Investing in Bonds vs Stocks: A Guide for Beginners

Looking to delve into the world of investing? Perhaps you’re wondering about the differences between investing in bonds and stocks. Well, you’ve come to the right place! In this beginner’s guide, we’ll walk you through the basics of investing in bonds and stocks, helping you make informed decisions that align with your financial goals.

When it comes to investing, understanding the key distinctions between bonds and stocks is crucial. Bonds are essentially loans made to governments, municipalities, or corporations, where investors act as lenders and receive regular interest payments over a fixed period. On the other hand, stocks represent ownership in a company, granting investors a share of its profits and the opportunity for capital appreciation. By weighing the risks and rewards of each investment type, you can make well-informed decisions that suit your risk tolerance and financial aspirations. So, let’s dive into the world of investing in bonds versus stocks and equip you with the knowledge you need to begin your investment journey with confidence.

Investing in Bonds vs Stocks: A Guide for Beginners

As a beginner investor, one of the first decisions you need to make is whether to invest in bonds or stocks. Both bonds and stocks offer opportunities for growth and income generation, but they also come with their own risks and considerations. In this guide, we will break down the basics of bonds and stocks, explore the risk and return associated with each, discuss different types of bonds and stocks, and analyze factors like investment goals, time horizon, income generation, liquidity, inflation protection, diversification, and tax considerations.

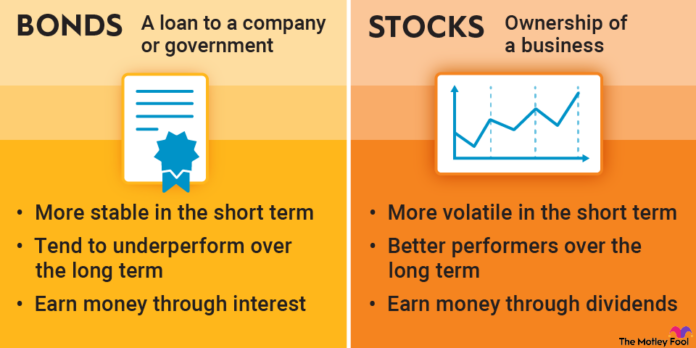

This image is property of m.foolcdn.com.

