Have you ever wondered how to invest in assets? Well, look no further! Here’s your comprehensive guide to investing in assets.

When it comes to investing in assets, it’s crucial to have a clear understanding of what you’re getting into. Assets refer to things that hold value such as real estate, stocks, bonds, precious metals, or even your own business. To start off, educate yourself about different asset classes and their potential returns. Then, assess your risk tolerance and financial goals to determine the right mix of assets for you. Remember, diversification is key to reducing risk and maximizing returns in the long run. Additionally, consider seeking guidance from a financial advisor who can help you navigate the complexities of the investment world. With patience, research, and informed decision-making, you can confidently embark on your journey to investing in assets. Good luck!

This image is property of Amazon.com.

Guide to Investing in Assets

Investing in assets is an essential part of building wealth and achieving financial security. Assets can provide you with a source of income, the potential for long-term growth, and a hedge against inflation. In this comprehensive guide, we will explore the world of assets, understand different investment objectives, explore various types of assets, evaluate asset classes, set an investment budget, develop an investment strategy, and make informed decisions about investing in assets for retirement. We will also discuss common risks associated with investing in assets and strategies to mitigate those risks. So, let’s dive in and become a savvy investor!

What are Assets?

Before delving into investing, it’s crucial to understand what assets are. Assets are anything of value that you own and can provide you with a financial benefit. They can be tangible or intangible. Tangible assets include physical items such as real estate, vehicles, gold, and art. On the other hand, intangible assets are non-physical assets like stocks, bonds, mutual funds, cryptocurrencies, and intellectual property rights.

Tangible vs. Intangible Assets

Tangible assets have a physical presence and can be seen and touched. They hold intrinsic value, and their prices can be influenced by various factors like supply and demand, economic conditions, and market trends. Intangible assets, however, do not have a physical form and are often represented by legal rights or contracts. They derive value from the perception of the market and may not always have a direct correlation with physical assets.

Examples of Assets

Assets come in various forms and have different characteristics and investment potential. Some common examples of assets include:

- Stocks: Shares of ownership in a corporation, representing a claim on its assets and earnings.

- Bonds: Debt securities where an investor lends money to an issuer in exchange for regular interest payments and the return of the principal at maturity.

- Real Estate: Property, whether residential, commercial, or industrial, that can be used for investment purposes or rental income.

- Commodities: Raw materials or primary agricultural products like gold, oil, wheat, or coffee that can be bought and sold in the market.

- Cryptocurrencies: Digital or virtual currencies that use cryptography for secure transactions and operate independently of a central bank.

- Mutual Funds: Investment vehicles that pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks.

Understanding these asset types is crucial to make informed investment decisions and diversify your portfolio effectively.

This image is property of Amazon.com.

Understanding Investment Objectives

Before investing, it’s important to determine your investment objectives. This involves clarifying your short-term and long-term goals and assessing your risk tolerance.

Short-term vs. Long-term Goals

Investment goals can be broadly categorized as short-term or long-term. Short-term goals typically have a timeframe of a few months to a few years, such as saving for a vacation, down payment on a house, or a wedding. Long-term goals, on the other hand, have a horizon of several years or even decades. Examples of long-term goals include saving for retirement, children’s education, or buying a second home.

Understanding the timeframe of your investment goals helps shape your investment strategy. Short-term goals may require more conservative investments to preserve capital, while long-term goals may allow for greater exposure to higher-return assets.

Risk Tolerance

Another critical aspect of understanding your investment objectives is assessing your risk tolerance. Risk tolerance refers to your ability to withstand potential losses and volatility in the market. Generally, risk and return go hand in hand – higher potential returns often come with higher risks.

It’s important to evaluate your risk appetite and determine the level of risk you’re comfortable with. This will help you choose asset classes that align with your risk tolerance and provide a balance between potential returns and the possibility of losses.

Types of Assets

Now that we have a better understanding of investment objectives, let’s explore the different types of assets available for investment.

Stocks

Stocks represent ownership in a company and provide investors with the opportunity to participate in the company’s growth and earnings. Investing in stocks can be profitable, but it also carries risks. Stock prices can fluctuate widely based on market conditions, company performance, and external factors.

