Are you curious about how to start investing in art? Look no further, because “A Beginner’s Guide to Investing in Art” is here to help you navigate this exciting world! With this guide, you will learn the essentials of investing in art and discover valuable tips to make informed decisions.

Delving into the realm of art investing can seem intimidating, but don’t worry! This guide will break things down for you, showcasing the various factors to consider when making art investments. From understanding different art forms and styles to exploring the importance of provenance and artist reputation, you’ll gain a solid foundation to kickstart your art investment journey. Get ready to learn the art of investing in art and watch your knowledge and portfolio grow!

This image is property of insights.masterworks.com.

Understanding the Art Market

What is the Art Market?

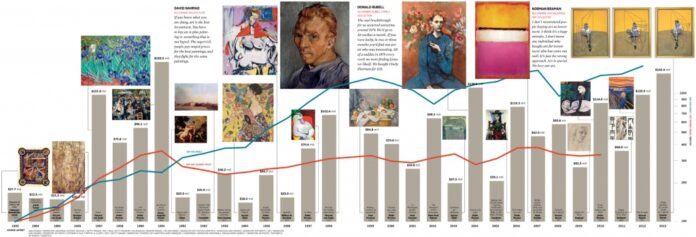

The art market refers to the buying and selling of artworks, including paintings, sculptures, photographs, and other forms of visual art. It operates like any other market, with the supply and demand for different artworks determining their value. The art market is a complex and dynamic system, influenced by various factors such as the artists’ fame and reputation, the quality and rarity of the artwork, economic conditions, and societal trends. It encompasses diverse participants, including artists, collectors, galleries, auction houses, and art dealers.

Factors Affecting the Art Market

Several factors play a significant role in shaping the dynamics of the art market. Artist reputation and demand are crucial in determining the value of their artworks. Artists with a strong track record, critical acclaim, and an established market presence tend to fetch higher prices for their creations. Additionally, economic conditions, consumer sentiment, and trends in art preferences play a role in shaping market trends. Political and social happenings, such as major exhibitions or awards, can also impact the perceived value of artworks.

Types of Art

Art comes in various forms, each with its unique characteristics and investment potential. Some common types of art include paintings, sculptures, drawings, prints, photography, and mixed media works. Each category has its own market dynamics and investment considerations. Paintings, for instance, are often highly sought after and can command substantial prices, especially if created by renowned artists. Sculptures, on the other hand, can offer a tangible and three-dimensional presence, attracting collectors interested in spatial art. It is important to consider your personal preferences, budget, and investment goals when determining which type of art to invest in.

Identifying Emerging Artists

Identifying emerging artists can be an exciting and potentially lucrative endeavor in the art market. These are artists who are gaining recognition and establishing their careers but have not yet reached the level of established artists. Investing in emerging artists can offer the opportunity to acquire artworks at more affordable prices while potentially benefiting from their future success. To identify emerging artists, you can attend art fairs and exhibitions, follow art blogs and magazines, and engage with the local art community. Looking for artists who have won awards or received critical acclaim can also be indicators of emerging talent.

Assessing Art Value

Assessing the value of art requires a combination of subjective and objective analysis. While art is undoubtedly subjective, there are objective factors that can influence its value. These factors include the quality and execution of the artwork, the artist’s reputation and career trajectory, the demand for the artist’s work, and the condition and provenance of the artwork. Additionally, market trends and comparative sales data can provide insights into the potential value of an artwork. Consulting with art advisors, auction house experts, or art appraisers can provide valuable guidance in assessing the value of art and making informed investment decisions.

Building Your Knowledge

Familiarizing Yourself with Art Movements

To navigate the art market successfully, it is important to be familiar with different art movements. Art movements represent distinct periods in art history characterized by similar artistic styles, techniques, and philosophical ideas. Some notable art movements include Renaissance, Impressionism, Cubism, Surrealism, and Abstract Expressionism. Understanding these movements can help you appreciate artworks, recognize influences in contemporary art, and make informed investment decisions. Reading books, attending lectures or seminars, and visiting museums and galleries dedicated to different art movements can deepen your understanding and enrich your art investment journey.

