Are you interested in learning how to invest in hybrid investments? Well, you’ve come to the right place! In this beginner’s guide, we will walk you through the basics and help you navigate the world of hybrid investments with ease.

When it comes to hybrid investments, it’s all about finding the right balance between risk and reward. These are investments that combine different asset classes, such as stocks and bonds, to create a diversified portfolio. This diversification helps spread out the risk and potentially increase your chances of making a profit. To get started, it’s important to do your research and understand the different types of hybrid investments available. From hybrid mutual funds to hybrid real estate investment trusts (REITs), there’s a wide range of options to choose from. Consider your financial goals, risk tolerance, and time horizon when selecting the right hybrid investment for you. Additionally, it’s crucial to stay informed and regularly review your investment portfolio to ensure it aligns with your evolving needs. With a bit of knowledge and the right approach, you can confidently embark on your journey to investing in hybrid investments and grow your wealth over time. Happy investing!

A Beginner’s Guide: How to Invest in Hybrid Investments

This image is property of image.isu.pub.

1. What Are Hybrid Investments?

Hybrid investments are financial instruments that combine different asset classes to provide investors with a diverse portfolio that can potentially generate both income and capital gains. These unique investments blend features from various types of assets, such as stocks, bonds, real estate, and more, allowing individuals to customize their investment strategy to meet their specific financial goals.

1.1 Definition of Hybrid Investments

Hybrid investments, also known as hybrid securities or hybrid instruments, are designed to offer a combination of income generation and growth potential. They typically include elements of both debt and equity, providing investors with a more balanced risk-return profile. These investments can be in the form of stocks and bonds, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), and many other hybrid financial products.

1.2 Benefits of Hybrid Investments

Investing in hybrid securities can offer several advantages for investors. Firstly, they provide diversification by combining different asset classes, helping to spread risk across a broader range of investments. This diversification can help to reduce the impact of market volatility on an investor’s portfolio. Secondly, hybrid investments can offer the potential for both stable income and capital appreciation, making them suitable for investors seeking a balance between risk and return. Lastly, these investments may also provide certain tax benefits or favorable treatment compared to traditional single-asset investments.

1.3 Risk Factors to Consider

While hybrid investments can offer potential benefits, it is crucial to understand the associated risks. The risk level of a hybrid investment will depend on the specific assets included in the investment and the market conditions. Factors such as interest rate risk, market volatility, credit risk, and issuer-specific risks can affect the performance of these investments. It is essential to carefully assess the risk factors before investing and consider consulting a financial advisor to determine if hybrid investments are suitable for your risk tolerance and investment objectives.

2. Types of Hybrid Investments

There are various types of hybrid investments available to investors. Each type has its unique characteristics and suitability for different investor preferences.

2.1 Stocks and Bonds

One of the most common types of hybrid investments is a combination of stocks and bonds. This mix allows investors to benefit from potential capital appreciation from equities, along with the stability and income generation of bonds. The proportion of stocks and bonds can vary depending on the investor’s risk tolerance and investment goals.

2.2 Real Estate Investment Trusts (REITs)

REITs are a type of hybrid investment that combines the features of real estate and stocks. By investing in REITs, individuals can gain exposure to the income potential of real estate properties without the commitment and risks associated with direct ownership. REITs typically generate income through rental payments from properties and can offer dividend payments to investors.

2.3 Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets, including stocks, bonds, and other securities. This diversity makes mutual funds a type of hybrid investment. Investors can choose from various types of mutual funds, each focusing on specific asset classes, sectors, or investment strategies.

2.4 Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer investors exposure to a diversified portfolio of assets, making them another type of hybrid investment. ETFs can include stocks, bonds, commodities, or other financial instruments, and they are designed to track specific indexes or sectors.

2.5 Hedge Funds

Hedge funds are alternative investments available to accredited investors and institutional investors. They employ a wide range of investment strategies and can include a mix of assets such as stocks, bonds, derivatives, and commodities. Hedge funds have the potential for higher returns, but they also come with higher risk levels and may have limited liquidity.

2.6 Unit Investment Trusts (UITs)

Similar to mutual funds and ETFs, UITs are also investment vehicles that pool assets from multiple investors. However, UITs have a fixed portfolio of investments that are held until the trust’s maturity date. This fixed composition distinguishes UITs from mutual funds and ETFs, making them a unique type of hybrid investment.

2.7 Hybrid Annuities

Hybrid annuities combine features of both insurance and investment products. These annuities offer regular income payments to investors while providing the potential for growth through investments in various asset classes. Hybrid annuities are designed to provide individuals with a long-term income stream during retirement.

2.8 Convertible Bonds

Convertible bonds are a form of debt security that can be converted into a predetermined number of common shares of the issuing company. This feature allows investors to benefit from potential stock price appreciation while still receiving regular interest payments. Convertible bonds provide a hybrid investment opportunity by combining elements of fixed income (bonds) and potential equity participation (stocks).