Bonds

Bonds are debt instruments issued by governments, municipalities, or corporations to raise capital. When you invest in bonds, you essentially lend money to the issuer in exchange for regular interest payments and the return of the principal at maturity. Bonds are generally considered less risky than stocks but offer lower potential returns.

Real Estate

investing in real estate involves purchasing properties, whether residential, commercial, or industrial, with the expectation of generating income or capital appreciation. Real estate investments can provide steady rental income, tax benefits, and long-term capital appreciation. However, they require careful research, property management, and may involve higher costs.

Commodities

Commodities are raw materials or primary agricultural products that can be bought and sold in the market. Examples include gold, silver, oil, natural gas, wheat, coffee, or corn. Commodities can offer diversification benefits and act as a hedge against inflation, but their prices can be influenced by various factors like supply and demand dynamics, weather conditions, and geopolitical events.

Cryptocurrencies

Cryptocurrencies have gained significant attention in recent years. These digital or virtual currencies operate using blockchain technology and offer decentralization and security features. Cryptocurrencies like Bitcoin and Ethereum have shown high volatility and the potential for substantial returns, but they also come with inherent risks like hacking, regulatory uncertainties, and market manipulation.

Mutual Funds

Mutual funds pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer diversification and professional management, making them suitable for investors looking for a hands-off approach.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds, similar to mutual funds, also pool money from multiple investors. However, ETFs are traded on stock exchanges like individual stocks. They offer the flexibility of buying and selling throughout the trading day and can track specific indexes or asset classes. ETFs provide an opportunity for diversification, lower costs, and liquidity.

Understanding these different asset classes allows you to choose investments that align with your objectives, risk tolerance, and investment strategy.

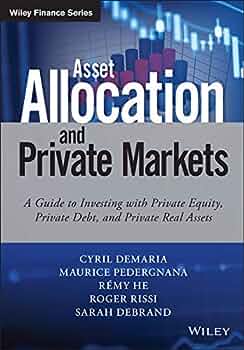

This image is property of mystockmarketbasics.com.

Evaluating Asset Classes

When considering investing in assets, it’s essential to evaluate asset classes based on various factors like past performance, volatility, and liquidity.

Past Performance

Past performance can be an indicative measure of an asset’s potential, but it does not guarantee future returns. Analyzing historical data can provide insights into an asset’s price movements, volatility, and overall performance in different market conditions. Investors often look at average annual returns and compare them to benchmarks or other similar assets to assess an asset’s historical performance.

Volatility

Volatility refers to the magnitude and frequency of price fluctuations in an asset. Highly volatile assets can experience significant price swings in short periods. While volatility can provide opportunities for profits, it also increases the risk of potential losses. Assessing the historical volatility of an asset can help you gauge the risk associated with it and determine if it aligns with your risk tolerance.

Liquidity

Liquidity refers to the ease of buying or selling an asset without significantly impacting its price. Highly liquid assets can be traded quickly and with minimal transaction costs. On the other hand, illiquid assets may have limited trading volume, making it harder to convert them into cash when needed. Evaluating the liquidity of an asset is vital to ensure you have sufficient flexibility and accessibility to your investments.

Setting an Investment Budget

Once you have evaluated different asset classes, it’s time to set an investment budget. This involves determining your available funds and allocating them appropriately across different assets.

Determining Available Funds

Before you start investing, evaluate your financial situation and determine how much money you can afford to invest. Consider your income, expenses, debts, and emergency fund requirements. It’s essential to have a clear picture of your financial health before committing funds to investments.

Allocating Assets

After determining your available funds, you need to decide on asset allocation – how you divide your investment across different asset classes. Asset allocation is a critical factor in your investment strategy as it helps diversify risk and balance potential returns.

The allocation strategy will depend on your investment goals, risk tolerance, and time horizon. A common rule of thumb is to invest in a mix of different asset classes, including stocks, bonds, and cash equivalents, based on your risk tolerance. Younger investors with a longer time horizon may have a higher allocation towards stocks for growth potential, while those nearing retirement may have a more conservative allocation with a higher percentage in bonds.

