In the ever-evolving landscape of venture capital funding for pre-seed startups, there are five key trends emerging that founders should be aware of. In a world where VCs are becoming more cautious and risk-averse, it is crucial for startups to navigate this landscape of skepticism and scrutiny in order to secure funding. According to data from Dropbox DocSend, fundraising in 2023 has become increasingly challenging, with fewer successful deals and longer timelines. However, despite the volatility, founders are still actively seeking funding, indicating their determination and resilience. To increase their chances of success, founders must adapt their pitch decks and structure them in a way that captures maximum attention and generates maximum interest. These trends highlight the shifting dynamics of the VC funding world, and founders must be prepared to adapt and innovate in order to thrive.

Trend 1: Shift towards later-stage startups

The venture capital (VC) landscape is witnessing a significant shift towards later-stage startups. VCs, in light of the changing economic landscape, are becoming more cautious and moving downstream, choosing to invest in slightly later-stage startups with less risk. While this caution may stifle some innovation, it also paves the way for a more sustainable and value-driven ecosystem.

Trend 2: Skepticism and scrutiny in the venture landscape

There is a growing sense of skepticism and scrutiny in the venture landscape. VCs are approaching fundraising with caution, as they are nervous about future funding and uncertain about where their next fund will come from. This cautious approach has the potential to impact innovation. However, it also highlights a focus on building a value-driven ecosystem that emphasizes long-term sustainability.

Trend 3: Longer fundraising timelines

Closing funding rounds is taking longer in the current VC landscape. There has been an increase in the time required to secure funding, and this trend is particularly evident in a comparison of successful fundraises in 2022 and 2023. In 2022, 25% of successful fundraises were completed in six weeks or less, while in 2023, the number dropped to 13%. This increase in fundraising timelines poses challenges for startups seeking funding within specific timeframes.

