While the world goes through one of the worse crises in modern times, the stock market is being profoundly affected as well. The coronavirus pandemic is shaking every single economy around the globe at an alarming rate, representing a grave issue for governments. The unfortunate rate in which the COVID-19 is sending people to the ER is causing major countries to restructure budgets, sending most of it towards healthcare.

This, of course, has negatively affected the global economy. With half the world in lockdown, the global economy has stopped almost completely, generating millions of dollars in losses every day. This pandemic has caused worrying volatility in the market where traders have panic-sold millions worth of stocks. This situation has forced some governments to trigger a market-wide circuit breaker, pausing trading for 15 minutes in an attempt to calm down the market. In the United States alone, the circuit-breaker has been activated four times in March.

Despite this situation, it is not all bad news. With the global crisis hitting every single market, there’s also room for opportunity. Stocks have lowered in price considerably, representing a unique opportunity for investors to jump in action and get as many shares as possible and hold for the next few years while the market goes back to normal. But what are the best stocks you could invest in right now?

Best Stocks To Invest In 2020 Amid Coronavirus Pandemic

COVID-19 represents a unique opportunity for investors to purchase high-quality growth stocks. While the world is not quite sure when this pandemic will be over, everybody agrees that eventually, it will come to an end. It could be months from now, but it will pass, and once it does, the economy will jump back to where it was a few months ago. This is precisely why this moment represents the best opportunity for investors to jump in. With that in mind, here are the top stocks to buy in 2020:

Before the Coronavirus spread globally, Facebook stocks were at an all-time high, quoted at $223 in January. After the crisis began, Facebook’s stock value took a hit and went down to $146. The company is already recovering from this hit, going back to a $165 price per share. While it is expected that the pandemic will hit hard on digital advertising in the following months, and Facebook will take some time to recover from this completely, but eventually, it will pass, and the company will regain full value.

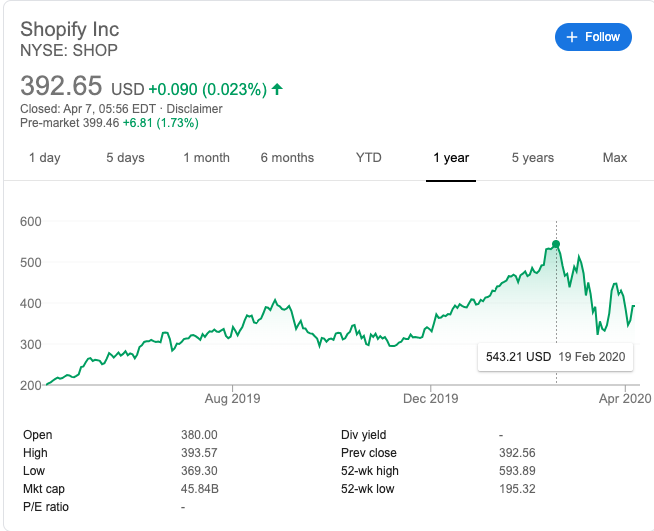

Shopify

Anything that will help people get through lockdown will thrive during the upcoming months. Providers like Shopify are part of this group. Online websites are becoming more relevant than ever, so it’s understandable why Shopify is a good investment at this point. In February, Shopify reached an impressive $543 per share and is now sitting at $392.

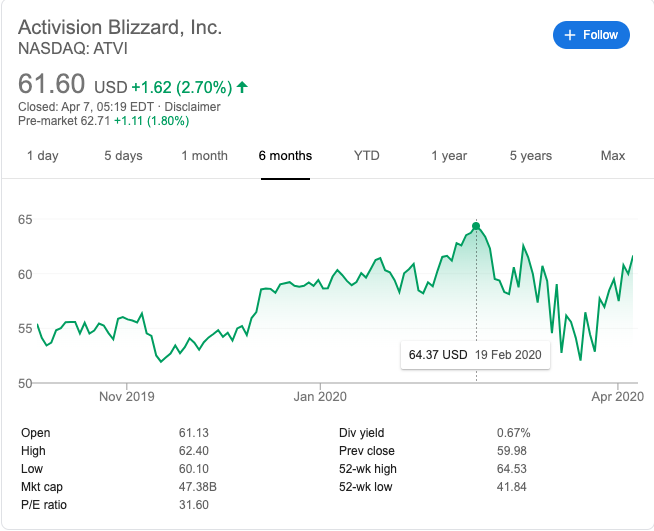

Activision Blizzard

Reports show that after most countries went into lockdown, the top searched on Google changed to video games. Just a few weeks ago, the top online searches were related to Air Jordans, Samsung, and iPhone; now, the top searches include Nintendo, Playstation, and Xbox. The pandemic has boosted the video game industry, and of course, video game publishers equally. While most stocks went down in February, Activision gained value and went up to $64 per share.

Video games will remain attractive during the pandemic and after, especially given the psychological impact that the virus will have on many people. While social distancing remains the number one piece of advice in every country, it is expected that states will continue to promote social distancing at least until a vaccine is created. This is precisely why the gaming industry is set to strive during the upcoming months, people will be buying video games to keep themselves and their kids entertained.

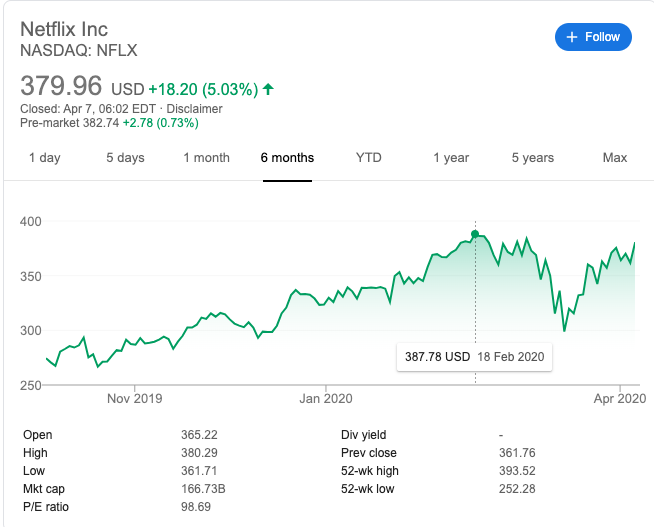

Netflix

Netflix is another major company that will continue to show growth despite the Coronavirus. As more and more people are being forced to remain in their houses, Netflix is becoming an essential service for all. In late January, Netflix reported substantial quarter numbers that included a robust subscriber growth and a strong guide for sub growth in the following months. As a result of this, Netflix stocks soared to $387. After the Coronavirus hit the market, it went as low as $298 but has recovered since then, sitting at $379 per share.

Etsy

This American-based e-commerce website offers users handmade or vintage items and craft supplies. This trend is becoming particularly popular worldwide, with millennials looking to purchase unique items in the market. While the pandemic is in full action, it is expected that more people will begin offering their products on Etsy, increasing the products available in the site and attracting more users to the platform. The company hit $62 per share in February and is now worth $46.

Remember that investing in any market requires extensive due diligence on your part and that this article does not represent financial advice.