PeerStreet is a marketplace that provides unprecedented access to high-quality real estate loan investments. In this interview, Rebekah Jack, marketing manager at PeerStreet, answers my questions in great detail.

What does PeerStreet do?

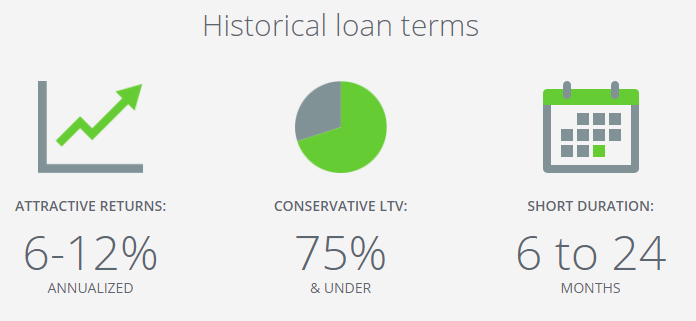

PeerStreet is a marketplace where investors can invest in real estate backed loans. We purchase loans from private lenders nationwide. These are short-term, high yield loans at 75% LTV or below and are backed by non-owner occupied properties. We curate these loans and make them available to accredited investors on our online platform. Investors can earn a 6-12% yield and lenders are able to free up their capital so that they can continue lending. PeerStreet is leveling the playing field between Main Street and Wall Street so that more people can have access to investing in this asset class.

Who are the founders of PeerStreet?

Our co-founders are Brew Johnson, Brett Crosby and Alex Perelman.

Brew Johnson worked as general counsel at VirtualTourist where he oversaw the company’s $85 million sale to Expedia/TripAdvisor. Before that, he was a real estate attorney at Allen Matkins Leck Gamble & Mallory and a technology attorney at Brobeck Phleger & Harrison. At Allen Matkins, Brew advised some of the largest real estate development and investment firms in the country on a wide variety of complex real estate transactions.

Brett Crosby was Director of Marketing at Google where he spent nearly 10 years managing many of Google’s most prominent products. Most notably, he co-founded Google Analytics, helped start Google’s mobile advertising business, ran the founding marketing team that launched Google+ and most recently ran the global marketing teams responsible for the dramatic growth of Chrome, Gmail, Docs and Drive. Before Google he co-founded Urchin Software Corporation, a web analytics service acquired by Google in 2005.

Alex Perelman has an extensive background in computer science, product development and entrepreneurial business. His experience includes roles at Electronic Arts and Activision, where he developed some of the world’s most successful video game franchises, including Call of Duty and Spiderman.

In which geographical areas / markets does PeerStreet operate? PeerStreet currently operates in about 30 states in the US and growing.

How is PeerStreet different from a REIT?

REITs are funds that typically invest in equity deals. You can’t choose what the fund invests in beyond a broad set of parameters. Private REITs often have high, front loaded fees.

PeerStreet empowers investors with the ability to customize a portfolio that’s as diverse as they’d like, by selecting properties across various geographical regions. In fact, we value making a diverse group of loans available across different markets, lenders, return rates, terms and LTVs. Beyond diversification, PeerStreet offers more flexibility and transparency than what’s available when you invest in a REIT.

Investors have the ability to self-select loan investments from pre-vetted opportunities and build portfolios of individual loans based on specific geographic regions, property types, loan maturities, etc. We provide important information about each property and its corresponding loan on the platform, encouraging investors to be familiar with their own investments. We also believe PeerStreet’s fee structure is generally less onerous than that of many REITs and allows investors to capture higher yields.

Furthermore, investors may be hard pressed to find a REIT that has a track record equivalent to PeerStreet. We are proud that we’ve had zero losses to date. One of the differences resides with our dedicated servicing and investment teams who move quickly to resolve late payment issues and defaults when they start to occur. We wrote an entire blog about this topic.

Can you describe PeerStreet in numbers?

We’ve funded $400+ Million in loans, we work with 100+ private lenders across the nation, we do business in 30+ states, we have 70+ employees and we are growing more and more. We have seen year over year growth of 400% and our average account size tends to triple in the first 3 months. Customers who were referred by a friend have accounts that are nearly twice the size of our typical account size. In the past 60 days, ~75% of all accounts ever funded made an investment, that’s an incredible statistic. So far we’ve sold almost 1000 loans and have had zero principal loss.