2.9 Preferred Stocks

Preferred stocks are a class of shares in a company that typically have higher priority over common stocks in terms of dividend payments and asset distribution in the event of liquidation. They provide investors with a stable income stream, similar to bonds, while also offering the potential for capital appreciation if the company performs well. Preferred stocks are considered a hybrid investment as they possess characteristics of both equity and debt instruments.

2.10 Balanced Funds

Balanced funds, also known as hybrid funds, are mutual funds or ETFs that provide a diversified mix of stocks, bonds, and other securities. These funds aim to achieve a balance between income generation and capital growth. Investors can choose from different types of balanced funds, such as conservative, moderate, or aggressive, based on their risk tolerance and investment goals.

This image is property of image.isu.pub.

3. Assessing Your Investment Goals and Risk Tolerance

Before investing in hybrid securities, it is important to evaluate your investment goals and risk tolerance. This assessment will help you determine which types of hybrid investments are suitable for your financial objectives.

3.1 Identifying Your Investment Objectives

Consider what you want to achieve through your investments. Are you primarily seeking income generation, capital growth, or a combination of both? Are you saving for retirement, a major purchase, or other financial goals? Understanding your investment objectives will help you select the most appropriate hybrid investments that align with your goals.

3.2 Determining Your Risk Tolerance

Understanding your risk tolerance is crucial in constructing a well-balanced investment portfolio. Different individuals have different levels of risk tolerance, which can be influenced by factors such as age, financial stability, investment experience, and personal preferences. Assess your comfort level with potential fluctuations in the value of your investments and determine how much risk you are willing to tolerate.

3.3 Considering Investment Horizon

Your investment horizon, or the time frame for which you plan to hold your investments, is an essential factor in determining suitable hybrid investments. Shorter-term investments may be more focused on income generation, while longer-term investments may have a higher allocation towards growth-oriented assets. Consider your time horizon when selecting hybrid investments to align with your investment goals.

4. Conducting Research on Potential Hybrid Investments

When evaluating potential hybrid investments, conducting thorough research is essential. Here are some factors to consider:

4.1 Evaluating Performance and Historical Data

Review the past performance of the hybrid investments you are considering. Look at how the investment has performed over different market cycles and compare it to relevant benchmarks or similar investment options. While historical performance does not guarantee future results, it can provide insights into the investment’s track record.

4.2 Analyzing Fund Managers and Analyst Recommendations

Examine the experience and track record of the fund manager or investment team responsible for managing the hybrid investment. Consider their investment philosophy, their approach to risk management, and their expertise in the asset classes included in the investment. Additionally, review analyst recommendations and insights from reputable financial institutions to gain a broader perspective on the investment’s potential.

This image is property of images.ctfassets.net.

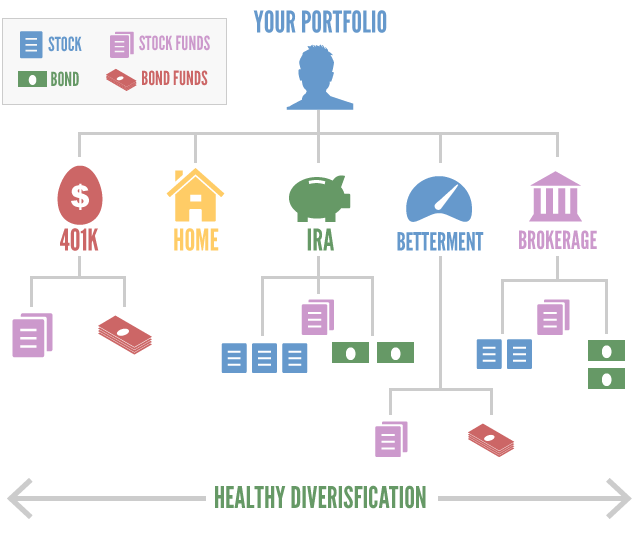

5. Diversification and Asset Allocation

Diversification is a fundamental principle in building a resilient investment portfolio. When it comes to hybrid investments, diversification involves spreading your investments across different asset classes to reduce risk and potentially enhance returns. Here are some key aspects to consider:

5.1 Importance of Diversification

Diversification helps to minimize the impact of a single investment’s poor performance on the overall portfolio. By investing in a mix of hybrid securities, you can achieve a more balanced risk-return profile. Diversification across various asset classes can also ensure that your investments are not overly concentrated in a specific industry or sector.

5.2 Allocating Assets in a Hybrid Investment Portfolio

To determine the optimal allocation of assets within your hybrid investment portfolio, consider your risk tolerance, investment goals, and time horizon. Balancing investments across different asset classes, such as stocks, bonds, and real estate, can help manage risk while still potentially achieving your desired returns. Periodically reassess and rebalance your portfolio as needed to maintain your desired asset allocation.

