Looking to make the most of your retirement plans? Here are some friendly tips to guide you towards successful investing. When it comes to investing in retirement plans, it’s crucial to ensure your hard-earned money is working for your future. Firstly, you may want to consider diversifying your investment portfolio. This means spreading your investments across a variety of assets, such as stocks, bonds, and mutual funds. Diversification can help reduce risk and maximize potential returns. Additionally, it’s important to determine your risk tolerance. Assessing how comfortable you are with potential fluctuations in your investments will help you align your portfolio with your financial goals. Lastly, regularly reviewing and adjusting your retirement plan is essential. Life circumstances change, and it’s crucial to adapt your investments accordingly to stay on track. By keeping these tips in mind, you can be well-prepared for a prosperous retirement journey. Happy investing!

Tips for Investing in Retirement Plans

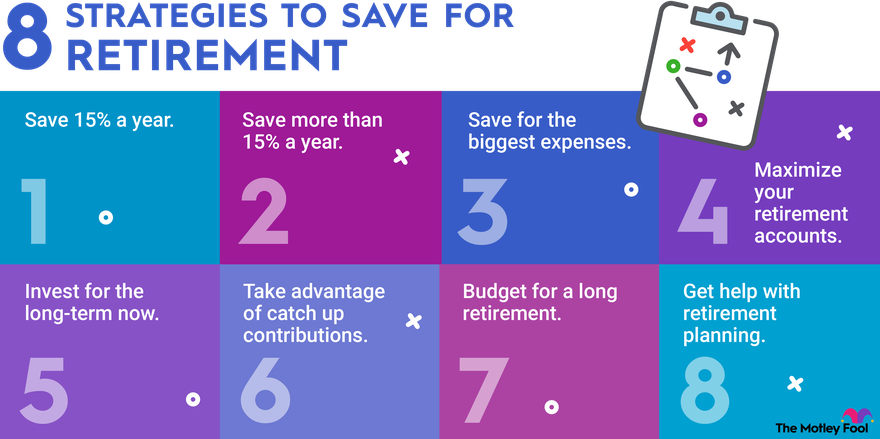

This image is property of m.foolcdn.com.

Choosing the Right Retirement Plan

Understanding Different Types of Retirement Plans

When it comes to choosing a retirement plan, it’s important to understand the different options available to you. Some common types of retirement plans include 401(k)s, Individual Retirement Accounts (IRAs), and pension plans. Each of these plans has its own set of rules and regulations, as well as unique benefits and drawbacks. By familiarizing yourself with the various types of retirement plans, you can make an informed decision about which one is the best fit for your needs.

Considering Your Financial Goals and Risk Tolerance

Before selecting a retirement plan, it’s essential to consider your financial goals and risk tolerance. Are you looking to grow your retirement savings aggressively, or are you more interested in preserving capital? Understanding your risk tolerance will help you determine the appropriate investment strategy for your retirement plan. Additionally, considering your financial goals will allow you to align your retirement plan with your desired lifestyle and retirement income needs.

Evaluating Tax Advantages and Eligibility Requirements

One crucial aspect to consider when choosing a retirement plan is the tax advantages it offers. Some retirement plans, such as traditional IRAs and 401(k)s, provide tax deferral benefits, meaning that your contributions may be deducted from your taxable income in the year you make them. It’s important to evaluate these tax advantages and consider how they align with your long-term financial goals. Additionally, don’t forget to take into account the eligibility requirements for each retirement plan, as they may differ based on factors such as age, income, and employment status.

Setting Realistic Retirement Goals

Determining Your Retirement Income Needs

To effectively plan for retirement, you must determine your retirement income needs. This involves calculating the amount of money you will require each year to cover living expenses, healthcare costs, and other financial obligations. By having a clear understanding of your income needs, you can make adjustments to your retirement plan that will ensure your financial security in your golden years.

Calculating Your Retirement Timeline

Another important aspect of setting realistic retirement goals is calculating your retirement timeline. Knowing when you plan to retire will help you determine how much time you have to save and invest before you reach your goal. The earlier you start planning for retirement, the longer your savings have to grow. However, even if you’re starting later in life, it’s never too late to take steps towards securing a comfortable retirement.

