Are you curious about investing in Bitcoin but don’t know where to start? Look no further! In this beginner’s guide, we will walk you through the steps of investing in Bitcoin, ensuring that you have the knowledge and confidence to get started.

To begin, it is important to understand the basics of Bitcoin and how it works. Bitcoin is a decentralized digital currency that operates on a technology called blockchain. This means that transactions are recorded on a public ledger, ensuring transparency and security. To invest in Bitcoin, you will need to create a digital wallet, which is where you will store your Bitcoin securely. There are various wallet options available, so it’s essential to choose one that suits your needs. Once you have set up a wallet, you can purchase Bitcoin through a digital currency exchange platform. It’s important to do thorough research on different exchange platforms to find one that is reputable and offers the features you desire. Remember to always invest what you can afford to lose and to stay informed about the market trends. By following these steps, you will be well on your way to investing in Bitcoin and potentially reaping the rewards of this exciting digital currency phenomenon. Happy investing!

This image is property of Amazon.com.

Understanding Bitcoin

What is Bitcoin?

Bitcoin is a digital currency that was created in 2009 by an anonymous person or group of people using the name Satoshi Nakamoto. It operates on a decentralized network known as the blockchain, which allows for secure and transparent transactions without the need for intermediaries such as banks. Unlike traditional currencies, Bitcoin is not issued or controlled by any government or central authority.

How does Bitcoin work?

Bitcoin works through a technology called blockchain, which is a public ledger that records all Bitcoin transactions. When someone makes a Bitcoin transaction, it is verified by a network of computers called miners. These miners solve complex mathematical problems, add the transaction to the blockchain, and receive a reward in the form of newly created Bitcoins.

Bitcoin transactions are also secured through cryptography. Each user has a unique digital signature that proves their ownership of the Bitcoin they are transferring. This ensures that transactions are authentic and cannot be altered or reversed.

Why consider investing in Bitcoin?

There are several reasons why people consider investing in Bitcoin. Firstly, Bitcoin has the potential for high returns. In the past, the price of Bitcoin has shown significant volatility, allowing early investors to make substantial profits. Secondly, Bitcoin provides an alternative form of investment that is not tied to traditional financial markets. This can be appealing to individuals looking to diversify their portfolios. Finally, Bitcoin offers the possibility of being at the forefront of a technological revolution. As cryptocurrency and blockchain technology continue to grow, investing in Bitcoin can be seen as an opportunity to be part of this innovation.

