Becoming a landlord is not easy, if it was everyone would become one. There is risk involved.

Real estate investment is interesting because of the allure of “passive income”, the idea of owning an asset which can provide a positive yield indefinitely.

Real estate investing requires a lot of work upfront,...

Owning the land you stand on, gives a unique feeling, in a sense it is a hallmark of achievement. Ownership of a slice of mother earth is something men have worked and fought for throughout history.

The price of land varies because of properties such as location, rental income and...

Homegrown is a property development finance crowdfunding platform, retail investors can participate in property development projects by providing a slice of the financing that the developer needs to build the project. In this interview, Anthony Rushworth, CEO and Founder of HomeGrown explains more how this business model works and...

The German real estate market is attractive to investors because it has been more predictable in its yield, prices and regulation than other similar assets across the Western asset markets. This stability comes from the attitudes of Germans to real estate and Government laws to avoid property speculation and rent spike...

TheSunExchange is a solar panel purchase and lease platform. Investors buy solar panels, The SunExchange then leases them out to third parties. Purchasing solar cells can be done with either Bitcoin or the South African rand. Potentially, the income generated from this platforms gives investors a passive income stream...

GrandBaymeGrand Baymen Belize is a development which offers various investing opportunities for investors, Rachel Jensen is an agent for this project. In this interview, she explains the various investment opportunities available in a development project in Belize.

Can you briefly introduce yourself?

After spending a couple of weeks in Nicaragua in...

Brickvest review (as of 2/10/2016)

BrickInvest is a platform for p2p loans backed by real estate portfolios in various countries.

SWOT Analysis

Advantages

Mix of Mainland EU, UK and US based properties. This will help you achieve geographical diversity.

Interest rates of more than 5%

Investments based on property portfolio rather than...

Investing in Nicaragua Real Estate

Interview with Michael I. Hanyecz is a property Advisor, in this interview he discuss the investment opportunities at Gran Pacifica.

Can you briefly introduce yourself?

The Gran Pacifica Beach & Golf Resort is a residential community in Nicaragua, it offers the best of both worlds a North American...

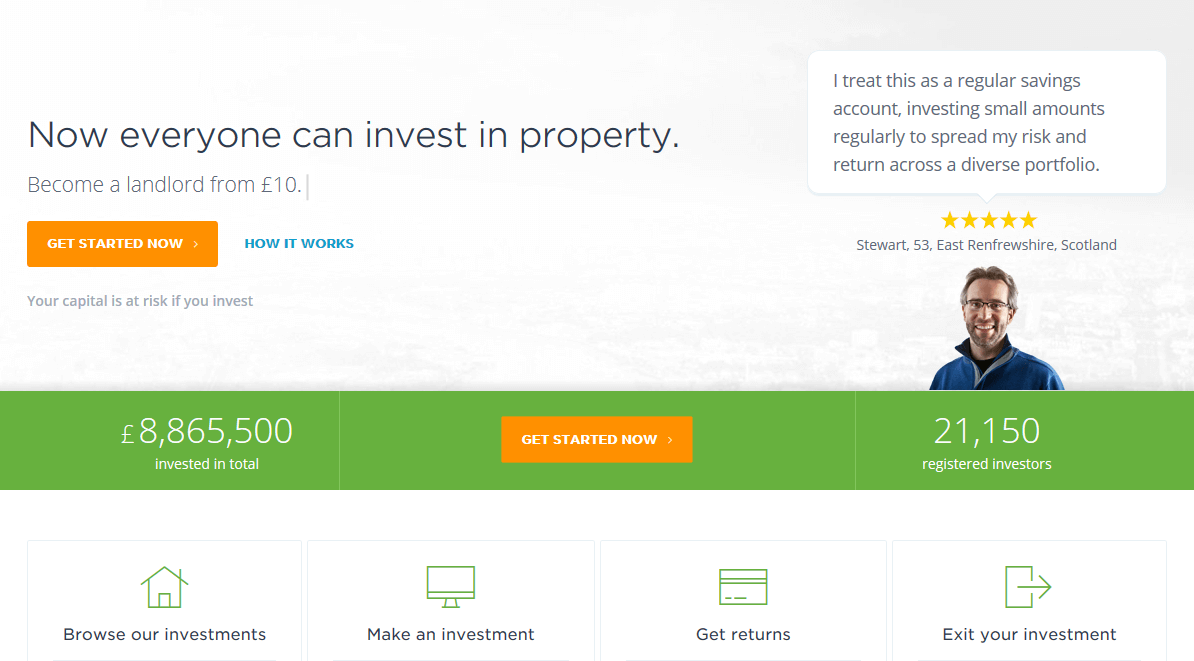

Crowd2let is a crowdfunding platform for investment properties. Keith Ivison Operations Director at Crowd2let explains how investors can access these opportunities.

What is Crowd2let?

Crowd2Let is a Property Crowdfunding portal facilitates investment in residential property.

Can you describe crowd2let in numbers?

Started in 2014 Crowd2Let have Crowdfunded 30+ properties raising more than £2m

What are the...

