertise needed to make prudent investment choices, secure consistent returns, and achieve your financial goals. So, grab a cup of coffee, sit back, and let’s embark on this exciting investment journey together!

This image is property of Amazon.com.

Understanding Debt Funds

Debt funds are a popular investment option for individuals looking to diversify their portfolio and generate stable returns. In simple terms, debt funds are mutual funds that invest in fixed-income securities such as government bonds, corporate bonds, and money market instruments. These funds aim to provide investors with regular income and relatively lower risk compared to equity funds.

What are debt funds?

Debt funds are investment vehicles that pool money from multiple investors and invest in fixed-income securities. These funds are managed by professional fund managers who carefully select securities based on the fund’s investment objective and strategy. The returns in debt funds come primarily from interest payments and capital appreciation of the underlying securities.

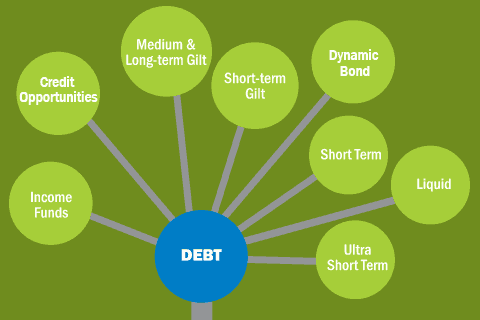

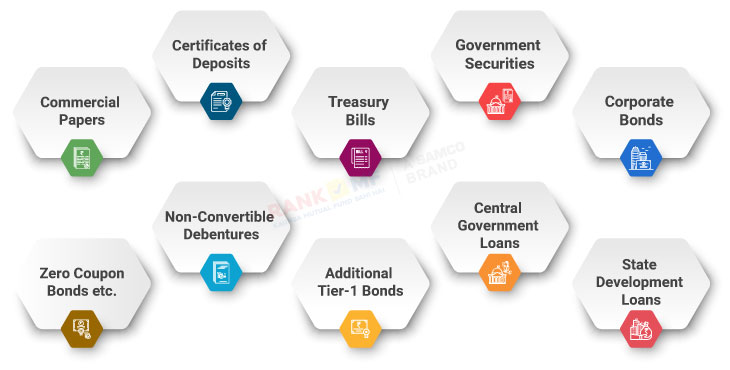

Types of debt funds

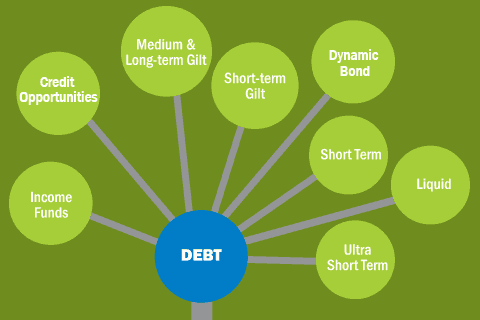

There are various types of debt funds available in the market, catering to different risk profiles and investment goals. Some common types of debt funds include:

-

Liquid Funds: These funds invest in short-term money market instruments with maturities of up to 91 days. They are suitable for investors seeking high liquidity and stable returns over a short duration.

-

Income Funds: Income funds primarily invest in fixed-income securities with longer maturities to generate regular income for investors. These funds are ideal for individuals looking for regular income generation.

-

Corporate Bond Funds: These funds invest in bonds issued by corporate entities. They offer higher yields compared to government bonds but come with a slightly higher risk.

-

Government Securities Funds: These funds primarily invest in government securities such as treasury bills and bonds. They are considered relatively safer due to the low credit risk associated with government-backed securities.

Benefits of investing in debt funds

Investing in debt funds offers several advantages for investors, including:

-

Stability: Debt funds are known for providing relatively stable returns compared to equity funds. This stability makes them an attractive option for conservative investors.

-

Diversification: Debt funds offer diversification benefits by investing in a wide range of fixed-income securities. This diversification helps reduce the overall risk of the investment portfolio.

-

Regular Income: Income funds and other debt funds focused on generating income provide investors with a regular stream of income through interest payments.

-

Liquidity: Debt funds, especially liquid funds, offer high liquidity, allowing investors to easily convert their investments into cash without significant impact on returns.

-

Tax Efficiency: Some debt funds, such as those investing in government securities, enjoy tax advantages, such as indexation benefits, which can help reduce tax liabilities.

Factors to Consider Before Investing

Before investing in debt funds, it is crucial to consider certain factors that can significantly impact your investment journey.

Risk and return profile

Debt funds have varying risk profiles based on the underlying securities and investment strategy. Funds investing in government securities generally carry lower risk compared to those investing in corporate bonds. It is important to assess your risk tolerance and align it with the risk profile of the fund you choose.

