Hi there! Interested in investing in NFTs? Look no further than “A Beginner’s Guide to Investing in NFTs.” This guide is designed to help you navigate the exciting world of Non-Fungible Tokens (NFTs) and understand how to invest in them.

In these pages, you’ll discover a wealth of information on what NFTs are, how they work, and why they have become so popular. We’ll explore the different types of NFTs you can invest in, from digital artwork and collectibles to virtual real estate and beyond. You’ll also find handy tips on how to evaluate NFT projects and choose the ones that align with your interests and investment goals.

Ready to get started? Let’s dive into the world of NFT investing together and unlock the potential opportunities waiting for you. Happy reading!

This image is property of Amazon.com.

A Beginner’s Guide to Investing in NFTs

1. What are NFTs?

NFTs, or Non-Fungible Tokens, have recently taken the digital world by storm. But what exactly are NFTs? In simple terms, NFTs are unique digital assets that are stored on a blockchain, a decentralized digital ledger that ensures transparency and security. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are interchangeable and have the same value, each NFT is one-of-a-kind and cannot be replicated or replaced.

1.1 Definition of NFTs

NFTs represent ownership of a specific digital item, whether it be a piece of digital artwork, collectible, music, virtual land, or even a tweet. Each NFT contains metadata that provides information about the asset, including its provenance, history, and ownership. This uniqueness and the ability to prove ownership make NFTs highly sought after by collectors and enthusiasts.

1.2 Characteristics of NFTs

There are several key characteristics of NFTs that set them apart from other digital assets. Firstly, NFTs are indivisible, meaning they cannot be divided into smaller units like cryptocurrencies. Each NFT represents the whole asset, making it a complete and distinct item. Secondly, NFTs are verifiable and cannot be counterfeited. The blockchain technology underlying NFTs ensures that every transaction and ownership transfer is recorded and can be publicly accessed, providing transparency and security. Lastly, NFTs are programmable, which means they can have embedded functionality or utility within certain digital ecosystems or platforms.

This image is property of cdn.coingape.com.

2. Understanding the Concept of Investing in NFTs

As the world becomes more digital, traditional forms of investment are shifting towards the digital realm as well. Investing in NFTs offers a unique opportunity to own and profit from digital assets that have both artistic and financial value. However, it’s essential to understand the concept of investing in NFTs before diving in.

2.1 Why Invest in NFTs?

Investing in NFTs can be enticing for various reasons. Firstly, NFTs have the potential for significant financial gains. Some NFTs have sold for millions of dollars, making it an attractive investment option. Moreover, NFTs provide a chance to support artists and creators directly. By purchasing an artist’s NFT, you are showing appreciation for their work and helping them monetize their talent. Additionally, investing in NFTs allows you to become a part of a vibrant and passionate community, where you can engage with like-minded individuals and participate in various events and discussions.

2.2 Risks and Considerations

Like any investment, there are risks involved in investing in NFTs that you should be aware of. One of the significant risks is market volatility. The value of NFTs can fluctuate rapidly, and it’s important to be prepared for potential losses. Furthermore, the NFT market is relatively new and lacks regulatory oversight compared to traditional investment markets. This lack of regulation can lead to scams and fraudulent activities, making it crucial to be cautious and do thorough research before investing. Lastly, the environmental impact of NFTs has raised concerns regarding the carbon footprint associated with blockchain technology. Understanding and considering these risks and considerations is vital when venturing into the world of NFT investing.

3. Steps to Start Investing in NFTs

Now that you have a basic understanding of NFTs and the concept of investing in them, let’s dive into the steps you can take to start your NFT investment journey.

3.1 Research and Understand the Market

Before investing in NFTs, it’s essential to research and understand the market thoroughly. Familiarize yourself with different types of NFTs, popular artists, and creators, and the overall trends and demands in the market. Stay updated with news and developments in the NFT space to make informed investment decisions.

3.2 Set a Budget

Like any investment, setting a budget is crucial in NFT investing. Determine the amount of money you are willing to invest and consider it as a long-term investment. Setting a budget will help you manage expectations and avoid overspending in the excitement of the NFT market.