Property investments can strength a diversified portfolio. There are three ways to invest in the housing market, owning and renting a property directly (landlording), peer to peer (p2p) property equity platforms, property funds. This is a comparison between P2P vs Landlording vs Property funds, it will help you understand how...

CrowdEstate funds real estate projects through the investor crowd. Märt Meerits an associate at Crowdestate, explains what is CrowdEstate and what is its competitive advantage compared to other platforms.

What is Crowdestate?

Crowdestate is a real estate crowdfunding marketplace offering high-quality, pre-vetted real estate investment opportunities. Only the best investment opportunities survive...

Eric Teng is the CEO of CrowdTo. In this interview, he explains more about their peer to peer property investments, and how international investors can access this market.

Can you tell us about this history of the CrowdTwo?

We started CrowdTwo because we realise that even average working people would like...

Interview with Alex Shvayetsky, partner at Caviar.

What challenge is Caviar addressing?

Diversification for cryptocurrency + traditional investors: Caviar is pioneering a dual-purpose token and crowdfunding platform built on the Ethereum blockchain to offer access to a stable real estate and cryptocurrencies, with built-in downside protection and automatic diversification.

What is the...

8 Things to Consider When Investing in Rental Properties

If you are looking for new passive income streams, chances are good that you consider investing in real estate. And it should come as no surprise since buying income properties is considered one of the best ways of building passive income....

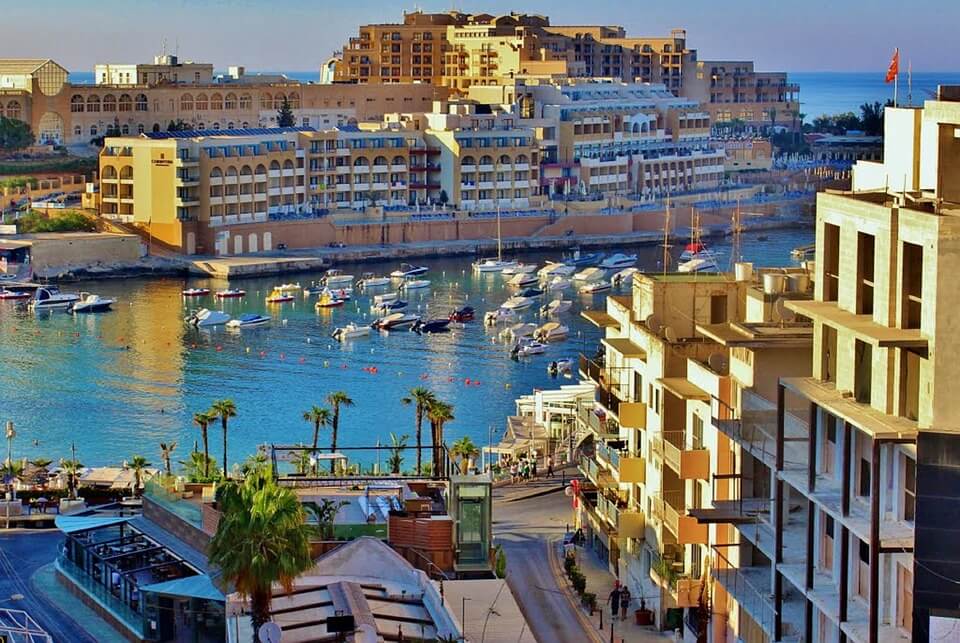

Malta (Europe) Commerical Real estate Investment Opportunities

Malta is a small island in the middle of the Mediterranean. In the last decade it has experienced significant growth, and the trend shows that it could become the Singapore or Hong kong of the Mediterranean.

Overview of the island's treasures

https://www.youtube.com/watch?v=3ZDDth-PShA

The Maltese economy

Malta...

In this article I will first discuss the Spanish real estate market, then I will discuss a way investors can participate in the Spanish real estate market.

Investing in Spanish property has become an attractive prospect in 2016. There are strong indications that the bust is over. House prices are...

Property Partner

Property Partner is a website which allows you to own a percentage of property assets.

SWOT Analysis

Strengths:

Hands of, no tenant fuss.

Sell your asset on their secondary market.

Liquidity.

Available to investors in the UK and EU (possibly worldwide?)

Weaknesses:

They feature quite some properties in London. (Is it in...

Disclaimer:

This is not financial advice this is an interview with Alt.Estate

The answers have been provided by Alt.Estate.

Investitin.com staff are not financial advisors; this is not financial advice.

This is not a buy, sell or hold recommendation of any assets mentioned in this interview.

Do your own research...

Disclaimer:

This is not financial advice this is our opinion.

Investitin.com staff are not financial advisors.

This is not a buy, sell or hold recommendation.

Do your own research before you invest in anything including this project.

This article/interview is not a suggestion or an endorsement of this ICO.

...

Property Moose Review

Property Moose property rental investments:

Property Moose finds suitable property investments and lists them on their site.

Registered investors can buy a number of shares in the investments. This is done by buying shares of the SPV (Special purpose vehicle) that owned the investment.

Investors earn dividends/rental from...