Considering Inflation and Healthcare Costs

When setting realistic retirement goals, it’s essential to consider the impact of inflation and healthcare costs. Inflation erodes the purchasing power of your retirement savings over time. By factoring in an estimated inflation rate, you can adjust your retirement savings goals accordingly. Additionally, healthcare costs tend to increase with age, making it necessary to account for these expenses when planning for retirement. It’s prudent to explore healthcare options and consider investing in a health savings account (HSA) to mitigate potential financial burdens.

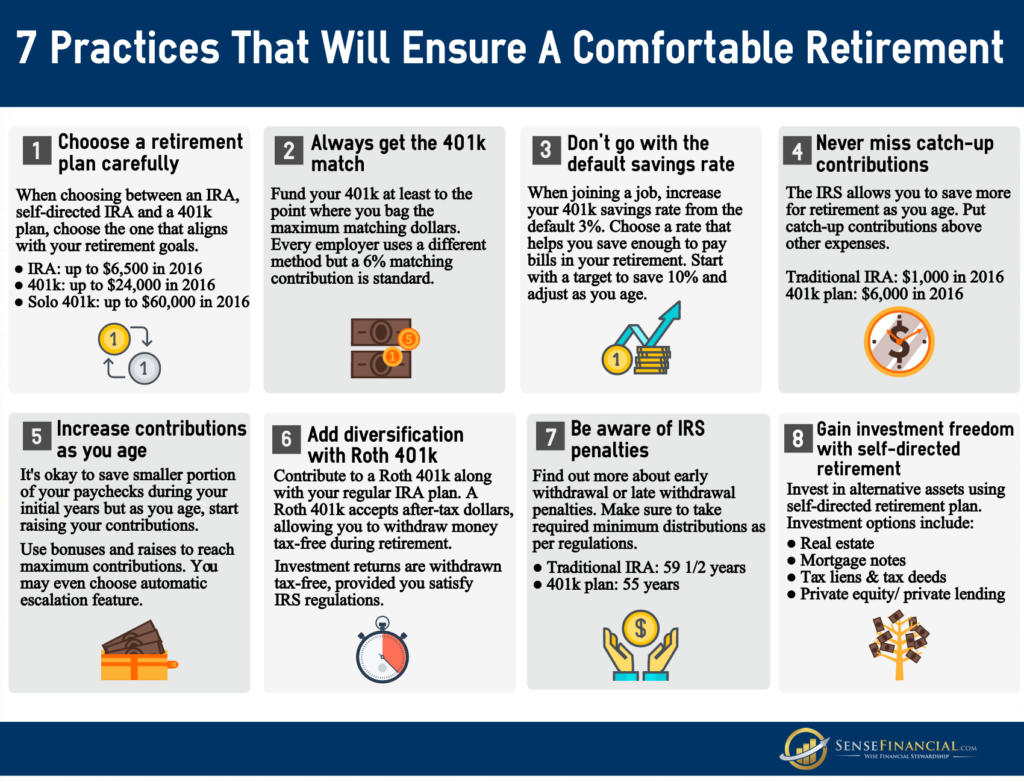

This image is property of www.sensefinancial.com.

Diversifying Your Portfolio

Understanding the Importance of Diversification

Diversification is a crucial strategy for managing risk in your retirement portfolio. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you reduce the likelihood of suffering significant losses from a single investment. Diversification helps to ensure that your portfolio is not overly reliant on any one investment, providing a more stable and balanced approach to retirement planning.

Allocating Assets Across Different Investment Classes

To effectively diversify your retirement portfolio, it’s important to allocate your assets across different investment classes. This means spreading your investments among stocks, bonds, mutual funds, and other investment vehicles. By diversifying in this way, you can take advantage of the potential growth opportunities offered by different asset classes while minimizing the risks associated with one particular investment.

Rebalancing Your Portfolio Regularly

Regularly rebalancing your retirement portfolio is essential to maintain your desired asset allocation and ensure that it aligns with your risk tolerance and financial goals. As the value of different investments fluctuates over time, your portfolio may become unbalanced. By periodically reviewing and rebalancing your portfolio, you can realign your investments with your desired asset allocation, reducing risk and maximizing potential returns.

Managing Risk and Volatility

Understanding Your Risk Tolerance

When it comes to retirement planning, understanding your risk tolerance is crucial. Your risk tolerance is a measure of how comfortable you are with the potential for fluctuating investment returns. It’s important to remember that higher-risk investments offer the potential for greater returns, but also carry a higher likelihood of losses. By assessing your risk tolerance, you can align your investment strategy with your comfort level and ensure that your retirement plan adequately balances risk and reward.