1. Understanding the Basics

1.1 Bonds

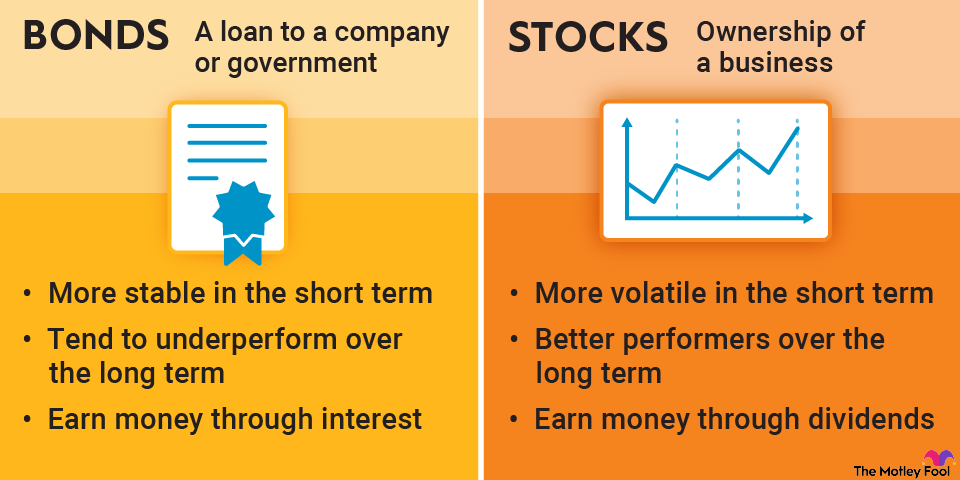

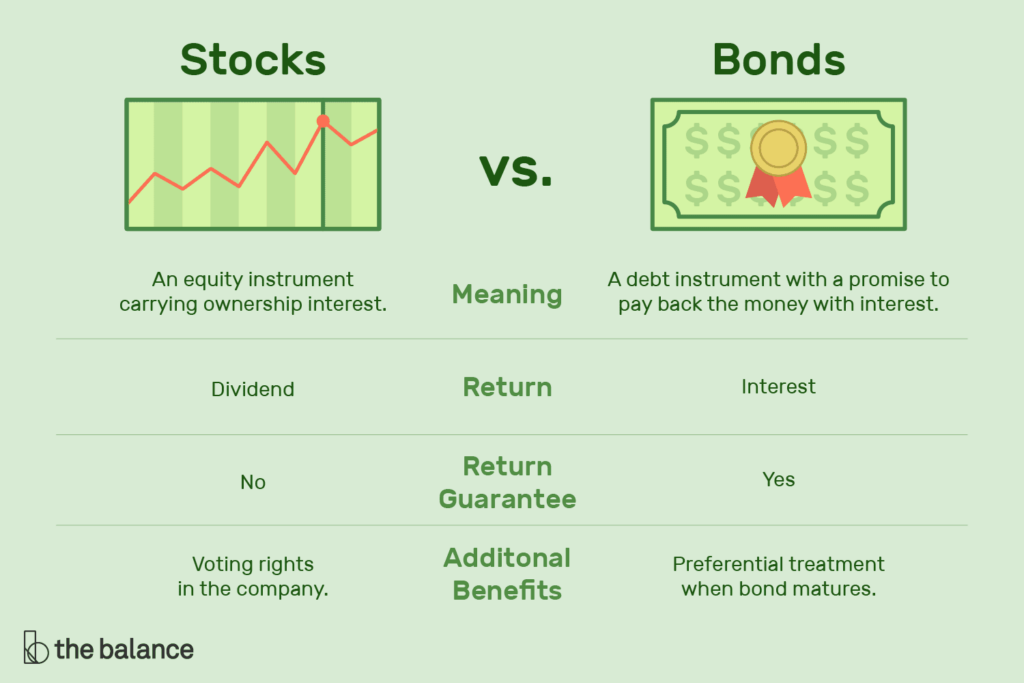

Bonds are debt instruments issued by the government or corporations. When you purchase a bond, you essentially lend money to the issuer, who promises to repay the principal along with periodic interest payments. Bonds are generally considered less risky than stocks because they provide a fixed income stream and have a predetermined maturity date. However, the returns on bonds tend to be lower compared to stocks.

1.2 Stocks

Stocks, on the other hand, represent ownership in a company. When you buy stocks, you become a shareholder and have the potential to benefit from the company’s profits through dividends and/or capital appreciation. Stocks are known for their higher potential returns, but they also come with greater volatility and risk. The value of stocks can fluctuate significantly in response to market conditions, company performance, and other factors.

2. Risk and Return

2.1 Risk of Bonds

While bonds are generally considered safer than stocks, they still carry some level of risk. The main risk associated with bonds is the possibility of default by the issuer. If the issuer is unable to make interest payments or repay the principal, bondholders may suffer financial losses. The risk of default varies depending on the issuer’s creditworthiness, with government bonds usually being the least risky.

2.2 Return of Bonds

The return on bonds primarily comes from the interest payments received throughout the bond’s duration. The yield on a bond is influenced by its coupon rate, face value, market interest rates, and the issuer’s creditworthiness. Bond returns are generally more predictable and stable compared to stocks, making them a popular choice for income-focused investors or those with a lower risk tolerance.

2.3 Risk of Stocks

Stocks are considered riskier than bonds due to their potential for price volatility. The value of a stock can be influenced by various factors such as economic conditions, industry trends, company performance, and investor sentiment. Market fluctuations can lead to significant short-term losses or gains. It’s important for investors to be prepared for the ups and downs of the stock market and have a long-term investment horizon.

2.4 Return of Stocks

The return on stocks comes from two main sources: dividends and capital appreciation. Some companies distribute a share of their profits to shareholders as dividends, providing a steady income stream. Additionally, the value of stocks may increase over time, allowing investors to sell their shares at a higher price than they purchased them. However, stock returns are not guaranteed, and there is always a possibility of losses if the market performs poorly.

This image is property of www.thebalancemoney.com.

3. Types of Bonds

3.1 Government Bonds

Government bonds are issued by national governments and are considered among the safest investments. These bonds are backed by the full faith and credit of the government. They offer a fixed interest rate, making them attractive for conservative investors seeking a stable income stream. Examples of government bonds include U.S. Treasury bonds, UK gilts, and German bunds.