Getting Started with Bitcoin Investment

Setting up a Bitcoin Wallet

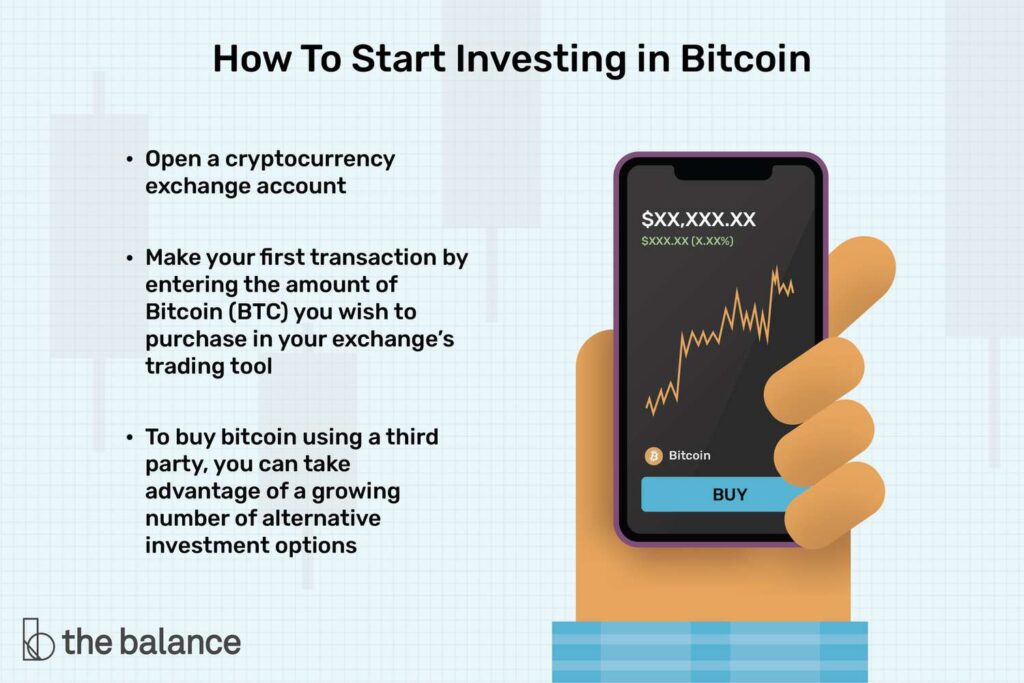

Before you can start investing in Bitcoin, you need to set up a Bitcoin wallet. A Bitcoin wallet is a digital wallet that allows you to store, send, and receive Bitcoin. There are various types of wallets available, including online wallets, hardware wallets, and mobile wallets. Each type has its own advantages and security considerations, so it is important to choose a wallet that suits your needs.

To set up a Bitcoin wallet, you can download a wallet application or sign up for an online wallet service. Once you have set up your wallet, you will be assigned a unique address, which you can use to send and receive Bitcoin.

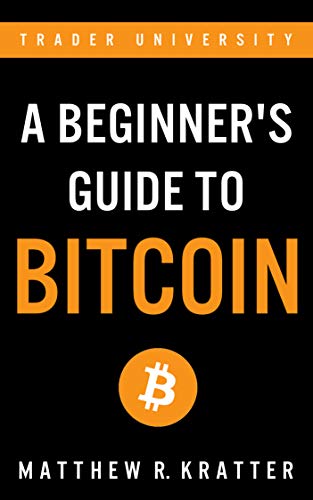

Choosing a Bitcoin Exchange

After setting up a wallet, the next step is to choose a Bitcoin exchange. A Bitcoin exchange is a platform where you can buy and sell Bitcoin using fiat currency or other cryptocurrencies. When selecting an exchange, it is important to consider factors such as security, reliability, fees, and available trading options.

Some popular Bitcoin exchanges include Coinbase, Binance, and Kraken. It is advisable to research different exchanges and read user reviews before making a decision.

Verifying your Identity

In order to comply with legal requirements, many Bitcoin exchanges require users to verify their identity before they can start trading. This process usually involves providing documents such as a passport or driver’s license and proof of address. Verification helps prevent money laundering and other illegal activities on the exchange.

To verify your identity, you will typically need to complete a Know Your Customer (KYC) process. This may involve filling out an online form, submitting the required documents, and waiting for approval from the exchange.

Securing your Bitcoin

Securing your Bitcoin is crucial to protect your investment from theft or loss. There are several security measures you can take to enhance the safety of your Bitcoin holdings.

Firstly, it is recommended to enable two-factor authentication (2FA) on your Bitcoin wallet and exchange accounts. 2FA adds an extra layer of security by requiring a secondary verification step, such as a unique code sent to your mobile device.

Additionally, you should consider storing the majority of your Bitcoin in a cold wallet, which is a wallet that is not connected to the internet. This reduces the risk of hacking or online attacks. It’s also important to regularly update your wallet and exchange software to benefit from the latest security patches.

This image is property of stashlearn.wpengine.com.

Analyzing Bitcoin Market

Understanding Market Trends

To invest wisely in Bitcoin, it is essential to understand market trends and factors that can influence Bitcoin’s price. Market trends refer to the general direction or sentiment of the Bitcoin market over a specific period of time. By analyzing trends, investors can make informed decisions about when to buy or sell Bitcoin.

To identify market trends, investors often use technical analysis. This involves studying price charts, patterns, and indicators to predict future price movements. It is important to note that market trends can be influenced by various factors, such as market demand, news events, and regulatory changes.

Evaluating Bitcoin’s Price

Evaluating Bitcoin’s price involves examining its current value and historical performance. By analyzing price patterns and market data, investors can gain insights into the potential future direction of Bitcoin’s price.

There are several metrics used to evaluate Bitcoin’s price, including market capitalization, trading volume, and price volatility. Market capitalization refers to the total value of all Bitcoins in circulation and is often used as an indication of Bitcoin’s overall worth. Trading volume represents the number of Bitcoins traded on a daily basis, while price volatility measures the degree of price fluctuations.