Researching Artists and their Works

Researching artists and their works is an essential step in building your knowledge and making informed investment decisions in the art market. By studying an artist’s biography, examining their body of work, and understanding their artistic journey, you can gain insights into their artistic value and potential for future success. Research can include reading artist interviews, analyzing exhibition catalogs, browsing online portfolios, and attending artist talks or panel discussions. By immersing yourself in the artist’s world, you can develop a deeper appreciation for their art and make more informed investment choices.

Art Journals and Publications

Art journals and publications are valuable resources for staying updated on art market trends, artist profiles, and critical analysis of artworks. Subscribing to reputable art magazines, such as ARTnews, Artforum, and ArtReview, can provide you with a wealth of information about the art market. These publications frequently feature articles on emerging artists, market insights, exhibition reviews, and interviews with industry experts. Art journals also offer a platform for thought-provoking commentary, allowing you to engage in the discourse surrounding the art world. Regularly reading art journals can help you stay informed and expand your knowledge as an art investor.

Art Fairs and Exhibitions

Attending art fairs and exhibitions is an excellent way to discover new artists, explore diverse artworks, and immerse yourself in the art market. Art fairs bring together galleries, collectors, and artists from around the world, offering a unique opportunity to view a wide range of artworks in one place. These events often showcase emerging artists alongside established ones, providing a platform for discovery and potential investment. Similarly, visiting exhibitions at galleries and museums allows you to experience artworks firsthand, engage with curators, and gain a deeper understanding of an artist’s body of work. Art fairs and exhibitions offer valuable networking opportunities and can open doors to exciting art investment prospects.

Art Galleries and Auction Houses

Art galleries and auction houses are key players in the art market, and engaging with them can enhance your understanding and access to art investments. Art galleries represent artists and display their works for sale. Visiting galleries allows you to see artworks up close, learn about artists represented by the gallery, and potentially acquire artworks directly. Auction houses, on the other hand, facilitate the buying and selling of artworks through auctions. Participating in an auction can be an exciting way to acquire unique or rare artworks, as well as gain insights into market trends and price fluctuations. Establishing relationships with galleries and auction houses can provide you with insider knowledge and access to exclusive art investment opportunities.

This image is property of lifebeyondsportmedia.com.

Setting Your Investment Goals

Short-term vs. Long-term Investments

When investing in art, it is crucial to define your investment goals, including your time horizon. Art investments can be categorized as short-term or long-term investments. Short-term investments typically involve buying artworks with the intention of selling them relatively quickly, capitalizing on price fluctuations or market trends. Long-term investments, on the other hand, involve acquiring artworks with the intention of holding them for an extended period, often with the expectation that their value will appreciate significantly over time. Clarifying your investment goals will help you determine the type of art to invest in, the level of risk you are willing to take, and the strategies you should employ.

Speculative vs. Collectible Art

Another consideration when setting your investment goals is distinguishing between speculative and collectible art. Speculative art refers to artworks that are acquired primarily for their potential financial returns. These artworks are often bought based on market trends, artist reputations, and potential resale value. Collectible art, on the other hand, focuses on artworks that are acquired for their aesthetic or personal value, often driven by passion and the desire to build a meaningful art collection. Understanding your motivations and preferences will help you align your investment goals with the type of art you choose to acquire.

Diversification of Art Portfolio

Like any investment portfolio, diversification is important when investing in art. Diversifying your art portfolio involves acquiring artworks from different periods, genres, and artists to spread the risks and potential rewards. By diversifying, you reduce the impact of market fluctuations on your overall art investment. Investing in artworks across multiple categories and artists hedges against the risk of a single artwork or artist underperforming. It is advisable to strike a balance between established and emerging artists, as well as different art movements, to build a well-rounded and resilient art portfolio.