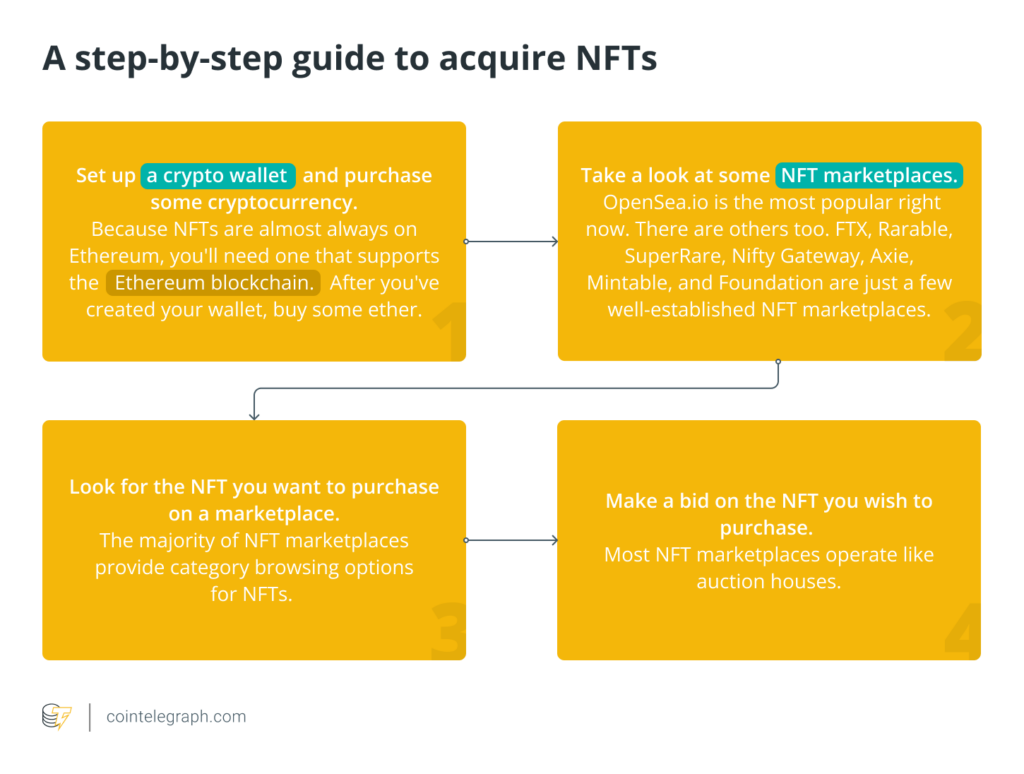

3.3 Choose a Marketplace

NFTs are bought and sold on various online marketplaces, each with its own features and characteristics. Research and choose a reputable marketplace that aligns with your investment goals and preferences. Some popular NFT marketplaces include OpenSea, Rarible, and SuperRare.

3.4 Create a Digital Wallet

To invest in NFTs, you need to have a digital wallet to store and manage your NFTs. There are different types of wallets, including online wallets, hardware wallets, and software wallets. Research and choose a wallet that suits your needs in terms of security and accessibility.

3.5 Connect your Wallet to the Marketplace

Once you have a digital wallet, you need to connect it to the chosen NFT marketplace. Each marketplace will have specific instructions on how to connect your wallet. Follow the instructions to ensure a seamless connection and enable you to buy, sell, and trade NFTs.

3.6 Develop a Strategy

Having a strategy is vital in NFT investing. Determine your investment goals, whether it’s for financial gains, supporting artists, or a combination of both. Research different NFTs and decide on the types of assets you want to invest in. Set criteria for evaluating and selecting NFTs, such as rarity, artistic value, utility, and demand. Having a clear strategy will help you make informed decisions and minimize potential risks.

This image is property of Amazon.com.

4. Evaluating and Selecting NFTs

When it comes to investing in NFTs, evaluating and selecting the right NFTs is crucial. Consider the following factors as you navigate the NFT market.

4.1 Rarity and Scarcity

Rarity and scarcity play a significant role in the value of NFTs. Look for NFTs that have a limited supply or are part of a collection with a limited edition. Generally, the scarcer an NFT is, the higher its potential value.

