When investing investors put their capital at risk. This risk changes according to events in the world. In particular, p2p investing is still a relatively new industry and thus is subject to more changes. Regulators, p2p lending platforms, borrowers, investors, loan demand, borrower choice and interest rates are agents...

Saving or investing? It’s a never-ending debate in personal finance management, especially now that many economies are struggling to recover from the Coronavirus pandemic. You probably have some money or are making enough money and have some left after expenses that you don’t know whether to save or invest.

We...

Step 1: Prepare yourself mentally and emotionally for your Financial Independence (FI) journey.

FI is not achieved in a day or a week, it is a multi-year process, an ultra marathon. FI will test your commitment and resilience. Body, Mind and Soul need to be committed to the success...

There are many different ways to invest money. They range from super easy and safe (a savings account), to more complex and risky (stocks and bonds). But there are some investments that should be avoided in all situations. Avoiding these kinds of investments will make it more likely you...

Buying a house is one of the most challenging undertakings for anyone. It’s not just about moving from one neighborhood to the other but also the financial management part. Most homebuyers seek financing to pay for a house, leading to a mortgage application.

Applying for a mortgage is not always...

For a young person in their 20s, fresh out of university with a new job, what do with extra money is the last thing they are thinking of. Retirement is years away, and plus first jobs rarely pay much. However, thinking about what to do with extra money is...

As an investor, sometimes seeking the advice or investment support of an experienced professional can help your investment journey. Among the available financial professionals, the difference between investment advisors and brokers confuse a lot of investors. Although both seem similar, the two professional fields are different; they operate under...

The Coronavirus pandemic is still raging through the globe. Companies are still struggling, people are losing jobs, and there’s no telling when the recovery period will start. There’s a need for people to spend wisely, now more than ever. Even if you still have your job, there’s no telling...

It is no secret that the Covid-19 pandemic has disrupted every aspect of our lives, leading to the loss of jobs and businesses' closure. One silver linings are how people have discovered the need to be self-employed or build multiple revenue streams. Many people have started businesses with all...

Investing your money and becoming financially independent begins with one simple step: saving money.

With a little bit of discipline and planning, you can easily save money on a daily basis. There’s no need to wait for your next paycheck or bonus. With these simple tips, you will be well...

Many people don’t like their corporate jobs and want to do something for themselves. Many other people complain that they are being underpaid for the amount of work they do. Joining another big corporate is an option, but it may not solve the underlying issues. The work may still...

Is financial independence worth pursuing?

What is the cost of financial independence?

Life is a zero-sum game because we have limited time. We can only do so much in the 15 hours we remain awake every day. This has to be subdivided between learning, the day job, family, and why not...

Verizon Media is hoping to target the next generation of spenders with its personal finance site Cashay.

Launched on Wednesday, the site will include information on money, managing finances, and preparing for the future, the company said in a statement.

"As the wealth gap continues to grow, financial literacy will be...

Americans are more satisfied than ever about their personal finances, according to a quarterly report by the American Institute of CPAs (AICPA).

The institute’s Personal Financial Satisfaction index reached an all-time high of 40.2 in the fourth-quarter of 2019, after plummeting to a record low in the prior quarter.

Personal Finance...

Not all p2p lenders are created the same. Each p2p lender has a different profile; investors need to find the right match between a p2p lender and their financial needs. How do investors select the right p2p lenders? This is a question I cannot answer for you, but I...

Increasing your financial wealth can be easy if you do it the right way. Treat money as your enemy, and it will show you no respect in return. But treat it as your friend, and it will be your greatest ally.

The money you have at this moment, whether it...

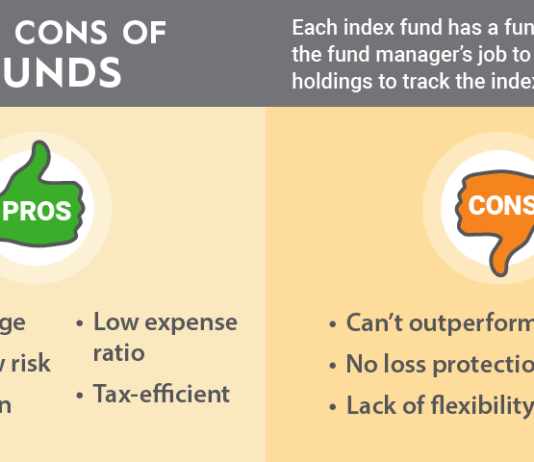

A blend / blended fund is an ETF or mutual fund investment that gives investors a chance to invest in value stocks and growth stocks. It’s one of the best investment strategies that allow you to diversify your portfolio, rather than investing in one of the strategies.

Growth vs. Value...

A comprehensive guide to investing in index funds for beginners. Learn the basics, tips, and strategies to make informed investment decisions. Take control of your financial future now!

So you have 1,000 Euros or 1,000 Dollars in your bank account and your fingertips are itching to do something with them. You know that the value of these 1,000 will diminish because of inflation and if you do not use them wisely in the short term - they...

When investing in real estate, it is good to know where to look for the best deals. Market listings are not the only option for this. Unfortunately, most beginner investors do not know that off-market properties often have better offers.

What Is An Off-Market Property?

Off-market properties or pocket listings are...