Reliance’s financial services unit, Jio Financial Services, has announced its plans to expand into the merchant lending and insurance sectors, aiming to revolutionize financial services in India. By adopting a digital-first approach, Jio Financial Services aims to simplify financial products, reduce costs, and provide easy access to every citizen through digital channels. The company also plans to offer simple, affordable, and innovative insurance products. Jio Financial Services will explore partnerships with global players and utilize predictive data analytics to create contextual products. With a strong capital foundation and a highly motivated leadership team, Jio Financial Services is well-positioned to transform the asset management industry and achieve tremendous success in the coming years.

Overview

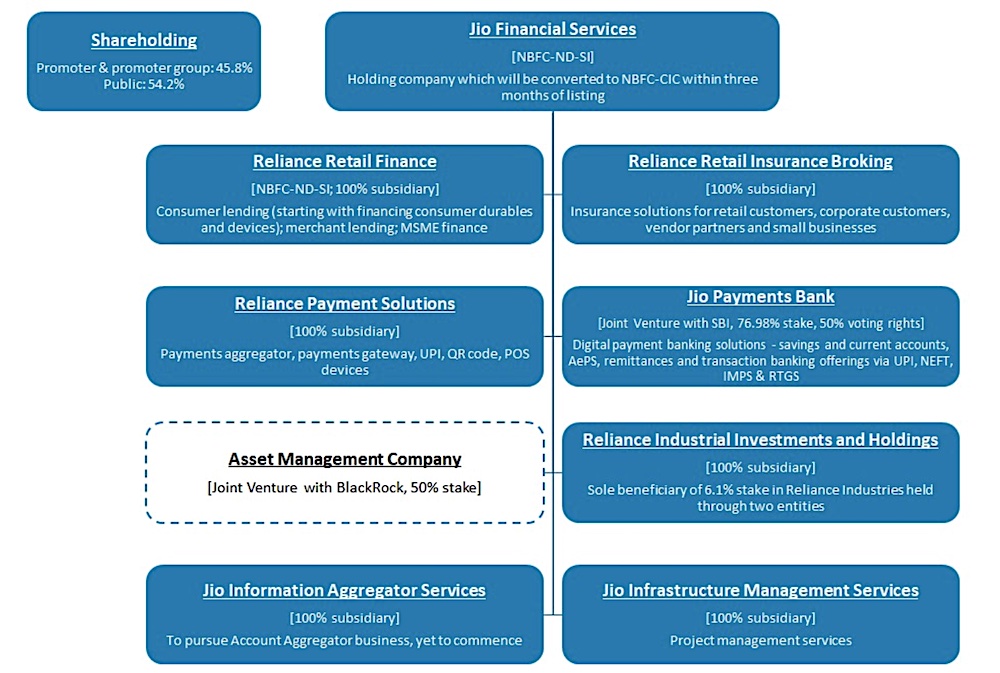

Jio Financial Services, the financial services unit of Reliance Industries, is set to expand its services in various areas. The company plans to enter the merchant lending and insurance segments and explore partnerships with global players. Additionally, Jio Financial Services will leverage predictive data analytics, explore blockchain-based platforms, and participate in central bank digital currency. This article will delve into the details of these expansions and discuss the company’s structure, reasons for optimism, and the leadership team.

Jio Financial Services to Expand Services

Introduction

Jio Financial Services, a subsidiary of Reliance Industries, aims to revolutionize the financial services industry in India. With a digital-first approach, the company plans to simplify financial products, reduce the cost of service, and expand its reach to every citizen through easily accessible digital channels. It seeks to democratize financial services for 1.42 billion Indians by providing simple, affordable, innovative, and intuitive products and services.

Expansion into Merchant Lending

One of the major expansions planned by Jio Financial Services is to venture into the merchant lending sector. The company aims to offer loans to tens of thousands of small and medium-sized enterprises (SMEs), merchants, and self-employed entrepreneurs. By analyzing the data obtained from its sound box payment system, Jio Financial Services can gain valuable insights into merchant behaviors. This data can then be used to offer loans based on individual creditworthiness, increasing accessibility to credit for businesses.

Entry into the Insurance Segment

Jio Financial Services also plans to enter the insurance segment. It aims to offer simple, smart life, general, and health insurance products through a seamless digital interface. By leveraging technology and data analytics, the company can provide personalized insurance solutions that cater to the specific needs of customers. This expansion into insurance will allow Jio Financial Services to further diversify its offerings and provide comprehensive financial services to its customers.

Exploring Partnerships with Global Players

To enhance its product offerings and expand its market reach, Jio Financial Services intends to explore partnerships with global players. By collaborating with established financial institutions and technology companies, Jio Financial Services can leverage their expertise and resources. These partnerships will enable the company to co-create contextual products that meet customer requirements in a unique and tailored manner. By leveraging the strengths of global players, Jio Financial Services can stay at the forefront of the rapidly evolving financial services landscape.

Use of Predictive Data Analytics

Jio Financial Services recognizes the power of predictive data analytics in delivering personalized and relevant financial products and services. By harnessing the massive amounts of data generated by its customer base, the company can gain valuable insights into customer behavior, preferences, and needs. These insights can then be used to develop innovative and customized financial solutions. By using predictive data analytics, Jio Financial Services can anticipate customer requirements and provide them with products and services that meet their evolving needs.