Returns in debt funds are influenced by interest rate movements and the credit quality of the underlying securities. Higher-risk funds have the potential for higher returns, while lower-risk funds offer stability but relatively lower returns. Consider your investment goals and risk appetite when selecting a debt fund.

Credit rating and quality

Credit rating agencies assign ratings to fixed-income securities based on their assessment of the issuer’s creditworthiness. It is advisable to invest in debt funds that primarily hold securities with higher credit ratings (such as AAA or AA-rated securities). These ratings indicate a lower risk of default and higher credit quality.

Monitoring the credit quality of the underlying securities held by the fund ensures that your investment is exposed to a relatively lower risk of default.

Expense ratio

The expense ratio represents the annual fees charged by the mutual fund to manage and administer the fund. It includes various costs such as fund management fees, administrative expenses, and marketing costs. A lower expense ratio indicates a more cost-effective fund, allowing you to maximize your returns.

Consider comparing the expense ratios of different debt funds to ensure that you are investing in a fund with a reasonable fee structure.

This image is property of cdn.rankmf.com.

Setting Investment Goals

When investing in debt funds, it is essential to define your investment goals to determine the appropriate investment strategy. Here are two key aspects to consider:

Short-term vs. long-term goals

Short-term goals typically have a time horizon of less than three years, while long-term goals extend beyond this period. For short-term goals, such as accumulating funds for a vacation or down payment on a house, it is advisable to invest in debt funds with shorter maturities and lower interest rate risk.

Long-term goals, such as retirement planning or funding education expenses, can benefit from investments in longer duration debt funds. These funds have the potential to earn a higher return over time, although they may be subject to short-term market fluctuations.

Income generation vs. capital appreciation

Another factor to consider when setting investment goals is whether you prioritize regular income or capital appreciation. Income funds predominantly focus on generating interest income and dividends, making them suitable for individuals seeking a regular income stream.

On the other hand, capital appreciation-oriented debt funds invest in securities that have the potential for price appreciation over time. These funds can be more volatile but may offer the potential for higher returns in the long run.

Understanding your investment goals and preferences will help you select the most suitable debt fund for your needs.

Determining Risk Tolerance

Assessing your risk tolerance is crucial when investing in debt funds. It involves understanding your ability to handle potential fluctuations in the value of your investments. Here are a few considerations to help determine your risk tolerance:

Assessing your risk tolerance

Evaluate your financial circumstances, investment goals, and time horizon to determine how much risk you can comfortably tolerate. If you are risk-averse and prefer stability, you may opt for lower-risk debt funds investing in government securities.

On the other hand, if you have a higher risk appetite and a longer time horizon, you may be willing to consider funds with slightly higher risk profiles to potentially earn higher returns.

Matching risk profile with suitable debt funds

Once you have determined your risk tolerance, it is essential to match it with the suitable debt funds available in the market. Funds with higher risk profiles may invest in longer duration securities, lower-rated corporate bonds, or other riskier instruments.

Conversely, funds with lower risk profiles tend to focus on government securities or highly-rated corporate bonds. By aligning your risk tolerance with the appropriate fund, you can strike a balance between risk and potential returns.

This image is property of Amazon.com.

Choosing the Right Debt Funds

With a wide range of debt funds available, selecting the right one requires careful consideration of your investment goals and risk profile. Here are three common types of debt funds to help you make an informed decision:

Government securities funds

Government securities funds primarily invest in debt instruments issued by the central or state governments. These funds carry relatively lower risk, as they are backed by the government’s creditworthiness. They are well-suited for conservative investors seeking stable returns and capital preservation.

Corporate bond funds

Corporate bond funds invest in debt securities issued by corporations. The credit ratings of these bonds vary, and they offer higher yields compared to government securities. These funds can be suitable for investors looking for slightly higher returns while accepting a moderate level of risk.

Income funds

Income funds aim to provide regular income to investors by investing in a mix of fixed-income securities. They typically hold a diversified portfolio of government bonds, corporate bonds, and money market instruments. These funds can suit investors seeking regular income generation while balancing risk and return.

To choose the right debt fund, carefully analyze the fund’s investment objective, past performance, credit quality of the underlying securities, and risk profile.

Analyzing Fund Performance

Past performance evaluation is an important aspect when considering debt funds for investment. While past performance is not an indicator of future returns, it can provide valuable insights into a fund’s performance and consistency.

Past performance evaluation

When analyzing fund performance, consider the fund’s returns over various time periods, such as one year, three years, and five years. Compare the fund’s performance to relevant benchmark indices and other similar funds in the category.

Look for consistency in returns and evaluate how the fund has performed during different market conditions. Consider factors such as downside risk management, volatility, and risk-adjusted returns to gauge the fund’s overall performance.