Identifying Market Indicators

Market indicators are tools that help investors assess the health and direction of the Bitcoin market. They provide insights into market sentiment, investor behavior, and potential price movements. Common market indicators include moving averages, relative strength index (RSI), and Bollinger Bands.

Moving averages are used to identify trends and potential support and resistance levels. RSI is a momentum indicator that measures the speed and change of price movements. Bollinger Bands indicate potential overbought or oversold conditions.

Performing Fundamental Analysis

Fundamental analysis involves evaluating a cryptocurrency based on its intrinsic value and underlying factors. In the case of Bitcoin, fundamental analysis considers factors such as adoption rate, network security, and technological advancements.

Investors can assess Bitcoin’s adoption rate by looking at the number of users, merchants accepting Bitcoin, and overall network activity. Network security is determined by analyzing the strength and resilience of the blockchain network. Technological advancements can include upgrades to the Bitcoin protocol or the development of new applications and use cases.

Creating an Investment Strategy

Setting Financial Goals

When investing in Bitcoin or any other asset, it is important to set clear financial goals. Financial goals can help guide your investment decisions and determine the amount of risk you are willing to take.

Consider factors such as your investment timeframe, desired return on investment, and your overall financial situation. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals can help you stay focused and motivated throughout your investment journey.

Determining Risk Tolerance

Risk tolerance refers to your willingness and ability to tolerate potential losses in pursuit of potential gains. When investing in Bitcoin, it is crucial to assess your risk tolerance and choose an investment strategy that aligns with your comfort level.

Factors that can influence risk tolerance include your age, investment goals, financial stability, and investment expertise. Conservative investors may prioritize capital preservation and opt for a more cautious approach, while aggressive investors may be comfortable taking on higher risks in pursuit of higher returns.

Allocating Funds

Allocating funds involves determining how much of your investment portfolio you will allocate to Bitcoin. This decision depends on various factors, including your risk tolerance, financial goals, and overall portfolio diversification.

Financial experts recommend diversifying your investment portfolio across different asset classes to reduce risk. Bitcoin can be considered as part of a broader investment strategy that includes stocks, bonds, real estate, and other assets.

Diversifying your Portfolio

Diversifying your portfolio is an important risk management strategy when investing in Bitcoin. By diversifying, you spread your investment across different assets, which can help mitigate potential losses and reduce overall volatility.

In addition to Bitcoin, consider investing in other cryptocurrencies, such as Ethereum or Litecoin. You can also explore traditional assets, like stocks, bonds, or real estate. Diversification helps to balance your investment portfolio and potentially maximize your returns.

This image is property of www.thebalancemoney.com.

Managing Bitcoin Investments

Monitoring Market Performance

To effectively manage your Bitcoin investments, it is crucial to regularly monitor the performance of the Bitcoin market. Stay informed about market trends, news events, and regulatory developments that could impact Bitcoin’s price and overall market sentiment.

Monitoring market performance can involve tracking Bitcoin’s price movements, trading volume, and market capitalization. Stay updated with market analysis and news updates from reliable sources to make informed decisions.

Tracking Portfolio Returns

Tracking portfolio returns is essential to evaluate the performance of your Bitcoin investments. Compare your returns to the performance of other assets in your portfolio and relevant market benchmarks. By tracking portfolio returns, you can assess the effectiveness of your investment strategy and make necessary adjustments.

Several portfolio tracking tools and platforms are available that allow you to track the value and performance of your Bitcoin holdings. These tools often provide comprehensive analytics and performance metrics to help you make informed investment decisions.

Implementing Stop-Loss Orders

Stop-loss orders are risk management tools that help protect your investments from significant losses. A stop-loss order allows you to set a predetermined price at which you want to sell your Bitcoin if its price drops below a certain level.

By implementing stop-loss orders, you can minimize potential losses and preserve capital. Stop-loss orders ensure that your Bitcoin holdings are automatically sold if the price reaches a specified threshold, reducing the need for constant monitoring.

Rebalancing your Investments

Rebalancing your investments involves periodically adjusting the allocation of your investment portfolio to maintain your desired risk and return profile. As the value of Bitcoin and other assets fluctuate, your portfolio’s asset allocation can deviate from your original strategy.

