Interview with Rode Luhaäär CEO & Co-founder of Paytailor

What is Paytailor?

Paytailor facilitates payments between merchants and customers, through standard devices and banks accounts, skipping the bank card infrastructure.

Paytailor payment platform provides accessibility beyond imagination combined with a powerful tool for marketing, creating a completely new, cost-effective and simple user experience for both, merchant and the customer.

What service does Paytailor offer to merchants?

Key advantages:

- Easy to adopt

- Low-cost payment solution that replaces card payment infrastructure

- Helpful tool to increase customer loyalty by built-in rewards and benefits solution.

Rode Luhaäär - Send messages or notifications for loyalty rewards, discounts, location based offers for users who opt in

- Point of sale payment

- Merchant has the opportunity to choose the way of accepting the payment. This can be done from smartphone, tablet or desktop. Once the merchant signs up with Paytailor, they can immediately start accepting payments. Mobile terminal can be taken to everywhere, allowing to accept payments wherever needed, either at outdoor events or on the go.

- In-app e-commerce: Paytailor built an e-Commerce platform on top of our mobile payments solution.

- Internet of things solution: Once the device is connected to the internet, Paytailor’s platform enables it to accept payments. Clearly, the device must provide a service or deliver a product.

For example, think of a restaurant, where customers typically order from a physical menu. With Paytailor, the restaurant can load the menu onto their e-commerce site, allowing the customers to order items from the app, and then paying directly from the app. Using a hybrid process, customers receive better service, while enabling waiters to get to more customers, faster.

Can you describe Paytailor in numbers?

Paytailor have processed 3263 payments and we have 2185 users and over 100 sale points live. Paytailor has already agreed additional 200 places, where to pay with Paytailor.

How many merchants are currently using Paytailor, are they concentrated in a particular geographic area?

Currently, Paytailor is operating in Estonian market, which is the home market. Paytailor has been operating for two years and during that time, the flexibility of the platform, as well of the products have been developed based on merchant feedback and real bottlenecks merchants are facing. This means Paytailor has been first and foremost focused on the development of the product. In Estonian market, Paytailor accepts payments in 117 sales points and increasing. Key focus on sales is on large chains, who enable more extensive scaling.

Paytailor has established a subsidiary in UK, as the first external market. Nevertheless, Paytailor sees several opportunities and interest across Europe for scaling.

What is the difference in fees between PayTailor and traditional merchant systems?

Paytailor is the only solution to skip the card payment infrastructure entirely. This means the merchant does not need integrations, additional devices nor create new bank accounts. Payment is being done over cloud, enabling the merchant and customer to carry out the transaction app-to-app with existing payment method and device.

E-commerce and IoT solutions offer greater efficiency but also open new opportunities for increasing their sales. In addition to the seemingly working payment, allowing to build new user experience via in-platform loyalty and marketing tools.

Will the PayTailor client also accept cryptocurrencies?

Paytailor payment platform acts as a payment aggregator, enabling to add any number of payment methods. This allows the customer to choose the desirable method. Current ICO is aimed at adding cryptocurrencies to Paytailor payment methods. Most importantly, this will help tremendously bringing cryptocurrencies into wider use.

Why does PayTailor need to issue an ICO? What are the advantages of the capital injection vs the loss of revenue?

Paytailor has launched an ICO aimed at creating more accessibility and allow people to pay in a way most cost-effective and suitable for them. While repaid scaling is essential for Paytailor, the key purpose of the ICO is to make cryptocurrencies widely used adding cryptocurrencies as a payment method to Paytailor mobile wallet.

As the concept has proven itself then capital injection creates significant scaling option. Sharing profit is possible because we are operating company at a reasonable cost.

What is the valuation of PayTailor with the current ICO setup? How was this figured calculated?

Paytailor company valuation has been confirmed over 2,467,000 $ It is calculated by existing VC’s, which is confirmed with real investments.

Will the token holders be entitled to revenue or profits?

Token holders can earn from trading and company profits.

What percentage of company profits will the token holders be entitled to?

10%

Can a PoS solution be more than just a transaction platform between a client and a merchant?

Yes. In addition to the payment that works seemingly in PoS, Paytailor is a helpful tool to increase customer loyalty by built-in rewards and benefits solution. Paytailor allows sending messages or notifications for loyalty rewards, discounts, location-based offers for users who opt-in.

Named solutions offer greater accessibility, efficiency and opportunities for growth to merchants, in addition to being a useful tool to create a mutually beneficial relationship with the customers.

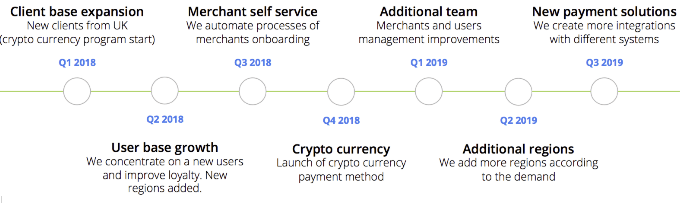

What is the roadmap of PayTailor for the next 18 months?

Would you like to add further information?

Please see some of the examples of payment solutions in videos:

More information:

Website: https://www.paytailor.com/en/

IoT payment in vending machine: https://www.youtube.com/watch?v=ThzcTuvyyB4

IoT payment in coffee machine: https://youtu.be/6zQgqXsIpkc

API integrated solution in taxi: https://www.youtube.com/watch?v=3whMnrPtHeI

PoS (app-to-app) payment: https://www.youtube.com/watch?v=E28fpeK-8Oo

We thank Rode Luhaäär for the interview.