Are you interested in learning more about investing in derivatives? Look no further than the “Beginner’s Guide to Investing in Derivatives.” This comprehensive resource provides you with the necessary steps, tips, and knowledge to start your journey in this exciting world of finance. From the basics of what derivatives are to understanding the various types available, this guide has got you covered.

Discover how to make informed investment decisions, manage risk effectively, and potentially maximize your returns. The “Beginner’s Guide to Investing in Derivatives” offers easy-to-follow explanations and real-life examples to help you grasp the concepts and strategies involved. Whether you’re a newcomer or have some experience, this guide will equip you with the essential tools to navigate the complexities of derivatives investing. Get ready to take your first steps into this dynamic and potentially rewarding investment field!

This image is property of d31d2kjntxi3yl.cloudfront.net.

Beginner’s Guide to Investing in Derivatives

What are Derivatives?

Derivatives are financial instruments that derive their value from an underlying asset or set of assets. These instruments allow investors to speculate on the future movements of the underlying asset without owning it directly. Derivatives can include futures, options, swaps, and forwards, each with its own unique characteristics and purposes.

This image is property of www.investopedia.com.

Types of Derivatives

Futures

Futures contracts are agreements to buy or sell an asset at a predetermined price and date in the future. They are commonly used for commodities, currencies, and stock indices. Futures offer leverage, allowing investors to control a larger position with a smaller amount of capital. They also provide liquidity and the ability to hedge against adverse price movements.

Options

Options grant the buyer the right, but not the obligation, to buy or sell an asset at a specific price within a predetermined period. There are two types of options: calls, which give the holder the right to buy, and puts, which give the holder the right to sell. Options are versatile instruments that can be used for speculation, hedging, and generating income through writing options.

Swaps

Swaps involve the exchange of cash flows or assets between two parties. They are usually used to manage interest rate and currency risk. The most common type of swap is an interest rate swap, where two parties exchange fixed and floating rate payments over a specified period. Swaps are customizable contracts that allow investors to tailor their exposure to various market factors.

Forwards

Forwards are similar to futures contracts but are privately negotiated between two parties. They involve an agreement to buy or sell an asset at a predetermined price and date in the future. Forwards are commonly used in the currency and commodities markets. Unlike futures, forwards are not standardized and are highly customizable to meet the specific needs of the parties involved.

Benefits of Investing in Derivatives

Portfolio Diversification

Derivatives offer the potential to diversify a portfolio by providing exposure to different asset classes and markets. By including derivatives in a well-rounded investment strategy, investors can reduce their overall risk and potentially enhance returns.

Hedging Risk

One of the primary benefits of derivatives is their ability to hedge against potential losses. For example, futures contracts can be used to offset the risk of adverse price movements in an underlying asset. Options can provide protection against market downturns, allowing investors to limit their downside risk.

Leveraged Trading

Derivatives allow investors to trade with leverage, meaning they can control a larger position with a smaller amount of capital. This amplifies both potential gains and losses. Leveraged trading can be a powerful tool for experienced investors looking to maximize their returns.

Potential for Higher Returns

Derivatives provide the opportunity for enhanced returns through speculation and active trading. By correctly anticipating market movements, investors can profit from price fluctuations and generate substantial gains.

This image is property of proschoolonline.com.

Risks of Investing in Derivatives

Market Volatility

The derivative markets are highly volatile and can experience rapid price swings. This volatility can lead to substantial gains, but it also exposes investors to significant losses if market conditions turn unfavorable.

Counterparty Risk

Derivatives involve contracts between two parties, and there is always a risk that one party may default on their obligations. This counterparty risk can be mitigated by trading derivatives on regulated exchanges, where clearinghouses act as intermediaries and guarantee the performance of trades.

Liquidity Risk

Certain derivatives, particularly those traded over-the-counter (OTC), may have limited liquidity. This means that it can be challenging to enter or exit positions at desired prices, and prices may be more susceptible to manipulation.

Complexity

Derivatives can be complex financial instruments, requiring a deep understanding of the underlying assets, contract terms, and market dynamics. Investing in derivatives without adequate knowledge and experience can lead to substantial losses.

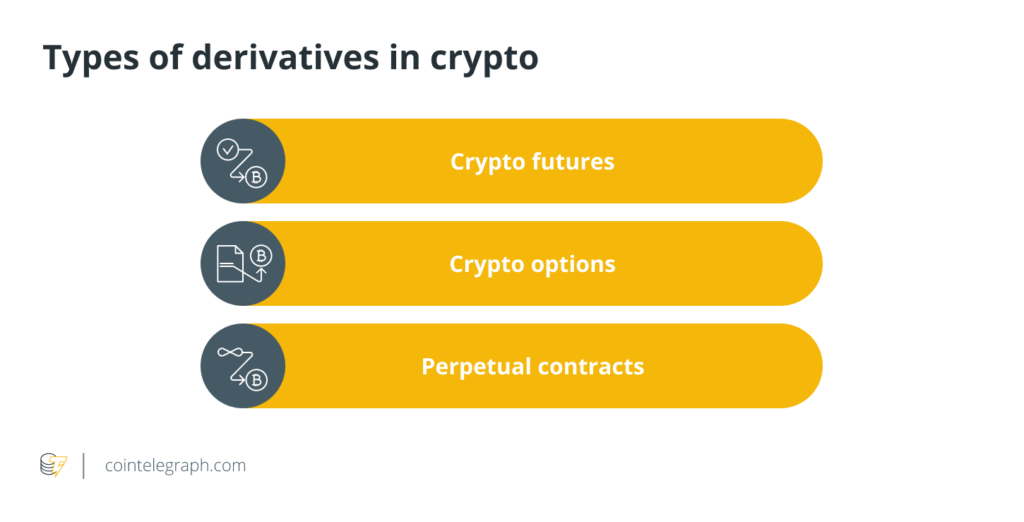

Understanding Derivatives Markets

Exchanges vs. Over-the-Counter

Derivatives can be traded on exchanges or over-the-counter (OTC). Exchange-traded derivatives are standardized contracts that trade on regulated platforms, offering transparency, liquidity, and centralized clearing. OTC derivatives, on the other hand, are privately negotiated and customized contracts, providing flexibility but also introducing additional counterparty risk.

