Interested in learning how to invest in AI? Look no further! “A Beginner’s Guide to Investing in AI” is here to help you navigate the exciting world of artificial intelligence and make informed investment decisions.

In this guide, you’ll discover the basics of investing in AI and gain valuable insights into this rapidly growing industry. From understanding the different types of AI technologies to recognizing potential investment opportunities, we’ve got you covered. You’ll also learn about the risks and challenges associated with investing in AI and how to mitigate them. So, get ready to embark on your journey into the world of AI investments and set yourself up for success!

A Beginner’s Guide to Investing in AI

Artificial Intelligence (AI) has emerged as one of the most exciting and promising sectors for investment. With its potential to revolutionize numerous industries, AI offers a multitude of opportunities for investors looking to capitalize on its growth. However, navigating the AI investment landscape can be daunting for beginners. In this comprehensive guide, we will walk you through the process of choosing the right AI investments, understanding the risks and rewards, exploring various investment options, building a diversified AI portfolio, understanding AI market performance metrics, seeking professional advice, keeping up with the latest AI developments, managing and monitoring your AI investments, and mitigating potential risks.

This image is property of Amazon.com.

Choosing the Right AI Investment

When it comes to investing in AI, one of the first steps is identifying the potential of AI companies. Look for companies that have a strong technological foundation, innovative approaches, and clear market potential. Both AI startups and established companies can offer attractive investment opportunities. While startups might have a higher potential for growth, established companies often have a track record of success and stability.

To make informed investment decisions, it’s crucial to thoroughly research AI companies. Dive into their business models, analyze their financial statements, and assess their competitive advantage. Additionally, keep a close eye on industry trends. Understanding the direction in which the AI industry is heading can help you identify investment opportunities that align with future demands.

Understanding the Risks and Rewards

Investing in AI stocks can be an exhilarating yet volatile venture. AI is a rapidly evolving field, and stock prices can experience significant fluctuations. Recognizing the volatility of AI stocks is essential to managing your investment portfolio.

Assessing the long-term potential of AI investments is crucial. While AI offers immense growth prospects, it’s important to be patient and take a long-term perspective when investing. Consider the potential impact of AI technology on various industries and how it may generate sustainable returns.

Evaluating the financial performance of AI companies is another key aspect. Analyze their revenue growth, profitability, and competitive positioning. It’s also essential to anticipate regulatory and ethical challenges that may arise in the AI industry and how they could influence the performance of AI investments.

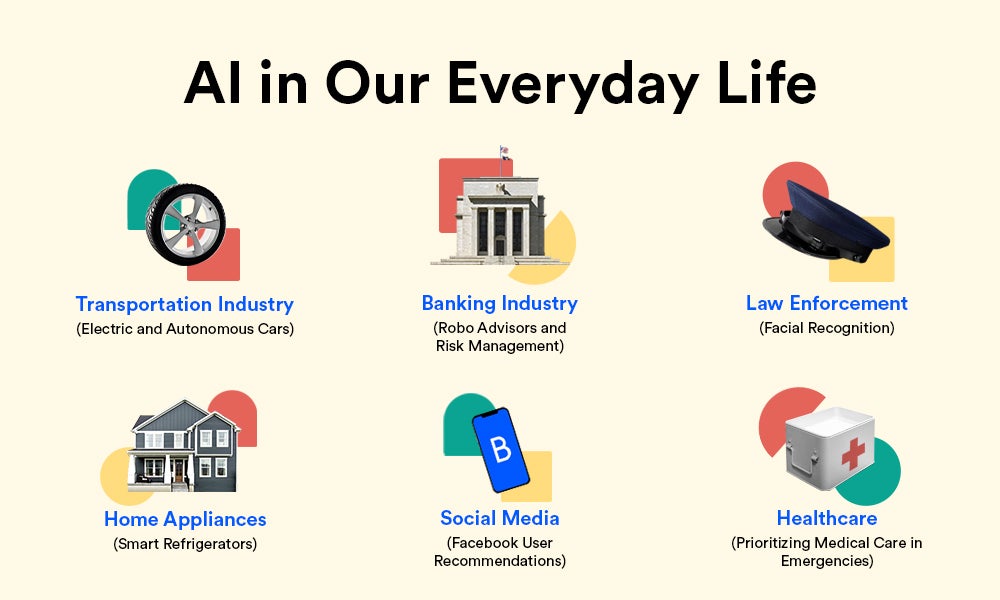

This image is property of www.bankrate.com.