3.2 Corporate Bonds

Corporate bonds are issued by companies to raise capital for various purposes. These bonds carry a slightly higher risk compared to government bonds as the creditworthiness of the issuing company plays a significant role. The interest rates offered on corporate bonds are typically higher to compensate for the increased risk. Investors can choose between investment-grade corporate bonds and high-yield bonds, also known as junk bonds.

3.3 Municipal Bonds

Municipal bonds, often referred to as munis, are issued by state and local governments to finance public projects like infrastructure development, schools, and hospitals. These bonds are generally exempt from federal income taxes, making them attractive to investors in higher tax brackets. Municipal bonds can be further classified as general obligation bonds or revenue bonds, depending on the source of repayment.

3.4 Treasury Bonds

Treasury bonds are long-term debt securities issued by the U.S. government. These bonds have maturities ranging from 10 to 30 years. Treasury bonds are considered extremely safe investments as they are backed by the full faith and credit of the U.S. government. They are often used by investors seeking to preserve capital, generate regular income, or diversify their investment portfolios.

4. Types of Stocks

4.1 Blue-chip Stocks

Blue-chip stocks are shares of large, reputable companies with a long history of stable earnings and dividends. These companies are often leaders in their respective industries and command a significant market presence. Blue-chip stocks are known for their relative stability and are considered less volatile than stocks of smaller companies. They are popular among conservative investors looking for long-term growth and income.

4.2 Growth Stocks

Growth stocks are shares of companies that are expected to experience above-average revenue and earnings growth. These companies are often in their early stages or operate in rapidly evolving industries. Growth stocks tend to reinvest a substantial portion of their earnings back into the business rather than distributing them as dividends. Investors in growth stocks are attracted by the potential for capital appreciation over time.

4.3 Dividend Stocks

Dividend stocks are shares of companies that consistently distribute a portion of their profits to shareholders in the form of dividends. These stocks are popular among income-focused investors who rely on the regular income stream. Dividend stocks can provide a steady cash flow, especially during periods of market volatility. Additionally, some dividend-paying companies have a history of increasing their dividend payments over time.

4.4 Penny Stocks

Penny stocks are shares of small companies that trade at a relatively low price. These stocks are often associated with higher risk and volatility due to the limited information available about the company and its financials. Penny stocks can experience significant price fluctuations in response to market speculation and investor sentiment. They are typically considered speculative investments and may not be suitable for beginners.

This image is property of www.easypeasyfinance.com.

5. Investment Goals and Time Horizon

5.1 Bonds for Long-Term Goals

Bonds can play a role in long-term investment goals, such as saving for retirement or funding a child’s education. By investing in bonds with longer maturities, investors can lock in a fixed income stream for an extended period. Bonds provide a level of stability to a portfolio and can serve as a hedge against stock market volatility. However, it’s essential to consider the potential impact of inflation on bond returns over the long term.

5.2 Stocks for Long-Term Goals

Stocks are well-suited for long-term investment goals, as they have historically generated higher returns compared to bonds. By investing in a diversified portfolio of stocks, investors can potentially benefit from the compounding effect and the growth potential of successful companies. It’s important to remain committed to long-term investments and avoid making rash decisions based on short-term market fluctuations.

5.3 Bonds for Short-Term Goals

For short-term investment goals, such as saving for a down payment on a house or a vacation, bonds can provide stability and a predictable income stream. By investing in bonds with shorter maturities, investors can ensure that their investment matures when they need the funds. Short-term bond investments are generally less exposed to interest rate fluctuations, making them a suitable choice for preserving capital.

5.4 Stocks for Short-Term Goals

Stocks are generally not recommended for short-term goals due to their potential for price volatility. In the short term, the stock market can experience significant fluctuations, making it challenging to predict short-term returns accurately. If you have a short-term goal, it’s best to focus on less risky investments like bonds or consider other low-risk options such as high-yield savings accounts or certificates of deposit (CDs).

6. Income Generation

6.1 Bonds for Income Generation

Bonds are widely regarded as income-generating investments. The fixed interest payments received from bonds can provide a consistent cash flow, making them attractive for investors seeking regular income. Retirees or individuals who depend on investment income often allocate a portion of their portfolios to bonds to meet their living expenses. However, it’s crucial to consider the impact of inflation, as bond interest payments may not keep pace with rising prices.