Fund manager expertise

The expertise and track record of the fund manager play a significant role in managing the fund’s performance. Evaluate the experience and qualifications of the fund manager, as well as their approach to managing the fund.

Research the fund manager’s ability to adapt to changing market conditions, make informed investment decisions, and consistently deliver results. A skilled and experienced fund manager can enhance the potential for better returns and effective risk management.

This image is property of www.valueresearchonline.com.

Understanding Costs and Fees

When investing in debt funds, it is crucial to understand the costs and fees associated with the investment. Here are two key aspects to consider:

NAV impact of expenses

The Net Asset Value (NAV) of a mutual fund represents the market value of its assets minus its liabilities. Expenses incurred by the fund impact its NAV over time. These expenses include the fund’s management fee, administrative costs, and other recurring expenses.

A higher expense ratio can erode the overall returns of the fund, so it is essential to factor in the impact of expenses when evaluating investment options.

Exit loads and transaction charges

Some debt funds have exit loads, which are charges levied by the fund house if you redeem your investment before a specified period. Exit loads are designed to discourage short-term trading and promote long-term investing.

Additionally, transaction charges may apply when buying or selling mutual fund units. Review the fund’s documentation to understand any applicable fees and charges to ensure they align with your investment strategy.

Tax Implications

Investing in debt funds may have tax implications that need to be considered. Here are two key areas to focus on:

Taxation of debt funds

Debt funds are subject to different tax treatments depending on the holding period and the investor’s tax bracket. Short-term capital gains, realized on investments held for less than three years, are added to the investor’s taxable income and taxed as per their applicable tax slab.

On the other hand, long-term capital gains, realized on investments held for more than three years, are taxed at a flat rate with indexation benefits available. Indexation adjusts the purchase price of the investment based on inflation, reducing the taxable gain and ultimately the tax liability.

Indexation benefit

Indexation benefit is a tax advantage available for long-term capital gains in debt funds. By adjusting the purchase price of the investment based on inflation, indexation reduces the taxable gain, resulting in lower tax liabilities.

Indexation benefits can significantly reduce the tax burden on long-term capital gains, making debt funds more tax-efficient compared to other investment options.

This image is property of cdnlearnblog.etmoney.com.

Investment Strategies

Having a well-defined investment strategy can enhance the effectiveness of your debt fund investments. Consider the following strategies:

Lump sum vs. SIP

Lump sum investment involves investing a significant amount in a debt fund at once. This strategy can be suitable if you have a surplus amount available for investment. However, timing the market becomes crucial when investing a lump sum.

Alternatively, Systematic Investment Plans (SIPs) allow investors to invest a fixed amount regularly in a debt fund. SIPs help mitigate the impact of short-term market fluctuations and can be an effective strategy for long-term wealth accumulation.

Systematic transfer plan (STP)

A Systematic Transfer Plan (STP) involves transferring a fixed amount from one mutual fund to another at regular intervals. This strategy can be useful for investors who want to shift their investments from equity funds to debt funds gradually. STPs provide a disciplined approach and mitigate the impact of sudden market movements.

Rebalancing portfolio

Regularly reviewing and rebalancing your debt fund portfolio is essential to maintain the desired asset allocation and risk profile. Rebalancing involves selling a portion of the outperforming funds and reinvesting in underperforming funds to ensure a balanced and aligned portfolio.

Consider your investment goals, market conditions, and risk tolerance when determining the most suitable investment strategy for your debt fund portfolio.

Monitoring and Reviewing

Monitoring and reviewing your debt fund investments are crucial to ensure they remain aligned with your financial goals. Here are two aspects to consider:

Regular portfolio evaluation

Regularly evaluate the performance of your debt fund portfolio and compare it with your investment objectives. Assess whether the funds are generating the expected returns and consider any changes in your risk appetite and financial circumstances.

If a fund consistently underperforms or no longer aligns with your investment goals, consider reallocating your investments to more suitable options.

Realigning investment strategy

As your financial goals and market conditions evolve, it is essential to realign your investment strategy. Review your investment objectives, risk tolerance, and time horizon periodically to ensure your debt fund investments continue to support your financial goals effectively.

Adjusting your investment strategy as needed will help you optimize your portfolio and increase the likelihood of achieving your financial objectives.

In conclusion, investing in debt funds can be a prudent strategy for individuals seeking stable returns and diversification in their investment portfolio. By understanding the different types of debt funds, evaluating risk factors, setting investment goals, and considering tax implications, you can make informed decisions to optimize your debt fund investments. Regular monitoring and review, along with a well-defined investment strategy, will help ensure that your debt fund investments remain on track to achieve your financial goals.