Exploring Different AI Investment Options

Investors have several options when it comes to investing in AI. One option is investing in AI funds or exchange-traded funds (ETFs) that focus on AI companies. These funds allow you to diversify your investments across multiple AI companies, providing exposure to the overall growth of the industry.

Another option is directly purchasing AI stocks. This approach allows you to specifically target companies you believe have the greatest potential. However, it’s essential to carefully research and analyze individual stocks before making investment decisions.

Venture capital investments in AI startups can be highly profitable, but they also carry greater risks. By investing in early-stage AI startups, you have the opportunity to be part of their growth journey. However, it’s crucial to carefully assess the startup’s business model, team, and market potential before making any commitments.

Participating in Initial Coin Offerings (ICOs) and token sales is another avenue for AI investments. ICOs provide the opportunity to invest in AI projects that utilize blockchain technology. However, caution is advised due to the high level of risk and the potential for regulatory challenges.

Building a Diversified AI Portfolio

Diversification is essential to minimize risks in any investment portfolio, including AI investments. Spreading investments across various AI technologies ensures that your portfolio is not reliant on the success of a single company or technology. By diversifying, you can potentially benefit from the growth of multiple AI sectors.

Balancing investments across different AI companies is equally important. Allocate your funds across companies with varying levels of risk and reward potential. This strategy helps mitigate the impact of underperformance by any single company.

Including AI investments in a broader portfolio strategy is also crucial. Consider how your AI investments fit into your overall investment goals and risk tolerance. A well-rounded portfolio should consist of investments across various sectors to ensure stability and potential growth.

It’s vital to consider the potential risks of overexposure to AI. While investing in AI can be lucrative, it’s important not to allocate an excessive portion of your portfolio to a single sector. Diversification beyond AI investments can help hedge against any potential downturns in the AI market.

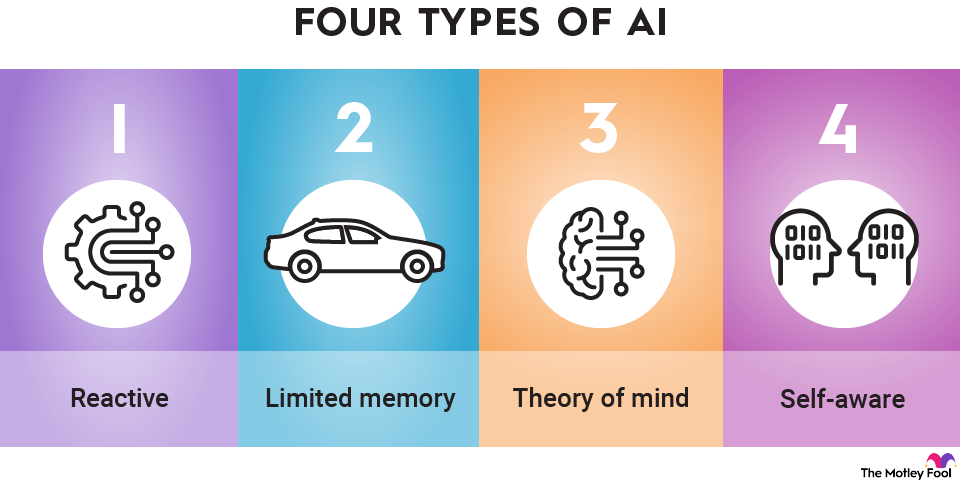

This image is property of m.foolcdn.com.