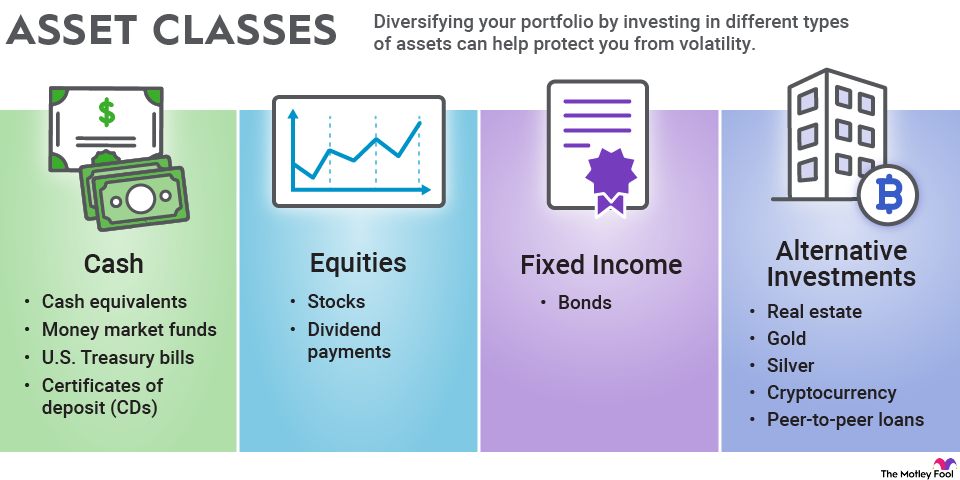

This image is property of m.foolcdn.com.

Developing an Investment Strategy

With your investment budget set, it’s time to develop an investment strategy that aligns with your goals and risk tolerance.

Diversification

Diversification is a key principle in investment strategy. It involves spreading investments across different asset classes, geographical regions, and industries to reduce the impact of any single investment’s performance on the overall portfolio. Diversification is aimed at minimizing risk and optimizing returns by capitalizing on different market conditions.

Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic value of an asset by analyzing its financial statements, industry outlook, competitive position, and other qualitative and quantitative factors. This analysis helps identify undervalued or overvalued assets, assisting investors in making informed decisions about the potential worth of investments.

Technical Analysis

Technical analysis focuses on studying historical price and volume data to predict future price movements. It involves analyzing chart patterns, trends, and indicators to identify buying or selling opportunities. While technical analysis is widely used by traders, it can also provide insights for long-term investors to make better entry or exit points.

Deciding on the Investment Approach

Investment approaches can vary based on your investment philosophy, goals, and risk appetite. Understanding different approaches allows you to select the one that best suits your needs.

Active vs. Passive Investing

Active investing involves actively buying and selling assets with the aim of outperforming the market or a specific benchmark. It requires ongoing research, analysis, and decision-making based on market trends and individual stock or asset evaluations. Passive investing, on the other hand, aims to match the performance of a specific index or asset class by buying and holding a diversified portfolio. Passive investment strategies are generally associated with lower costs and less active involvement.

Growth vs. Value Investing

Growth investing focuses on investing in companies or assets expected to grow at an above-average rate. Growth investors seek companies with strong earnings growth potential, innovative products or services, and expanding markets. Value investing, on the other hand, involves finding undervalued assets or companies that are trading below their intrinsic value. Value investors look for assets that are priced lower than their perceived worth, offering potential gains when the market corrects the undervaluation.

Income Investing

Income investing focuses on generating a steady stream of income from investments. It often involves investing in dividend-paying stocks, high-yield bonds, or real estate investment trusts (REITs) that distribute rental income. Income investing is suitable for investors seeking regular cash flow, such as retirees or those looking for passive income while preserving capital.

Contrarian Investing

Contrarian investing involves going against market sentiment and making investment decisions that are contrary to prevailing popular opinion. Contrarian investors believe that markets tend to overreact to news and events, offering opportunities to buy assets when sentiment is negative and sell when it is overly positive. Contrarian investing requires extensive research and a contrarian mindset to identify opportunities that may not be evident to the broader market.