Considering Your Time Horizon

Your time horizon refers to the amount of time you have until you plan to retire. Your time horizon plays a significant role in determining your investment strategy. The longer your time horizon, the more aggressive you can afford to be with your investments. This is because, with a longer time horizon, you have more time to ride out short-term market fluctuations and benefit from the potential long-term growth of your investments. It’s important to consider your time horizon when making investment decisions and ensure that your portfolio aligns with your retirement goals.

Applying Risk Management Strategies

Managing risk and volatility in your retirement plan involves employing various risk management strategies. These strategies can include diversification, asset allocation, and frequent portfolio rebalancing. Additionally, it can be wise to set clear investment objectives, review your portfolio regularly, and make adjustments as necessary to mitigate potential risks. Consulting with a financial advisor can provide valuable insight into effective risk management strategies tailored to your specific circumstances.

This image is property of m.foolcdn.com.

Maximizing Contributions and Tax Benefits

Understanding Contribution Limits

When investing in a retirement plan, it’s important to understand the contribution limits associated with each plan. Contribution limits set the maximum amount of money you can contribute to your retirement account each year. By familiarizing yourself with these limits, you can ensure that you are maximizing your contributions to take full advantage of the benefits offered by your retirement plan.

Taking Advantage of Employer Matches

If you have access to a 401(k) or other employer-sponsored retirement plan, it’s essential to take advantage of any employer matches offered. Many employers provide a matching contribution to their employees’ retirement accounts, up to a certain percentage of their salary. By contributing enough to receive the maximum employer match, you can effectively double your retirement savings without any additional out-of-pocket expense. Not taking advantage of this benefit is essentially leaving free money on the table.

Exploring Tax-Advantaged Retirement Accounts

There are various tax-advantaged retirement accounts available, such as traditional IRAs and Roth IRAs. These accounts offer different tax benefits, such as tax-deductible contributions or tax-free withdrawals in retirement. It’s crucial to explore the tax advantages associated with each type of retirement account and determine which one aligns with your long-term financial goals and tax planning strategies.

Choosing the Right Investments

Determining Your Investment Style and Objectives

Choosing the right investments for your retirement plan depends on your investment style and objectives. Your investment style refers to your approach to investing, such as aggressive, conservative, or balanced. Your investment objectives, on the other hand, encompass your long-term financial goals and where you are on your retirement timeline. By determining your investment style and objectives, you can select investments that align with your risk tolerance and provide the potential growth necessary to reach your retirement goals.

Considering the Investment Options Available

When it comes to choosing investments for your retirement plan, there are numerous options available, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each investment option carries its own set of risks and potential rewards. It’s important to consider factors such as historical performance, investment fees, and the overall fit with your investment style and objectives. Conducting thorough research and potentially seeking professional advice can help you make informed investment decisions that align with your retirement goals.

Seeking Professional Advice if Needed

While it is possible to manage your retirement plan on your own, seeking professional advice can provide valuable guidance and expertise. A financial advisor can help you navigate the complexities of retirement planning, assess your risk tolerance, recommend suitable investment options, and help you stay on track with your retirement goals. When selecting a financial advisor, be sure to evaluate their credentials, experience, and track record to ensure that they are qualified to provide the guidance you need.

This image is property of www.thebalancemoney.com.

Monitoring and Reviewing Your Portfolio

Staying Informed About Market Trends and News

To effectively manage your retirement portfolio, it’s important to stay informed about market trends and news. Keeping up with market developments can help you make informed decisions about your investments, identify potential opportunities, and navigate potential risks or challenges. Staying informed can be as simple as reading financial news, following reputable sources, and staying up-to-date with economic indicators.

Regularly Assessing the Performance of Your Investments

Regularly assessing the performance of your investments is a crucial part of managing your retirement portfolio. By tracking the performance of your investments, you can identify areas of strength and weakness and make adjustments as necessary. While short-term fluctuations are common, it’s important to evaluate the long-term performance of your investments to ensure that they align with your retirement goals.

Making Adjustments When Necessary

As you review the performance of your retirement portfolio, it may be necessary to make adjustments. This could include rebalancing your asset allocation, selling underperforming investments, or reallocating funds to take advantage of emerging opportunities. Making adjustments based on your portfolio’s performance and evolving market conditions can help you maintain a well-diversified and resilient retirement plan.