6. Considerations for Tax Efficiency

When investing in hybrid securities, it is important to consider the tax implications and seek tax-efficient investment strategies. Here are some considerations:

6.1 Understanding Tax Implications of Hybrid Investments

Different hybrid investments may have varying tax treatments. Determine whether the income generated from the investment is considered ordinary income, qualified dividends, or long-term capital gains. Understanding the tax implications can help you evaluate the after-tax returns of your investments.

6.2 Tax-Efficient Investment Strategies

Work with a financial advisor to develop tax-efficient investment strategies, such as utilizing tax-sheltered accounts like Individual Retirement Accounts (IRAs) or employer-sponsored retirement plans. Additionally, consider investments that generate tax-efficient income, such as municipal bonds, or tax-efficient funds that aim to minimize tax liability by limiting taxable distributions.

This image is property of www.listenmoneymatters.com.

7. Costs and Fees

Understanding the costs and fees associated with hybrid investments is essential for assessing their overall performance and impact on your investment returns. Consider the following factors:

7.1 Grasping the Various Investment Fees

Different hybrid investments may have different fee structures, including management fees, advisory fees, sales charges, or expense ratios. Familiarize yourself with these fees and evaluate their impact on your investment returns over time. Be aware that seemingly small fees can compound over the long term and significantly affect your overall investment growth.

7.2 Comparing Expense Ratios

Expense ratios provide an indication of a mutual fund or ETF’s annual operating expenses as a percentage of its total assets. Compare expense ratios of different hybrid investments to understand the costs involved in managing the investment. Lower expense ratios can potentially result in higher net returns for investors over time.

7.3 Balancing Costs and Performance

When evaluating hybrid investments, it is crucial to strike a balance between costs and performance. Lower-cost investments may not always deliver better returns, and higher-cost investments may not necessarily outperform their peers. Consider the investment’s historical performance, risk factors, and fees collectively to make an informed investment decision.

8. Opening an Investment Account

To start investing in hybrid securities, it is necessary to open an investment account. Here are some steps to follow:

8.1 Selecting the Right Account Type

Determine the type of investment account that suits your needs. It can be an individual brokerage account, an IRA for retirement savings, or a 401(k) if offered by your employer. Consider factors such as contribution limits, tax advantages, withdrawal restrictions, and any associated fees when selecting the account type.

8.2 Choosing a Reputable Brokerage Firm

Research and select a reputable brokerage firm that offers the investment options and account services you require. Consider factors such as trading fees, customer service, research tools, and educational resources provided by the brokerage. Ensure the firm is regulated by relevant financial authorities to protect your investments.

8.3 Opening the Account

Follow the brokerage firm’s instructions to open the investment account. This typically involves completing an application, providing identification documents, and funding the account. Once your account is opened and funded, you can proceed with investing in hybrid securities.

This image is property of blog.mint.com.

9. Making Your First Hybrid Investment

After opening an investment account, it is time to make your first hybrid investment. Here are some steps to follow:

9.1 Placing an Order

Research the hybrid investments you have identified as suitable for your portfolio. Determine the amount of investment you are comfortable with and place an order through your brokerage account. You can specify the number of shares or the dollar amount you wish to invest. Consider setting up automatic investment plans to facilitate regular contributions to your hybrid investments.

9.2 Monitoring Your Investment

Regularly monitor the performance of your hybrid investments. Keep track of news and market developments that could impact your investments. Consider setting up automated alerts or notifications to stay informed about price movements, dividend payouts, or other relevant updates.

9.3 Reviewing and Adjusting Your Portfolio

Periodically review your investment portfolio to ensure it remains aligned with your investment goals and risk tolerance. Assess the performance of your hybrid investments and compare them to relevant benchmarks or similar investments. If necessary, rebalance your portfolio by selling or buying hybrid investments to maintain your desired asset allocation.

10. Seeking Professional Advice

If you are uncertain about investing in hybrid securities or need guidance creating a well-rounded investment portfolio, it is beneficial to seek professional advice. Consider consulting a financial advisor who specializes in hybrid investments.

10.1 Benefits of Consulting a Financial Advisor

A financial advisor can help assess your financial situation, risk tolerance, and investment goals to recommend suitable hybrid investments. They can provide expert insights, personalized investment strategies, and help you navigate through complex investment decisions.

10.2 Locating a Trustworthy Financial Advisor

When selecting a financial advisor, it is important to research their qualifications, credentials, and experience. Look for professionals who are registered with reputable regulatory bodies and those who have expertise in the specific types of hybrid investments you are interested in. Seek referrals from trusted sources or consider utilizing online platforms that connect investors with verified financial advisors.

In conclusion, investing in hybrid securities can be an effective way to diversify your portfolio and potentially achieve a balance between income generation and capital growth. By understanding the different types of hybrid investments, evaluating your investment goals and risk tolerance, conducting thorough research, diversifying your portfolio, considering tax efficiency, assessing costs and fees, opening an investment account, making informed investment decisions, and seeking professional advice when needed, you can embark on a successful journey of investing in hybrid securities. Remember that investing involves risk, and it is important to make decisions that align with your personal financial situation and long-term goals.