Who can open an account on PeerStreet?

Accredited investors which are either US residents or entities formed in the US which have a US social security or tax ID number can open an account on PeerStreet. We have many types of investors on the platform: high net worth individuals, family offices, and institutions. Our goal is to level the playing field between Wall Street and Main Street by allowing investors across the spectrum unprecedented access and diversification in this asset class.

What has been the average ROI in 2015 and 2016? (In %) For regulatory reasons, we are not able to publish extremely specific data points, but we can say that platform-wide, yields have historically ranged between 6-12%.

Is the interest paid monthly for all loans?

The documentation for each underlying loan requires interest to be paid monthly with a principal payment due upon maturity, but payments may be late or not made at all depending on the behavior of the specific borrower.

We work with a nationwide payment servicer, for the majority of our loan servicing. They are a 35 year old company that serviced the entire Fannie Mae portfolio. PeerStreet also has a Servicing and Finance team dedicated to all of our active loans. We have standard processes for distribution along with escalation and follow up at every potential late stage a borrower may fall into all the way up to potential foreclosure.

To date, we have dealt with two foreclosures out of nearly 1,000 loans and have experienced zero losses. While late payments aren’t uncommon in this space, a great majority of our loans have never had a late payment.

Currently, there is more demand for capital than supply, how does the queuing system determine who buys the available loans?

There are many variables to look at here. We’re currently posting 80+ loans a month. If you were to allocate $1k per loan, we expect you would be able to get $10k invested fairly quickly, depending upon the investment parameters you set up. The more broadly you apply Automated Investing settings, the more loans you will qualify for and the faster those funds will be allocated.

What is the fee structure for investors?

PeerStreet’s spread is typically 1%. This structure aligns PeerStreet with investors because we get paid alongside investors. PeerStreet also participates in origination fees, late fees and other borrower facing fees from time to time.

PeerStreet sources loans from various third parties. What makes this system interesting to the investors?

Our approach is designed to allow us to scale while maintaining quality to the end investor. We generally believe that local lenders make better credit decisions. So, instead of sourcing loans directly from borrowers, we prefer to work with existing lenders who lend in specific geographies. This allows us to leverage their local real estate market expertise and borrower relationships. These borrower-lender relationships have also proven advantageous in the event of a workout situation such as when a borrower has trouble paying or finishing a project. We then check their work with data, a manual underwrite, valuation, etc. Only once a loan passes our rigorous process do we make it available for investment.

The result for investors is a highly curated set of investments and unprecedented ability to diversify in a previously difficult to access asset class.

Co-founder and COO, Brett Crosby, has written about our approach in greater detail here : https://medium.com/@brettc/how-are-loans-like-sushi-e3320f3c726c

What is the % of loans accepted by PeerStreet?

Exact numbers fluctuate from month to month, but historically, we’ve accepted roughly half of the loans that have been submitted to our platform from our approved set of lenders.

Are loans presented with information such as loan to value, location and size of loan?

Yes, that information is provided to investors as well as originator name and experience, property valuation, comparable valuations, information about the borrower, payment terms, extension options, and an overview of the submarket.

How does PeerStreet verify this information?

Aside from all the data we use to verify that the loan makes sense, we have a team of real estate analysts who evaluate and underwrite each loan individually. We typically order our own valuation from a third party to verify the lender’s valuation before we purchase a loan.

For tax purposes, how is the income from PeerStreet is considered as income or capital gains?

PeerStreet investors are investing in a mortgage-pass-through security which is tied to an underlying loan, so it’s not interest income or capital gains. At the end of the year, PeerStreet sends a 1099 to each investor for the investor to then report the income on their tax returns as and when required by the IRS.

PeerStreet has an impressive track record, only two out of 1,000 notes has faced foreclosure and in that case investors had all their capital refunded.

What are the elements within PeerStreet that enable such an outstanding performance? Internally, we focus on maintaining a strong company culture. Externally, it’s our goal to serve our customers.

For more information please visit: Peer Street

We thank Rebekah Jack for the interview.