6.2 Stocks for Income Generation

While stocks are not traditionally seen as income-generating investments, some stocks do pay dividends to shareholders. Dividend stocks can provide a reliable stream of income, especially when selected from companies with a history of consistent dividend payments. Dividend income can be reinvested or used to cover living expenses. However, not all stocks pay dividends, and the dividend amount may vary over time depending on the company’s financial performance.

This image is property of tokenist.com.

7. Liquidity

7.1 Liquidity of Bonds

Bonds are generally considered to be liquid investments. The bond market allows investors to buy and sell bonds on exchanges or directly from the issuer. However, the liquidity of individual bonds can vary based on factors such as the bond’s maturity, credit rating, and market demand. Government bonds and highly rated corporate bonds tend to be more liquid compared to lower-rated bonds or bonds issued by smaller companies.

7.2 Liquidity of Stocks

Stocks are highly liquid investments. They can be bought or sold on stock exchanges during trading hours. The stock market provides ample liquidity, allowing investors to enter or exit positions relatively quickly. However, the liquidity of individual stocks can vary. Blue-chip stocks with high trading volumes tend to have higher liquidity, while smaller stocks or those with low trading volumes may have lower liquidity.

8. Inflation Protection

8.1 Bonds as Inflation Protection

Bonds, particularly inflation-linked bonds like Treasury Inflation-Protected Securities (TIPS), can offer some protection against inflation. These bonds are designed to adjust their principal value and interest payments based on changes in inflation. By investing in inflation-linked bonds, investors can potentially preserve the purchasing power of their investment and mitigate the impact of rising prices.

8.2 Stocks as Inflation Protection

Stocks have historically provided a hedge against inflation. When inflation occurs, the prices of goods and services tend to rise, and companies may be able to pass these increased costs onto consumers. As a result, the earnings and dividends of successful companies may also increase. By investing in stocks, particularly in companies with strong pricing power, investors can potentially benefit from increased earnings and dividends during inflationary periods.

This image is property of Amazon.com.

9. Diversification

9.1 Diversifying with Bonds

Bonds can play a crucial role in diversification. Adding bonds to a portfolio that contains stocks can help reduce overall portfolio volatility. Bonds tend to have a low correlation with stocks, meaning their prices may not move in tandem with stocks. By diversifying with bonds, investors can potentially reduce the impact of a downturn in the stock market and balance the risk and return profile of their portfolio.

9.2 Diversifying with Stocks

Diversification within stocks is equally important. Investing in a mix of different types of stocks, such as blue-chip, growth, dividend, and international stocks, can help spread risk and potentially enhance returns. By diversifying across various sectors and geographic regions, investors can reduce the impact of a single company or market event on their portfolio. Regular monitoring and rebalancing are crucial to maintaining an effective diversification strategy.

10. Tax Considerations

10.1 Tax Implications of Bonds

Bond investments can have tax implications. Interest earned from bonds is generally subject to federal income tax. However, certain types of bonds, such as municipal bonds, may be exempt from federal taxes or offer tax advantages for residents of the issuing state. It’s essential to consider the tax implications of bond investments and consult with a tax professional to optimize tax efficiency.

10.2 Tax Implications of Stocks

Stock investments can also have tax consequences. Dividends received from stocks are generally subject to federal income tax, with the tax rate depending on the investor’s income bracket. Capital gains taxes may also apply when stocks are sold for a profit. However, certain tax strategies, such as holding stocks in tax-advantaged accounts like Individual Retirement Accounts (IRAs) or utilizing tax-loss harvesting, can help minimize the tax burden.

In conclusion, investing in bonds and stocks requires a careful evaluation of your investment goals, risk tolerance, time horizon, and other factors. Bonds provide stability, regular income, and preservation of capital, making them suitable for conservative investors or those with short-term goals. Stocks offer the potential for higher returns but come with greater volatility and risk, making them more appropriate for long-term growth objectives. By understanding the basics, considering factors like risk and return, exploring different types of bonds and stocks, and evaluating key considerations, you can make informed decisions when entering the exciting world of investing. Remember, a well-diversified portfolio incorporating both bonds and stocks can help provide a balanced approach to wealth creation and long-term financial success. Happy investing!