Regularly reviewing and rebalancing your investments allows you to sell assets that have appreciated in value and purchase assets that may be undervalued. This helps to maintain the desired asset allocation and maximize the potential for long-term growth.

Staying Informed

Following Bitcoin News

To stay informed about the latest developments in the Bitcoin market, it is essential to follow Bitcoin news from reputable sources. Stay updated with news regarding regulatory changes, technological advancements, and market trends that can impact the price and adoption of Bitcoin.

Reputable sources can include financial news websites, cryptocurrency news platforms, and official announcements from Bitcoin-related organizations. Be cautious of misinformation or sensationalized news and prioritize reliable and unbiased sources.

Joining Online Communities

Joining online communities can provide valuable insights and discussions about Bitcoin investments. Platforms such as forums, social media groups, and online communities dedicated to cryptocurrencies can facilitate learning and sharing of information.

Engaging with other Bitcoin enthusiasts and investors can provide new perspectives and help you stay up to date with the latest trends and developments in the Bitcoin community. Participate in discussions, ask questions, and share your own experiences to enhance your knowledge and understanding.

Attending Crypto Conferences

Attending crypto conferences and events can be a great way to expand your knowledge and network with industry professionals. These conferences often feature keynote speeches, panel discussions, and workshops that cover various aspects of Bitcoin and cryptocurrency investments.

By attending crypto conferences, you can gain insights from experts, learn about the latest trends and innovations, and connect with like-minded individuals. Look for conferences and events that align with your interests and investment goals.

Engaging with Industry Experts

Engaging with industry experts can provide valuable guidance and insights when investing in Bitcoin. Seek out experts who have a deep understanding of cryptocurrencies, blockchain technology, and investment strategies.

You can engage with industry experts through online platforms, podcasts, webinars, or by attending workshops or seminars. By learning from experienced professionals, you can gain valuable knowledge and make more informed investment decisions.

This image is property of scholarlyoa.com.

Minimizing Risks and Pitfalls

Avoiding Ponzi Schemes

When investing in Bitcoin, it is essential to be aware of the potential risks associated with Ponzi schemes. Ponzi schemes are fraudulent investment operations that promise high returns but rely on new investors’ money to pay previous investors.

To avoid Ponzi schemes, conduct thorough research on any investment opportunities and be cautious of unrealistic promises or guaranteed profits. Stick to reputable exchanges and investment platforms that comply with regulatory requirements and have a transparent track record.

Recognizing Phishing Attempts

Phishing attempts can pose a significant risk to your Bitcoin investments. Phishing is a fraudulent practice where scammers try to deceive individuals into revealing sensitive information, such as login credentials or private keys.

To protect yourself from phishing attempts, be cautious of suspicious emails, messages, or websites that ask for personal information. Always verify the authenticity of communication channels before providing any sensitive data.

Being Cautious of Volatility

Bitcoin’s price is known for its volatility, which means it can fluctuate significantly in a short period. While volatility can present opportunities for profit, it also carries risks. Bitcoin’s price can be influenced by various factors, including market sentiment, regulatory changes, and technological advancements.

Being cautious of volatility involves understanding the potential risks associated with sudden price movements and being prepared for potential losses. Consider your risk tolerance and investment goals and develop strategies to mitigate the impact of volatility on your portfolio.

Keeping Personal Information Secure

When investing in Bitcoin, it is essential to prioritize the security of your personal information. This includes safeguarding your login credentials, private keys, and any other sensitive data associated with your Bitcoin investments.

Use strong and unique passwords for your Bitcoin wallet and exchange accounts. Enable two-factor authentication whenever possible. Regularly update your software and utilize reputable security measures, such as firewalls and antivirus software.

Taxation and Legal Considerations

Understanding Tax Regulations

When investing in Bitcoin, it is important to understand the tax regulations and reporting requirements in your jurisdiction. Tax obligations can vary depending on factors such as the duration of your investment, the amount of profit made, and the local tax laws.

Consult with a tax professional or seek guidance from relevant government authorities to ensure compliance with tax regulations. Keep records of your Bitcoin transactions, including purchases, sales, and any relevant fees, as they may be required for tax reporting purposes.

