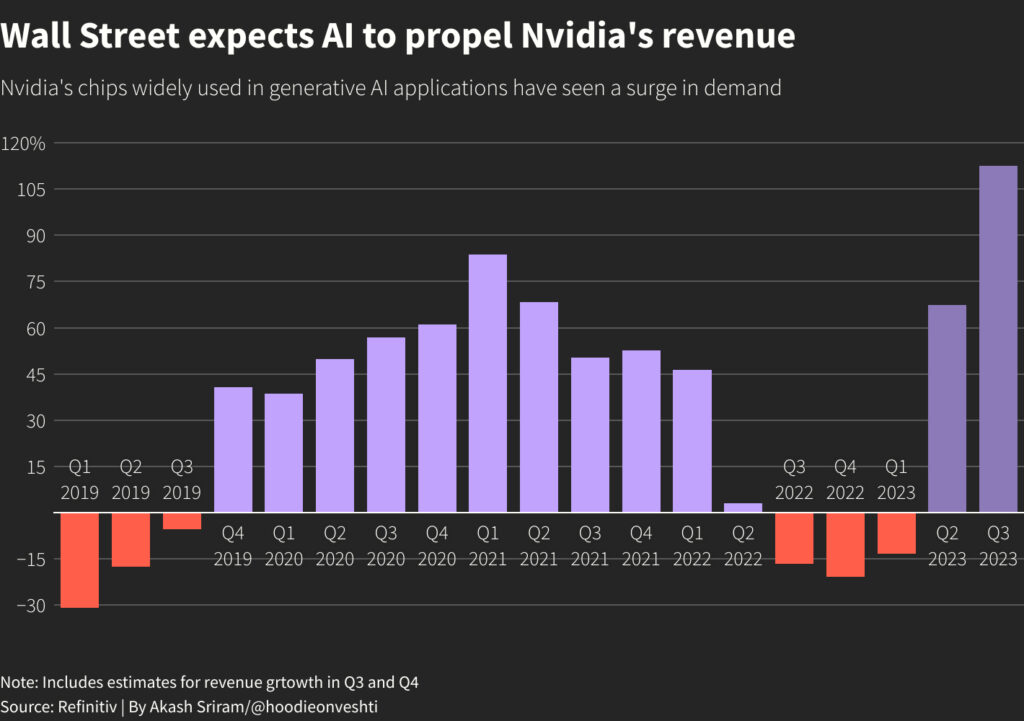

Nvidia has experienced extraordinary growth driven by the demand for artificial intelligence (AI). In its recent earnings report, the company revealed a staggering 101% year-over-year growth, with $13.5 billion in revenue for the quarter. This growth is largely attributed to the high demand for Nvidia’s GPU chips, which are essential for running large language models and other AI workloads. With data center compute revenue tripling year over year, Nvidia seems poised to sustain this growth as AI becomes increasingly prevalent in various industries. However, the example of Zoom’s recent growth slowdown serves as a reminder that even the most prosperous companies may face challenges in maintaining their momentum. It remains to be seen whether Nvidia can continue its upward trajectory in the long term.

Nvidia’s Astonishing Growth Driven by AI Demand

Nvidia, the leading GPU manufacturer, has experienced impressive growth in recent years, fueled largely by the increasing demand for artificial intelligence (AI) technology. With eye-popping earnings and significant year-over-year growth, Nvidia has positioned itself as a key player in the tech industry. But can Nvidia sustain this level of growth? Let’s take a closer look at the factors driving Nvidia’s success and examine the possibility of maintaining its momentum.

Nvidia’s Impressive Earnings

Nvidia’s recent earnings report has undoubtedly captured the attention of investors and industry experts alike. The company reported revenue of $13.5 billion for the quarter, a staggering 101% increase compared to the previous year. These numbers significantly surpassed Nvidia’s own guidance of $11 billion, signaling a remarkable performance that can’t be ignored.

The main driver behind these astonishing earnings is the growing demand for Nvidia’s GPU chips. These chips are in high demand for running large language models and other AI-driven workloads. As companies across various industries increasingly rely on AI technology, Nvidia has become a go-to choice for powerful and efficient GPU solutions.

The Role of AI in Nvidia’s Growth

It’s essential to understand the pivotal role that AI plays in Nvidia’s growth. AI technology has been transforming industries and revolutionizing the way businesses operate. From self-driving cars to language processing models, AI is becoming a crucial component of numerous applications.

Nvidia recognized the potential of AI early on and strategically positioned itself to capitalize on this emerging market. The company invested heavily in developing GPU technology optimized for AI workloads, putting it ahead of its competitors. As a result, Nvidia’s GPUs have become the industry standard for AI-related tasks, creating a significant revenue stream for the company.

