Get ready for Cohesity’s highly anticipated public listing! After facing setbacks due to unfavorable market conditions, the $3.7 billion data startup is gearing up to go public once again. Cohesity, known for its cloud-based data backup solutions, filed confidential IPO paperwork in December 2021 but was met with a closed IPO window. However, with hopes for the IPO market to reopen this fall, the company is ready to seize the opportunity. CEO Sanjay Poonen emphasized the company’s state of readiness and its focus on profitability and positive free cash flow, proving that Cohesity is well-positioned to make a splash in the market. Stay tuned for the latest updates on this exciting development!

Heading One

Subheading One

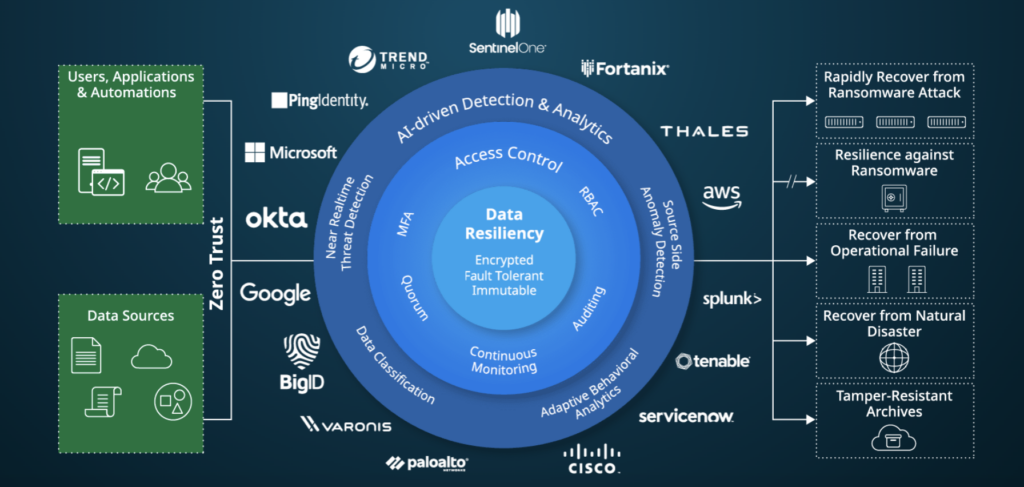

Cohesity, the $3.7 billion data startup, is making preparations for a public listing as the company hopes for the return of IPOs this fall. The company recently hired a new chief financial officer and is ready to go public as soon as it receives the go-ahead from its bankers. Cohesity helps businesses store their data backups on cloud services like Microsoft Azure and Amazon Web Services. Although this isn’t the first time the company has prepared for an IPO, its timing in the past was less than ideal, with the tech IPO window closing due to inflation and rising interest rates. However, recent signs indicate that the IPO window may open again next month, and Cohesity wants to seize the opportunity to go public.

Subheading Two

Cohesity’s CEO, Sanjay Poonen, is confident in the company’s readiness to go public. Speaking about the company’s state of readiness, he mentioned that if the market opens up, Cohesity will pick the right time for its IPO. Poonen, known for his previous role as VMware’s chief operating officer, wants to ensure that Cohesity is fully prepared before proceeding with the IPO. To strengthen the leadership team, Cohesity recently hired Eric Brown as its chief financial officer and Srinivasan Murari as its head of engineering. The company also signed new deals with Google Cloud, Microsoft, and IBM, and extended its partnerships with Cisco and Hewlett Packard Enterprise. Moreover, Cohesity released data from the market research firm IDC, which showed a 29% annual revenue growth in 2022.

Heading Two

Subheading One

Valued at $3.7 billion, Cohesity is aiming for a market capitalization of at least $5 billion with its IPO. The company has raised a total of $672.3 million in venture capital funding, and its last funding round was in April 2020, with a total of $250 million raised. While Poonen didn’t comment on the target market capitalization, he emphasized the importance of profitable growth and positive free cash flow. Cohesity has been focusing on achieving profitability before going public, including implementing layoffs to streamline operations. With 2,100 full-time employees, Cohesity is committed to demonstrating strong financial performance to attract investors.

