What is inflation?

Ultimately, the result of inflation to the individual is the loss of purchasing power.

That means, that if inflation is greater than zero, 100 dollars today would have less purchasing power tomorrow then they have today. With 100 dollars today one can buy one pair of shoes, in a Har that same $100 will buy you one pair of shoes.

Simplified inflation example:

Imagine two men are on a desert island, one of them has three bottles of water (water man), the other has 300 dollars (money man). They know that rescue is guaranteed in 3 days time. They agree to share the water and the money. On the second day, the money man finds $1,000 in a plastic bag on the shore. The are now only two bottles of water on the island but the money supply is $1200.

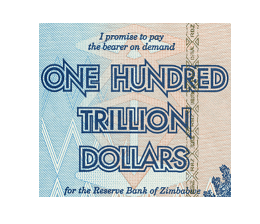

The two bottles are suddenly worth $600 each rather than only $100 each. This is an extreme example, but similar scenarios have played out in countries like Venezuela and Zimbabwe.

Practical Example: Burger King’s Whopper

“Another popular burger fast food joint, Burger King’s famous Whopper is much more expensive now than it was in the 1950s. In 1957, a Whopper cost only $0.37 — today that price is $3.99.“

Source: https://www.reviewjournal.com/business/12-fast-food-prices-then-versus-now/

What are the benefits of inflation?

- To stimulate the consumer to spend today rather than save for tomorrow, this creates jobs.

- To dilute the debts of those who borrow most

- To decrease a currency value, which makes it exports cheaper.

- Wages have less purchasing power if they are not adjusted for inflation in time.

Who creates inflation?

There are many sources of inflation, but ultimately government currencies are backed by the future ability of governments to tax its citizens and to attract productive workers into their territories which then can tax. Whoever can create money out of thin air has the power to create inflation.

If you want to learn more about inflation, research the following topics

- Fractional reserve banking

- Money printing

- Speed of money

- FIAT currency

- Bank run

- Electronic bank run

- Money Supply

- M1 vs M2

- Quantitative Easing

What are the three stages of inflation?

It is said that inflation has three stages, each stage has different dynamics in terms of the rate of inflation the ability of governments to control inflation and the collective perspective on the rising prices.

Stage 1: Low Inflation

Officially most Central Banks target a level of inflation between 2% and 4%. Although considered low this could erase the purchasing power between 20% and 40% in a decade. The general population is not concerned with inflation.

Stage 2: High Inflation / Asset inflation

The market price of assets which are inflation proof grows higher. This is because investors are trying to preserve their capital by converting capital which is losing its purchasing power into tangible assets or other currencies which are not inflating.

At this stage, both the smart institutional money and the inflation savvy investor seek out protection, and this increases the velocity of money and the demand for such assets. This cycle starts feeding on itself.

Stage 3: Hyper Inflation / Price Inflation

This is an extreme situation where the general public starts losing faith in a currency. Money loses value at a very high rate; people want to get rid of money in exchange for any goods as quickly as possibly. Authorities tend to implement measures to stop inflation, which has a large impact on personal and business finances.

How to beat inflation?

Beating inflation is difficult, because any strategy to do so involves risk. When money is exchanged for any investment vehicle, there are a number of risks one takes in exchange for the possibility of beating inflation.

Strategies that may beat Inflation:

- Holding assets which cannot be created out of thin air rather than assets which can be diluted.

- Precious Metals. In the very long term there are efforts for gold asteroid mining and deep sea gold mining which can increase supply. In addition central banks have a lot of gold.

- Certain Real Estate can hold its value and provide a revenue stream which is inflation adjusted.

- Consider a Government’s stance during an inflationary period and invest in assets which will have less chance of being targeted for windfall taxes.

- Hold fixed interest loans; this will allow you to use the capital today while paying it back with inflated money.

- Research TIPS: Treasury Inflation-Protected Securities

- Move to jurisdictions where inflation is under control

- Resources such as Precious Metals, Developed Property in town centers or beach fronts and Natural Resources tend to offer protection against high inflation. However these assets tend to have slower growth during times of economic stability. A highly speculative hedge against inflation would be crypto currencies which have a limited supply such as Dash or Bitcoin.

Human needs will be present in any economic situation, human skills that serve those needs will never lose value. Consider Maslow’s triangle and where you can position your services or products in a high inflation scenario. - Research Bitcoin. There will only ever be 21,000,000 Bitcoins.

Real asset investors vs Hoarders a tax saving tip:

In a high inflation scenario, hoarders will become scapegoats and the economic turmoil will be partially blamed on them. The difference between a hoarder and a wise investor is the time they bought the inflation hedge. Keeping records will give you some level of protection against being labelled a hoarder.

Conclusion

An inflation hedge has a place in everyone’s portfolio, insurance to protect against the erosion of purchasing power. This insurance will cost less money when it is bought in normal economic times, if we enter stages 2 and 3 of an inflationary cycle this insurance will become more expensive. Discuss inflation on your next meeting with your financial advisor and ask him what will happen to your portfolio if inflation goes to 5% or 10%…