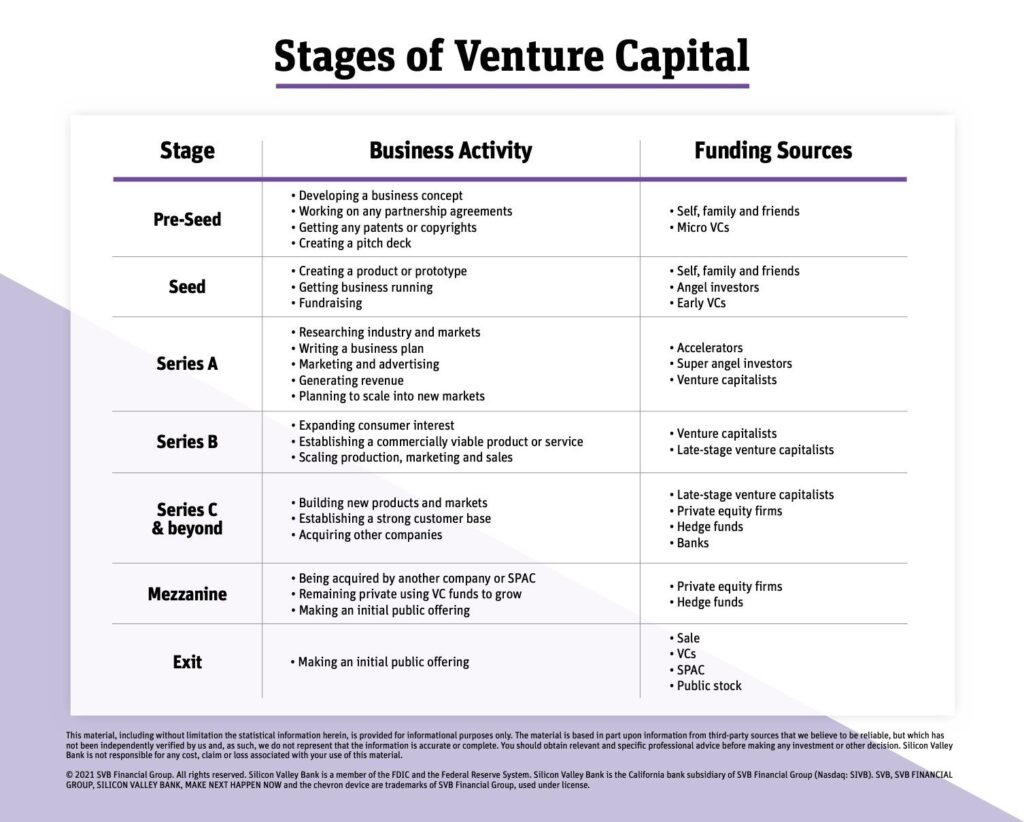

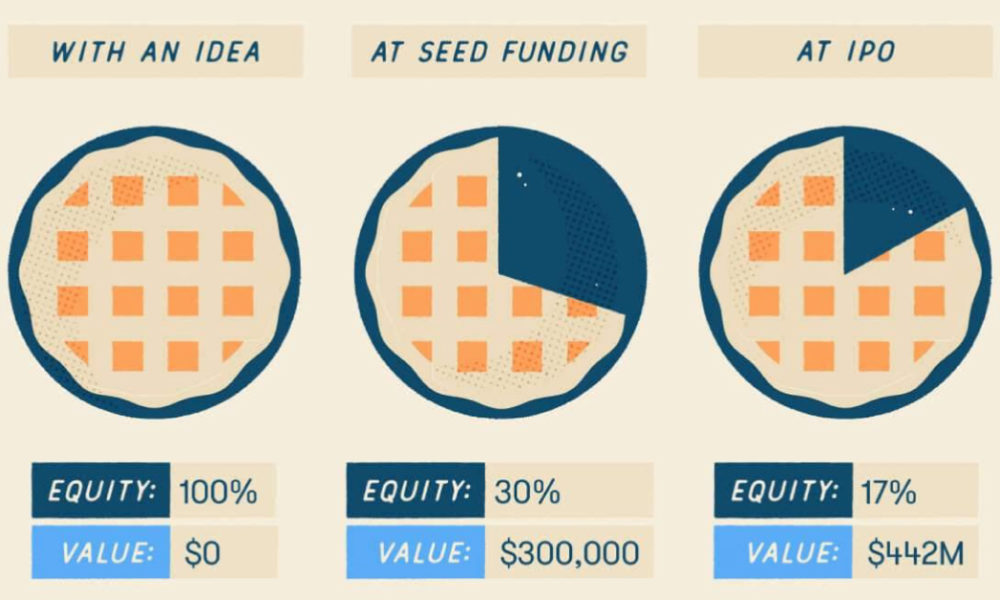

Trend 4: Decrease in pre-seed investments

Pre-seed investments have experienced a significant decline in recent times. Comparing the investment data from Q2 2022 and Q2 2023, there has been a noticeable decrease in investment at the pre-seed stage. In Q2 2023, pre-seed investment was halved compared to the previous year. This decline in pre-seed investments indicates a cautious approach from VCs and highlights the challenges faced by early-stage startups in securing funding.

Trend 5: Increasing founder activity

Despite the volatility and challenges in the VC landscape, founder activity remains persistently high. There has been a 16% increase in the number of pitch decks sent out by founders, indicating a continued drive to secure funding. Interestingly, VCs are spending 12% less time reviewing these pitch decks, suggesting a need for founders to capture attention quickly and succinctly. This surge in founder activity may be fueled by tech workers who were laid off and started their own companies.

Recommendations for founders

Founders navigating the challenging VC landscape can benefit from a few key recommendations. Firstly, it is important to understand the current dynamics and adapt accordingly. Building a pitch deck that captures attention and communicates the value proposition effectively is crucial. Learning from data on successful fundraises, such as the insights provided by DocSend, can provide valuable guidance for structuring pitch decks and increasing the chances of securing funding.

Implications for VC funding and startup ecosystem

The trends observed in VC funding for pre-seed startups have several implications for both VC funding and the overall startup ecosystem. The current market correction may actually have its benefits, as it forces both VCs and startups to approach funding with greater diligence and caution. Balancing diligence with recognizing opportunities is key to ensuring a healthy and sustainable venture capital landscape. The long-term impact of these trends on both VC funding and startup success remains to be seen.

Future outlook for VC funding

Predictions and projections for the future of VC funding point towards a need for adaptation to changing circumstances. The current trends highlighted in this article indicate the need for startups and VCs to be flexible and responsive to the shifting landscape. Factors such as economic conditions, market demand, and government policies will influence future trends in VC funding. Keeping a finger on the pulse of these key factors is essential for startups seeking funding in the future.

Case studies of successful pre-seed startups

Examining case studies of successful pre-seed startups can provide valuable insights and inspiration for aspiring founders. Highlighting examples of startups that secured early-stage funding and analyzing their strategies can offer practical lessons for navigating the fundraising landscape. Aspiring founders can learn from their successes and understand the key elements that contributed to their achievements.

Conclusion

In conclusion, the VC funding landscape for pre-seed startups is undergoing significant changes. The shift towards later-stage startups, increasing skepticism and scrutiny, longer fundraising timelines, decrease in pre-seed investments, and increasing founder activity are all trends to be mindful of. Founders need to adapt to the challenging VC landscape by structuring effective pitch decks and learning from successful fundraises. These trends have implications for VC funding and the startup ecosystem, and it is important for both startups and VCs to strike a balance between diligence and opportunity. Looking towards the future, the ability to adapt to changing circumstances and staying informed about key factors influencing VC funding will be critical for startup success.