This image is property of Amazon.com.

Investing in Assets for Retirement

Investing in assets for retirement requires a focused approach and consideration of specific retirement accounts and plans.

Pension Plans

Pension plans are employer-sponsored retirement plans where employers contribute a predetermined amount to a retirement fund on behalf of their employees. Pension plans provide a steady income stream after retirement and offer tax advantages. However, they are less common nowadays, with most companies transitioning to other retirement plans.

Individual Retirement Accounts (IRAs)

Individual Retirement Accounts, or IRAs, are tax-advantaged retirement accounts that individuals can contribute to on their own. Traditional IRAs allow for tax-deductible contributions, while Roth IRAs allow for tax-free withdrawals in retirement. IRAs offer flexibility and control over investment decisions, making them popular options for retirement savings.

401(k) Plans

401(k) plans are employer-sponsored retirement savings plans that allow employees to make contributions through automatic payroll deductions. Many employers provide matching contributions up to a certain percentage, effectively increasing the amount saved for retirement. 401(k) plans offer tax advantages, and contributions can grow tax-deferred until withdrawn in retirement.

Roth IRAs

Roth IRAs are retirement accounts where contributions are made with after-tax income. Earnings on Roth IRAs grow tax-free, and qualified withdrawals in retirement are also tax-free. Roth IRAs are particularly advantageous for individuals expecting to be in a higher tax bracket during retirement.

Risks and Mitigation Strategies

Investing in assets involves inherent risks. Understanding these risks and implementing mitigation strategies is essential to protect your investments.

Market Risk

Market risk refers to the potential for investments to decline in value due to broad market conditions. Factors such as economic downturns, geopolitical events, or changes in investor sentiment can impact the overall market and affect asset prices. It’s crucial to diversify your portfolio and establish a long-term investment horizon to mitigate market risk.

Inflation Risk

Inflation risk is the potential loss of purchasing power due to rising prices over time. Inflation erodes the value of your money, and investments with low or fixed returns may not keep pace with inflation. To mitigate inflation risk, consider investing in assets that historically perform well during inflationary periods, such as real estate or commodities.

Interest Rate Risk

Interest rate risk refers to the impact of changing interest rates on fixed-income investments. When interest rates rise, the value of existing bonds or other fixed-income investments tends to decline. To mitigate interest rate risk, diversify your fixed-income investments and consider the duration of the bonds you hold.

Currency Risk

Currency risk arises when investing in assets denominated in foreign currencies. Fluctuations in foreign exchange rates can impact the value of your investments. Currency risk can be mitigated by diversifying across different currencies or using hedging strategies.

Diversification

Diversification is an effective risk mitigation strategy. By spreading your investments across different assets, sectors, or geographic regions, you can reduce the impact of individual asset risk. Diversification allows you to participate in the potential upside of multiple investments while minimizing the impact of any one investment’s decline.

Monitoring and Adjusting Investments

Investing in assets is not a one-time activity. It requires regular monitoring and adjustments to ensure your investments remain aligned with your objectives.

Regular Portfolio Assessment

Regularly reviewing your portfolio is crucial to determine if any adjustments are necessary. Assess the performance of each asset class relative to your expectations, review asset allocation, and consider rebalancing if necessary.

Rebalancing

Rebalancing involves adjusting your asset allocation to maintain the desired level of risk and return. As some assets outperform or underperform others, the original portfolio allocation can shift. Rebalancing involves selling some investments and buying others to return to your desired asset mix.

Staying Informed

Staying informed about market trends, economic indicators, and company-specific news is important for making informed investment decisions. Keep up with financial news, read research reports, and follow reputable sources to stay updated on the latest developments.

Conclusion

Investing in assets can provide you with a path to financial growth, income generation, and long-term wealth preservation. By understanding different asset types, evaluating asset classes, setting investment objectives, and developing a well-thought-out investment strategy, you can navigate the world of investing with confidence. However, it’s important to consider risks, continuously monitor your investments, and seek professional advice to make informed decisions. Remember, investing is a journey, and it’s crucial to stay informed, adapt your strategy as needed, and remain committed to your long-term goals. Happy investing!