Understanding AI Market Performance Metrics

To assess the performance of AI investments, it’s essential to evaluate key market performance metrics. Start by analyzing AI revenue growth and profitability. Look for companies that demonstrate consistent revenue growth and the potential for sustained profitability.

Assessing the size and potential of the AI market is equally important. Determine the market size and identify growth prospects within different AI sectors. A rapidly expanding market provides greater opportunities for investment growth.

Tracking AI adoption and deployment rates can also help you assess the success of AI investments. Monitor how quickly industries are implementing AI technologies and the impact they have on businesses. A high adoption rate indicates growing demand and potential market saturation.

Analyzing AI market competition allows you to consider the competitive landscape of AI investments. Identify companies with a strong competitive advantage, unique technologies, or superior market positioning. Understanding the competitive environment is crucial for making informed investment decisions.

Seeking Professional Investment Advice

While investing in AI can be rewarding, it’s advisable to seek professional advice to navigate the complexities of the AI investment landscape. Consult with financial advisors who specialize in AI investments. Their expertise can provide valuable insights and guide you toward suitable investment opportunities.

Attending AI investment conferences and events allows you to network with industry professionals and gain a deeper understanding of current AI trends. Engaging with AI thought leaders and experts through communities and forums can also provide valuable perspectives and keep you informed about the latest developments.

This image is property of Amazon.com.

Keeping Up with the Latest AI Developments

To stay well-informed about AI investments, it’s essential to keep up with the latest developments in the field. Follow AI research and development efforts to gain insights into emerging technologies and innovations. Subscribe to newsletters and publications that provide updates on AI policy and regulatory changes.

Staying informed about AI industry news and events is crucial for identifying potential investment opportunities. Stay updated on market trends, mergers and acquisitions, and partnerships within the AI industry. In addition, learn from successful AI investors by studying their investment strategies and experiences.

Managing and Monitoring AI Investments

Implementing a long-term investment strategy is vital when it comes to managing AI investments. Avoid short-term speculation and focus on the long-term potential of your investments. Patience and discipline are key to successfully navigating the AI investment landscape.

Set realistic financial goals for your AI investments. Define your investment horizon, risk tolerance, and desired returns. Regularly review and adjust your AI investment portfolio to align with your financial goals and changing market dynamics.

Keeping track of AI company performance is crucial. Monitor the financial performance, market positioning, and technological advancements of the companies in your portfolio. Regularly assess their progress to ensure that they continue to meet your investment objectives.

This image is property of blog.mint.com.

Mitigating AI Investment Risks

Diversifying your investments beyond AI is an effective way to mitigate risks. Include investments from other sectors to ensure a balanced portfolio. By diversifying, you reduce the impact of potential downturns in the AI market on your overall investment portfolio.

Understanding AI-specific risks and challenges is essential for risk mitigation. AI technologies may face regulatory hurdles, ethical concerns, and privacy issues. Stay updated on these challenges and assess how they may impact your AI investments.

Staying updated on AI company and industry developments is critical for risk mitigation. Be vigilant of any changes in company strategies, leadership, or market dynamics. React accordingly to minimize potential risks and optimize your investment decisions.

Avoid hasty investment decisions in the AI space. Take the time to conduct thorough research, analyze the potential risks, and weigh your investment options. By avoiding impulsive investments, you can minimize the potential negative impact on your portfolio.

Conclusion

Investing in AI can be a lucrative opportunity for those looking to capitalize on technological advancements and the growth potential of the AI industry. By choosing the right AI investments, understanding the risks and rewards, exploring different investment options, building a diversified AI portfolio, understanding market performance metrics, seeking professional advice, keeping up with the latest developments, managing and monitoring investments, and mitigating risks, you can position yourself for success in the dynamic and exciting world of AI investing. Remember to conduct thorough research, set realistic goals, and approach AI investments with a long-term perspective. With these insights and strategies, you can navigate the AI investment landscape and potentially reap the benefits of this transformative technology.