Determining Your Budget

Before entering the art market, it is essential to determine your budget for art investments. Establishing a clear budget will help guide your investment decisions and ensure you stay within your financial means. Set a realistic range that considers both the purchase price of artworks and associated costs such as insurance, framing, and storage. It is recommended to start with a conservative budget and gradually increase it as you gain experience and see returns on your investments. Be mindful not to overextend your finances, as art investments should be seen as a long-term commitment that requires patience and thoughtful decision-making.

Evaluating the Quality of Art

Authenticity and Provenance

Authenticity and provenance are crucial considerations when evaluating the quality and value of art. Authenticity refers to the artwork’s origin and the assurance that it is genuinely created by the artist it is attributed to. Provenance, on the other hand, refers to the documented history of the artwork, including its ownership, exhibition history, and any relevant certifications or appraisals. Verifying the authenticity and provenance of an artwork ensures its legitimacy and can significantly impact its value. Working with reputable galleries, auction houses, or independent experts can provide reassurance and expertise in evaluating the authenticity and provenance of art.

Condition and Conservation

The condition of an artwork is important in determining its value and long-term preservation. Assessing the condition involves examining the overall physical state, including any signs of damage, deterioration, or restoration. Original artworks in excellent condition generally command higher prices than those with significant damage or wear. Conservation plays a role in maintaining and preserving the artwork’s condition over time. Proper conservation involves using appropriate techniques, materials, and environmental conditions to prevent degradation and potential damage. Considering the condition and conservation history of an artwork is crucial in evaluating its quality and long-term investment potential.

Artistic Technique and Skill

The artistic technique and skill demonstrated in an artwork contribute to its qualitative value and aesthetic appeal. Assessing the technique involves evaluating the artist’s mastery of their chosen medium, their use of colors, composition, brushwork, or any other technical aspects relevant to the artwork. Artistic skill contributes to the uniqueness and artistic value of the artwork, distinguishing it from others. Recognizing and appreciating different artistic techniques can deepen your understanding and appreciation of art, allowing you to make informed judgments about the quality and value of artworks.

Rareness and Availability

The rarity and availability of an artwork can significantly affect its value. Limited edition artworks or those created by artists with a small body of work tend to be more valuable due to their scarcity. Additionally, artworks that are no longer available in the market, such as those held in private collections or museums, can hold higher value. Rarity enhances desirability and exclusivity, factors that can drive up prices. When evaluating art, consider its availability and rarity in relation to the artist’s body of work and market demand to gauge its long-term investment potential.

Artistic Vision and Expression

Artistic vision and expression are intangible yet crucial aspects that contribute to the allure and value of art. These qualities represent the artist’s unique perspective, creativity, and ability to convey emotion or meaning through their artwork. Artworks that exhibit a strong artistic vision and convey a powerful expression often resonate with collectors and can appreciate in value over time. Evaluating artistic vision and expression requires a subjective analysis, as it involves personal interpretation and emotional connection. Considering these elements can help you identify artworks that speak to you and align with your own artistic sensibilities.

This image is property of cdn.shopify.com.

Navigating the Art Buying Process

Online Marketplaces and Auctions

The advent of online marketplaces and auctions has revolutionized the art buying process, providing convenience, accessibility, and a global reach for art enthusiasts. Online platforms such as Artsy, Saatchi Art, and eBay allow collectors to browse and purchase artworks from the comfort of their homes. Online auctions, conducted by auction houses like Christie’s and Sotheby’s, offer a platform for acquiring high-value artworks through a competitive bidding process. When buying art online, it is crucial to verify the seller’s authenticity, review the artwork’s condition and provenance, and consider any associated costs such as shipping and insurance.

Art Dealers and Advisors

Engaging with art dealers and advisors can provide valuable guidance and expertise throughout the art buying process. Art dealers represent artists and help connect collectors with artworks that align with their preferences and investment goals. Working with an art dealer allows you to access exclusive artworks and negotiate prices based on their established relationships with artists and galleries. Art advisors, on the other hand, offer independent advice and expertise, assisting collectors in navigating the art market, assessing art value, and making informed investment decisions. Their insights can help you build a well-rounded art portfolio and maximize your art investment potential.