Joint Venture with BlackRock

Jio Financial Services has formed a joint venture with BlackRock, a leading global investment management corporation. This partnership aims to transform the asset management industry by introducing a full-service tech-enabled asset manager. By offering affordable and transparent investment products, Jio Financial Services and BlackRock aim to meet the investment needs of every segment of society. With BlackRock’s expertise and Jio Financial Services’ digital-first approach, this joint venture has the potential to drive significant growth and disruption in the asset management industry.

Exploration of Blockchain-based Platforms

Jio Financial Services is actively exploring the potential of blockchain-based platforms in various aspects of its operations. Blockchain technology offers enhanced security, transparency, and efficiency, making it an ideal solution for financial services. By leveraging blockchain, Jio Financial Services can streamline processes, reduce costs, and enhance trust in its operations. This exploration of blockchain-based platforms highlights Jio Financial Services’ commitment to adopting innovative technologies that benefit both the company and its customers.

Participation in Central Bank Digital Currency

As the financial services industry moves towards digitalization, Jio Financial Services aims to be at the forefront of this transformation. The company plans to actively participate in the development and implementation of central bank digital currency (CBDC). By leveraging CBDC, Jio Financial Services can offer faster, more secure, and cost-effective financial transactions. This participation in CBDC showcases Jio Financial Services’ commitment to embracing emerging technologies and driving the digital revolution in the financial services sector.

Jio Financial Services Company Structure

Ownership in Reliance

Jio Financial Services owns 6.1% of Reliance, highlighting its strong association with the parent company. This ownership represents the commitment and support of Reliance Industries towards Jio Financial Services’ growth and success. It provides Jio Financial Services with a solid foundation and access to the resources of Reliance Industries, further strengthening its position in the financial services industry.

Capital Intensity of the Sector

The financial services industry is known for its capital-intensive nature, requiring substantial investment to establish and operate. Jio Financial Services recognizes this and has capitalized itself with a net worth of Rs 1,20,000 crore, making it one of the world’s highest capitalized financial service platforms at inception. This strong capital foundation enables Jio Financial Services to build a best-in-class, trusted financial services enterprise and achieve rapid growth.

Capital Foundation and Net Worth

Jio Financial Services’ capital foundation and net worth provide the company with a solid financial base to support its ambitious expansion plans. With a net worth of Rs 1,20,000 crore, Jio Financial Services has the financial strength and stability to weather market fluctuations and drive long-term growth. This capital foundation enables the company to invest in cutting-edge technology, develop innovative products, and pursue strategic partnerships, positioning it for success in the competitive financial services industry.

Strong Board and Leadership Team

Jio Financial Services is blessed with a strong board led by Shri K.V. Kamath, a veteran and highly respected banker. The board brings a wealth of experience and expertise in the financial services industry, guiding the strategic direction and decision-making of the company. Additionally, Jio Financial Services is building a highly motivated leadership team comprising financial industry experts and young leaders who are eager to take on big challenges. This combination of experience and enthusiasm ensures that Jio Financial Services has the right leadership to drive its vision and achieve tremendous success.

Reasons for Optimism

Digital-first Architecture

One of the key reasons to be optimistic about Jio Financial Services is its digital-first architecture. By adopting a digital-first approach, the company gains a significant advantage in reaching millions of Indians. In a country where internet penetration is rapidly increasing, Jio Financial Services can leverage digital channels to provide accessible and convenient financial services to a wide customer base. This digital-first architecture enables Jio Financial Services to overcome traditional barriers and revolutionize the way financial services are delivered in India.

Capital Intensity

Despite the capital-intensive nature of the financial services industry, Jio Financial Services has a strong capital foundation to support its growth. With a net worth of Rs 1,20,000 crore, the company has the financial resources to invest in technology, infrastructure, and talent. This capital intensity allows Jio Financial Services to scale its operations rapidly, expand its product offerings, and explore new opportunities. The strong capital base also instills confidence in investors and stakeholders, further fueling the company’s growth and success.

Strong Board and Leadership Team

Jio Financial Services’ strong board and leadership team provide another reason for optimism. Led by Shri K.V. Kamath, the board brings extensive experience and a deep understanding of the financial services industry. With their guidance and strategic oversight, Jio Financial Services can navigate challenges and seize opportunities effectively. Additionally, the motivated leadership team comprising industry experts and young leaders brings fresh ideas, energy, and innovation to the company. This strong board and leadership team ensure that Jio Financial Services is well-positioned to overcome obstacles and achieve its ambitious goals.

Conclusion

Jio Financial Services, a subsidiary of Reliance Industries, is set to expand its services and revolutionize the financial services industry in India. Through its digital-first approach, the company aims to simplify financial products, reduce costs, and provide accessible financial services to every citizen. With expansions into merchant lending and insurance, partnerships with global players, use of predictive data analytics, exploration of blockchain-based platforms, and participation in central bank digital currency, Jio Financial Services is poised for tremendous success. Supported by a strong capital foundation, a robust board, and a motivated leadership team, Jio Financial Services is well-positioned to drive innovation, disrupt the industry, and create meaningful impact in the lives of millions of Indians.