Reporting Bitcoin Investments

In many jurisdictions, Bitcoin investments are subject to taxation, and it is important to accurately report your investments and any associated income or capital gains. Failure to report Bitcoin investments can result in penalties or legal consequences.

Be aware of the reporting requirements in your jurisdiction and ensure that you properly report any income or gains from your Bitcoin investments. Consult with a tax professional for guidance on the specific reporting obligations in your country.

Complying with Anti-Money Laundering Laws

Bitcoin investments are subject to anti-money laundering (AML) laws and regulations in many jurisdictions. AML laws are in place to prevent illicit activities, such as money laundering and terrorist financing.

When investing in Bitcoin, it is important to comply with AML laws, which may include verifying your identity, reporting suspicious transactions, and adhering to know-your-customer (KYC) requirements. Familiarize yourself with the AML regulations applicable to your jurisdiction and ensure compliance to avoid legal repercussions.

Seeking Professional Advice

Given the complex nature of Bitcoin investments and the legal and tax considerations involved, it is advisable to seek professional advice. Consult with a financial advisor, tax professional, or legal expert who specializes in cryptocurrencies and can provide guidance tailored to your specific circumstances.

Professional advice can help you navigate the complexities of Bitcoin investments, ensure compliance with legal and tax regulations, and make informed investment decisions.

This image is property of coinsutra.com.

Future Outlook of Bitcoin

Predictions and Speculations

The future outlook of Bitcoin is a topic of ongoing debate and speculation. Various experts, analysts, and investors have different predictions about Bitcoin’s future price and its role in the global financial system.

Some proponents of Bitcoin believe that its price will continue to rise, driven by increased adoption, institutional investment, and advancements in blockchain technology. Others argue that Bitcoin’s value may be subject to significant volatility and regulatory challenges.

As with any investment, it is important to approach predictions and speculations with caution and conduct thorough research before making investment decisions.

Potential for Mainstream Adoption

Bitcoin has the potential for mainstream adoption as a form of alternative currency and a store of value. As more individuals, merchants, and institutions recognize the benefits and utility of Bitcoin, its adoption may increase.

Factors that can contribute to mainstream adoption include regulatory clarity, technological advancements, and increased understanding and acceptance of cryptocurrencies among the general population. However, widespread adoption is not guaranteed and may take time to fully materialize.

Impact of Technological Advancements

Technological advancements in the field of cryptocurrencies and blockchain technology can significantly impact the future of Bitcoin. Innovations such as scalability solutions, privacy-enhancing features, and interoperability with other blockchain networks can enhance Bitcoin’s functionality and usability.

Advancements in technology can also address concerns such as transaction speed and cost, making Bitcoin more practical for everyday use. It is important to stay informed about technological developments and their potential impact on Bitcoin’s future.

Government Regulations and Policies

Government regulations and policies can have a substantial impact on the future of Bitcoin. Regulatory frameworks can provide clarity and legal certainty, which can promote mainstream adoption and investment in Bitcoin.

However, governments may also impose restrictions or regulations that could limit the growth and usage of Bitcoin. Staying informed about regulatory developments and government policies can help investors understand the potential risks and opportunities associated with Bitcoin investments.

Key Takeaways

Investing in Bitcoin can be an exciting and potentially profitable venture, but it is important to approach it with caution and thorough research. Here are some key takeaways to keep in mind:

-

Start with thorough research: Learn about Bitcoin, its technology, and the factors that can influence its price. Understand the risks associated with investing in cryptocurrencies.

-

Invest what you can afford to lose: Bitcoin investments can be volatile, and there is no guarantee of returns. Only invest funds that you can afford to lose without significant financial impact.

-

Stay updated with market developments: Regularly monitor market trends, news events, and regulatory changes that can impact Bitcoin’s price and overall market sentiment.

-

Seek guidance from experts: Consider consulting with financial advisors, tax professionals, and legal experts who specialize in cryptocurrencies. Their guidance can help you navigate the complexities of Bitcoin investments and ensure compliance with legal and tax regulations.

By following these key takeaways and making well-informed decisions, you can embark on your Bitcoin investment journey with confidence.