Important Update: 15/11/2017

Combicoin has now reopened its sales. To buy CombiCoins please visit: https://triaconta.com/

Interview with Don Molenaar co-founder of Triaconta and CombiCoin

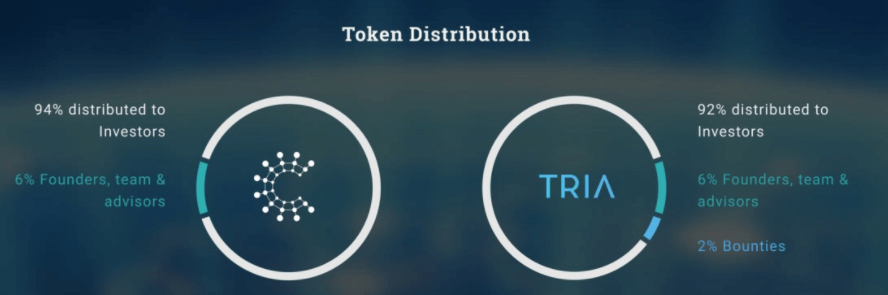

Combicoin: An ERC20 token which will group the top 30 crypto coins

Triaconta: An ERC20 token which represents the profits of the automated bot reblancing the value of Combicoin on the exchanges.

Where is the Triaconta based?

The Netherlands

Where is Triaconta incorporated?

The Netherlands

Can you provide some key ideas on why the team is well positioned to fulfil the whitepaper plans?

The people behind CombiCoin and Triaconta have a vast experience in the field of automated

exchange software and defining derivatives. With lots of years of entrepreneurial and advisory experience in the tech and derivative industries, the management team together with the advisors are cut out for the task at hand.

What stage is the software for the combi coin and the Triaconta coin in?

Alpha stage. The coins itself is already pushed onto the Ethereum blockchain.

What security measures will be applied to the storage of tokens and coins?

We are going to use cold storage in high security off site vaults.

How much of the profits will be distributed and what happens to the rest?

50%. The rest of the profit will be used to pay for all expenses and continuous development on the trading software.

How will the indexing feature work?

We will actually buy the top 30 of cryptocurrencies to back CombiCoin. During the ICO 91% of the money invested, will be used to buy these top 30 coins.

How is the index rebalanced?

Every two months a complete revision and rebalancing of the top30 is done. Revision means that every two months bad performing coins will be replaced with new coins. The rebalancing procedure is to guarantee the diversity within CombiCoins backing. If one cryptocurrency sharply increases in value, it might have a higher weight within the asset pool. We do not want that, so during a rebalancing procedure, all weights of coins in CombiCoin are averaged with the ideal weight of 1/30. So for example, if Bitcoin has a weight of 6% in CombiCoin, it will be brought back to (6+3.33)/2 = 4,67%.

How long does a coin need to be in the top 30 to be considered to be part of the index?

A coin needs to be available on at least three exchanges during the four weeks immediately preceding the construction of the ranking.

On which exchanges will the coins be listed first?

We are in talks with a few exchanges, but we cannot name the exchanges just yet.

Will the Combicoin system be working on several exchanges?

Yes, the more exchanges the trading software uses the better because the software can pick the best prices for currencies on the different exchanges.

What if the coin is not listed on any exchanges by the 1st January 2018?

We can create our own combi exchange there are multiple open source solutions to create one.

How will the exchange fees be paid?

All fees will be paid from the starting costs fee.

Will there be more than one trading pair as of the 1st of January? (ETH/Combi and BTC/Combi)

Preferably we would have multiple ones. We see CombiCoin as a great tool for new investors in crypto. So usd/combi could be interesting as well.

What are the key pros and cons of both of Combicoin and Triaconta?

The pro’s are that CombiCoin diversifies the risks of investing in cryptocurrency and at the same time benefit from any currency that are in its asset that grows in value. The assets underneath CombiCoin are actively managed to ensure that the risks stay diversified.

Cons: CombiCoin will not have the explosive growth rate that some currencies have. But no one knows beforehand which coins do well and which do not, but if a coin from the top 30 suddenly surges CombiCoin will benefit from it.

What are the main risks for the project and how is Triaconta mitigating them?

The biggest risk is that CombiCoin is not listed by any of the exchanges. But we bring more to the table then just one coin. We need to continuously buy and sell assets of the top 30, that is why we a

What happens to the value of the coins invested between now and the 1st of January?

Will the fund value be set in terms of total contributions in the various coins? (Eth Btc) and then whatever the value of these funds is January 1 will be converted to thr top 30?

AS soon as we hit the 2.000.000 USD mark we will start buying assets. Meaning that the CombiCoin will be constructed and asset-backed.

During the first months, we will openly show how much assets there are currently hold and how many CombiCoin are created. We will also show what the value of 1 combicoin is. So between now and the 1st of January CombiCoin will grow together with the market.

How are dividend yielding and forks handheld?

The dividends from the assets backing combicoin will be used to buy more assets. If a currency forks then all the assets from the fork will be invested in buying more assets.

In both instances the combicoin will increase in value. The amount depends on the answer to the above question.

Will the bot be tested in a simulated market?

What kind of oracles will this bot use? How many of them? What kind of sage guards will this bot use to make sure it is not compromised or hacked? Can it tolerate sudden spikes?

Our team has experience in building a similar software for the energy trading platforms epex spot and Nord Pool spot. We will follow the same development cycle and use all lessons learned to make sure the software will work as it should and doesn’t make wrong decisions when something very unexpected happen.

More information:

We thank Don Molenaar for the interview.