Negotiating Art Prices

Negotiating art prices is an essential skill for collectors and investors. While the listed price of an artwork may seem fixed, there is often room for negotiation, especially in the secondary market or when dealing directly with artists or galleries. Conducting thorough research, understanding the artist’s market value, and being knowledgeable about market trends can provide leverage during negotiations. It is essential to approach negotiations in a respectful and mutually beneficial manner, taking into account the interests of both parties. Negotiating art prices can result in acquiring artworks at more favorable prices, enhancing your art investment’s potential returns.

Ensuring Secure Transactions

Ensuring secure transactions when buying art is of utmost importance. With the growth of online platforms and digital transactions, it is crucial to verify the seller’s authenticity and the purchase’s legitimacy. When buying from galleries, auction houses, or established online platforms, you can be more confident in the transaction’s security. Conducting due diligence, researching the seller or platform, and looking for customer reviews or testimonials can provide reassurance. When purchasing high-value artworks, employing the services of a reputable escrow company or working with trusted intermediaries can add an extra layer of protection. Taking steps to ensure secure transactions safeguards your investments and offers peace of mind.

Artwork Insurance

Artwork insurance is a critical aspect of owning and protecting your art investments. Artworks can be vulnerable to various risks, including theft, damage due to accidents, fire, or natural disasters. Insuring your art collection provides financial protection in case of any unforeseen circumstances. It is advisable to consult with specialized art insurance companies that understand the unique requirements of insuring artwork. The insurance policy should cover the agreed-upon value of the art and consider factors such as condition, provenance, and location. Properly insuring your artworks safeguards your investment and provides you with the confidence to enjoy and display your collection.

Storing and Displaying Your Art

Climate and Environmental Considerations

Climate and environmental considerations are crucial when storing and displaying art. Extreme temperature, humidity, direct sunlight, and fluctuations in these conditions can have a detrimental impact on artwork, potentially causing fading, warping, or deterioration. It is advisable to store artworks in a controlled environment with stable temperature and humidity levels. Displaying artworks away from direct sunlight and humidity sources ensures their preservation. Consulting with professionals or museum experts can provide guidance on the ideal storage conditions for different types of artworks. Proper climate and environmental considerations prolong the lifespan of your art collection and maintain its value.

Proper Framing and Mounting

Proper framing and mounting not only enhance the aesthetic appeal of artworks but also protect them from physical damage and deterioration. Framing helps protect artworks from dust, moisture, and potential impacts, while mounting securely fastens the artwork within the frame, preventing movement or warping. Using acid-free materials in framing and mounting ensures the longevity of the artwork by reducing the risk of chemical reactions or degradation. Consulting with professional framers and conservators can provide guidance on suitable framing techniques and materials specific to each artwork’s requirements. Good framing and mounting practices safeguard your art investments and enhance their visual appeal.

Art Storage and Preservation

Art storage and preservation are essential considerations for maintaining the condition and value of your artworks. When not on display, artworks should be stored in a secure and climate-controlled space, preferably away from areas prone to flooding or structural damage. Proper storage involves using acid-free and archival-quality materials, such as acid-free tissue paper and specialized art storage boxes, to protect artworks from dust, light exposure, and physical damage. It is important to handle artworks with care, using gloves to prevent any transfer of oils or dirt. Regular inspections and maintenance of stored artworks ensure early detection of any potential issues or deterioration.

Lighting and Art Presentation

Lighting plays a crucial role in presenting artworks in their best light while ensuring their preservation. The type of lighting used, such as incandescent, fluorescent, or LED, can affect the appearance and conservation of artworks. Ultraviolet (UV) filters and low-heat light bulbs should be used to minimize UV and heat damage to the artwork. Direct lighting on artworks should be avoided, as it can cause fading and potential damage to pigments or delicate surfaces. Balancing the intensity, positioning, and quality of light enhances the visual impact of the artwork while protecting its long-term condition.