Subheading Two

Poonen acknowledged that the IPO landscape has changed since the 2008 financial crisis. While the previous tech IPO boom was driven by high growth and low interest rates, Poonen believes that companies should focus on profitable growth and free cash flow. By prioritizing profitability, Cohesity aims to uphold the fundamentals of building a successful company. Poonen emphasized that valuations should be based on a company’s ability to generate free cash and secure future capital. In a market that has been challenging for tech companies, demonstrating financial stability and sound management of cash flow may be crucial for investors in the future.

Subheading Three

Looking ahead, Cohesity is optimistic about the potential reopening of the IPO window. If SoftBank’s spinout of Arm in September goes well, it could pave the way for a new wave of IPOs. Cohesity is prepared to seize the opportunity and become one of the hot IPOs in early 2024. The company’s focus on profitability, strategic partnerships, and continued growth sets a strong foundation for its future as a public company. With its innovative data storage solutions and the support of investors, Cohesity aims to make a significant impact in the data industry.

Heading Three

Subheading One

Cohesity’s IPO preparations have attracted attention from industry experts and investors alike. As the company gears up for a potential public listing, it highlights the resilience of startups amidst challenging market conditions. Cohesity’s ability to adapt and prioritize profitability amidst market fluctuations positions it as a promising contender in the data storage sector.

Subheading Two

The success of Cohesity’s IPO will not only determine the company’s future but also serve as a litmus test for the overall health of the IPO market. After a long hiatus caused by global economic uncertainties, the return of IPOs could indicate a resurgence of investor confidence and a renewed appetite for tech IPOs. Cohesity’s IPO could mark a turning point for the market, setting the stage for other tech startups to follow suit.

Heading Four

Subheading One

In preparation for its IPO, Cohesity’s CEO, Sanjay Poonen, has strategically built a strong leadership team. The recent appointments of Eric Brown as CFO and Srinivasan Murari as head of engineering bring valuable expertise and experience to the company. By assembling a talented and knowledgeable team, Cohesity positions itself for success in the competitive landscape of the data storage industry.

Subheading Two

As part of its IPO preparations, Cohesity has forged key partnerships with industry giants like Google Cloud, Microsoft, and IBM. These collaborations not only increase Cohesity’s market presence but also showcase the confidence that industry leaders have in the company’s innovative solutions. The extended partnerships with Cisco and Hewlett Packard Enterprise further strengthen Cohesity’s position in the market and demonstrate the value that investors and industry players see in the company.

Subheading Three

Cohesity’s commitment to continuous innovation is evident in its new generative-AI product, developed in collaboration with its strategic partners. This product allows companies to extract valuable insights from their data backups and streamline operations. By leveraging artificial intelligence, Cohesity enhances its offerings and delivers increased value to its customers. These technological advancements further solidify Cohesity’s position as a leader in the data storage sector.

Heading Five

Subheading One

Navigating the IPO landscape requires careful timing and market awareness. Cohesity’s CEO, Sanjay Poonen, understands the importance of choosing the right time to go public. While Cohesity is ready to proceed with its IPO, Poonen acknowledges the need to evaluate market conditions and ensure optimal timing. This approach demonstrates Cohesity’s strategic approach to its IPO, with a focus on maximizing shareholder value and capitalizing on market opportunities.

Subheading Two

The potential reopening of the IPO window represents a significant opportunity for Cohesity. By closely monitoring market developments and staying in sync with industry trends, Cohesity can position itself for a successful IPO. The company’s emphasis on being “public ready” demonstrates its proactive approach to seizing opportunities and capitalizing on favorable market conditions.

Heading Six

Subheading One

Cohesity’s IPO journey signifies the culmination of years of hard work, innovation, and strategic decision-making. From its inception as a data startup to its current position as a formidable player in the industry, Cohesity has overcome various challenges and emerged as a leader in the data storage space. The IPO symbolizes a new chapter in Cohesity’s growth story, unlocking new possibilities and opportunities for the company to expand its reach and impact.