Comparing Nvidia’s Growth to Zoom’s

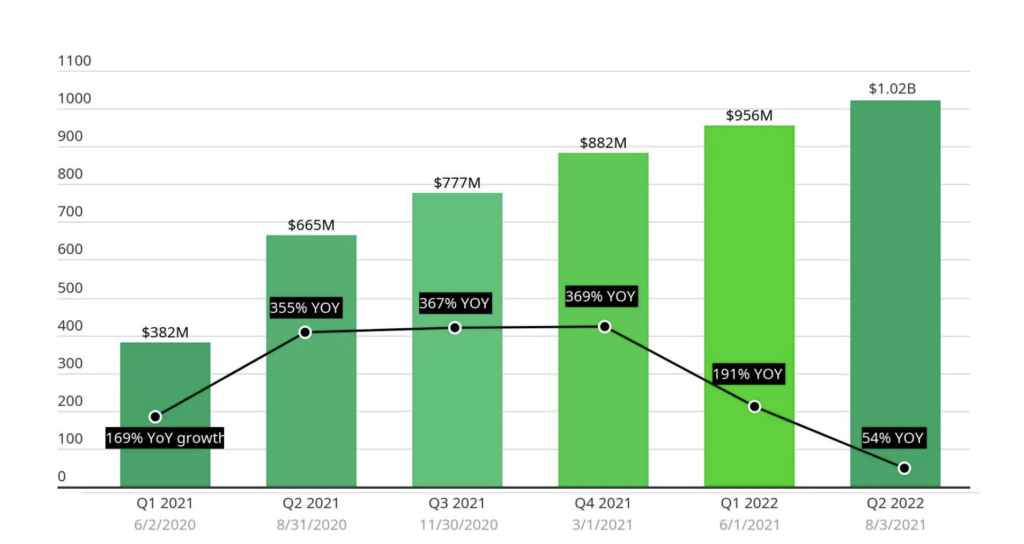

To gain a better perspective on Nvidia’s growth trajectory, it’s worth examining the case of Zoom, a video conferencing platform that experienced explosive growth during the pandemic. Zoom’s revenue soared during the lockdown period when companies worldwide relied on remote communication tools to keep their operations running smoothly.

However, Zoom’s growth rate has dramatically slowed down in recent quarters. While the company continues to grow, the pace of growth has diminished significantly. This raises an important question: Could Nvidia face a similar fate as Zoom?

The Future of Data Center Demand

One of the key factors driving Nvidia’s growth is the increasing demand for data centers. In today’s digital landscape, data centers play a critical role in housing and processing vast amounts of information. With the rise of AI and other compute-intensive applications, the need for data center resources has skyrocketed.

According to a Synergy Research report, web scalers are actively expanding their data center infrastructure, with plans to add over 300 new data centers in the coming years. This surge in data center growth presents a tremendous opportunity for Nvidia. As companies invest in resources to support AI workloads, Nvidia stands to benefit from the demand for its high-performance GPUs.

Nvidia’s Position in the Data Center Market

Nvidia’s strong position in the data center market is a significant factor contributing to its impressive growth. The company’s HGX platform, designed for generative AI models, has become increasingly popular among cloud service providers and large consumer internet companies.

The unique combination of Nvidia’s powerful GPU technology and the scalability of its HGX platform has made it a preferred choice for organizations in need of high-performance computing solutions. By cementing its position in the data center market, Nvidia has secured a stable and lucrative revenue stream.

CEO’s Optimism for Long-Term Growth

Nvidia’s CEO, Jensen Huang, remains optimistic about the company’s long-term growth prospects. During the post-earnings report call with analysts, Huang expressed his confidence in Nvidia’s ability to sustain its current level of growth.

Huang believes that the data center industry is in the midst of a long-term transition. With an estimated $1 trillion invested in data centers annually, capital spend is increasingly focused on accelerated computing and generative AI. According to Huang, these trends will continue to drive growth in the industry for years to come, with Nvidia at the forefront of this technological revolution.

The Possibility of Sustaining Growth

Despite the optimism surrounding Nvidia’s growth prospects, it’s essential to acknowledge the possibility of saturation and market dynamics that may eventually impact the company’s trajectory. History has shown that rapid growth often slows down over time. This is evident in the case of Zoom, which experienced a significant deceleration in growth rates after a period of explosive expansion.

While Nvidia’s position in the AI market is formidable, it’s important to monitor how the industry evolves and whether new competitors or technology advancements could disrupt Nvidia’s dominance. Additionally, changes in market demand and economic conditions could also influence Nvidia’s growth potential.

Lessons from Zoom’s Growth

Nvidia can draw valuable lessons from Zoom’s growth journey. While Zoom’s growth rate has diminished, the company has managed to retain its scale and continue growing, albeit at a slower pace. This demonstrates that sustaining growth, even if it slows down, is possible for businesses that adapt to changing market dynamics and maintain their relevance.

Nvidia can learn from Zoom’s ability to constantly innovate and expand its product offerings. By diversifying its portfolio and exploring new markets and applications for its GPU technology, Nvidia can mitigate the risks associated with potential slow growth in its core market segments.

The Potential Downside

While the future looks promising for Nvidia, it’s crucial to consider the potential downsides that could impact its growth trajectory. One factor to be mindful of is the rapid pace of technological advancements. The tech industry is notorious for disruptive innovations that can quickly change the competitive landscape.

To sustain its growth, Nvidia must remain at the forefront of technological advancements and continuously invest in research and development. Failure to adapt to new trends or emerging technologies could pose a significant threat to Nvidia’s market position.

Conclusion

Nvidia’s astonishing growth driven by the demand for AI technology has positioned the company as a prominent player in the tech industry. The increasing adoption of AI and the growing need for powerful computing solutions have created a fertile ground for Nvidia to thrive.

While the future looks promising, Nvidia must navigate the ever-changing landscape of technology and market dynamics to sustain its growth. By staying ahead of the curve, diversifying its offerings, and continuously pushing the boundaries of GPU technology, Nvidia can maintain its position as a leader in the data center market and drive long-term growth.