Art Installation and Hanging

Proper art installation and hanging techniques are essential in ensuring the safety, stability, and visual impact of artworks. The location of art within your space, such as walls with suitable support and weight-bearing capacity, should be considered. Consulting a professional art installer or experienced framer can provide guidance on best practices for hanging different types of artworks. Using appropriate hanging hardware, such as grommets, D-rings, or security fixtures, ensures secure attachment to the wall. It is important to follow museum-standard guidelines, aligning artworks correctly and maintaining appropriate spacing between them. Proper art installation and hanging techniques allow you to showcase your artworks while ensuring their safety and impact.

This image is property of i.ytimg.com.

Understanding Art Taxation

Capital Gains Tax

Capital gains tax is a tax assessed on the profit earned from the sale of an asset, including art. When selling art, the difference between the purchase price and the sale price is considered a capital gain. This gain may be subject to capital gains tax, depending on the tax laws in your jurisdiction. The rate of capital gains tax can vary depending on factors such as the holding period and the applicable tax regulations. It is important to consult with a tax advisor or accountant to understand the specific capital gains tax implications related to art investments in your country.

Inheritance Tax

Inheritance tax, also known as estate tax or death tax, is imposed on the transfer of assets upon the owner’s death. The value of art held in an estate is included in the calculation of inheritance tax liability. The tax rate and thresholds may vary depending on the country’s tax laws and the relationship between the deceased owner and the beneficiary. Understanding the inheritance tax regulations and potential exemptions in your jurisdiction is crucial for effective estate planning and minimizing tax liabilities. Seeking professional advice from tax experts or estate planners can facilitate the efficient transfer of art assets to future generations.

VAT on Art Sales

Value-added tax (VAT) is a consumption tax levied on goods and services in many countries. Art sales may be subject to VAT depending on the jurisdiction and the nature of the transaction. VAT rates and exemptions vary between countries, and some jurisdictions offer reduced or zero-rated VAT for certain types of artwork or sales in specific circumstances. It is important to research and understand the VAT regulations in your country when buying or selling art. Given the complexity of VAT regulations in relation to art, consulting with a professional tax advisor or accountant can help ensure compliance and mitigate tax risks.

Tax Benefits of Donating Art

Donating art can offer tax benefits in some jurisdictions. Many countries provide tax incentives to encourage individuals or corporations to donate artworks to museums, cultural institutions, or charitable organizations. These incentives often include income tax deductions or credits based on the appraised fair market value of the donated artwork. The specific rules and regulations surrounding art donations and tax benefits vary between jurisdictions. It is important to consult with tax advisors or legal experts familiar with art tax laws to fully understand and maximize the tax benefits of donating art in your specific circumstance.

Managing and Maintaining Your Art Collection

Art Valuations and Appraisals

Regular art valuations and appraisals are essential for managing and maintaining your art collection. Art valuations provide an updated assessment of your art investments’ worth, taking into account market trends, demand for specific artists or genres, and the condition of the artworks. Appraisals conducted by certified appraisers adhere to standardized procedures and provide an estimate of the fair market value of the artwork. Keeping a record of appraisal reports, purchase receipts, and other documentation is crucial for insurance purposes, estate planning, and maintaining accurate financial records. Periodic appraisals and valuations allow you to track the value of your collection and make informed decisions about your art investments.

Regular Art Maintenance and Conservation

Regular art maintenance and conservation are essential to preserve the condition and value of your artworks. Proper art maintenance involves periodic inspections, cleaning, and addressing any signs of damage or deterioration. Dusting artworks regularly with a soft, lint-free cloth helps prevent the accumulation of dirt or debris. For more delicate or valuable artworks, professional conservators should be consulted for specialized cleaning and conservation techniques. Conservation treatments, such as stabilizing fragile materials, cleaning, or repairing damages, can prolong the lifespan of the artwork and maintain its aesthetic and monetary value. Engaging with a professional conservator ensures the proper care and preservation of your art collection.