Subheading Two

The IPO process is not just a financial milestone for Cohesity, but also a testament to its vision and ability to create value. As the company gears up for its public debut, it reflects the resilience and determination of its leadership and employees. Cohesity’s continued growth and strategic partnerships demonstrate its commitment to driving innovation and delivering exceptional solutions to its customers.

Subheading Three

Cohesity’s IPO represents more than just the financial success of the company; it is a reflection of the broader tech landscape and the potential for startups to thrive in an ever-evolving market. By navigating the intricacies of the IPO journey, Cohesity paves the way for other ambitious startups, inspiring them to pursue their goals and unlock their full potential.

Heading Seven

Subheading One

Cohesity’s hiring of a new CFO, Eric Brown, and head of engineering, Srinivasan Murari, exemplifies the company’s commitment to building a strong leadership team. With their extensive experience and industry knowledge, Brown and Murari bring fresh perspectives and expertise to Cohesity. Their appointments reinforce Cohesity’s dedication to attracting top talent and positioning itself for long-term success.

Subheading Two

Cohesity’s strategic partnerships with leading industry players such as Google Cloud, Microsoft, and IBM represent a significant milestone in the company’s growth journey. These collaborations not only demonstrate Cohesity’s market appeal but also open doors to new opportunities and customer segments. By leveraging the strengths of its partners, Cohesity can deliver enhanced solutions that address the evolving needs of businesses across various industries.

Heading Eight

Subheading One

As Cohesity prepares for its IPO, its focus on profitability and positive free cash flow sets it apart from other tech companies. CEO Sanjay Poonen emphasizes the importance of sustainable growth and responsible financial management. By prioritizing profitability, Cohesity aims to build a solid foundation for long-term success and create value for its shareholders.

Subheading Two

Cohesity’s dedication to profitability is underscored by its recent cost-cutting measures, including layoffs. While layoffs are never easy, they are often necessary to align resources and streamline operations. Cohesity’s proactive approach to cost management reflects its commitment to financial discipline and efficiency, further enhancing its ability to generate positive cash flow.

Subheading Three

Cohesity’s focus on profitability should resonate with investors, who are increasingly aware of the importance of sustainable and responsible financial practices. By demonstrating its ability to generate positive cash flow, Cohesity sets a strong precedent for other tech companies and reinforces investor confidence in its ability to deliver long-term value.

Heading Nine

Subheading One

Cohesity’s IPO preparations reflect the company’s commitment to careful planning and strategic execution. By evaluating market conditions and staying attuned to investor sentiment, Cohesity ensures that it maximizes its chances of a successful public listing. This attention to detail and proactive approach distinguish Cohesity as a company that is well-prepared and ready to embrace the challenges and opportunities of the public market.

Subheading Two

Cohesity’s IPO journey represents a significant milestone in the company’s growth trajectory. From its early days as a data startup to its current position as a prominent player in the industry, Cohesity’s IPO symbolizes its evolution and progress. The company’s unwavering focus on innovation, profitability, and customer value underscores its commitment to long-term success and establishes a solid foundation for future growth.

Heading Ten

Subheading One

As Cohesity embarks on its IPO journey, it enters a new phase of growth and transformation. The company’s strong leadership, strategic partnerships, and focus on profitability position it for success in the public market. By capitalizing on market opportunities and leveraging its industry expertise, Cohesity aims to create long-term value for its shareholders and make a lasting impact in the data storage industry.

Subheading Two

The IPO represents the culmination of Cohesity’s efforts to build a resilient and innovative company. It validates the hard work and dedication of its employees and leadership team. Cohesity’s IPO is not just a financial event; it is a testament to the power of vision, perseverance, and strategic decision-making. As Cohesity embarks on this new chapter, it is poised to shape the future of the data storage industry and make a meaningful contribution to the digital landscape.