4.2 Artistic and Creative Value

The artistic and creative value of an NFT is subjective but can greatly influence its desirability and potential value. Research and explore different artists and creators, and consider their artistic style, reputation, and popularity. Look for NFTs that resonate with you and have the potential for wider appreciation.

4.3 Unique Utility or Functionality

Some NFTs offer unique utility or functionality within specific digital platforms or ecosystems. These NFTs can provide additional value beyond their artistic or collectible worth. Consider NFTs that offer utility, whether it’s access to exclusive content or special privileges within a particular community.

4.4 Popularity and Demand

Popularity and demand can drive the value of NFTs. Keep an eye on trends and popular themes in the NFT market, as well as influencers and celebrities who are active in the space. NFTs associated with popular names or aligned with trending topics have the potential for higher demand and value.

4.5 Authenticity and Verification

As the NFT market grows, ensuring the authenticity and verification of NFTs becomes crucial. Before investing in an NFT, verify its authenticity and legitimacy. Look for NFTs that have been verified or certified by reputable platforms or organizations to minimize the risk of purchasing counterfeit or unauthorized assets.

5. Navigating NFT Marketplaces

Once you have identified the NFTs you want to invest in, it’s time to navigate the different NFT marketplaces. Consider the following aspects when choosing and using NFT marketplaces.

5.1 Popular NFT Marketplaces

There are several popular NFT marketplaces where you can buy, sell, and trade NFTs. Some of the most well-known marketplaces include OpenSea, Rarible, SuperRare, NBA Top Shot, and CryptoPunks. Research and explore these marketplaces to find the one that suits your investment goals and preferences.

5.2 Key Features and Considerations

Each NFT marketplace offers unique features and considerations. Look for marketplaces that have a user-friendly interface, extensive collections, robust search and filtering options, and strong community engagement. Consider features such as royalty fees, secondary market options, and social features that contribute to the overall experience.

5.3 Fees and Transaction Costs

Be aware of the fees and transaction costs associated with buying, selling, and trading NFTs. Each marketplace has its own fee structures, including listing fees, transaction fees, and royalties. Understand the fee structure of the marketplace you choose and consider these costs when evaluating the potential returns on your investments.

5.4 Trading and Auction Mechanics

Different marketplaces have various trading and auction mechanics. Some allow for fixed-price sales, while others have bidding systems or auction formats. Familiarize yourself with the mechanics of the marketplace you choose to ensure you understand how to participate in sales or auctions effectively.

This image is property of images.booksense.com.

6. Tips for Successful NFT Investments

To maximize your chances of success in the NFT market, consider the following tips when investing in NFTs.

6.1 Follow Trends and Stay Informed

Stay up to date with the latest trends, news, and developments in the NFT market. Follow influential artists, creators, and collectors on social media platforms and engage with the NFT community. Being knowledgeable about the market will help you identify potential investment opportunities and make informed decisions.

6.2 Diversify your Portfolio

Diversification is key to managing risk in any investment portfolio, including NFTs. Consider investing in a variety of NFTs across different categories, artists, and platforms. By diversifying your portfolio, you minimize the impact of market fluctuations and maximize the potential for positive returns.

6.3 Engage with the NFT Community

Engaging with the NFT community can offer valuable insights and opportunities. Join online forums, attend virtual events and conferences, and connect with like-minded individuals. By actively participating in the community, you can gain knowledge, expand your network, and increase your chances of discovering promising NFT investment opportunities.

6.4 Choose Quality over Quantity

When investing in NFTs, quality should take precedence over quantity. Instead of trying to accumulate a large number of low-value NFTs, focus on investing in high-quality assets with long-term value potential. By investing in fewer but higher-quality NFTs, you increase the chances of significant returns and appreciation.

6.5 Be Mindful of Scams and Frauds

The NFT market, like any emerging market, is not immune to scams and fraudulent activities. Be cautious and vigilant when investing in NFTs. Conduct thorough research on the seller or creator before making a purchase, verify the authenticity of the NFT, and be wary of deals that seem too good to be true. Remember, if something seems questionable, it’s better to walk away than risk becoming a victim of scams or frauds.