Regulation and Oversight

Derivatives markets are subject to regulatory oversight to ensure fair and orderly trading. Regulatory bodies enforce strict rules and regulations to protect investors, promote transparency, and maintain market integrity. Understanding the regulatory environment is crucial when investing in derivatives.

Market Participants

Various participants engage in derivatives markets. These include individual investors, institutional investors, speculators, hedgers, and market makers. Each participant plays a unique role in shaping market dynamics and liquidity.

This image is property of s3.cointelegraph.com.

Factors to Consider Before Investing in Derivatives

Risk Tolerance

Derivatives are inherently risky investments. Before investing, it is essential to assess your risk tolerance and determine if you are comfortable with the potential losses that may occur. Risk tolerance varies from investor to investor, and it is crucial to align your investments with your personal comfort level.

Investment Goals

Clearly defining your investment goals is essential before engaging in derivatives trading. Are you looking for short-term gains or long-term growth? Are you seeking income generation or capital preservation? Understanding your objectives will help guide your derivative investment strategy.

Knowledge and Experience

Derivatives can be complex financial instruments that require a deep understanding of the underlying asset, market dynamics, and risk management strategies. It is crucial to have a solid foundation of knowledge and experience before diving into derivative trading.

Financial Resources

Derivatives trading often requires a significant amount of capital. Before investing, ensure that you have sufficient financial resources to meet margin requirements and withstand potential losses. It is crucial to have a well-defined risk management strategy and only invest what you can afford to lose.

Setting Up a Derivatives Trading Account

Selecting a Brokerage Firm

Choosing the right brokerage firm is vital when setting up a derivatives trading account. Consider factors such as reputation, commission fees, trading platforms, customer support, and the range of available derivative products. It is advisable to compare different brokerage firms and choose the one that best suits your needs.

Account Opening Process

Opening a derivatives trading account typically involves providing personal information, completing application forms, and verifying your identity. Each brokerage firm may have different requirements and processes, so it is important to follow the specific instructions provided by your chosen firm.

Funding Your Account

Once your derivatives trading account is open, you will need to fund it to start trading. This usually involves transferring funds from your bank account to your trading account. Different brokerage firms may have various funding options, including wire transfers, credit/debit card deposits, or electronic payment methods. Choose the most convenient method for you and follow the provided instructions.

This image is property of qph.cf2.quoracdn.net.

Choosing the Right Derivatives

Research and Analysis

Thorough research and analysis are essential when selecting derivatives to trade. Evaluate market conditions, historical price data, and relevant news and events that may impact the underlying asset’s performance. Utilize technical analysis tools and fundamental analysis techniques to identify potential trading opportunities.

Understanding Underlying Assets

Derivatives derive their value from underlying assets, so it is crucial to have a solid understanding of these assets. Whether it’s commodities, stocks, bonds, or currencies, familiarize yourself with the factors that influence their prices and the dynamics of their respective markets.

Evaluating Options and Strategies

Different derivatives offer various strategies and approaches. Assess the risk-reward profile of different options, such as buying/selling calls or puts, employing spreads, or executing more complex strategies. Understand the potential gains and losses associated with each strategy and choose the one that aligns with your investment goals and risk tolerance.

Placing Trades and Managing Positions

Order Types and Execution

When placing trades, it is important to understand the various order types available and how they are executed. Market orders, limit orders, stop orders, and trailing stop orders are some commonly used types. Each order type has its own execution rules and requirements, so be sure to familiarize yourself with them before placing trades.

Monitoring and Adjusting Positions

Once you have entered a position, actively monitor it to assess its performance. Regularly review market conditions, news, and events that may impact the asset’s price and adjust your position accordingly. Be prepared to cut losses or take profits based on your predetermined risk management strategy.

Stop Loss and Take Profit Orders

Stop loss and take profit orders are essential risk management tools. A stop-loss order can automatically close a losing position if the price reaches a specified level, limiting potential losses. Take profit orders, on the other hand, automatically close winning positions when the price reaches a predefined level, securing profits.

Monitoring and Evaluating Performance

Tracking Trades and Positions

Keeping track of your trades and positions is crucial for evaluating performance and making informed investment decisions. Utilize trade journals or online platforms to record important details such as entry/exit prices, profit/loss calculations, and trading notes. Regularly review these records to identify patterns and areas for improvement.

Analyzing Profit and Loss

Analyzing profit and loss is essential to understand the effectiveness of your derivative trading strategy. Track your gains and losses over time and assess the risk-reward profile of your trades. Identify profitable patterns and strategies that work well for you and make adjustments accordingly.

Reviewing and Adjusting Strategies

As with any investment approach, it is important to regularly review and adjust your derivative trading strategies. Market conditions and dynamics evolve over time, so it is crucial to adapt your strategies accordingly. Consider new opportunities, reevaluate risk management techniques, and continuously educate yourself to stay ahead of market trends.

By following this beginner’s guide to investing in derivatives, you can gain a deeper understanding of these financial instruments and make informed investment decisions. Remember to prioritize risk management, continually educate yourself, and seek guidance from knowledgeable professionals when needed.