Art Collection Documentation

Documenting your art collection is crucial for its management, insurance, and future planning. Each artwork in your collection should have a detailed record, including information such as the artist’s name, title of the artwork, medium, dimensions, date of creation, and acquisition details. Additional documentation can include certificates of authenticity, condition reports, appraisals, and provenance information. Maintaining a comprehensive inventory of your art collection, along with supporting documents, allows for efficient organization, easy retrieval of information, and accurate record-keeping. Regularly updating and managing your art collection documentation ensures clarity, accessibility, and transparency in managing your investments.

Art Collection Management Software

Art collection management software can be a valuable tool for organizing, documenting, and tracking your art collection. These software platforms provide a centralized database to catalog and manage your artworks, facilitating efficient organization and record-keeping. With features such as image storage, customizable field entries, and document management, art collection management software streamlines the management of your collection and provides a comprehensive overview of your assets. Some platforms also offer valuation tracking, exhibition history, and reporting capabilities, aiding in the appraisal process and informing future investment decisions. Researching and selecting a suitable art collection management software can greatly enhance your art collection management experience.

Engaging with the Art Community

Engaging with the art community is an enriching way to deepen your knowledge, share insights, and build connections within the art world. By attending art events, joining art organizations, and participating in art discussions, you can contribute to the dialogue surrounding art and gain valuable insights from fellow enthusiasts, collectors, and industry professionals. The art community provides a platform for networking, knowledge-sharing, and discovering new opportunities in the art market. Engaging with the art community can broaden your perspective, enhance your understanding of art, and help you navigate the complexities of the art market more effectively.

This image is property of masterinvestor.co.uk.

Monitoring Art Market Trends

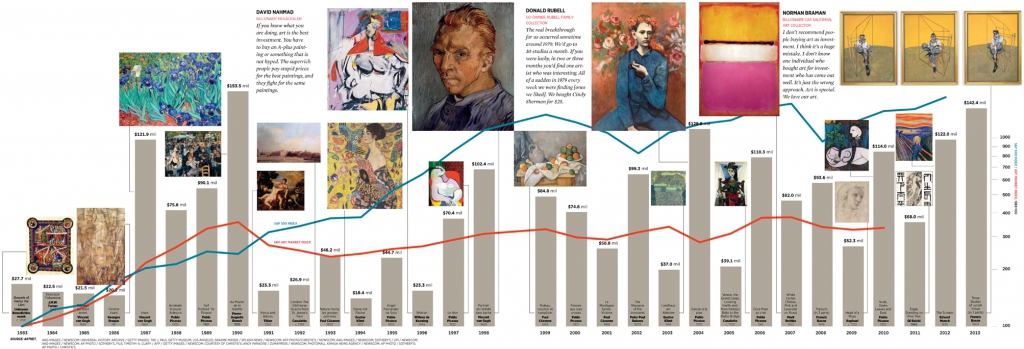

Art Market Reports

Art market reports provide insights into market trends, artist performance, and pricing dynamics. These reports are typically published by art market research firms, industry experts, or auction houses. Art market reports analyze sales data, auction results, and other economic indicators to offer a comprehensive overview of the art market. By regularly reviewing these reports, you can identify emerging trends, market shifts, and potential investment opportunities. Staying informed about the latest art market reports ensures you are up to date with current developments and armed with the knowledge necessary to make informed investment decisions.

Auction Results and Records

Auction results and records are valuable sources of information for understanding market trends, artist value, and price benchmarks. Auction houses provide public access to past auction results, allowing you to track the sale prices of artworks, compare market demand for different artists, and analyze the performance of specific art movements or genres. Examining auction results provides insights into the relative popularity and value of different artists, as well as fluctuations in prices over time. Regularly monitoring auction results allows you to identify emerging artists, track artist recognition, and make informed investment decisions based on market trends.