7. Potential Risks and Challenges in NFT Investing

While NFT investing can be exciting and profitable, it’s important to be aware of the potential risks and challenges involved.

7.1 Market Volatility and Uncertainty

The value of NFTs can be highly volatile and unpredictable. Fluctuations in demand, market trends, and overall sentiment can significantly impact the value of NFTs. Be prepared for potential losses or price corrections and consider a long-term investment approach.

7.2 Lack of Regulation and Legal Frameworks

Unlike traditional investment markets, the NFT market currently lacks comprehensive regulatory oversight and legal frameworks. This absence of regulation increases the risk of scams, counterfeit NFTs, and legal disputes. It’s important to research and educate yourself on relevant laws and regulations, as well as conduct due diligence when investing in NFTs.

7.3 Environmental Concerns

The energy consumption associated with blockchain technology, on which NFTs are built, has raised concerns about the environmental impact of NFTs. The carbon footprint of NFTs and their contribution to climate change is an ongoing topic of debate. Consider the environmental implications and explore platforms that prioritize sustainability and energy efficiency.

7.4 Intellectual Property and Copyright Issues

NFTs involving copyrighted content or intellectual property rights can be complex. Ensure that the NFT you are purchasing has the necessary permissions and rights from the original creator or owner. Copyright infringement or unauthorized use of intellectual property can lead to legal repercussions or loss of value.

This image is property of s3.cointelegraph.com.

8. Future Outlook and Potential of NFTs

The future of NFTs is filled with exciting possibilities and potential. Here are some areas where NFTs could have a significant impact:

8.1 Evolving Trends and Opportunities

NFTs have the potential to evolve and adapt to emerging trends and technological advancements. Virtual reality (VR), augmented reality (AR), and gaming are areas where NFTs can revolutionize ownership and digital interaction.

8.2 Integration of NFTs into Various Industries

NFTs are not limited to the art world. Industries such as music, sports, fashion, real estate, and even education are exploring the potential of NFTs. The integration of NFTs into these industries can unlock new revenue streams, customization options, and unique experiences for consumers.

8.3 Potential Impact on Art and Collectibles Market

NFTs have already made a significant impact on the art market, providing artists with new ways to monetize their creations and bypass traditional gatekeepers. NFTs have the potential to democratize the art world, allowing artists of all backgrounds to thrive and connect directly with collectors and fans.

9. NFT FAQs

To address common questions about NFTs, here are some frequently asked questions and their answers:

9.1 What is the difference between NFTs and Cryptocurrencies?

NFTs and cryptocurrencies are both built on blockchain technology but serve different purposes. Cryptocurrencies like Bitcoin and Ethereum are fungible, meaning one unit is interchangeable with another and has the same value. NFTs, on the other hand, are non-fungible and represent ownership of a unique digital item.

9.2 How are NFTs created?

NFTs are created using smart contracts deployed on blockchain platforms. Artists, creators, or developers can mint their digital assets into NFTs by using specific platforms and marketplaces. The minting process involves proving ownership, specifying the characteristics of the asset, and storing it on the blockchain.

9.3 How does ownership work with NFTs?

Ownership of an NFT is recorded on the blockchain, creating a transparent and immutable ownership history. The blockchain acts as a decentralized ledger that validates and verifies each transaction. As an NFT owner, you have proof of ownership and control over the digital asset.

9.4 How can NFTs be sold or traded?

NFTs can be sold or traded on various online marketplaces. By connecting your digital wallet to the marketplace, you can list your NFTs for sale at a fixed price or participate in auctions. Once a transaction is completed, the ownership of the NFT is transferred to the buyer, and the transaction is recorded on the blockchain.

10. Conclusion

Investing in NFTs can be an exciting and potentially lucrative venture, but it requires careful research, strategizing, and understanding of the market. By educating yourself on the world of NFTs, evaluating and selecting high-quality assets, and navigating reputable marketplaces, you can embark on your NFT investment journey with confidence. Remember to stay informed, be mindful of risks, and continually adapt your investment strategy as the NFT landscape evolves. With the right approach, investing in NFTs can be a rewarding and enjoyable experience.