Avoiding Common Mistakes

Not Starting Early Enough

One of the most common retirement planning mistakes is not starting early enough. The power of compound interest makes an early start crucial for building a substantial retirement nest egg. By starting early, you can take advantage of the time value of money and potentially accumulate a larger retirement fund. It’s never too early to start planning for retirement, so don’t delay in getting started on your journey towards financial security.

Failing to Diversify Adequately

Another mistake to avoid is failing to diversify adequately. Relying too heavily on a single investment or asset class exposes your retirement savings to unnecessary risk. Diversification helps to spread risk and reduces the potential impact of any single investment’s performance on your overall portfolio. By diversifying across asset classes and investment types, you can create a more robust and stable retirement plan.

Letting Emotions Drive Investment Decisions

Allowing emotions, such as fear or greed, to drive investment decisions is a common pitfall in retirement planning. Emotion-driven investment decisions can result in impulsive actions that may harm your long-term financial goals. It’s important to stay disciplined and maintain a long-term perspective when making investment decisions. Relying on thorough research, informed advice, and a well-thought-out investment strategy can help you avoid making decisions based on short-term market fluctuations or emotional reactions.

This image is property of m.foolcdn.com.

Seeking Professional Advice

Considering the Expertise of a Financial Advisor

Seeking professional advice from a financial advisor can provide valuable expertise and guidance throughout your retirement planning journey. Financial advisors possess the knowledge and experience to help you navigate the complexities of retirement planning, assess your risk tolerance, and recommend suitable investment strategies. Their expertise can help ensure that you have a well-designed retirement plan that aligns with your long-term financial goals.

Evaluating Credentials and Track Record

When selecting a financial advisor, it’s important to evaluate their credentials and track record. Look for advisors who hold relevant certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These credentials indicate that the advisor has met rigorous standards and possesses the necessary expertise. Additionally, review their track record and ensure that their investment philosophy aligns with your goals and risk tolerance.

Determining if the Fees are Reasonable

Before engaging the services of a financial advisor, it’s important to determine if the fees are reasonable. Financial advisors typically charge fees based on a percentage of your assets under management (AUM) or on a per-hour basis. It’s important to understand the fee structure and compare it to the value and services provided. While fees are an important consideration, don’t solely base your decision on cost. Instead, focus on finding an advisor who can provide the right balance of expertise, service, and value for your unique needs.

Planning for Withdrawals and Required Minimum Distributions

Understanding Withdrawal Rules and Penalties

Planning for withdrawals and required minimum distributions (RMDs) is a crucial aspect of retirement planning. Different retirement plans have different rules regarding withdrawals and penalties for early or late withdrawals. It’s important to familiarize yourself with these rules to avoid incurring unnecessary taxes or penalties. Additionally, planning for your withdrawals helps ensure that you have a steady stream of income throughout your retirement years.

Budgeting for Retirement Expenses

As you plan for withdrawals, it’s essential to budget for retirement expenses. Take into account your estimated living expenses, healthcare costs, and any other financial obligations you may have. By creating a comprehensive budget, you can ensure that your retirement income is sufficient to cover your expenses and that you’re adequately prepared for financial uncertainties that may arise.

Managing Required Minimum Distributions

Once you reach the age of 72, you are required to start taking minimum distributions from certain retirement accounts, such as traditional IRAs and 401(k)s. These required minimum distributions (RMDs) ensure that you are actively using your retirement savings and paying the necessary taxes on those distributions. It’s important to understand the rules around RMDs and make the necessary arrangements to comply with them. Failing to take the required withdrawals can result in significant tax penalties.

In conclusion, investing in retirement plans requires careful consideration of various factors, including the different types of retirement plans available, your financial goals and risk tolerance, tax advantages, and eligibility requirements. Setting realistic retirement goals involves determining your retirement income needs, calculating your retirement timeline, and accounting for inflation and healthcare costs. Diversifying your portfolio, managing risk and volatility, and maximizing contributions and tax benefits are essential strategies for building a secure retirement plan. Choosing the right investments, monitoring and reviewing your portfolio, and avoiding common mistakes are critical for long-term success. Seeking professional advice, planning for withdrawals and required minimum distributions, and budgeting for retirement expenses are also important aspects to consider. By following these tips and taking a proactive approach to retirement planning, you can increase the likelihood of achieving your financial goals and enjoying a comfortable retirement.