Art Indices and Market Analysis

Art indices and market analysis are tools used to assess the overall performance and trends within the art market. Art indices track price movements and provide a benchmark for evaluating the value of artworks and art as an asset class. These indices aggregate sales data from various sources, including auction sales and private transactions, to create composite measures of market performance. Analyzing art indices and market analysis can provide insights into the overall health and direction of the art market, helping you assess the potential returns and risks associated with art investments. Regularly monitoring market indices helps you stay informed and make strategic investment decisions.

Tracking Artist Popularity and Recognition

Tracking artist popularity and recognition is essential for understanding their market value and potential investment opportunities. Artists who consistently receive critical acclaim, awards, or museum exhibitions often gain recognition and attract collector interest. Monitoring artist recognition involves following their career trajectory, staying informed about their latest achievements, and analyzing their exhibition and sales history. Artists who are gaining momentum and recognition may present potential investment opportunities, as their artworks may appreciate in value as their careers progress. Regularly tracking artist popularity and recognition allows you to identify emerging talents and make informed investment decisions based on their potential growth.

Selling Your Art Investments

Determining the Right Time to Sell

Determining the right time to sell your art investments depends on various factors, including market conditions, artist popularity, and your investment goals. Artworks may reach their highest potential value during times of increased demand or when an artist’s market presence is at its peak. Keeping an eye on market trends, tracking artist recognition, and consulting art market experts can provide insights into opportune moments for selling. Moreover, personal circumstances, financial needs, or shifts in investment strategy may also influence the decision to sell. Analyzing and aligning market conditions and your investment goals will help you identify the right time to sell your art investments.

Auctions and Private Sales

Selling art investments can be accomplished through auctions or private sales. Auctions offer a competitive bidding process that can drive up the price of artworks, especially if there is high demand or limited supply. Participating in art auctions conducted by reputable auction houses can provide exposure to a wide range of potential buyers and potentially fetch higher prices. Alternatively, private sales involve negotiating directly with collectors, galleries, or art dealers. Private sales can offer greater privacy, control over the sale process, and the opportunity to target specific buyers or institutions. Deciding between auctions and private sales depends on factors such as the artwork’s value, demand, and your specific objectives as a seller.

Art Advisors and Consultants

Engaging art advisors or consultants when selling art investments can provide valuable guidance and expertise. Art advisors offer specialized knowledge of the art market, reliable valuation insights, and access to a network of collectors, galleries, and potential buyers. They can assist with pricing strategies, marketing campaigns, negotiation techniques, and navigating the complexities of the art selling process. Art consultants provide tailored advice and assessment of your art collection, helping you curate a saleable portfolio and identify the best opportunities for selling. Working with art advisors or consultants fosters a strategic approach to selling art investments, maximizing return on investment and ensuring a smooth transaction.

Marketing and Promoting Art Sales

Marketing and promoting art sales are crucial steps in attracting potential buyers and maximizing the visibility of your artworks. Effective marketing strategies involve utilizing various channels such as social media, online platforms, art publications, and targeted marketing campaigns. Engaging professional photographers, writers, and designers to create high-quality promotional materials can enhance the presentation and desirability of your artworks. Highlighting the unique attributes, provenance, and artist biography can captivate potential buyers and provide them with the information they need to make an informed decision. Thoughtful marketing and promotion efforts increase the likelihood of reaching the right audience and achieving successful art sales.

Capitalizing on Artist Recognition

Capitalizing on artist recognition can significantly enhance the value and marketability of your art investments. When an artist gains critical acclaim, receives awards, or achieves significant milestones, their artworks often appreciate in value as demand increases. By following artists’ careers and staying informed about their achievements, you can anticipate opportunities to sell artworks at more favorable prices. Timing the sale of artworks to coincide with significant recognition or milestones can maximize returns. It is important to consult with art market experts or advisors who can provide guidance on the optimal strategy for capitalizing on artist recognition and achieving successful art sales.